In October 2024, seven years after Steve Shaw founded Bondsavvy's bond recommendation service, Bondsavvy launched the Bondsavvy Economic Advisor newsletter to provide an unbiased perspective on how economic trends and public policy impact subscribers' investments and other key "pocketbook" issues.

Below is a preview of our first Economic Advisor article, "How More Fed Rate Cuts Could Impact Bond Yields and Mortgage Rates." This preview includes about one-third of the full 16-page article. Subscribe to our economic newsletter to access this full article, as well as our upcoming newsletter articles.

Now that the US Federal Reserve has begun cutting interest rates, the key questions are: "What could this mean for bond yields, investors, and future mortgage rates?" Luckily, Fed rate cuts have occurred three times this century, and we can use these previous cycles to evaluate the potential impact of this rate-cutting cycle.

Understanding the future direction of US Treasury yields can help investors decide where to invest, and this article discusses certain key considerations. In addition, based on where longer-term US Treasury yields move over the next several years, homeowners can decide whether mortgage rates could improve and whether buying or refinancing now is a good idea.

Key takeaways from this Bondsavvy Economic Advisor article include:

- As interest rate hikes end, short- and long-term US Treasury yields converge before then diverging in the wake of interest rate cuts.

- Fed rate cuts impact longer-term bond yields, but they do not determine them.

- As of October 8, 2024, US Treasury yields had already fallen significantly from their October 2023 peaks. Based on prior rate cut cycles, 10-year Treasury yields could fall further, but longer-term yields likely have limited room to fall, in the near term, from October 8, 2024 levels.

- If historical precedent is followed and assuming constant mortgage margins, mortgage rates tied to the 10-year US Treasury could fall slightly by yearend 2026 should Fed rate cuts total an additional 200 basis points. This could be mitigated by ongoing risks in the US Treasury market.

- Further Fed rate cuts would continue to erode returns offered by money market funds, CDs, and short-term bond funds. Individual corporate bonds, where investors can lock in long-term income and benefit from potential capital appreciation, are a compelling alternative.

This article analyzes prior movements of US Treasury yields and the fed funds rate to establish ranges of where bond yields and mortgage rates could head should we see an additional 200 basis points of rate cuts by 2026. Readers should note that the supply and demand for US Treasurys, overall financial conditions, and other factors will also heavily impact bond yields and mortgage rates.

To evaluate how Fed rate cuts beginning September 2024 could impact US Treasury yields, this article compares the fed funds rate to the 2-year, 10-year, and 20-year US Treasury yields during the three most recent Fed interest rate cycles. Per the September 2024 Fed dot plot, the median projection of the yearend 2026 federal funds rate was 2.75% to 3.00%, or 250 basis points (2.5 percentage points) lower than the 5.25% to 5.50% target range before the September 18, 2024 FOMC meeting.

Since a 250-basis-point Fed rate cut is the current projection, our analysis on prior Fed rate cuts will focus on where US Treasury yields stood after approximately 250 basis points of interest rate cuts. In certain cases, when rate cuts were larger, we will also show the impact of these Fed rate cuts on US Treasury yields.

