On December 10, 2025, the US Federal Reserve projected to reduce the target range of the fed funds rate an additional 50 basis points by yearend 2027. After lowering the fed funds rate 25 basis points today, the target range would fall from 3.50%-3.75% to 3.00%-3.25% by yearend 2027, according to the December 2025 Fed dot plot. This is the same level of rate cuts projected by the previous Fed dot plot.

As money market yields move in lockstep with the fed funds rate, we expect the Vanguard VMFXX 7 day yield to fall to approximately 3.59% by the new year.

There was a wide distribution among the 19 FOMC meeting participants regarding 2026 Fed rate cuts. Four participants projected no 2026 rate cuts, while four projected 25 basis points, and another four projected 50 basis points.

Newly appointed Fed governor Stephen Miran appears to have projected 150 basis points of 2026 Fed rate cuts. Mr. Miran voted against today's 25 basis-point rate cut, as his preference was to reduce the rate by 50 basis points. FOMC members Austan Goolsbee and Jeffrey Schmid also voted against the rate cut, as they preferred no change to the target range.

Key takeaways from today's FOMC meeting and Summary of Economic Projections (the "SEP") release included:

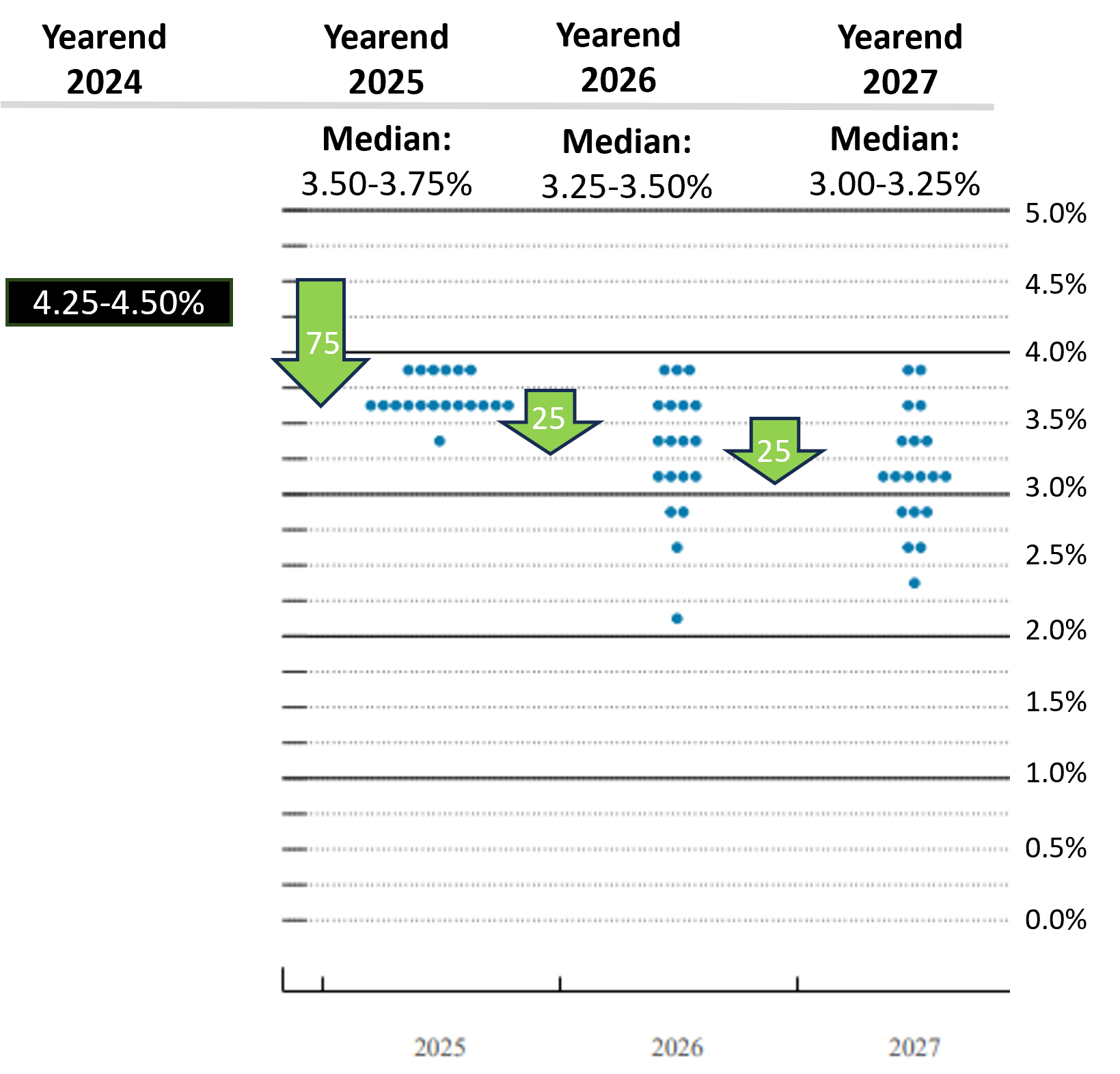

- The median of the December 2025 Fed dot plot projections sees the fed funds rate falling 25 basis points in 2026 and 25 basis points in 2027, as shown in Figure 1.

- The Fed projects inflation to remain elevated, with PCE inflation expected to end 2026 at 2.4%, 20 basis points lower than the September 17 projection. It expects PCE inflation of 2.1% by yearend 2027.

- Meeting participants raised 2026 real GDP growth projections by 50 basis points to 2.3%; however, 20 basis points was related to growth being taken from Q4 2025 and put into Q1 2026 due to the government shutdown and reopening.

- As of December 3, 2025, the Fed had reduced the size of its securities holdings ("the Fed balance sheet") by $2.5 trillion, to $6.5 trillion, since reaching a peak of $9 trillion in April 2022.

