It takes municipal bond issuers more than 300 days, on average, to file annual audited financials per the MSRB. In contrast, it took Oracle Corp. 18 days to file its FY 2025 annual report.

Despite this lack of municipal bond financial transparency, about 45% of municipal bonds are owned by individual investors, a level of adoption not yet seen for corporate bonds. This article seeks to change this by offering an objective comparison of investing in corporate bonds vs. municipal bonds. Key differentiators include:

- Municipal bond tax equivalent yields mislead investors and overstate the benefits of owning municipal bonds vs. corporate bonds.

- Corporate bonds can achieve higher after-tax returns than municipal bonds.

- Corporate bonds are far more liquid and easier to trade than muni bonds.

- Corporate bond financial disclosures are more frequent, timely, and comprehensive than municipal bond disclosures, which enables corporate bond investors to assess value and potential investment upside.

- Municipal bonds often behave in the same way and do not offer the diversification available with corporate bonds.

1. Muni Bond Tax Equivalent Yields

Overstate the Benefits of Owning Municipal Bonds vs. Corporate Bonds

A muni bond's taxable equivalent yield should not be the deciding factor when choosing between municipal vs.

corporate bonds. When investors calculate taxable equivalent yields, they're assuming muni and corporate bonds have

similar terms.

They do not.

As we discuss in our municipal bond tax

equivalent yield blog post, muni bonds are typically callable at par value many years -- often times more than 10 years --

before maturity. Therefore, their income can vanish over a decade before a bond is set to mature. Due to this income

uncertainty, it is a big mistake to assume a municipal bond with a higher tax equivalent yield than a corporate

bond's YTM will achieve stronger after-tax returns over the life of an investment.

Reasons why municipal bond tax equivalent yields are misleading include:

- Favorable investment grade corporate bond call provisions secure income for these bonds whereas onerous municipal bond call

provisions remove income certainty for most municipal bonds.

- Since most municipal bonds can be called long before maturity at par value, their upside is limited. This limits

capital appreciation and total return opportunities. Investment grade corporate bonds have bondholder-friendly

"make-whole calls," which enable their prices to rise higher.

- For municipal bonds trading at a discount to par value, a significant portion of such bonds' YTMs relates to

capital appreciation from the bond's current price to its par value. Since municipal bond and corporate bond

capital gains are taxed at the same rate in the United States, we cannot include the capital gain portion of a

municipal bond's YTM when calculating tax equivalent yields. Doing so can materially overstate a municipal

bond's taxable equivalent yield.

- The muni bond tax equivalent yield formula assumes the investor's tax rate never changes for the life of the

bond. Investors nearing retirement could be in a lower post-retirement tax bracket. Investors should factor this

in when calculating taxable equivalent yields.

2. Corporate Bonds Can Achieve Higher After-Tax Returns Than Muni Bonds

We discussed above the reasons why muni bond tax equivalent yields are generally misleading. While these are

important points, there are three key additional considerations when comparing potential municipal vs. corporate

bond investment performance:

- Corporate bonds should generally outperform municipal bonds in tax-deferred accounts, such as IRAs, where the

corporate bonds' higher interest and potential capital gains can grow tax-free until withdrawal.

- Fidelity.com and other venues for buying bonds online do not offer high

yield municipal bonds, but they do offer high yield corporate bonds. Due to

flaws of corporate bonds ratings, there are many cases where high yield

corporate bond issuers can have superior credit quality versus investment grade issuers. Over time, high yield

bond issuers can improve their credit quality, which can reduce default risk, lower credit spreads, and increase bond prices. Such credit-quality-driven

capital appreciation opportunities are typically not available for investment grade municipal bonds.

- Even when giving municipal bonds full credit for taxable equivalent yields, corporate bond yields can still be

higher than muni bond tax equivalent yields, as we show in Figure 1. This is before considering the negative

impact onerous municipal bond call provisions have on income certainty and potential capital growth.

Figure 1 shows the results of an August 20, 2025 corporate and municipal bond search on Fidelity.com. We conducted

bond searches for bonds with 2- to 4-year maturities and 9- to 11-year maturities to show how municipal vs.

corporate bond yields compared.

