Advantages of Corporate Bonds vs. Stocks

| |

Corporate Bonds |

Stocks |

Strong potential returns

with lower risk Strong potential returns

with lower risk |

|

|

Greater certainty

of recurring income Greater certainty

of recurring income |

|

|

Greater protection of principal Greater protection of principal |

|

|

More investment options More investment options |

|

|

Strong potential returns with lower risk

Strong potential returns with lower risk

Individual Corporate Bonds vs. Stocks

A key advantage of individual corporate bonds vs. stocks is that they can achieve

strong investment

returns and

limit your downside.

While corporate bonds typically do not experience the price volatility of stocks, a

variety of factors can cause corporate

bond prices to move, which can create opportunities to invest in corporate bonds with

strong upside.

Being able to quantify your downside is an important tool for individual bond investors.

A key reason why there is less

downside to bonds vs. stocks is that a bond is a contract between the issuing company

and the bondholder. The company

must pay interest on the bonds on specific dates, and it must return the face value of

the bond ($1,000 per bond) at

the bond's maturity date. Both of these factors stabilize the value of corporate bonds.

Stocks don't provide the same

level of commitment to shareholders, as a company can suspend dividend payments, and

investors have limited recourse

other than selling the stock. We saw this during the COVID-19 crisis, as some of the

largest companies in the world,

including Disney, Royal Dutch Shell, Boeing, and Ford either suspended or reduced their

stock dividends.

In addition

to having contracted interest and principal payments, corporate bondholders are senior to

common and preferred stockholders

in a company's capital structure. This is most relevant in the event a company files

for Chapter 11. In such

cases, bondholders often will not be made whole; however, since they are senior to

stockholders, bondholders are guaranteed

to have a larger recovery of their principal than stockholders, who are often completely

wiped out.

Greater certainty of recurring income

Greater certainty of recurring income

Bond issuers have contractual obligations to bondholders that are much more stringent

than obligations to shareholders.

This starts with the bond issuer's obligation to pay interest on time, typically on a

semi-annual basis. If a company

stops paying its interest to bondholders, the issuer could be deemed to have caused an

'event of default,' which could

enable bondholders to take certain actions to obtain their interest payments and/or a

return of their principal.

Stocks do not have these same obligations, and companies can, at the drop of a hat,

suspend dividend payments to stockholders,

as happened during the COVID-19 crisis in 2020.

Many retirement investors need to know that recurring interest or dividend payments

will continue to be paid, which is

why corporate bonds can be a more compelling investment opportunity for retirement

investors seeking a reliable income

stream. It wasn't too long ago that General Electric had a AAA credit rating and

was one of the world's most valuable

companies. After years of underperformance, in October 2018, GE cut

its quarterly dividend to $0.01 per

share. If this can occur at one of the world's most valuable companies, no

stockholder is immune from dividend cuts

or suspensions.

Greater protection of principal

Greater protection of principal

When investors buy stock of a company, there is no guarantee that the company will repay

the investor anything. The stock could

go up and it could go down depending on the company's performance and market

conditions.

As noted above, the face value of a corporate bond is $1,000. When a bond

matures, the issuing company owes the bondholder

the face value of the bond he purchased. This provides corporate bond investors with a

much higher level of principal security

relative to stockholders.

In addition, bondholders are more senior in a company's capital structure than

stockholders. In the event of a bankruptcy,

stockholders typically get wiped out where bondholders can recover a portion of their

principal depending on the value

of the company and what other debt obligations it has.

Being senior in a company's capital structure and having a contractual obligation to

receive the bond's face value at maturity

provides corporate bondholders a greater level of principal protection than that of

stockholders.

More investment choice than the stock market

More investment choice than the stock market

On any given day, people can invest in nearly 9,000 individual corporate bonds,

approximately double the number of publicly

traded stocks. This enables investors to build portfolios that are well suited to

their investment objectives and

risk profiles. For example, a more aggressive investor could favor high-yield

bonds and longer-dated investment grade

bonds. More conservative investors may stick to bonds of higher credit quality

and, to reduce pricing volatility,

limit the time to maturity of investment-grade bonds. We like to say "there's a

corporate bond for everyone."