- Following the 2:00pm release of the Fed's rate announcement and SEP, the 10-year and 30-year US Treasury yields were 4.16% and 4.79%, respectively, according to Bloomberg. These yields were two basis points and one basis point lower than where they closed December 9.

Money market fund returns closely mirror the fed funds rate. If the fed funds rate follows the projected path to low-3.00% by 2027, investors in the Vanguard VMFXX money market fund should expect their returns to follow suit.

Bondsavvy has added 23 new recommended corporate bonds over the last year, with pick date yields to maturity ranging from 4.72% to 9.13%. Yields of large money market funds, such as Vanguard VMFXX, vary monthly and will fall as the fed funds rate declines. Bond fund distributions also vary monthly and cannot be relied upon to deliver income the way fixed-rate individual corporate bonds can.

Bondsavvy Subscriber Benefit

Moody's and S&P bond ratings do not assess whether a bond is a good value and, therefore, can have limited use for investors. Bondsavvy identifies corporate bonds that pay high coupons relative to their risk and offer capital appreciation opportunities.

Get Started

The December 2025 Fed Dot Plot

The Fed dot plot shows the projected yearend target range for the fed funds rate from each of the 19 FOMC meeting

participants. Each dot represents the opinion of one FOMC participant. As shown in Figure 1, three different groups of four FOMC

participants projected varying yearend 2026 fed funds target ranges. One group projected no 2026 rate cuts, another projected one rate cut, and the third group of four saw two 2026 rate cuts. There was one projection, likely by new appointee Stephen Miran, of a yearend 2026 fed funds rate target range of 2.00%-2.25%.

Figure 1: December 2025 Fed Dot Plot Showing Projected Target Range of Fed Funds Rate

Source: December 10, 2025 FOMC Summary of Economic Projections and Bondsavvy calculations.