As to be expected, the average yield to worst, before

calculating tax equivalent yields, was higher for corporate bonds. For bonds with 9- to 11-year maturities,

corporate bond vs. municipal bond yields to worst were 5.04 and 3.47%, respectively, a difference of 1.57 percentage

points. For the shorter-dated bonds, investment grade corporate bonds' yield to worst was 1.67 percentage points

higher than the average municipal bond yield to worst (4.13% vs. 2.46%).

Figure 1: Yield to Worst

Comparison of Municipal Bonds vs. Corporate Bonds from August 20, 2025 Fidelity.com Bond Search

|

2- to 4-Year

Maturities* |

9- to 11-Year

Maturities* |

| Municipal Bonds Average (Not Tax Adjusted) |

2.46% |

3.47% |

| Corporate Bonds Average |

4.13% |

5.04% |

|

|

|

| Muni Bond Tax Equivalent Yields

|

|

|

| @ 22% tax rate |

3.15% |

4.45% |

| @ 24% tax rate |

3.24% |

4.57% |

| @ 30% tax rate |

3.52% |

4.96% |

| @ 36% tax rate |

3.84% |

5.42% |

Sources: Fidelity.com bond search with Bondsavvy analysis. * Two- to four-year maturities are bonds maturing from

August '27 to December '29. Nine- to eleven-year maturities are for bonds maturing August 2034 to August 2036. The

2- to 4-year maturities analysis included 18,419 municipal bonds and 713 investment grade corporate bonds. The 9- to

11-year maturity analysis included 18,981 municipal bonds and 1,733 investment grade corporate bonds.

Even when we show tax equivalent yields in Figure 1 for the more than 18,000 municipal bonds in each bond search, tax

equivalent yields are still lower than investment grade corporate bond YTMs with one exception: 9- to 11-year

maturities for someone in the 36% tax bracket. Of course, these tax rates will be different for each investor, but

we show in Figure 1 a range of federal-only as well as combined federal and state income tax rates to illustrate our

point.

Bondsavvy Subscriber Benefit

Steve Shaw founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started

Of the 9- to 11-year municipal bonds, the median bond was callable at par value four years before maturity

compared to 92 days before maturity for the corporate bonds. As discussed earlier, this creates significant income

uncertainty as well as reinvestment risk for municipal bond investors.

In addition, approximately 18% of the 9- to 11-year municipal bonds were priced below 96% of par value on August 20,

2025. Therefore, for a sizeable portion of bonds, expected capital gains between August 20, 2025 and maturity could

have been a material part of the bond's YTM. Calculating municipal bond tax equivalent yields based on a municipal

bond priced at a discount to par value overstates the municipal

bond tax equivalent yield since capital gains from municipal and corporate bonds are taxed at the same rate in the

United States.

Selecting Between Corporate vs. Municipal Bonds

The inherent advantage of owning corporate bonds vs. municipal bonds is that, even in a taxable brokerage account,

corporate bond yields can be higher than muni bond tax equivalent yields. We then need to consider the

myriad other advantages of investment grade corporate bonds, including their more favorable call provisions that

maximize income certainty and potential capital appreciation.

Of course, Figure 1 shows averages across a search of thousands of bonds. A key benefit of owning individual bonds vs. bond funds is that investors can find diamonds in the rough

that can outperform the market -- sometimes significantly. We can find bonds that, relative to their risk, pay high

coupons and offer capital appreciation opportunities. While we believe finding these opportunities is easier with

corporate bonds due to their superior financial transparency and higher trading activity, there can be, in certain

cases, muni bonds that offer compelling yields relative to their risk and may be beneficial to own.

3. Corporate Bonds Are Far More Liquid and Easier to Trade Than Municipal Bonds

Why Corporate Bond vs. Municipal Bond Liquidity Is Important

According to the CFA Institute, " 'market liquidity' describes an asset's ability to sell quickly without having to

reduce its price to a significant degree." Since the only way for a bond investment to exceed the purchase date's

YTM is to sell bonds before maturity, bond

market liquidity truly matters.

