Bondsavvy, the leading provider of individual corporate bond recommendations for individual investors, calculates leverage

ratios to assess default risk and relative value of corporate bond investments. Leverage ratios tell us how much

debt a bond

issuer has relative to its cash flow, or EBITDA, which is a company’s earnings before interest, taxes, depreciation,

and amortization. As soon as we

calculate a company’s leverage ratio, we can compare the risks and potential returns for a variety of corporate bond

investments.

This article reviews the leverage ratio formula, its rationale, where to find the information investors need to

calculate leverage ratios, why a bond

issuer’s leverage ratio can be more important than its bond rating,

and how we use leverage ratios and other data points to make bond recommendations for Bondsavvy's subscribers. We

also discuss how leverage ratios

are included in financial covenants.

Leverage Ratios Are One of Many Important Investment Considerations

While very important, leverage ratios are one of many factors that make up the bond investment analysis we

present when recommending new corporate bonds. Watch this sample edition of The Bondcast to

see all of Bondsavvy’s investment considerations, which include the following:

Bond issuer level

- Revenue and EBITDA growth

- Upcoming debt maturities

- Capital allocation, or what a company does with the money it earns (stock buybacks, dividends, capex, debt

paydown, acquisitions)

- Leverage ratio and interest coverage ratio

- Cash balances relative to company debt

- Potential for credit ratings upgrades or downgrades

- Ranking of unsecured bonds relative to any senior debt in a company’s capital structure

- Financial covenant cushion

Bond level

Since most bond issuers have many bonds outstanding, we also need to evaluate a number of bond-level, or

CUSIP-level, considerations such as:

- How credit spreads and YTMs of a company’s

bonds compare to comparable

corporate bonds

- Trading activity reported to TRACE

- Magnitude and quality of live bid-offer quotes

- Any ‘term premium’ available, where yields of corporate bonds with a longer time to maturity have higher yields

than those due in the nearer term

Macro level

Lastly, we consider a number of macro factors, including:

- Trends and future potential movement of Treasury yields

- Performance of certain industry groups relative to others

- Level of industry concentration of currently recommended corporate bonds

As we will discuss later, we believe this level of fixed income analysis is superior to that of the bond rating

methodologies used by Moody's and S&P, which ignore a bond's price,

YTM, maturity date, and interest rate risk. Further, the way bond rating methodologies "misweigh" various factors

causes many bond ratings to be inaccurate

from a default risk perspective. Often times, bond rating agencies bestow investment-grade bond ratings on large,

global companies that have far

weaker financials than many smaller, nimbler high yield bond issuers.

More to come later in this article.

Leverage Ratio Formula

Leverage ratios tell bond investors the amount of debt a company has relative to its EBITDA. One company might have a

higher absolute level of debt

compared to another company; however, we need to compare a company’s debt balance to its EBITDA to see how well its

cash flow can support its debt.

As shown in Figure 1, the leverage ratio formula is a company’s total debt divided by its last twelve months’

EBITDA. All else equal, a company

with a high leverage ratio of 6x or 7x has a materially higher risk of default than a company with a low leverage

ratio of 1-2x.

Figure 1: Leverage Ratio Formula

We will now discuss each component of the leverage ratio formula and where to find each key piece of information.

Why Is EBITDA in a Leverage Ratio important?

Reason 1: Understanding a bond issuer's level of cash flow to service its debt

With the exception of lending institutions, which borrow money they lend customers to generate net interest income,

we use EBITDA as the primary metric

to assess a company’s earnings relative to its debt and interest expense. Most investors are familiar with net

income, so it’s important for investors

to know why we add back certain figures to a company’s net income to arrive at EBITDA. Before we discuss the

rationale for adding back certain numbers

to a company’s net income, let’s review how to calculate EBITDA.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