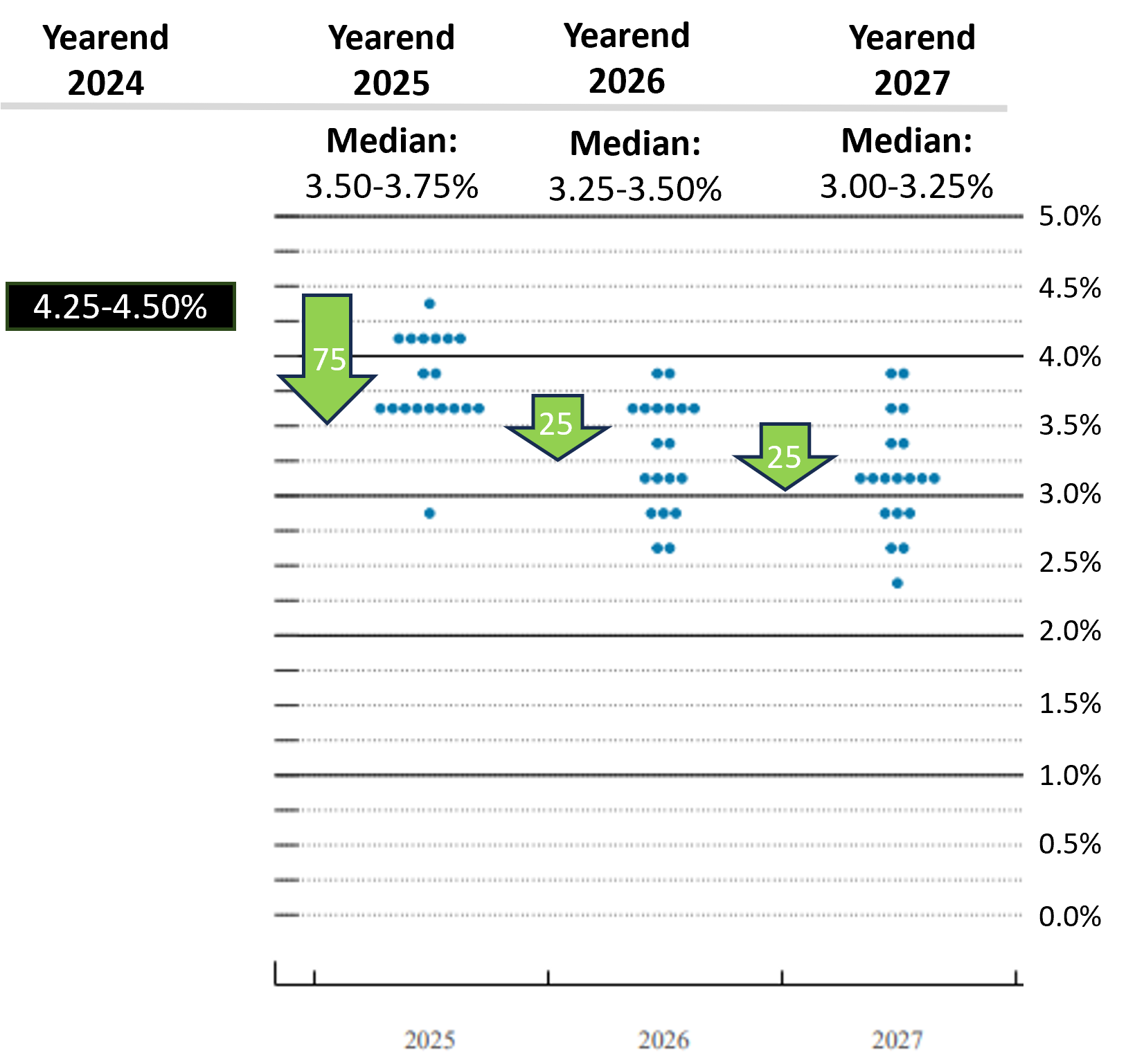

We compare the December 2025 Fed dot plot above to the September 2025 Fed dot plot in Figure 1a below. As shown, the median projections of yearend 2026 to 2027 fed funds rates were consistent between these two Fed dot plots. In December 2025, Mr. Miran, the most ardent would-be rate cutter, reduced his 2026 dot an additional 50 basis points to 2.00% to 2.25%.