When bonds have many live bid-ask quotes and trade regularly throughout the day, it is easy for investors to

determine whether they are getting a fair price for a bond. Further, bid-ask spreads often shrink with more trading

activity and live price quotes, which can improve the prices at which investors transact and the investment

performance they can achieve. Since municipal bonds can often go months -- and even years -- without trading,

investors wishing to sell before maturity can lose several points, which can wipe out an entire year's interest

income.

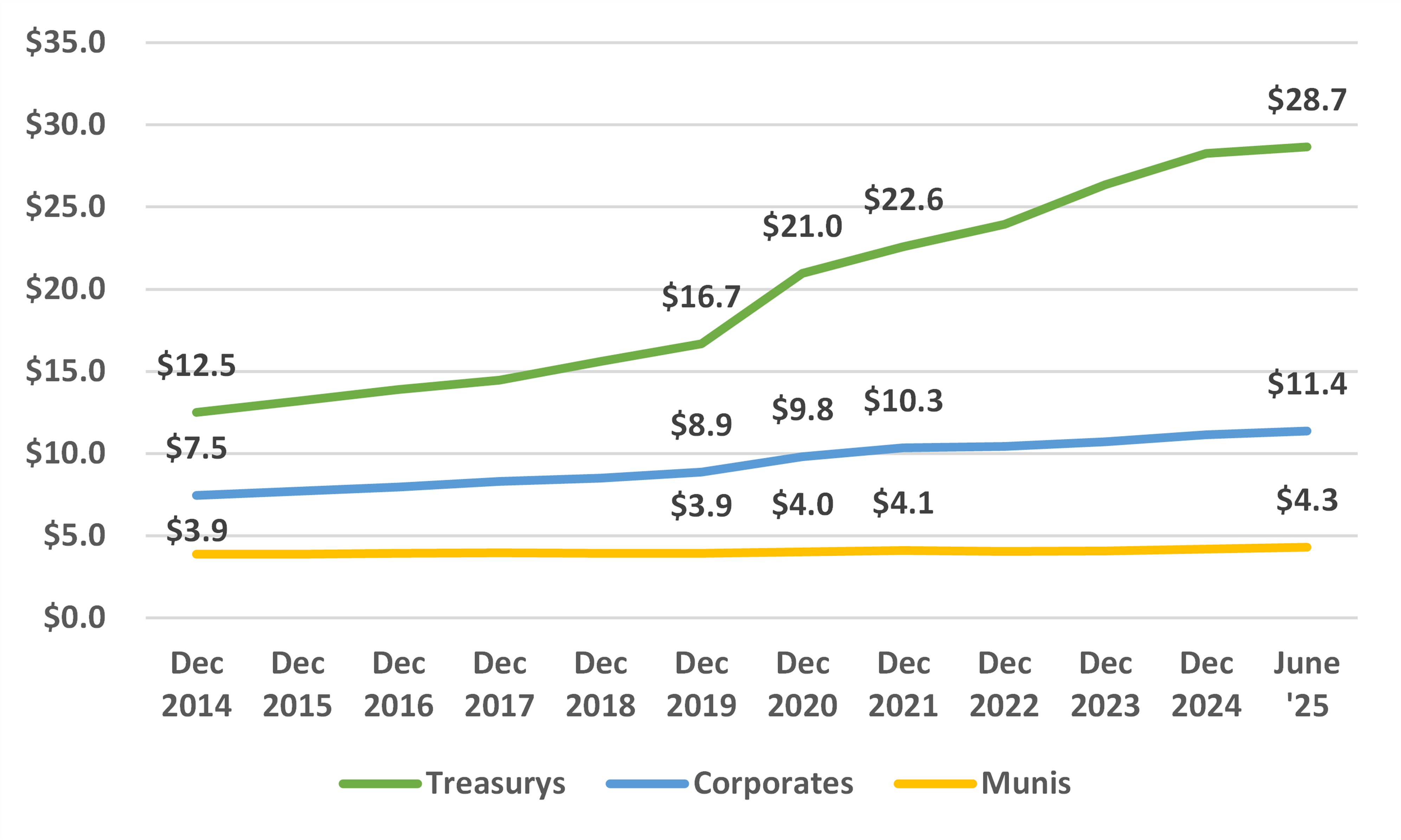

Growth of Municipal Bonds vs. Corporate Bonds and US Treasurys

As of June 2025, the municipal bond market was much smaller ($4.3 trillion) than both the US corporate ($11.4