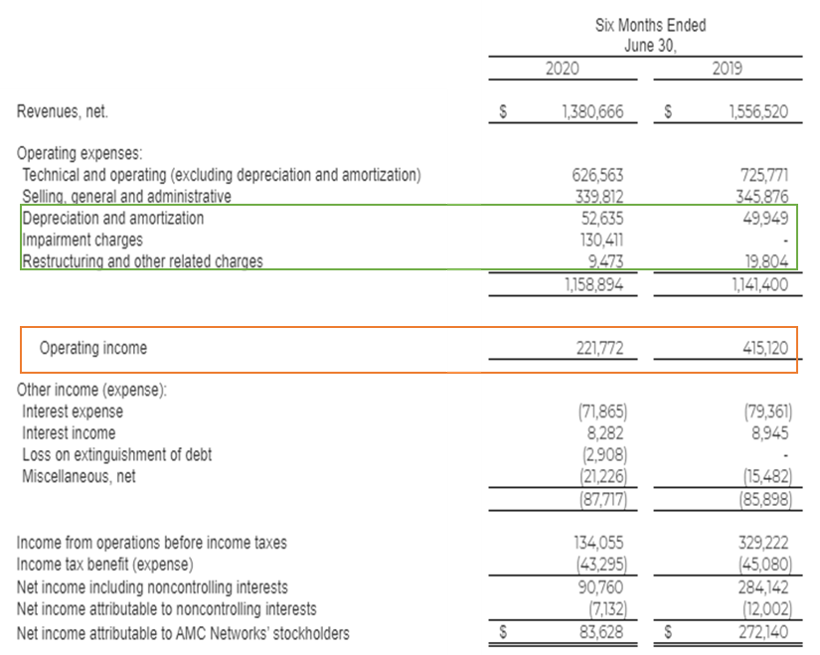

In Figure 2, we show the income statement of AMC Networks (Nasdaq: AMCX), a company that produces and distributes

cable TV and over-the-top (OTT) programming.

We found this information in AMC Networks’ 10-Q, which it filed with the US Securities and Exchange Commission

("SEC") on August 5, 2020 after the completion

of the company’s second quarter of 2020. You can find a company’s SEC filings by Googling the company’s name

followed by “IR” or “investor relations.”

This search should return a URL for the company’s investor relations webpage, which is where you can locate all SEC

filings.

As shown in Figure 2, when companies report earnings, they show the current reporting period beside the comparable

year-earlier period so investors can

compare how the company is performing relative to the prior year.

Figure 2: AMC Networks Income Statement (in thousands)

Source: AMC Networks Form 10-Q filed August 5, 2020

The EBITDA calculation begins with operating income (boxed in orange), which tells investors the profitability

of the company purely from its operations.

If we were calculating net income, as shown in Figure 2, we would deduct interest expense, taxes, etc. from

operating income.

You’ll see, boxed in green, three of the line items that are deducted from revenues to calculate operating

income:

1) Depreciation and amortization;

2) Impairment charges; and

3) Restructuring and other related charges

Operating income is a financial performance metric under generally accepted accounting principles, or GAAP. Over

time, however, non-GAAP measures,

such as EBITDA, have gained popularity, as they provide investors with additional information that can be more

relevant to those assessing a company’s

ability to service its debt. We need to know the cash flow available to service debt, which is why we add back

non-cash items. We also

add back non-recurring items such as restructuring expense, as we want our EBITDA figures to represent a 'steady

state' of the business. We show

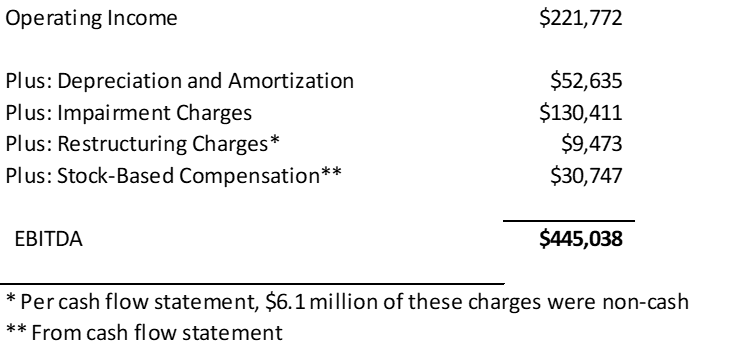

the EBITDA calculation for AMC Networks in Figure 3:

Figure 3: AMC Networks EBITDA Calculation for Six Months Ending June 30, 2020

$ in thousands

In Figure 2, AMC Networks split out depreciation, amortization, impairment, and restructuring charges in its income

statement. Stock-based compensation

was included in “Selling, general and administrative;” however, it was not split out on the income statement. We had

to find that number in AMC

Networks’ cash flow statement, which was also disclosed in AMC's 10-Q. Many companies won’t split out depreciation

and amortization on the income

statement; however, these figures can always be found on the cash flow statement.

As noted above, we typically will add back non-recurring restructuring charges; however, there are many companies

that are serial restructurers.

In this case, we would typically not add back restructuring charges since, for these companies, such

expenses are recurring in nature.

Reason 2: Understanding a bond issuer's debt covenant compliance cushion

Corporate bond issuers must comply

with debt covenants, which are limitations

placed on a bond issuer designed to protect bondholders. Debt covenants may limit the amount of stock dividends a

corporate bond issuer can pay and

the amount of stock it can repurchase. Debt covenants can also limit a company’s ability to sell assets and to incur

debt above certain levels.