Join Bondsavvy Economic Advisor

Join Bondsavvy Economic Advisor

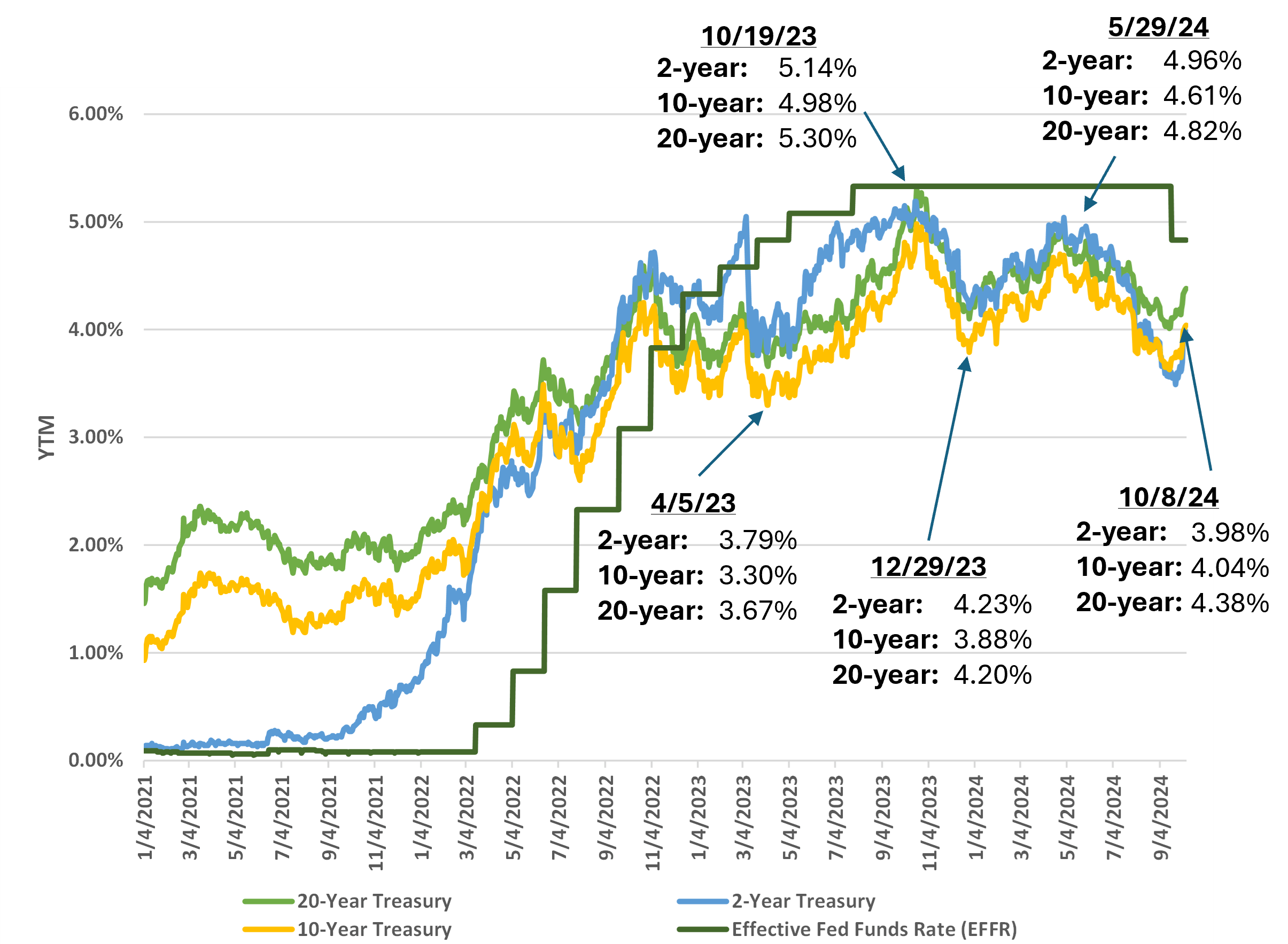

Many investors are familiar with the target range of the federal funds rate. For charting purposes, we use the Effective Fed Funds Rate ("EFFR"), which is the volume-weighted median of overnight federal funds transactions reported to the Fed. As of October 8, 2024, the EFFR was 4.83%.

Fed Funds Rate vs. US Treasury Yields: January 2021-October 8, 2024

Let's start with where things stand today. In analysis we present later, we show the amount US Treasurys rose and fell in the wake of the three interest rate cycles that occurred prior to the current cycle that began in 2022.

As we will show in our case studies, at the end of an interest rate hike period, short- and long-term Treasury yields typically converge near the cycle's peak fed funds rate. Similar to previous cycles, Treasury yields peaked on October 19, 2023, as shown in Figure 1. Since then, US Treasury yields have already fallen materially, with the 2-year Treasury falling 116 basis points ("bps") to 3.98% on October 8, and the 20-year Treasury falling 92 basis points, from 5.30% on October 19, 2023 to 4.38% on October 8, 2024. These recent Treasury yield reductions happened after only 50 basis points of rate cuts.

Figure 1: Impact of 2022-2024 Interest Rate Hikes and Cuts on US Treasury Yields

Sources: US Treasury and Federal Reserve Bank of New York data. Chart created by Bondsavvy.