Figure 1a: September 2025 Fed Dot Plot Showing Projected Target Range of Fed Funds Rate

Source: September 17, 2025 FOMC Summary of Economic Projections and Bondsavvy calculations.

The FOMC Press Conference December 10, 2025

On December 10, 2025, Fed Chair Jerome Powell hosted a press conference after the FOMC released its 2:00pm Eastern Time

statement that it would be reducing the target range of the fed funds rate by 25 basis points to 3.50% to 3.75%. Figure A shows key

statements he made during the press conference, which included the FOMC's views on current economic conditions,

including growth and inflation.

Figure A: Key Statements from the FOMC Press Conference on December 10, 2025

Image licensed from Getty Images.

Bondsavvy Subscriber Benefit

Steve Shaw founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high total return opportunities relative to their risk.

Get Started

Summary of Last Four Fed Dot Plots

Figure 1b compares the median levels for fed funds rate cuts and the fed funds target range across the last four Fed

dot plots. The total amount of 2025-2027 fed rate cuts projected has been little changed over the last four Fed dot plots.

Our recent economic newsletter article shows the impact 250 basis points of Fed rate cuts

has had on US Treasury yields during the three most recent rate-cutting periods.

Figure 1b: Summary of Last Four Fed Dot Plots

|

2025 |

2026 |

2027 |

Total Rate Cuts ('25-'27) |

| Median Level of Rate Cuts in Given Year |

|

|

|

|

| December 2025 Fed Dot Plot | -75 bps | -25 bps | -25 bps | -125 bps |

| September 2025 Fed Dot Plot | -75 bps | -25 bps | -25 bps | -125 bps |

| June 2025 Fed Dot Plot | -50 bps | -25 bps | -25 bps | -100 bps |

| March 2025 Fed Dot Plot |

-50 bps |

-50 bps |

-25 bps |

-125 bps |

|

|

|

|

|

| Median Yearend Fed Funds Target Range |

|

|

|

|

| December 2025 Fed Dot Plot | 3.50%-3.75% | 3.25%-3.50% | 3.00%-3.25% | |

| September 2025 Fed Dot Plot | 3.50%-3.75% | 3.25%-3.50% | 3.00%-3.25% | |

| June 2025 Fed Dot Plot | 3.75%-4.00% | 3.50%-3.75% | 3.25%-3.50% | |

| March 2025 Fed Dot Plot |

3.75%-4.00% |

3.25%-3.50% |

3.00%-3.25% |

|

Sources: FOMC Summary of Economic Projections Reports and Bondsavvy analysis.December 2025 Summary of Economic Projections

In connection with creating the Fed dot plot, FOMC participants project key US economic data points, including

unemployment, inflation, and GDP growth. Figure 2 provides a summary of the projections across recent Fed SEPs.

As shown, compared to the previous SEP, the December 2025 SEP showed a 20-basis-point reduction in yearend 2026 PCE inflation (to 2.4%) and a 50-basis-point increase in 2026 real GDP growth (to 2.3%).