Companies with bond ratings of Baa3 / BBB- and

above (investment grade)

generally have fewer debt covenants with which to comply than high yield bond issuers. The reason for this

is that corporate bonds rated

below investment grade are deemed to have a higher risk of default in the opinion of bond rating agencies.

Therefore, the bondholders require an

extra level of security to guard against the issuer not being able to satisfy its debt obligations.

A key covenant for many corporate bond issuers is the leverage ratio. The leverage ratio formula shown in Figure 1 is

very similar to the leverage ratio

formula used to calculate debt covenant compliance. For bond issuers with a leverage ratio covenant, every quarter,

they will have to calculate the leverage

ratio and certify that the leverage ratio does not exceed the debt covenant limit.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

Interestingly, during the COVID-19 crisis, a number of corporate bond issuers were saved by the fact that they issued

company bonds when they were still

rated investment grade, and their debt covenants did not require them to maintain leverage ratios below a certain

level. Many companies, including

large retailers, had negative EBITDA during the first half of 2020, which caused their leverage ratios to skyrocket.

For example, Nordstrom, which

was rated Baa1 / BBB+ before COVID-19, saw its leverage ratio increase from 1.9x on August 3, 2019 to 57.3x on

August 1, 2020. Had Nordstrom's bond

rating been below investment grade prior to the onset of COVID-19, it likely would have had to comply with a

leverage ratio debt covenant, which it would

have violated in 2020.

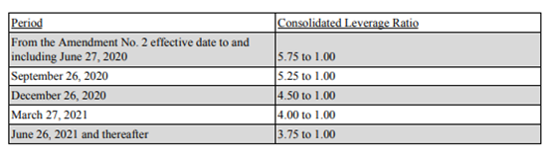

In certain cases, bond issuers can renegotiate debt covenants with their lenders. Figure 4 shows the leverage ratio

covenant limits for Tupperware

Brands Corporation. Like many retailers, Tupperware was hard hit by COVID-19. As a result, it needed to amend its

debt covenant package with

its lenders, as the company may have breached its previous set of debt covenants.

As shown in Figure 4, the leverage ratio steps down, or decreases, over time, as Tupperware is expected to improve

operations as COVID-19 hopefully subsides

and business returns to normal. On each date specified in Figure 4, Tupperware will need to report a consolidated

leverage ratio that is no greater

than the limit show in Figure 4. For example, when the company reports earnings for the quarter ending September 26,

2020, the company’s leverage

ratio may not exceed 5.25x.

Figure 4: Leverage Ratio Covenant Example -- Tupperware*

* Source: Tupperware SEC filings. Covenant as

amended on February 28, 2020.

Should the actual ratio exceed the financial covenant, Tupperware could be in breach of the covenant, which could,

after a cure period, result in an event

of default.

Understanding how leverage ratios compare to a corporate bond issuer’s debt covenants is key to understanding the

risk of a corporate bond investment and

shows why it is so important to calculate leverage ratios as part of our bond investment analysis. It should be

noted that Bondsavvy calculates a

bond issuer’s leverage ratio when we make an initial corporate bond recommendation and each time we update

our recommendation after companies

report quarterly earnings throughout the course of the year.

Reason 3: Compare ‘like for like’ metrics

When investors assess the value of publicly traded stocks, they

examine P/E ratios, or price-to-earnings

ratios, to see at which multiple different stocks trade. The lower a company’s P/E ratio means you are paying less

for each dollar of a company’s

earnings and, in some cases, obtaining a better value for the stock. The denominator in a P/E ratio is the company’s

earnings per share, or EPS.

The earnings number is the company’s net income, which is then divided by the company’s shares outstanding to obtain

EPS.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

The reason net income is used as the earnings yardstick for stocks is that common shareholders get paid

after a company pays its interest expense

and taxes. Stock investors need to look at what earnings are potentially distributable to common shareholders, which

is why common stockholders evaluate

net income and P/E ratios.

Bondholders, on the other hand, are serviced with earnings before interest and taxes are paid. This is why,

from a debt investor's perspective,

we look to EBITDA and not net income. The goal is to compare ‘like for like’ metrics as best as we can, which is why

debt investors focus on EBITDA

and stock investors focus on net income.

