Individual corporate bonds can provide the investing trifecta: 1) high contractual income, 2) principal protection, and 3) opportunities for capital appreciation. Neither stocks nor bond funds provide all three of these benefits.

But how do investors select from the 11,000 corporate bonds available on online bond trading platforms?

Luckily, there is The Bondcast, Bondsavvy's exclusive financial webinar where it presents new corporate bond recommendations to its subscribers. This fixed income blog post provides answers to frequently asked questions for The Bondcast and the Bondsavvy investment service.

New Corporate Bond Recommendations Coming March 5

Bondsavvy presents new bond recommendations each quarter during The Bondcast, an interactive subscriber-only webcast. Our next edition of The Bondcast will be March 5, 2026 at 5:00pm EST and is only available to Bondsavvy Premier subscribers. We make new recommendations each quarter so we can incorporate issuing companies' latest quarterly financials and capitalize on new investment opportunities over the course of the year.

Why Own Individual Bonds vs. Bond Funds and Stocks

As noted earlier, individual corporate bonds can provide what bond funds and stocks do not provide on their own: 1) high contractual income, 2) principal protection, and 3) opportunities for capital appreciation.

One of the biggest weaknesses with bond funds is their distributions vary monthly, so investors cannot lock in high long-term income the way investors can with individual corporate bonds. Some bond funds can have turnover exceeding 500%, meaning the entire holdings of the fund turn over five times in a year. This results in significant trading costs, which are not disclosed to investors, as well as investors' inability to know what a bond fund's future distributions will be.

Bondsavvy Subscriber Benefit

Steve Shaw founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. We have shown how a select portfolio of individual corporate bonds can outperform the leading bond funds and ETFs.

Get Started

For stocks, the S&P 500 dividend yield on February 11, 2026 was a paltry 1.13% according to Gurufocus.com, and dividend payments can be slashed or discontinued overnight when companies hit a rough patch.

The income offered by individual corporate bonds is contractual and lasts until a bond's maturity date. To view the distribution of Bondsavvy's current bond recommendations, go to the subscribe to Bondsavvy page and click the "Picks at a Glance" link.

Overview of The Bondcast

We founded Bondsavvy to empower individual investors to benefit from the income, capital growth, and relative safety individual corporate bonds can provide. The Bondcast simplifies the 11,000-bond corporate bond universe to a select number of easy-to-understand investment recommendations. It puts individual investors in control of their fixed income portfolios.

1. Why own individual corporate bonds now?

We strongly advocate investors build bond portfolios over time; however, as of this February 11, 2026 update, there are several factors making now a compelling time to invest in individual corporate bonds:

- The S&P 500 now trades near a 30x price-to-earnings (P/E) ratio compared to approximately 22x in February 2016, according to Gurufocus.com. Historically, there has been an inverse relationship between purchase-date P/E ratios and future stock market returns.

- The S&P 500 dividend yield, according to gurufocus.com, was 1.13%, a fraction of the yields currently offered by individual corporate bonds. Click "Picks at a Glance" on the Bondsavvy subscription page to view the range of YTMs offered by Bondsavvy's current bond recommendations.

- Money market 7-day yields, such as those of Vanguard VMFXX, have fallen 1.70 percentage points to 3.60% since the US Federal Reserve began cutting rates in September 2024. We expect money market yields to keep falling should the Fed cut rates further per the December 2025 Fed dot plot.

- Income distributions for bond funds and ETFs vary monthly and do not enable investors to lock in long-term income, as can be done with individual corporate bonds.

- Since bond funds and ETFs do not trade relative to par value and lack underlying financial metrics, investors cannot assess whether bond funds or ETFs are trading at compelling values.

No. While there is always excitement around new bond recommendations, as of February 11, 2026, Bondsavvy had 29 corporate bonds rated 'buy' in addition to 32 rated 'hold.' We have as much conviction in previous recommendations rated 'buy' as we do in brand-new picks.

We update all buy/sell/hold ratings from previous recommendations each quarter based on the latest issuer financials and bond pricing and yield metrics. We provide additional email updates in the case of mergers, tender and exchange offers, and other material events impacting our bond issuers.

In addition, before attending their first edition of The Bondcast, subscribers would be well served to review our prior recommendations. They may decide to purchase some of these recommendations in advance of our March 5, 2026 edition of The Bondcast.

