Corporate bond investing has moved online in a big way. Individual investors can execute trades in seconds and at prices often as good as -- or even better than -- the world's largest investors. Both bid-offer spreads and online bond trading commissions are low, making it easy for individual investors to benefit from the income, relative safety, and capital appreciate corporate bonds can provide.

The question of where to buy bonds has been answered: "Buy corporate bonds online."

Online brokerages have made bond investing easy and efficient; however, selecting among the thousands of available corporate bonds can be a daunting task. That's why there's Bondsavvy corporate bond recommendations.

Benefits of Buying Corporate Bonds Online

Bondsavvy's focus is recommendations for individual corporate bonds; however, investors can buy corporate bonds, municipal bonds, Treasury

bonds, and agency bonds online from a number of online brokers. That said, while many investors gravitate toward munis, the amount of trading activity and number of price quotes for each corporate bond CUSIP far exceeds what is available for muni bonds. There are millions of muni bond CUSIPs, which results in trading activity to be distributed across a huge number of bonds. In the 9,000 individual corporate bonds available on online bond trading platforms, trading activity is concentrated across a smaller number of bonds, which results in narrow bid-ask spreads and high-quality prices for individual investors.

For US investors, online bond trading platforms include Fidelity Investments, E*TRADE Financial (now part of Morgan Stanley),

Charles Schwab, Interactive Brokers, and Vanguard. For international investors, we have heard good things about Interactive Brokers and Schwab International.

Bond investors benefit from many advantages when they buy corporate bonds online, including:

1) Seeing the largest amount of corporate bond quotes

2) Minimizing corporate bond bid-offer spreads

3) Paying the lowest brokerage commissions

4) Enjoying fast and efficient trade execution

Above all, what buying corporate bonds online does is promote transparency and fairness. Corporate bond investing has come a long way from where it was in the 1980s

and 1990s. Today, bond investing is a technology-enabled marketplace where individual investors can typically execute trades at bond prices just

as good as the world's largest bond investors, as Bondsavvy founder Steve Shaw presented to the SEC.

Figure 1: Evolution of Corporate Bond Trading

Photos licensed from Shutterstock

In the old days, individual investors would call a broker, and the broker would provide a list of corporate bonds and the bond prices at which they were

available. There was virtually no way for individual investors to know if they were getting a fair price. Today, individual investors have

all the information with the click of a button.

Retail bond investors can see how many dealers are providing corporate bond quotes for a particular bond CUSIP and

can view TRACE (the Trade Reporting Reporting and Compliance Engine, which is operated by FINRA) data to see historical trades for corporate bonds and

how they compare to bond prices offered

in the market.

We discuss details of the advantages of buying bonds online later in this post.

Where To Buy Corporate Bonds Online: Recommended Brokerages

Where to buy bonds online best in class: Fidelity and E*TRADE

Out of the online brokerage firms, we recommend investors looking for where to buy bonds have accounts at two online brokerages: Fidelity.com and E*TRADE. Both bond-trading

platforms offer a full bond inventory with up to 9,000 individual corporate bonds, quality trade execution, and competitive brokerage commissions. While E*TRADE's platform has improved through the years, the overall functionality and ease of use of Fidelity.com is better. On the other hand, an advantage of E*TRADE is the ability to create a watchlist, a feature that should be more widely available on online brokerages.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

The primary reason for having accounts at two online brokerages is to ensure you are receiving the best price possible for the bonds you buy and sell.

While corporate bond inventory can be similar across online brokerage firms, certain brokerages have different rules with respect to what bond price quotes investors

can see. Some brokerages may be more conservative with respect to certain high-yield bonds and may not show all -- or any -- bond price quotes for

certain individual corporate bonds.

This can happen during times of significant bond market volatility.

For example, during the peak of the COVID-19 crisis in March 2020, we saw numerous cases where certain online brokerages were

showing quotes for a corporate bond and others weren't showing any price quotes for the same corporate bond. In addition, for some bond price quotes, the minimum trade quantity required to execute a trade was materially higher than normal.

Where to buy bonds online honorable mention: Vanguard and Charles Schwab

Vanguard also offers a good bond-trading platform with transaction fees similar to other brokerages. The company's foundation, however, is as an index fund provider. While investors can execute trades on Vanguard.com, it's doubtful the company will invest heavily on its retail bond trading platform given where its bond-fund priorities lie.