trillion) and US Treasury ($28.7 trillion) bond markets. In addition, municipal bonds are often issued by very small

entities, which has resulted in millions of muni CUSIPs outstanding. (For those new to bonds, in the United States,

bonds are identified with a CUSIP, a nine-character alphanumeric code).

Since the overall muni bond market is much smaller than the corporate bond market and since there are millions more

muni bond CUSIPs than corporate bond CUSIPs, muni bond trading activity is spread across many different CUSIPs. As a

result, the trading activity in each bond is limited, which can make it difficult for muni bond investors to execute

trades at good prices, especially when they are selling bonds before maturity.

Figure 2 shows the growth of the US Treasury, corporate, and municipal bond markets. Since December 2014 until June

2025, the amount of US Treasury securities outstanding has increased 129% to $28.7 billion, per the US Treasury.

During this period, the municipal bond market has grown 11%, while the size of the US corporate bond market is up 52%.

Figure 2: Growth of US Bond Market by Asset Class -- December 2014 to June 2025

$ in trillions outstanding

Sources: US Treasury and the US Federal Reserve.

Why Municipal Bond Trading Activity Is Limited

As we will show you, corporate bond vs. municipal bond trading activity and liquidity significantly favors corporate

bonds. We can evaluate bond trading activity and liquidity in three different ways:

- An asset class's total average daily volume divided by the number of unique CUSIPs available for trading

- Frequency of trades in a specific bond CUSIP

- The "depth of book" or level of live bid-ask quotes for a specific CUSIP

Figure 3 shows the average daily trading volume for municipal bonds vs. corporate bonds and US Treasurys. US

Treasurys have the highest amount of daily trading activity -- $1 trillion -- and the smallest number of actively

traded CUSIPS: 635. As a result, trading activity is concentrated in a very small number of CUSIPs, making US

Treasurys the most liquid fixed income market.

Figure 3: Average Daily Trading Volumes and Number of Available CUSIPs for Munis, Corporates, and US Treasurys

|

# Unique CUSIPs

on Fidelity.com* |

Average Daily Trading

Volume ($ Billions)** |

| Municipal Bonds |

107,500 |

$15 |

| Corporate Bonds |

10,500 |

$48 |

| US Treasurys |

635 |

$1,021 |

Sources: US Treasury, US Federal Reserve, and Fidelity.com. * CUSIP figures are as of September 15, 2025. **Average

daily volumes are for August 2025.

Corporate bonds have over three times the average daily trading volume of municipal bonds -- $48 billion vs. $15

billion -- and only 10% of the number of CUSIPs available for trading on Fidelity.com. This means corporate bonds

have significantly greater trading volume for each actively traded CUSIP than municipal bonds.

Of course, for corporate and municipal bonds, there will be CUSIPs -- such as 144A private placement offerings --

that will not be available on Fidelity.com and other online bond brokerage platforms. That said, if we included

CUSIPs not available on Fidelity.com, average daily trading volume per available CUSIP would favor corporate bonds

by an even greater extent.

Significantly Higher Trading Volume per CUSIP for Corporate Bonds vs. Municipal Bonds

When buying bonds online, investors can see the historical trading activity

for bonds in which they are considering. They can then compare the prices they see quoted to the most recently

executed trades. This is easy to do for corporate bonds that trade regularly, but not so for municipal bonds, as we

show in the following charts.