Summary Impact of Fed Funds Rate Cuts on Treasury Yields

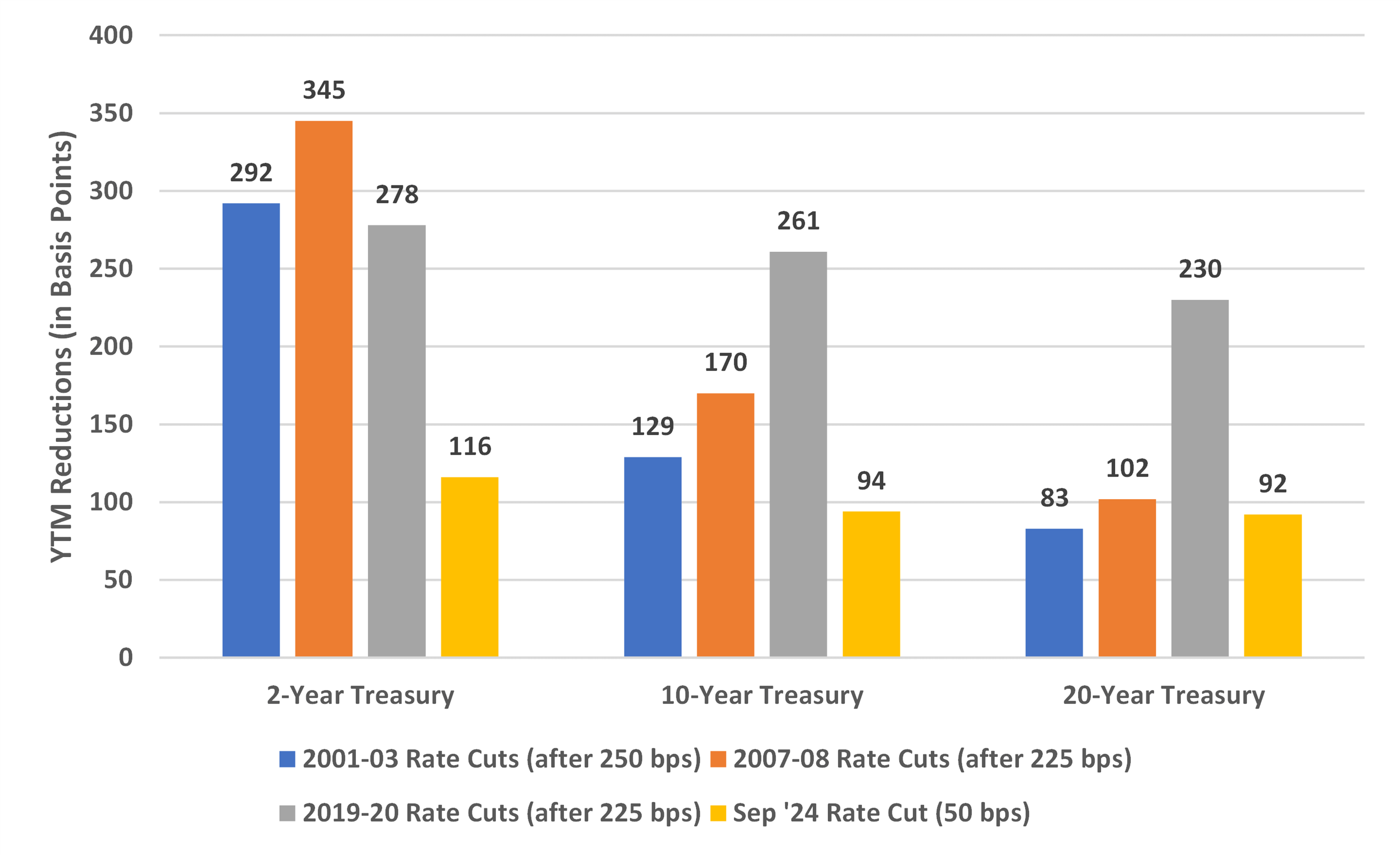

This Bondsavvy Economic Advisor article seeks to project where US Treasury yields could be headed if, per the September 2024 Fed dot plot, the Fed's forecast of 250 basis points of interest rate cuts through 2026 comes to fruition. Figure 1a provides a summary of the amount (in basis points, or "bps") US Treasury yields fell in response to the most recent interest rate cycles.

For example, after the first 225 to 250 basis points of rate cuts across the last three complete interest rate cycles, the 10-year US Treasury YTM fell 129, 170, and 261 basis points. As of October 8, 2024, the 10-year US Treasury YTM has fallen 94 basis points from its October 2023 peak.

View full article at Bondsavvy Economic Advisor.