Charles Schwab also offers a good bond-trading platform; however, based on our last review of the Schwab bond-trading system, it didn't show customers

the live bid side of a corporate bond quote prior to purchasing the bond. This makes it very difficult to evaluate the level of liquidity available

in a corporate bond. In our view, seeing a bond's bid-offer spread is an important part in determining which corporate bonds we recommend to investors

purchasing our investment newsletter subscription. We

believe, generally speaking, in selling bonds before maturity to

maximize income and total investment returns. Knowing the depth of bid quotes on

corporate bonds is key to our bond investment analysis.

While Bondsavvy is not affiliated with either Fidelity or E*TRADE, our founder

Steve Shaw has led investor education webinars for both companies, including:

Figure 2: Steve Shaw's Investor Education Webinars with Online Bond Brokerages

| Date | Online Brokerage | Title | More Information |

| May 1, 2025 | Fidelity | Corporate Bond Investing for Active Investors | View webinar recording |

| April 24, 2024 | Fidelity | Navigating Corporate Bond Investing Challenges |

|

| April 18, 2023 | Fidelity | Finding Value in Corporate Bonds | View Fidelity webinar preview |

| May 11, 2022 | Fidelity | Bond Buying Opportunities for the Brave | View webinar preview |

| Aug 5, 2021 | Fidelity | Corporate Bond Investing for Total Return | View webinar preview |

| Aug 4, 2020 | Fidelity | Corporate Bond Investing in Unprecedented Times | |

| Aug 6, 2019 | Fidelity | Rethinking Bond Investing | View webinar preview |

| Nov 6, 2018 | E*TRADE | Active Corporate Bond Investing | View webinar preview |

| May 17, 2018 | Fidelity | The Case for Active Bond Investing | |

Why Buy Bonds Online

Investors who know where to buy bonds buy bonds online and benefit from many advantages. It all begins with the number of bond price quotes available at online brokerages, which creates a competitive marketplace

with many bonds from which to choose and typically narrow bid-offer spreads.

Please note that bid-offer spreads are the difference between the lowest-priced offer quote and the highest-priced bid quote. These are different

than corporate bond credit spreads, which are the difference between

a corporate bond's YTM and the YTM of a Treasury bill, note, or bond with a similar maturity date.

We discuss each of the key advantages investors who buy bonds online can enjoy:

See the largest amount of corporate bond price quotes and minimize bid-offer spreads

Online brokerages create a competitive market for your corporate bond investments by aggregating corporate bond quotes from over 100 dealers.

These dealers range in size and focus and include Bank of America, Interactive Brokers, Brownstone Investment Group, Sierra Pacific Securities, SumRidge

Partners, Wells Fargo, and many more. These dealers are not long-term investors but are rather 'market makers,' which generate profit through buying

corporate bonds at the bid price and selling corporate bonds to investors at the offer price.

Typically, for each corporate bond available on an online brokerage, there will be five to twelve dealers providing live-and-executable bid-offer quotes.

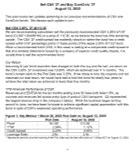

The below example shows a depth of book for eBay bonds due in 2042 (CUSIP 278642AF0) on January 22, 2020, illustrating how competitive the corporate bond market can be and the narrow corporate bond spreads individual investors can enjoy. While this example is from several years ago, investors would see similar robust levels of bond quotes today.

Figure 3: Sample Price Quotes When Buying Corporate Bonds Online -- eBay 4.00% 7/15/42

* Depth of book shown on Fidelity.com on January 22, 2020.

Factors impacting corporate bond trading liquidity

For the eBay bonds, in this example, 10 dealers were providing live bid quotes and 12 dealers were providing offer quotes. This is a robust

level of corporate bond quotes, and not every bond will have this level of liquidity. Generally speaking, bond issues with a greater amount outstanding

will often have a larger number of bond price quotes, as these bonds often trade more actively than smaller-sized bond issuances. That said,

even corporate bonds that are small in issuance size can trade actively, especially if there is news related to a particular bond issuer.