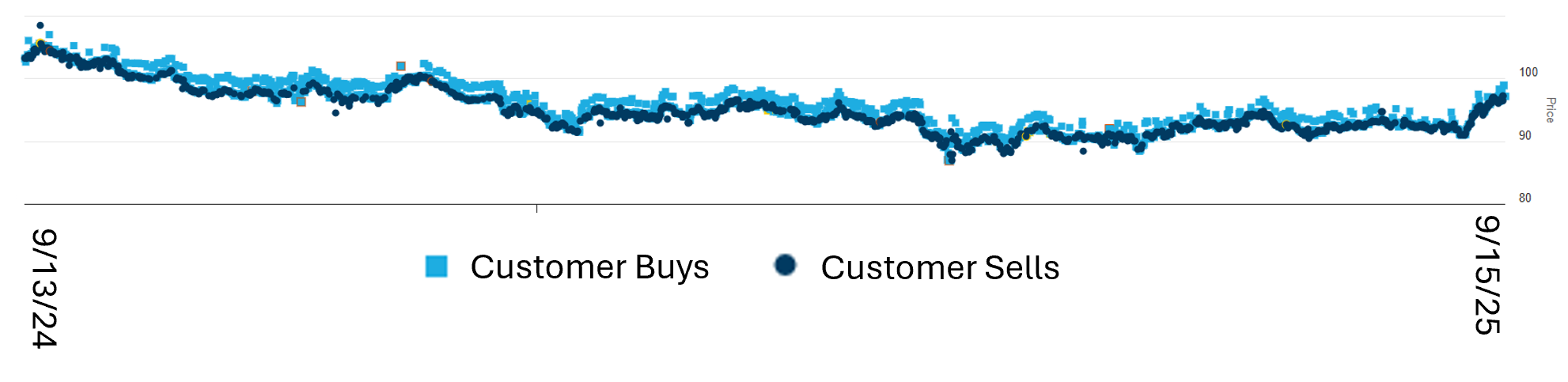

Figure 4 shows trading activity for the Oracle 5.55% 2/6/53 bond (CUSIP 68389XCQ6) for the twelve months ended

September 15, 2025. As shown, there have been hundreds of trades in this bond over the last year. This Oracle bond's

large $2.25 billion issuance size positively impacts the bond's trading volume, given there is such a large amount

outstanding. This is a large issuance size for a corporate bond. For corporate bonds, $500 million to $1+ billion is

a common issuance size, with investment grade bonds toward the high end of the range and high yield bonds often

toward the low end of the range.

Figure 4: Oracle 5.55% 2/6/54 Historical Trading Activity - September 13, 2024 to September 15, 2025

Source: FINRA market data presented on Fidelity.com

Trading activity in the corporate and municipal bond markets is a night-and-day comparison. As noted above, there are

over 100,000 municipal bond CUSIPs available on Fidelity.com but only $15 billion of average daily volume

marketwide. Therefore, municipal bond trading activity is widely dispersed, and trading activity in each bond CUSIP

can be limited.

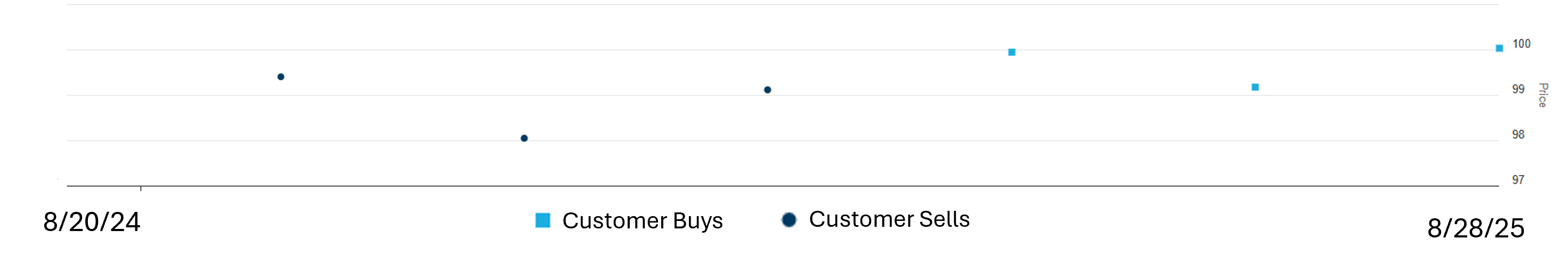

Figure 5 shows the trading activity in the Shelby County, TN Health Educational Housing 4.00% 8/1/35 bond (CUSIP