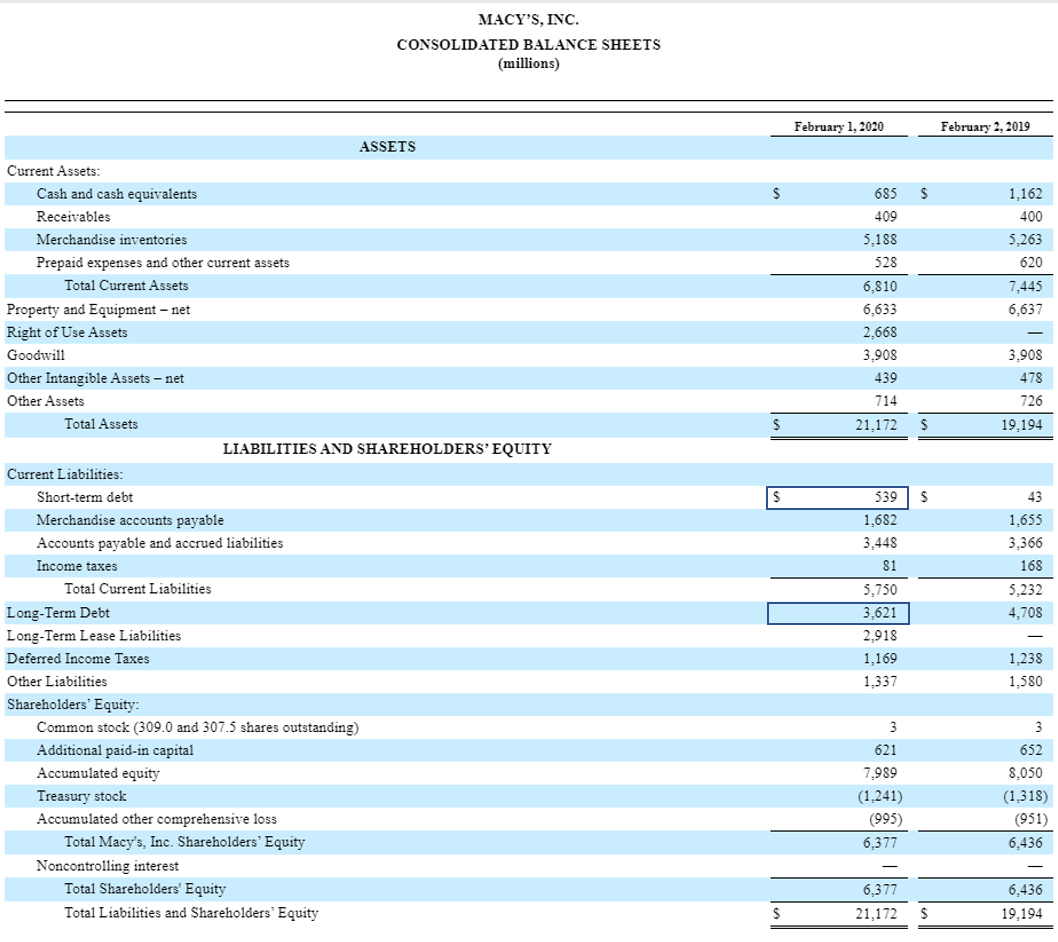

Where do we find a company’s debt balance to use in the leverage ratio formula?

Now that we've discussed how to calculate EBITDA, the denominator of the leverage

ratio formula, let's now turn our attention to the numerator, total company debt. Figure 5 shows the balance sheet

for retailer Macy’s, Inc., which

the company reported in its 10-K for the fiscal year ending February 1, 2020. Companies will typically break out

debt in two line items on their

balance sheets: short-term debt and long-term debt. Short-term debt is a current liability and reflects debt that is

due within the next year from

the balance sheet date. Long-term debt is any debt that’s not classified as short-term debt.

Figure 5: Macy’s Balance Sheet

Source: Macy’s 10-K filed March 30, 2020.

The debt figures presented in the Macy’s 10-K (boxed above) are big numbers: $539 million of short-term debt and

$3,621 million of long-term debt. These

figures typically include certain accounting adjustments, which we will normalize so our leverage ratio calculations

reflect the company’s total debt.

Fortunately, most companies provide additional detail on what type of debt (senior bank debt, unsecured bonds,

convertible bonds, etc.) makes up the short-term

debt and long-term debt disclosed on their balance sheets. The various pieces of debt, along with other capital

raised by a company, constitute a company’s

‘capital structure.’