As we'll discuss later, we believe the 261-basis-point decline in the 10-year US Treasury following the 2019-2020 rate cuts is an anomaly, as it happened in the wake of Covid-19 when the Fed cut interest rates to zero, grew its balance sheet over 70% to $7.1 trillion, and Q2 2000 US GDP fell an unprecedented 30%. We believe a better comparison is the 129- and 170-basis-point drops to 10-year Treasury yields after the first 250 basis points of 2001-2003 cuts (the blue bar) and the first 225 basis points of 2007-2008 rate cuts (the dark orange bar). Since, on October 8, 2024, the 10-year Treasury had fallen 94 basis points from its peak to 4.04%, reaching the Treasury yield reductions of the 2001-2003 and 2007-2008 rate cut periods imply 10-year yields of 3.28% and 3.69%, respectively. This would represent 76- and 35-basis-point reductions, respectively, from the October 8, 2024 10-year YTM of 4.04%.

Figure 1a: Reductions in Treasury Yields Resulting from Interest Rate Cuts (1)

(1) Yield reductions for the first three rate cut periods are from each interest rate cycle's yield peak to the date one month after the fed funds rate was cut 250 basis points in 2001-2003 and 225 basis points in the 2007-2008 and 2019-2020 rate cut periods. The yield reduction from the September 2024 rate cut is as of October 8, 2024. Sources: US Treasury and Federal Reserve Bank of New York data and Bondsavvy calculations.

Also, as shown in Figure 1a, the impact Fed rate cuts have to short-term Treasury yields is generally more pronounced than their impact on longer-term yields. For example, in the 2007-2008 rate cut period, the 2-year, 10-year, and 20-year US Treasury yields fell 345, 170, and 102 basis points, respectively.

One caveat is that we measure the US Treasury yield impact one month following the rate cut that had taken the fed funds rate down between 225 to 250 basis points from its cycle peak. This is one of the reasons the 2019-2020 example is an anomaly, as long-term Treasury yields increased materially later in 2020 and into 2021, as financial markets recovered.

Join Bondsavvy Economic Advisor

Join Bondsavvy Economic Advisor

One additional point relates to 20-year bond yields. Per Figure 1a, the 20-year US Treasury yield had already fallen 92 basis points from the yield peak on October 19, 2023 until October 8, 2024. Arguably, when compared to the yield reductions of the 2001-2003 (83 basis points) and 2007-2008 (102 basis points) rate cut periods, this implies limited near-term potential yield reductions for 20-year Treasurys.

Lastly, the US is substantially more indebted in 2024 than it was just 15 years ago, on a debt-to-GDP basis. Deficit spending continues unabated, with deficit hawks in the halls of Congress a truly endangered species. This will continue to bring on new supply of US Treasurys for years to come, which can limit how much further US Treasury yields can fall.

How Fed Rate Cuts Could Impact Mortgage Rates

As shown in Figure 1a above, on October 8, 2024, the 10-year US Treasury yield had fallen 94 basis points to 4.04% from the 4.98% peak reached October 19, 2023. If the 10-year Treasury yield followed the decline of the 2001-2003 and 2007-2008 fed rate cut periods, the total decline would be between 129 to 170 basis points. This would imply the 10-year US treasury yield could fall another, approximately, 35 to 75 basis points from October 8, 2024 levels should the Fed follow through with an additional 200 basis points of rate cuts.