821697V30). Over a year-long period, there were only three customer-buy and three customer-sell trades. Municipal

bonds typically do not have live bid-side quotes due to the lack of trading activity in each CUSIP. Therefore, it

can be a guessing game in terms of what price investors can get when selling bonds before maturity. This lack of trading

activity makes employing an active fixed income investment strategy for municipal bonds much more

difficult than it is for corporate bonds.

Figure 5: Trading Activity for the Shelby County 4.00% '35 Bond -- August 20, 2024-August 28, 2025

Source: EMMA market data presented on Fidelity.com

One other interesting note is, for the six trades in Figure 5, how muted the price changes were. During this time

period, the 10-year Treasury peaked at 4.79% on January 13, 2025 and hit a trough of 3.82% on August 20, 2024,

nearly one full point of change. These significant moves appear to have had little impact on the prices at which the

Shelby '35 bond traded.

Robust Price Quotes for Corporate Bonds vs. Municipal Bonds

When investors buy corporate bonds online, they benefit from narrow bid-ask spreads driven by a robust level of live bid-ask quotes. For each corporate bond CUSIP, there will typically be six to eight dealers providing live-and-executable quotes on both the bid and ask sides.

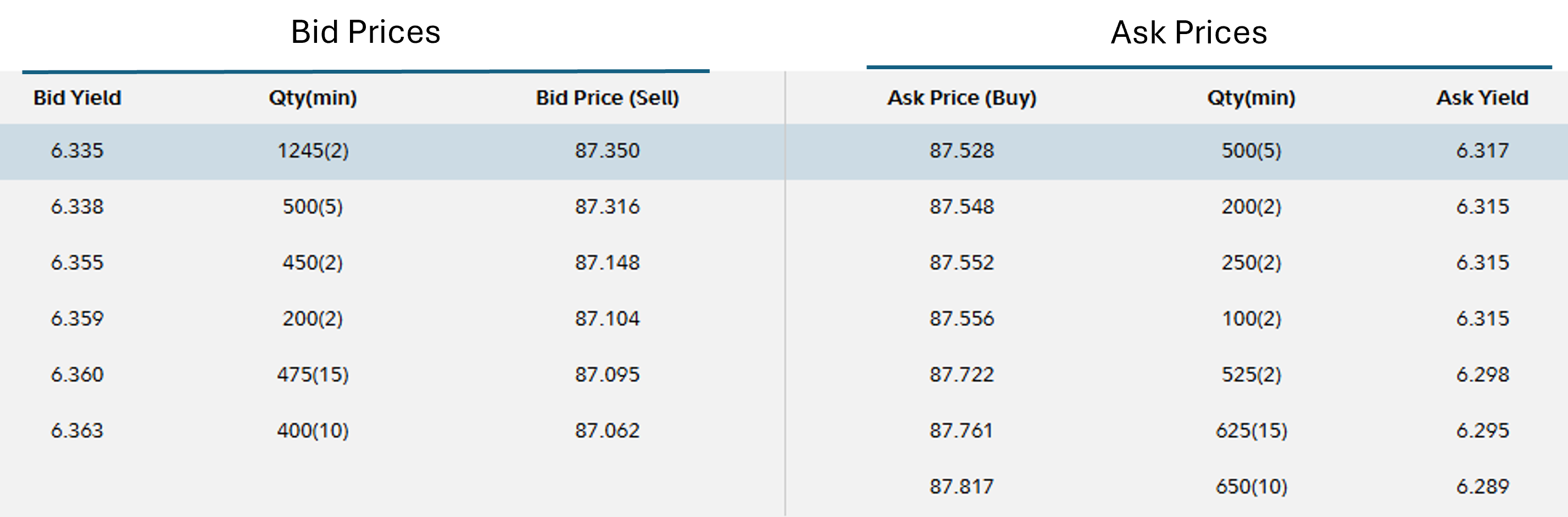

Figure 6 shows the level of live bid-ask quotes for the General Motors 5.20% 4/1/45 bond (CUSIP 37045VAJ9) available August 20, 2025 on Fidelity.com. As shown, there were six quotes on the bid side and seven on the offer side. The bid-ask spread on a yield to maturity basis was less than two basis points (6.335% bid yield vs. 6.317% ask yield). On a "dollar-price" basis, the bid-ask spread was 0.178 points (87.350 bid price vs. 87.528 ask price).

Figure 6: Depth of Book for General Motors 5.20% 4/1/45 Bond

Source: Fidelity.com. Taken on August 20, 2025