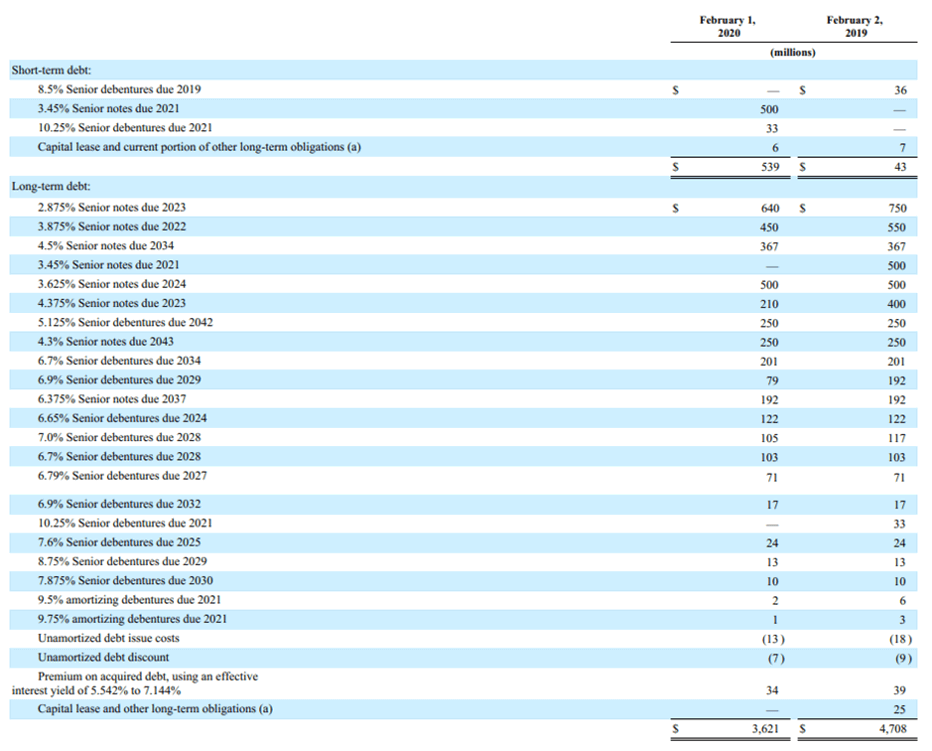

Investment Considerations Beyond Leverage Ratios: Capital Structure

While corporate bondholders are senior to stockholders, they are junior to senior debtholders. When one investor is

‘senior’ to another, the senior investor

has priority to claims made on the company in the event of a restructuring or Chapter 11 filing. To the benefit of

bondholders, on February 1, 2020,

Macy’s did not have any debt senior to its bonds, as shown in Figure 6. Senior notes and senior debentures are both

bonds and they are pari passu, which

means that both securities have the same level of seniority within the Macy’s capital structure.

Many corporate bond investors, following conventional wisdom, favor shorter-term bonds vs. longer-term bonds;

however, in the event of a bankruptcy, all

bonds with the same level of seniority are deemed pari passu. As a result, if a company went bankrupt on

January 1, 2021, bonds due in 2029

and 2042 would obtain the same level of recovery. Therefore, if investors can stomach the higher level of volatility

associated with longer-term

corporate bonds, they can often achieve materially higher returns and have the same near-term default risk as

shorter-term bondholders. Some of our

recommendations with the highest investment

returns have been

long-term investment-grade corporate bonds.

Figure 6 shows Macy’s corporate debt schedule as of February 1, 2020. On this date, Macy’s was in reasonably good

health. As shown below, Macy’s reduced

its debt from $4.7 billion on February 2, 2019 to $3.6 billion on February 1, 2020. In addition, as previously

noted, there was no debt senior to its bonds.

On February 1, 2020, Macy’s leverage ratio stood at a rock-solid 1.5x.

Figure 6: Macy’s Debt Schedule as of February 1, 2020

Source: Macy's 10-K for year ending Feb 1, 2020

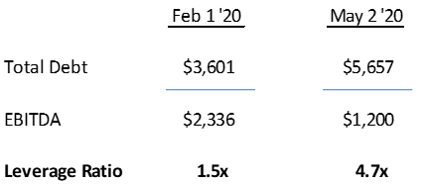

Then, COVID-19 hit, and Macy’s had to close its stores and sales plunged. Macy’s drew down $1.5 billion on its senior

credit facility and, due to

COVID-19, its last twelve months’ EBITDA fell from $2.34 billion on February 1, 2020 to $1.2 billion on May 2, 2020.