A 'big issuance' would be a bond that had at least $1 billion outstanding. This eBay bond had $750 million outstanding when the above quotes

were available. Bond issuance sizes of $300 million and less can be characterized by fewer available quotes and executed trades. That

said, there are many corporate bonds with small issuance sizes that trade actively and can have as many live bond price quotes as shown above.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

If a bond trades more actively, bond investors have a greater number of data points to determine if they are getting a good price for a bond, as they

can view TRACE-reported trades in their brokerage account and compare the live bond price quotes to recently executed corporate bond trades.

This is a far cry from the way the corporate bond market worked decades ago, as corporate bonds today trade in a competitive marketplace with typically reasonably narrow bid-offer spreads.

Factors impacting corporate bond bid-offer spreads

In the eBay bonds shown above, the bonds were quoted with a bid-offer spread of 0.12 points, on a dollar-price basis, and 0.01 percentage points (or

1 basis point) on a yield-to-maturity basis. Corporate bond bid-offer spreads can vary based on the maturity date of the bond, how actively the bond

trades, and the number of dealers providing bond price quotes.

Bonds with a long time to maturity, such as the eBay '42 bonds, will often have wider bid-offer spreads on a dollar-price basis. The reason for

this is bonds with a longer time to maturity are more sensitive to changes in interest rates since changes in interest rates will impact the bondholder for a longer period of time

than they do for investors in shorter-term bonds. Read our How to Profit from Rising Interest Rates blog post to learn our strategy during periods of rising interest rates.

For corporate bonds, interest rate risk is largest for long-dated investment-grade corporate bonds, where prices can be heavily impacted by changes

in underlying Treasury yields. Movements in corporate bond credit spreads can either amplify or mitigate the impact of falling or rising US Treasury yields.

It's important for investors to weigh interest rate risk and credit risk when evaluating new corporate bond investments.

Please note the eBay bonds information was taken before Covid-19 set in and represents what bond quotes typically look like in 'normal' times. For many

corporate bonds, Covid-19 created historic bond price volatility that reduced the number of live quotes. Subsequent to the depths of the Covid-19

crisis in March 2020, the corporate bond market returned to a more normal situation, with the typical level of live corporate bond quotes. It is important,

however, for investors to understand that, during extreme times such as the Covid-19 crisis, bond market liquidity can dry up quickly, and it can be

difficult to buy and sell bonds at compelling prices.

During parts of March and April 2020, there were often no live corporate bond quotes on the bid side. During this time, Bondsavvy moved its recommendations

to "hold" until corporate bond markets began to recover. Over time, we began moving recommendations back to 'buy' as bond market conditions improved

and we evaluated how the issuers of our recommended bonds would weather the Covid-19 crisis.

What if I choose not to buy bonds online?

Most online brokerages differ from traditional full-service brokerages, as traditional brokerages often do not enable

customers to see all of the bond price quotes provided by third-party dealers (aka "Street Inventory"). They, instead, often only show customers

corporate bonds their trading desks are quoting. As a result, these customers often see less bond inventory at worse prices since they do not

enjoy the benefit of competitive bond price quotes. In addition, these full-service brokerages can charge fat financial advisor commissions or management fees, which eat away at investment returns.

Pay the lowest bond trading fees

If a Fidelity.com customer was to purchase the above eBay bonds at a price of 100.094, Fidelity would mark up the eBay bonds by 0.1 points, which is equivalent

to $1 per $1,000 face value of bonds. Since bonds are quoted as a percentage of their face value, a bond price quote of 100.094 means the value

of the bond is $1,000.94. With the $1 mark-up, the customer would pay $1,001.94 for each of the eBay bonds plus accrued interest from the last coupon payment date until the trade settlement date.

These bond brokerage commissions are in sharp contrast to bond trading fees charged by traditional brokerages, which often charge a two-point markup for each bond. For example, that same bond quoted at 100.094 could be shown to a customer of a traditional brokerage at 102.094 -- a two-point markup. This bond brokerage commission is equivalent to $20

per bond, or 20x the amount charged on Fidelity.com and other online brokerages. These fees add up, as an investor would pay $2,000 to purchase

a $100,000 face value bond portfolio and then another $2,000 if the investor elected to sell bonds before maturity. Depending on how long an investor owns a particular bond,

these brokerage commissions could exceed bond fund management fees for a similarly sized portfolio. Minimizing transaction and management fees

is a key advantage investors receive when they buy bonds online.

Read our fixed income blog post to learn how an investor would have saved approximately $48,000 in financial advisor fees if he were to buy bonds online rather than through

a traditional brokerage.