3. Why should I attend The Bondcast financial webinar?

Once investors understand the benefits of owning individual bonds vs. bond funds, they need to decide which among the 11,000

available corporate bonds to add to their portfolios. Without Bondsavvy, this is a daunting task.

Without Bondsavvy, investors must sift through thousands of bonds and rely on corporate bond ratings for financial

analysis. The problem with this approach is that bond rating methodologies are flawed, often underrating high yield bonds and overrating investment grade bonds. In addition, bond ratings do not speak to whether a bond is a compelling investment, as they ignore a bond's price, YTM, credit spread, and interest rate risk.

Bondsavvy Subscriber Benefit

Bondsavvy's corporate bond recommendations are a big step up from bond ratings. Our investment analysis identifies bonds at compelling prices and yields and that we believe can outperform over the long term.

Get Started

Bondsavvy's corporate bond

research evaluates over 15 investment

considerations when we make new bond recommendations. Not only do we evaluate the creditworthiness of a bond

issuer, but we seek to understand whether a prospective bond investment represents a good value. Our goal is

to identify bonds that pay high yields relative to their risk and offer compelling total return opportunities.

Read our fixed income investing

strategy post to learn more.

Watch Steve Shaw present “What to Know Before Investing in Bonds.”

Get Free Video

Bondsavvy simplifies bond investing by taking a large universe of bonds and narrowing it down to a select list of recommendations we believe can outperform the leading bond funds and ETFs. Bondsavvy subscribers use our bond recommendations to buy bonds online and build bond portfolios.

4. Is The Bondcast a live event? How will I gain access?

Yes, The Bondcast is a live subscriber event we host on Zoom. Shortly before the live event, we will email Zoom details for The Bondcast. Should you not be available on March 5, you can access a recording of the live event several hours after the presentation concludes. Upon subscribing, you will see details for all current 61 buy/hold recommendations as well as the presentations supporting each recommendation.

The Bondcast is

interactive, as our subscribers post questions that our founder Steve Shaw

answers throughout the webcast.

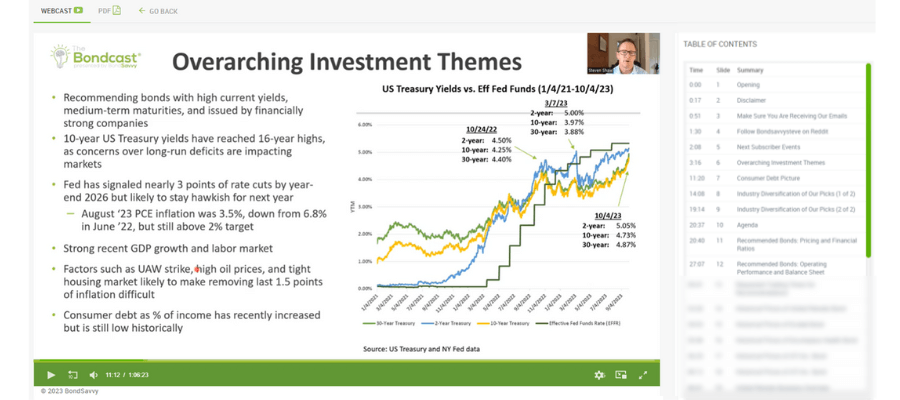

We kick off each edition of The Bondcast with a brief discussion of overarching investment themes.

These themes help us narrow down the bond universe to certain sectors, credit quality, and maturity dates. Figure 1b shows a slide where we discussed key investment themes during a previous edition of The Bondcast.

Figure 1b: Sample Slide from Previous Edition of The Bondcast

You'll notice a table of contents to the right of the slide. Once we post a recording of The Bondcast in our subscriber area, we append a table of contents so subscribers can click on the slides of greatest interest.

5. If I subscribe to Bondsavvy, do I gain access to prior Bondsavvy bond recommendations?

Yes. From our first set of bond recommendations made September 26, 2017, Bondsavvy has made 152 corporate bond recommendations. We currently have 29 bonds on our 'buy' list and another 32 corporate bonds rated hold. The remaining bonds have previously been sold.