Together, these factors caused

Macy’s leverage to increase to a high 4.7x. We show the February 1 and May 2, 2020 leverage ratios for Macy’s in

Figure 7:

Figure 7: Macy’s Leverage Ratio – February 1, 2020 vs. May 2, 2020 ($ in millions)

The situation at Macy's shows us why monitoring corporate bond investments, a key part of our bond newsletter subscription,

is so important. In the wake of COVID-19, companies' fortunes changed in an instant. While most companies were able

to raise additional capital

and live to fight another day, many companies lost their pristine pre-COVID balance sheets. This could have

long-term implications for such companies

depending on how quickly they are able to turn around their businesses.

How We Apply Leverage Ratios to Investment Analysis

When we recommend corporate bonds to Bondsavvy subscribers, with few exceptions, we have generally

stayed with corporate bond issuers that have leverage ratios less than 4.00-4.25x and, ideally, less than 3.5x. The

challenge with bond issuers

that have high leverage ratios of 5x and higher is that, in the event of a significant business downturn, the

company’s leverage ratio could easily rise

to 7x or 8x, a level of debt that is often unsustainable, unless the company is anticipating strong future growth.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

Our corporate bond recommendations are always at the bond, or CUSIP, level. That said, regardless of how many bonds

a company issues, that issuer

will only have one consolidated balance sheet and income statement. Therefore, all of the leverage ratios we

calculate are at the corporate bond

issuer level. Figure 8 shows the leverage ratios, cash, debt, and bond ratings as of the dates we recommended a

specific individual bond of the indicated

issuers. As noted above, we generally look for bonds with low leverage ratios. While Albertsons' leverage ratio was

4.3x when we initially

recommended the Albertsons '29 bond on September 26, 2017, the company's leverage ratio was less than 3x on June 20,

2020, as the company has been paying

down debt and increasing EBITDA. You'll see our other sample bond recommendations were all 2.5x and lower.

Figure 8: Leverage Ratio Examples

Source: Company SEC filings and earnings releases.

(1) As reported for the most recent financial reporting period prior to the Pick

Date.

This article began by saying that leverage ratios enable investors to determine the relative value of potential

corporate bond investments. Figure

8 shows the range of leverage ratios of select bond issuers whose bonds we previously recommended. We can evaluate a

corporate bond's relative value

by comparing a bond issuer's leverage ratio to corporate bond credit spreads,

yields to maturity, and prices. When we made each of the above recommendations, the corporate bonds shown below in

Figure 9 all represented compelling

relative values to other bonds in the corporate bond market.

For example, while Albertsons' 4.3x leverage ratio was higher than the other three bonds we recommended, the

Albertsons '29 bonds (CUSIP 013104AF1)

had a 10.74% YTM and an 8.46% credit spread at the time we recommended the bonds. In addition, the Albertsons bonds

had fallen well below par value to

78.50 in the wake of Amazon purchasing Whole Foods and Albertsons suspending its IPO. The high YTMs and credit

spread coupled with the low price

and reasonable leverage ratio made the Albertsons '29 bonds a compelling relative value and a good buy.

We believed the Verizon bonds '42 (CUSIP 92343VBG8), Bed Bath bonds '24 (CUSIP 075896AA8), and Tiffany '44 bonds

(CUSIP 886546AD2) also represented compelling

relative values. In the case of Tiffany, the company had a low leverage ratio of 1.0x, and there was a compelling

4.70% YTM on the Tiffany bonds

due 2044. The yield was relatively high due to Tiffany's business being mostly flat. We were fortunate that, two

months after making this recommendation,

LVMH announced an offer to acquire Tiffany, which caused the bonds to increase significantly in value. We sold the

bonds 4 1/2 months later at a

26% total return, as we discuss in our Tiffany bonds blog post.

Figure 9: Overlaying Leverage Ratios with Credit Spreads, Bond Prices, and YTMs

How Leverage Ratios Can Be More Important Than Bond Ratings

At the beginning of this article, we discussed the primary investment considerations that constitute

Bondsavvy's fixed income

analysis. We consider these factors together when evaluating the potential risk and return of new

investments. We believe this financial analysis is a step above corporate bond ratings, as the latter only

contemplate a corporate bond’s default risk, and even that they don’t do particularly well.

Corporate bond ratings do not speak to the

investment rationale of

a corporate bond since they ignore a bond’s price, yield to maturity, yield to worst, interest rate sensitivity, and

maturity date.

Further, their evaluation of credit risk often misses the mark due to flawed bond

ratings methodologies.

While investors can’t be one-trick ponies and only look at leverage ratios, leverage ratios alone can be a better

gauge of default risk than bond ratings.

The reason for this is that, for corporate bond ratings, basic credit metrics such as leverage ratios and interest

coverage ratios often receive very small

weightings as part of the overall bond ratings methodology, as we show in our below examples.