Not only do investors buying bonds online benefit from narrow bid-ask spreads, but they can transact in small quantities. The minimum bond purchase quantity for the GM bond's best ask-side quote (87.528) was five bonds. It was two bonds for the best bid-side quote. The minimum quantities are shown in parentheses in the "Qty(min)" column in Figure 6.

If an investor only wanted to buy two bonds, she could still do so at a slightly higher price (87.548), which was only 0.02 points higher than the "top of book" ask price.

For more on how bonds are quoted when investing in bonds online, please watch our What to Know Before Investing in Bonds video.

Limited Price Quotes for Municipal Bonds

As we discussed earlier, there are millions of municipal bond CUSIPs but only $15 billion of average daily volume vs. $48 billion in daily volume for US corporate bonds. Therefore, muni bond trading activity is widely dispersed, and there is typically limited live price quotes for municipal bonds.

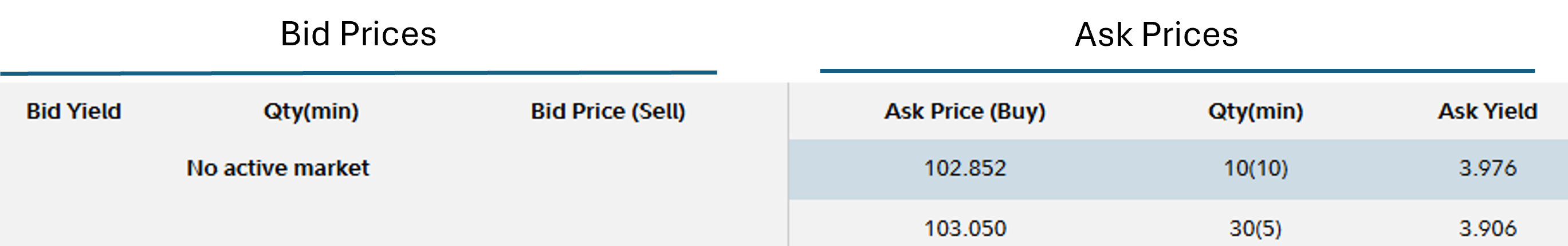

Figure 7 shows the depth of book for a municipal bond: New York State Dormitory Authority 5.00% 3/15/44 (CUSIP 64990AMV4), which had two live ask-side quotes and no bid-side quote. This is a typical level of quoting for municipal bonds, which generally have no live bid side quotes and one or two ask-side quotes.

Figure 7: Depth of Book for NY State Dormitory Authority 5.00% 3/15/44 Municipal Bond

Source: Fidelity.com. Taken on September 19, 2025

An eagle-eyed investor might ask why this bond's yield to worst is 3.976% when the price isn't far above par value and there are 19 years left until maturity. As we discussed earlier, municipal bonds are typically callable at their $1,000 par value long before maturity. In the case of the New York State Dormitory Authority '44 bond, it is callable at par value September 15, 2028. If the bond was called in three years at par value, it would lose nearly three points of capital during that time, which is why the yield to worst is 3.98% vs. the bond's 5.00% coupon.