As a Bondsavvy subscriber, you gain access to our existing bond recommendations, as well as all new bond picks for as long as you are a Bondsavvy subscriber. View our corporate bond returns page to see the performance of previously recommended bonds, including the bond names and CUSIPs for bond recommendations we have exited.

6. How long is The Bondcast and what's the agenda?

The Bondcast is a 60-minute presentation, which consists of i) Overarching investment themes and market

conditions; ii) Pricing and financial ratios of our recommended bonds and bond issuers; iii) Historical bond prices

and call provisions; and iv) Analysis of each bond issuer's business, growth, risks, capital allocation, capital

structure, and recent financial performance.

Based on the investment analysis presented during The Bondcast, subscribers will be able to decide which bonds

they want to add to their investment portfolios. Click to view a sample edition of The Bondcast.

7. How many corporate bond

recommendations will you make at each edition of The Bondcast?

We typically make four new bond recommendations during each edition of The Bondcast. Our corporate bond recommendations are at the individual bond, or CUSIP or ISIN, level.

8. How are Bondsavvy recommendations split between investment-grade and

high-yield corporate bonds?

Historically, we have had a fairly even split; however,

based on market conditions, at certain editions of The Bondcast, it may skew slightly

toward either investment-grade or high-yield corporate bonds. Of our last 60 corporate bond recommendations through November 2025, we have recommended 27 high yield bonds and 33 investment grade bonds.

View our corporate bond returns page

to see a breakdown of our investment

grade and high yield bond recommendations.

9. Am I going to have to do a bunch of work to make corporate bond investments?

No.

Bondsavvy does the heavy lifting for you. During The Bondcast, we will

provide you key pieces of information on each company and corporate bond we are recommending, boiling down each

recommendation to two to three PowerPoint slides.

Along with additional color provided during

The Bondcast, you will have the information you need to make an investment. All you'll need to do

is copy and paste your selected bond CUSIPs (or ISINs for non-US investors) to execute trades through online bond

trading platforms such as

Fidelity.com, E*TRADE, Schwab, Vanguard, and Interactive Brokers, or whichever brokerage you use.

Watch Steve Shaw present “What to Know Before Investing in Bonds.”

Get Free Video

That said, investors must understand that

investing in individual corporate bonds is not a "set it and forget it" investment strategy in the way bond index

funds are. It is incumbent upon Bondsavvy subscribers to view our new recommendations and recommendation

updates so they can make investment decisions.

International subscribers should look into which online brokerages support corporate bond trading in their areas.

10. What happens if a bond recommendation changes?

Bondsavvy updates its bond recommendations each quarter

during The

Super Bondcast financial webinar. During The Super Bondcast, we review each issuing

company's updated financials, as well as each bond's update price, yield to maturity, and credit

spread. We then discuss the rationale for each updated buy/sell/hold

recommendation.

We complement The Super Bondcast with written recommendation updates we email subscribers and post in the Bondsavvy subscriber

area.

11. Can I view prior editions of The Bondcast?

Yes, for as long as you subscribe to Bondsavvy,

you have access to recordings of all Bondsavvy financial

webinars, including The Bondcast and Super Bondcast.

12. Is Bondsavvy an SEC-registered trading

platform, broker-dealer, investment adviser, or asset manager?

None of the above. Bondsavvy is not registered as an investment adviser under the Investment Advisers Act

of 1940, or the securities laws of any state

or other jurisdiction, nor is such registration contemplated. Bondsavvy makes recommendations on

individual corporate bond investments and charges

a fee to customers. We do not hold customer assets, and we do not execute trades on behalf of

customers.

13. Are Bondsavvy's corporate bond investment recommendations specific to my portfolio?

No, Bondsavvy does not provide personalized advice. As Bondsavvy operates under the publishers' exemption of the

Investment Advisers Act of 1940, the investments discussed during The Bondcast do not

take into account an investor's particular investment objectives, financial situation or needs. In making an

investment decision, each investor must rely on his or her own examination of the investment, including the merits

and risks involved. Please

read the Bondsavvy general disclaimer.

While Bondsavvy does not provide

personalized advice, we have published the How

To Build a Bond Portfolio blog post, which provides some key considerations for investors

constructing bond portfolios.

We hope to welcome you as a new Bondsavvy subscriber and that we'll see you on The Bondcast.

Get Started

Watch Free Sample