Moody's and S&P, the two leading bond rating agencies, weigh different factors to arrive at their corporate bond

ratings. These weightings vary

by industry group and include factors such as a company's size, competitive position, revenue and market

diversification, credit ratios, and financial

policy.

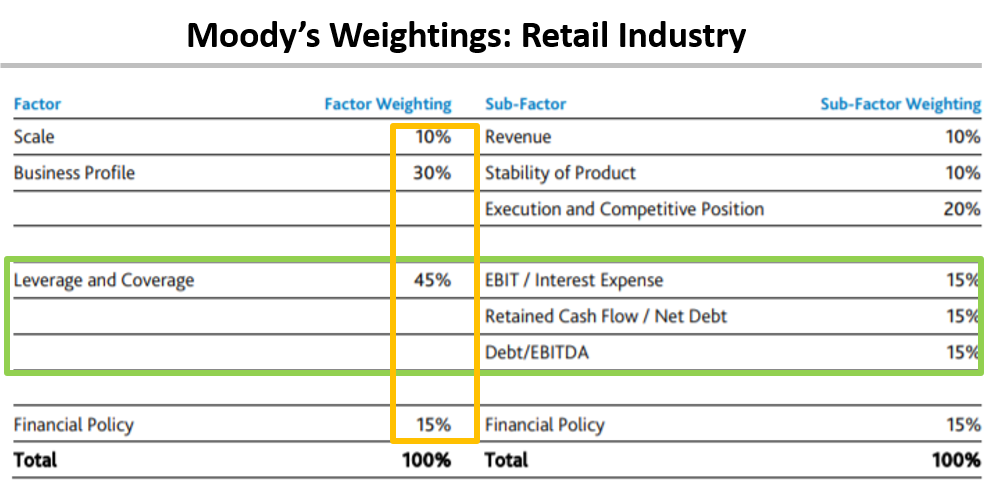

Figure 10 shows the bond rating weightings for the retail and alcoholic beverage industries. For retail, we believe

the weightings make general sense,

as leverage and coverage ratios account for 45% of the rating, with financial policy (i.e., how a company allocates

capital) accounting for 15%.

Size, product stability, execution, and competitive position account for the remaining 40% of the bond rating.

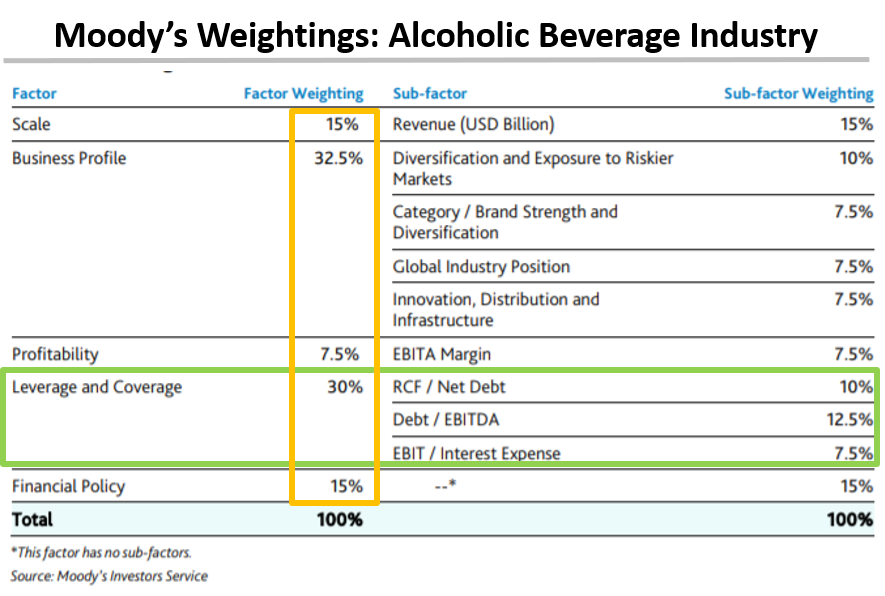

Alcoholic beverages, on the other hand, have weightings skewed toward fuzzy metrics such as innovation and

diversification. Leverage and coverage

ratios only account for 30% of the overall bond rating calculation. Therefore, you could have a bond issuer that has

a high leverage ratio of 5x,

but, if it has lot of revenue and is in many global markets, these more heavily weighted metrics win the day. While

we don't believe leverage ratios

can be the only factor investors evaluate, it doesn't matter how well diversified a company is or how much revenue

it has if it has too much debt relative

to earnings. This is why we believe, in many cases, a company's leverage ratio can be more important than the

company's bond rating.