Figure 2: Median Economic Projections of FOMC Participants

| Date of Projection |

2026 |

2027 |

Longer Run |

|

|

|

|

| Unemployment Rate |

|

|

|

| December 2025 | 4.4% | 4.2% | 4.2% |

| September 2025 | 4.4% | 4.3% | 4.2% |

| June 2025 | 4.5% | 4.4% | 4.2% |

| March 2025 |

4.3% |

4.3% |

4.2% |

| December 2024 |

4.3% |

4.3% |

4.2% |

|

|

|

|

| PCE Inflation |

|

|

|

| December 2025 | 2.4% | 2.1% | 2.0% |

| September 2025 | 2.6% | 2.1% | 2.0% |

| June 2025 | 2.4% | 2.1% | 2.0% |

| March 2025 |

2.2% |

2.0% |

2.0% |

| December 2024 |

2.1% |

2.0% |

2.0% |

|

|

|

|

| Change in Real GDP |

|

|

|

| December 2025 | 2.3% | 2.0% | 1.8% |

| September 2025 | 1.8% | 1.9% | 1.8% |

| June 2025 | 1.6% | 1.8% | 1.8% |

| March 2025 |

1.8% |

1.8% |

1.8% |

| December 2024 |

2.0% |

1.9% |

1.8% |

Source: FOMC Summary of Economic Projections ReportsHow Fed Funds Rate Changes Have Impacted US Treasury Yields