Enjoy fast and efficient bond trade execution

Bondsavvy founder Steve Shaw is the former head of Tradeweb direct and a senior executive of BondDesk Group, two companies that built the technology for retail brokerages to

buy and sell bonds online on behalf of their investor clients. He saw firsthand the level of investment made to ensure fast and efficient

bond trade execution.

Today, nearly all bond trades with a live quote are filled promptly, with order submission to trade execution often

taking less than one second. Technology companies such as Tradeweb and ICE BondPoint and retail brokerages have invested heavily to make

bond investing more fair and efficient for individual investors. We expect this investment and focus to continue and for individual investors

to be the beneficiary of improvements made to US corporate bond market trading.

Where To Buy Corporate Bonds: Alternatives to Online Brokerages

Bondsavvy makes recommendations on individual corporate bonds. We believe there are many advantages to owning corporate bonds vs. municipal bonds and individual bonds vs. bond funds. That said, investing is no "one size fits all" solution, and there are other ways for individual investors to own bonds. These alternatives are better suited to investors who are comfortable ceding control over their investments to someone else. They will generally require less involvement than owning individual corporate bonds directly.

Alternative 1 on Where To Buy Bonds: Buy Corporate Bonds Through Mutual Funds and ETFs

Investors looking for exposure to thousands of different bonds can own bonds through bond funds and ETFs. These bond funds will generally own a variety of bonds, including corporate bonds. For example, Vanguard Total Bond Market Index Fund (Symbol: VBTLX) the world's largest bond fund, held over 11,000 bonds on September 30, 2024. Its holdings included 47% Treasury and Agency bonds, 26% in corporate bonds, and 22% mortgage- and asset-backed securities.

Investors can purchase bond funds and ETFs through their brokerages.

Bond Fund Disadvantages

A key challenge of owning these large funds, however, is that an investor seeking exposure to a specific sector, such as oil & gas bonds, can't do it. In 2022, an example of bonds that held their value were high yield corporate bonds issued by oil & gas companies. These issuers had been buoyed by higher oil prices. Many had paid down significant amounts of debt, so the high coupons many of these bonds offered were compelling. Only by owning individual bonds can investors gain concentrated exposure to these bonds.

In addition, investors cannot assess the value of bond funds and ETFs as they can with individual corporate bonds. With individual corporate bonds, investors can compare a bond issuer's financial metrics, such as leverage ratios, to a bond's price relative to par value, YTM, and credit spread. Doing so enables investors to compare the relative value of one corporate bond to another.

Since bond funds trade relative to their net asset value per share and don't have underlying financial metrics, it is not possible to assess their value. This removes one of the most important tools for investors, which is one reason we encourage investors to own individual corporate bonds over bond funds.

Alternative 2 on Where To Buy Bonds: Buy Corporate Bonds Through Full-Service Brokers

Investors who do not want to manage their own investments can have them managed by a full-service financial advisor. The investor will either pay the advisor a percentage of assets under management or pay bond brokerage fees for each trade executed by the financial advisor. The financial advisor will work with investor clients on creating customized portfolios. That said, from our experience, most financial advisors have very limited knowledge of bond investing.

For fixed income investments, financial advisors typically put clients into bond funds. This is layered fees at its worst, as the investor is paying the advisor 1% plus whatever management fee is charged by the bond fund. In addition, bond funds do not disclose their transaction fees to investors. These fees can be significant and erode investor returns.

There are a small number of financial advisors who buy corporate bonds on behalf of clients. It's important for investors choosing this route to understand the financial advisor's bond investing expertise, the financial advisor fees charged, and whether they can buy corporate bonds from 'the Street' or whether they can only buy bonds from the advisor firm's trading desk.

Why Use Bondsavvy To Buy Corporate Bonds Online

Bondsavvy empowers investors to benefit from the income, relative safety, and capital appreciation opportunities corporate bonds can provide. Our subscribers know exactly what they are investing in. We recommend corporate bonds across credit quality, maturity dates, and over 15 issuer industries so subscribers can create portfolios suited to their investment objectives. We do this at a fraction of the expense of full-service financial advisors. Click our "Get Started" button to learn about our subscription options or the "Watch Free Sample" button to view a sample edition of The Bondcast, our exclusive subscriber webcast where we present new corporate bond recommendations.

Get Started Watch Free Sample