Figure 10: Bond Rating Weightings for Retail and Alcoholic Beverage Industries

Many self-directed investors and financial advisors will assess the risk/reward of a corporate bond by comparing

corporate bond ratings to the YTMs and

prices of various bonds. The problem with this approach is that it assumes the Moody’s and S&P bond ratings

accurately reflect a bond’s credit

risk, or risk of default. We have shown above how bond rating methodologies vary across industries and can penalize

certain companies if they aren’t

big and well-diversified behemoths. Within the world of bond ratings, there is an underlying bias against companies

that are smaller in size and

generate most of their business in one country, even if that country is the United States.

Comparing Leverage Ratios of Bonds with Similar Bond Ratings

Many bond market gurus and media talking heads address the BBB corporate bond market

as if every corporate bond rated BBB is on the verge of being downgraded, or worse, defaulting. It’s doubtful these

people have spent much time reading

the SEC filings of bond issuers to evaluate the default risk of an issuer. Instead, they blindly rely on the bond

rating agencies to do the work

for them. Figure 11 shows us why this is a bad idea.

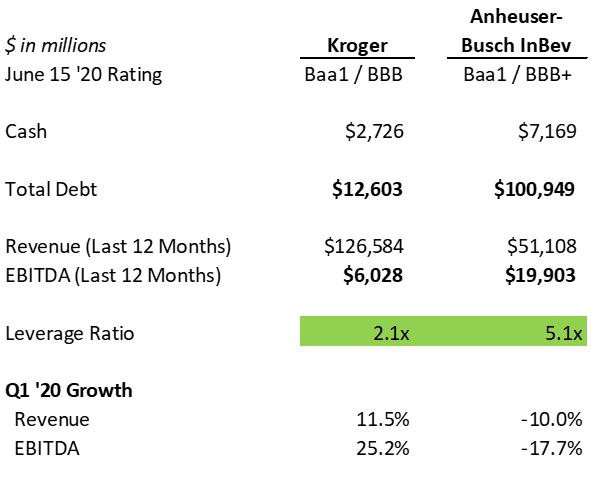

Kroger, a leading US grocery chain, and Anheuser-Busch InBev (“AB InBev”), a global alcoholic beverage company, have

nearly identical bond ratings as

shown in Figure 11. On June 15, 2020, Kroger was rated Baa1 / BBB and AB InBev was rated Baa1 / BBB+. This is where

the similarities end.

Kroger has a rock-solid 2.1x leverage ratio compared to 5.1x for AB InBev, which is more typical of a B-rated

corporate bond issuer. We believe Kroger

is slightly underrated at BBB, as its financials are stronger than certain A-rated bond issuers, and COVID-19 has

been a tailwind that has accelerated

growth and positioned Kroger and similar companies well for the future.

Figure 11: Kroger vs. AB InBev -- Similar Bond Ratings but Vastly Different Leverage Ratios*

* AB InBev balance sheet data are as of 12/31/19 while its income statement figures are

through 3/31/20. Kroger’s financials are for the period ending 5/23/20

AB InBev’s business has been hurt by the shutdowns of bars and restaurants across the world. As a result, the

company’s Q1 2020 revenues and EBITDA

fell 10% and 17.7%, respectively. The reason it has kept its undeserved investment-grade rating is due to the bond

ratings methodology shown in Figure

10, which weighs a company’s business profile and scale more heavily than it weighs interest coverage and leverage

ratios. In the end, while business

diversification is nice, a company with a 5.1x leverage ratio is on the verge of serious trouble if its earnings

aren’t growing. It doesn't matter

how well diversified a company's business is if it is has too much debt and its earnings are shrinking.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

Kroger has a far lower leverage ratio than AB InBev, and its business has been strongly growing. AB InBev has high

leverage and a declining business.

How Moody’s and S&P justify AB InBev's IGINO rating (“Investment Grade in Name Only”) is a head scratcher to us.

Conclusion

Comparing bond issuer leverage ratios to the credit spreads, YTMs, and prices of an issuing company's bonds enables

investors to assess the relative value

of potential corporate bond investments. As discussed earlier, while leverage ratios are important, they are one of

many factors Bondsavvy's fixed income research considers

prior to making new bond recommendations to our bond newsletter subscribers.

Our goal with educating investors about leverage ratios is that this metric becomes as widely used and understood by

bond investors as P/E ratios are by

stock investors. With this, we will increase investors' comfort with individual corporate bonds and empower more

investors to benefit from the income, potential capital appreciation, and relative safety individual corporate bonds can provide.

Get Started

Watch Free Sample