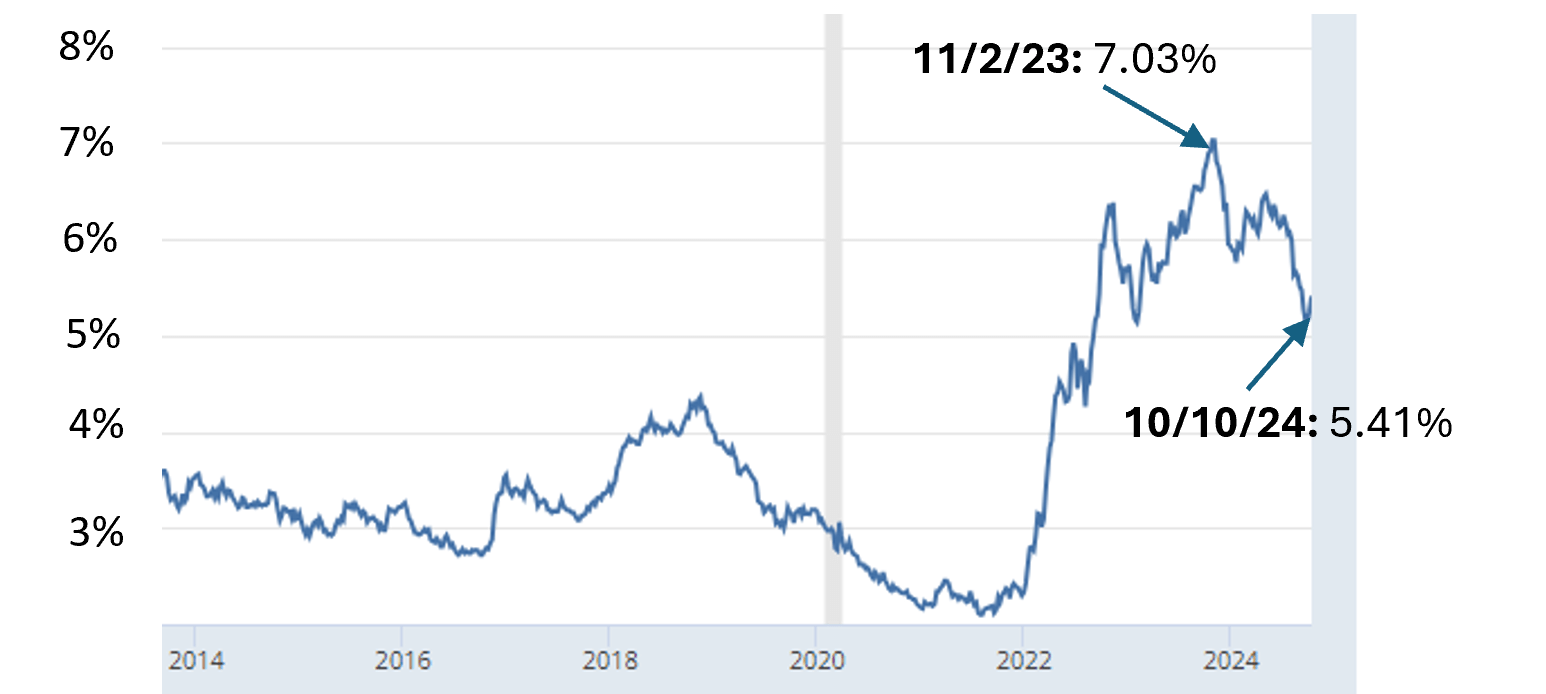

Since many long-term fixed-rate mortgages are indexed off the 10-year US Treasury, this could result in slightly lower fixed mortgage rates, assuming mortgage rate margins don't change from current levels. That said, as illustrated in Figure 1b, 15-year fixed mortgage rates have already fallen 162 basis points from their November 2, 2023 peak of 7.03%.

Figure 1b: 15-Year Fixed Rate Mortgage Average in the United States

Source: Freddie Mac.

Risks to potentially lower mortgage rates include the potential for the underlying US Treasury market to sell off (resulting in higher yields) due to unsustainable debt levels. For Q2 2024, total public debt as a percentage of US GDP reached 120%, up from 80% in Q2 2009, according to data from the Office of Management and Budget and the St. Louis Federal Reserve Bank.

In addition, as mortgage rates have fallen since 2023, existing home prices have risen. To illustrate, the mean sales price of existing homes, according to the National Association of Realtors, increased 4% from $528,600 in August 2023 to $549,900 in August 2024. Therefore, should mortgage rates fall in the wake of further Fed rate cuts, such reductions may not be enough to offset potentially higher mortgage principal balances associated with higher home sale prices.

How Fed Rate Cuts Could Impact the Investment Landscape

When Bondsavvy evaluates new corporate bond recommendations, US Treasury yields are one of 16 factors in our investment analysis. We seek to identify bonds that pay high yields relative to their risk and, when possible, offer potential capital appreciation.

Click the below button to subscribe to Bondsavvy Economic Advisor and read the rest of this article. Existing Bondsavvy investment recommendation subscribers should log into their Bondsavvy accounts to subscribe.

Join Bondsavvy Economic Advisor

Join Bondsavvy Economic Advisor

The complete "How More Fed Rate Cuts Could Impact Bond Yields and Mortgage Rates" article is 16 pages in length.