We expect this enhanced level of investment choice in bonds vs. stocks to continue,

as corporate bond issuance has remained

strong and the number of companies going public through initial public offerings (IPOs)

has waned, falling 67% from 1999

to 2017. The number of publicly traded stocks decreased 45% from 1996 to 2015.

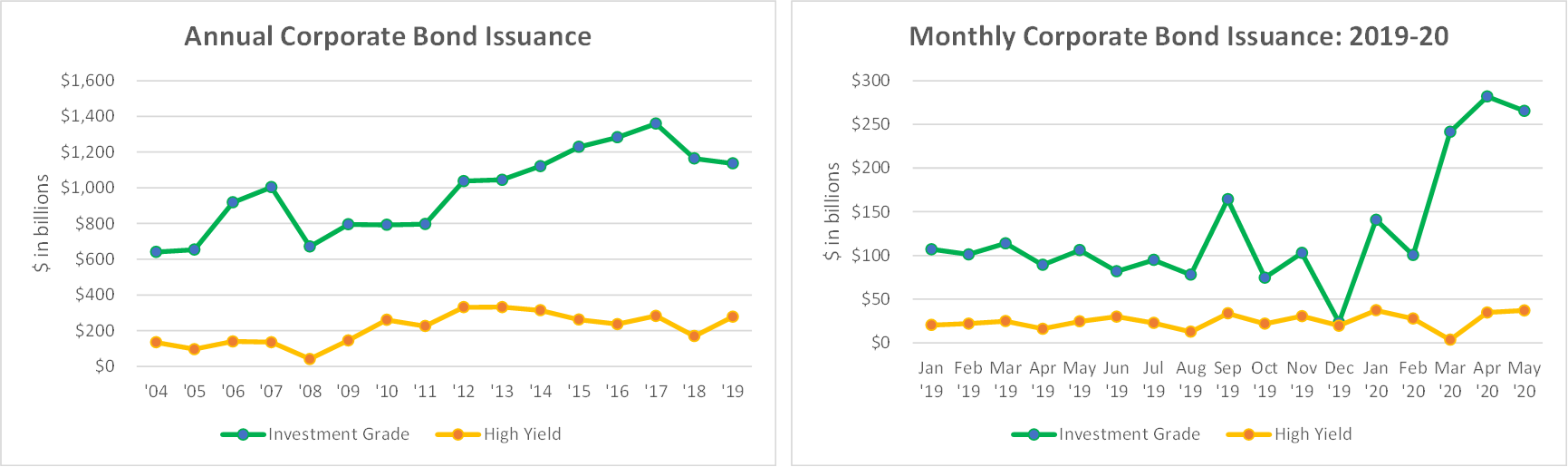

While 2018 corporate bond issuance fell to $1.3 trillion vs. $1.6 trillion in 2017, the

previous-record 2017 issuance levels were

a 3.5x increase from 1997. In Q4 2018, companies sold over six times more in bonds vs.

stocks. At the end of 2018, there was approximately

$9.2 trillion of corporate bonds outstanding, which is 2.4x the size of the municipal bond

market and nearly 60% the size of the

United States Treasury market.

In the wake of COVID-19 in 2020, many companies needed to borrow heavily to finance

losses as a result of many industries being

shut down or significantly restricted. As shown in Figure 1, monthly corporate bond

issuance surged to record levels in April

and May 2020. Monthly investment-grade corporate bond issuance exceeded $250 billion

in both April and May 2020. Across

these two months alone, companies issued over $500 billion in corporate bonds, which was

over 40% of all 2018 investment-grade

corporate bond issuance.

While many companies have work to do to support their new levels of indebtedness, the

significant issuance shows a robust corporate bond market

that can serve investors

across varying investment objectives and risk profiles.

Figure 1: Annual and Monthly Corporate Bond Issuance Volumes*

* Source: SIFMA bond issuance data

* Source: SIFMA bond issuance data

Another perspective

This article reviews our rationale for owning corporate bonds vs. stocks. For

a perspective on dividend stocks, you may

find the following websites of interest:

Dividend Aristocrats

Dividend Kings

Monthly Dividend Stocks