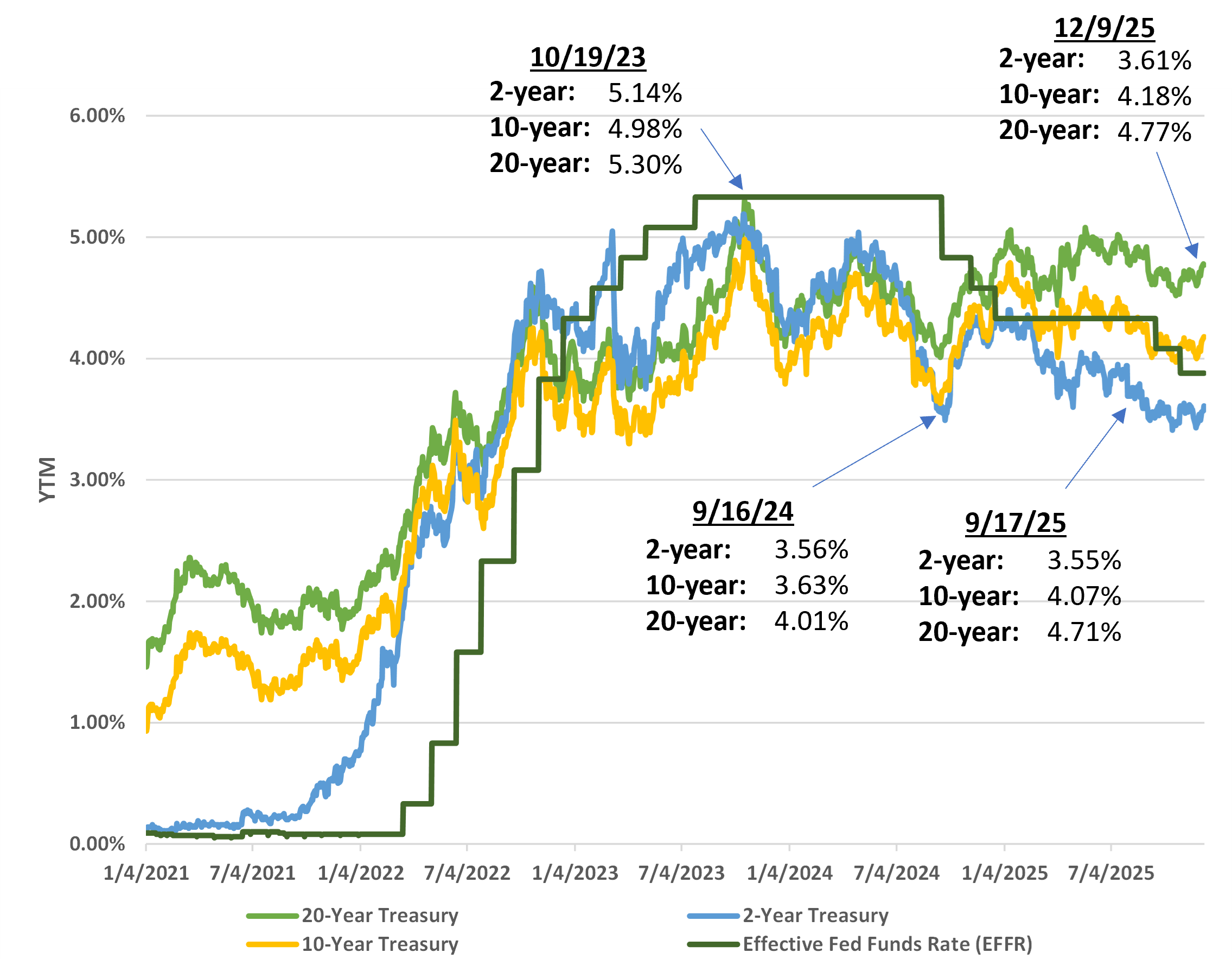

While the US Federal Reserve does not control long-term US Treasury yields, Fed policy and expectations of Fed policy

changes can have a big impact. Figure 2b compares the Effective Fed Funds Rate to the 2-year, 10-year, and 20-year

US Treasury yields. Longer-term Treasury yields impact what homeowners pay for mortgages and the interest rates

companies pay on their debt, resulting in significant impact to economic conditions.

Per Figure 2b, US Treasury yields began increasing in advance of the Fed's first rate increase in March 2022. As

these yields increased, they converged and had been moving, generally, in similar directions. Treasury yields fell

in late-2023 after reaching a peak in October 2023, but then rose again until spring 2024, as inflation remained

stubborn.

Then, in anticipation of Fed easing, there was a significant decrease in US Treasury yields across the yield curve.

From mid-April to mid-September 2024, the 2-, 10-, and 20-year yields fell 142, 101, and 84 basis points,

respectively. Yields then reversed course again, as September and October 2024 inflation reports came in hot, and

concerns over continued high US budget deficits remained.

Between September 2024 and December 9, 2025, 2-year, 10-year, and 20-year US Treasury yields have risen 5, 55, and 76 basis points, respectively.

Preview our recent economic newsletter

article to see how previous Fed rate cuts impacted bond yields and what this could mean for the path of bond

yields in the future.

Figure 2b: US Treasury Yields vs. Effective Fed Funds Rate -- January 4, 2021 to December 9, 2025

Source: US Treasury data as presented by Bondsavvy.

As shown in Figure 2b, US Treasury yields have increased slightly from September 17 to December 9, 2025, with the 2-year, 10-year, and 20-year US Treasury yields increasing 6, 9, and 6 basis points, respectively.

What the Fed Dot Plot Means for Investors

The expected downward trajectory of the fed funds rate creates advantages for individual corporate

bonds over other investments, such as money market funds and bond funds and ETFs.

Total money market fund assets were $7.0 trillion as of June 17, 2025, up $200 billion from December 2024,

according to Investment Company Institute.

As we discuss in our Eight Reasons Not to Own Vanguard VMFXX

blog post, the VMFXX yield is highly correlated to the fed funds rate. As the fed funds rate falls, the VMFXX yield

would fall as well. In addition, since money market funds such as Vanguard VMFXX cannot achieve capital

appreciation, such investments would not benefit from an increase in bond prices associated with falling interest

rates.

Money market and bond fund distributions vary each month, and investors cannot lock in income the way they can with

individual bonds. In our VMFXX yield blog post, we discuss

how high-quality US corporate bonds have advantages to Vanguard VMFXX, including higher potential returns, lower

fees, and higher credit quality. Individual corporate bonds allow investors to lock in high yields for 5, 10, or 20+

years and to benefit from capital appreciation opportunities. Neither of these key investment objectives is

possible with money market funds.

Bondsavvy added 23 new recommended corporate bonds over the last year, with yields to maturity ranging from 4.72% to 9.13%. Total return opportunities can be

higher than bond YTMs, as we show in our corporate bond returns page.

Get Started

Watch Free Sample