4. More Frequent and Detailed Financial Disclosures Make Assessing Value in Corporate Bonds Easier

Being able to buy and sell bonds at good prices is a key part of minimizing costs and maximizing returns. That

said, it is one piece of a bigger puzzle. Another key part is assessing the financial wherewithal of the issuing

entity so we can compare an issuer's creditworthiness to the potential returns offered by the issuing company's

bonds.

Here, again, corporate bonds have a significant advantage vs. municipal bonds.

To start, in many cases, the issuing companies for corporate bonds are already household names such as Microsoft,

Wal-Mart, Apple, and others. With basic knowledge of these companies, investors can begin assessing whether bonds

they issue are compelling values.

On the other hand, few have likely heard of the Porter Special Utility District in Porter, Texas, a municipal bond

issuer.

One could get comfortable with municipal bond issuers from far-flung parts of the United States if they had timely,

regular, and comprehensive financial filings, but they do not. Municipal bond issuers typically only report

financials once per year, and these reports come long after the reporting period ended. According to

the Municipal Securities Rulemaking Board (MSRB), between 2010 and December 2023, the average municipal bond issuer

took 325 calendar days to submit audited financials.

The US Securities and Exchange Commission ("SEC") requires US companies to file quarterly earnings reports within 40 days of quarter end and 60 days of yearend. They

must also file 8-Ks anytime there is a "material event," such as an acquisition or a capital raising transaction.

Companies also file annual proxy statements to disclose executive compensation policies and amounts and stock

ownership of key employees and significant shareholders. This level and frequency of financial disclosures is a key

part to evaluating issuing-company creditworthiness.

Of course, there have been recent rumblings about the SEC relaxing quarterly filing requirements; however, we believe most

companies will continue reporting their financials quarterly. Nonetheless, even a relaxed "every-six-months"

reporting cycle would still be superior to what investors receive from municipal bond issuers.

5. A Portfolio Heavy with Municipal Bonds Can Be a One-Trick Pony Light on Diversification

To be clear, we are not believers in the overdiversification offered by bond funds. In fact, bond-fund

overdiversification is one of the key reasons why the corporate bond returns

achieved by Bondavvy's recommendations have outperformed the leading corporate bonds ETFs.

That said, we do believe some level of diversification is important to maximize potential performance and to mitigate

risk. Corporate bond investors can:

- Diversify across issuing companies: Across Bondsavvy's 68 recommended corporate bonds include

issuing companies from over 15 different industry groups. While we seek to recommend bonds issued by companies

that have industry tailwinds, over a period of five to ten years, industry dynamics can change quickly.

Diversifying across a broad range of industry groups enables Bondsavvy

subscribers to maximize returns and mitigate risk. While municipal bond investors can diversify by the

issuing entity's source of revenue, it's questionable whether owning a New York City general obligation bond and

a New York State Dormitory Authority bond offers much diversification.

- Diversify across bond ratings: When the US Federal Reserve raised interest rates significantly

in 2022 and 2023, investment grade bonds were among the worst performing investments due to their higher

interest rate risk. Higher coupons and shorter maturity dates reduce interest rate risk of high yield corporate

bonds, which can make them a vital part to a bond portfolio. As noted above, investors will be hard pressed to find any

high yield municipal bonds when buying bonds online. Read our corporate bond credit spreads blog post to learn more about why high yield bonds generally have lower interest rate risk than investment grade

bonds.

- Diversify across maturity dates: While both municipal bond and corporate bond investors can

diversify across maturity dates, we believe corporate bond investors can do it better. In Figure 1 above, we

showed how significantly higher the yield to worst of corporate bonds vs. municipal bonds was. This only

included investment grade corporate bonds. If high quality high yield corporate bonds get added to this example,

the higher yields offered by corporate vs. municipal bonds would be even more pronounced.

To view the range of maturity dates and yields to maturity of Bondsavvy's recommended corporate bonds, please visit the

Bondsavvy subscription page and click the "Picks at a Glance" hyperlink.

Get Started

Watch Free Sample

(1) Source: Municipal Securities Rulemaking Board. Data are from 2010 to 2023.