Many high yield corporate bonds have achieved strong recent performance, but investors often avoid these investments

due to their perceived higher default risk.

Due to bond rating flaws, however, select high yield bond issuers have stronger financials than companies with

investment grade bond

ratings. In addition, high yield bonds generally have lower interest rate risk than investment grade bonds,

which enabled high yield bonds to outperform investment grade bonds during the 2022-2023 US interest rate hikes.

Bondsavvy seeks to recommend high yield

corporate bonds that pay high interest relative to their risk and provide capital appreciation opportunities.

These investments come with both positives and negatives, of which investors must be aware. This fixed income blog

post provides an unbiased deep dive into high yield bonds so you can decide whether to add them to your bond

investing portfolio.

A High Yield Corporate Bond Example

As of August 13, 2024, Ford Motor Company bonds had a Ba1 bond rating by Moody's, making them high yield bonds. It

has this high yield bond rating despite strong financial performance and reporting $26 billion of automotive cash

vs. $19 billion of automotive debt as of June 30, 2024. Bondsavvy estimates that over 95% of issuers with investment

grade bond ratings (Baa3/BBB- and higher by Moody's and S&P) have substantially more debt than cash on their

books.

A corporate bond portfolio with only investment grade bonds would have

performed poorly in 2022 to 2023, as the Fed hiked interest rates, and US Treasury yields followed suit. Investors

would be surprised to learn that corporate bonds issued by Apple and Microsoft, two of the world's most profitable

companies, fell over 30% during this time.

Since high yield bond performance is generally driven more by an issuer's financial performance than by market

interest rates, many high yield bonds held their values in 2022 and 2023, outperforming many investment grade bonds.

Five Key Takeaways from This High Yield Bond Blog Post

We believe owning individual corporate bonds offers many advantages over bond

funds, including higher potential returns, lower fees, the ability to build a portfolio specific to your objectives,

fixed coupon payments, among others. Before investing in high yield bonds, however, it's important for investors to

assess their advantages and challenges.

Five key things to know before investing in high yield bonds are:

- High yield bonds' lower interest rate risk can positively impact performance.

- High yield bond issuers can have stronger financials than many investment grade issuers.

- A company may have debt that is senior to its bonds, a factor that could impact an investment decision depending

on an issuer's overall financial condition.

- Call provisions can limit high yield bond investor returns.

- High yield bond investing is not for 'set it and forget it' investors. Investors must monitor issuer financial

performance and market conditions, which is a key component of the Bondsavvy investment service.

Later in this fixed income blog post, we will discuss each of these items and provide two case studies illustrating

how high yield bond issuers can have stronger financial profiles than investment grade bond issuers.

Bondsavvy's Focus on High Yield Corporate Bonds

As of August 13, 2024, 38 of Bondsavvy's 68 buy/hold corporate bond recommendations were high yield bonds.

Identifying high yield bonds issued by financial strong companies that pay high coupons and offer strong total

return opportunities is a key part of the Bondsavvy value proposition. View our corporate bond returns page to see the performance of our previously

recommended high yield and investment grade corporate bonds.

What Are High Yield Bonds?

Interestingly, the term "high yield bonds" is only somewhat related to the yields such bonds have. Instead,

the term "high yield bonds" refers to bonds that have bond ratings that are below investment grade, or

Baa3/BBB- by Moody's and S&P. High yield bonds were previously called "junk bonds," but they were later

rebranded by bankers who didn't want to refer to their clients with such an insulting term.

High yield bonds are generally corporate bonds, as US Treasury and government-sponsored entity (GSE) bonds currently

have Aaa/AA+ bond ratings and municipal bonds available online have investment grade bond ratings. Investors may, on

occasion, come across high yield municipal bonds, but given the very limited (and extraordinarily delayed) financial

disclosures offered by municipal bond issuers, they are generally a bad idea.

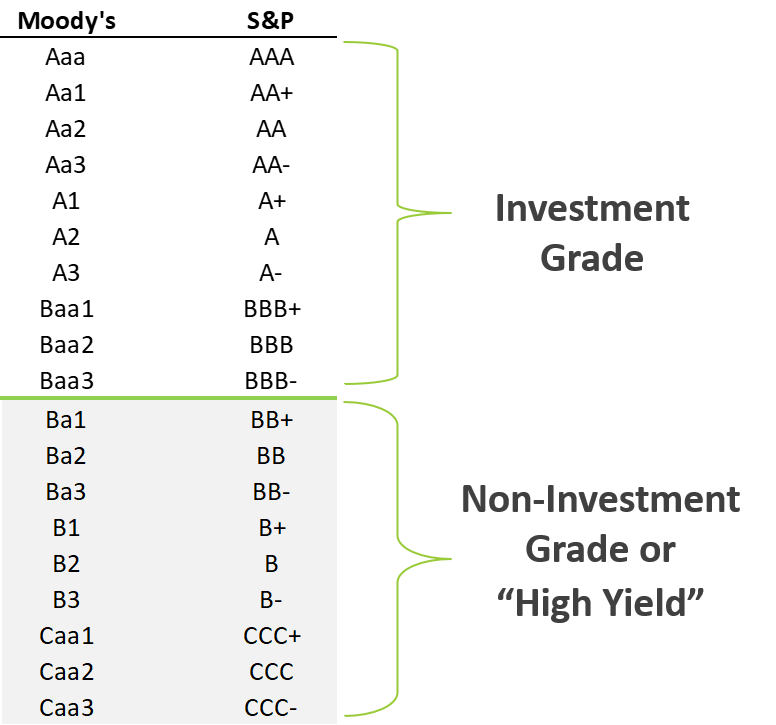

Figure 1 shows the bond ratings scale. Any bond rated below Baa3/BBB- is referred to as a high yield corporate bond.

Figure 1: Corporate Bond Ratings Scale

The problem with the junk bond moniker is that it doesn't reflect that bond rating

methodologies are flawed, and there are many cases where bonds rated below investment grade can have

stronger financials than bonds issued by investment-grade-rated corporate bond issuers. More on this later.

Split-Rated Bonds

A split-rated bond is one that is rated investment grade by one rating agency and below investment grade at another.

On August 13, 2024, an example of a split rated bond was the Ford Motor 7.500% 8/1/26 bond (CUSIP 345370BP4), which

was rated Ba1 by Moody's and BBB- by S&P. Please note that, when buying bonds online, split-rated bonds will typically be classified as

high yield corporate bonds for bond search purposes.

HIGH YIELD BONDS: KEY ADVANTAGES AND DISADVANTAGES

1. High Yield Bonds' Lower Interest Rate Risk Can Positively Impact Performance

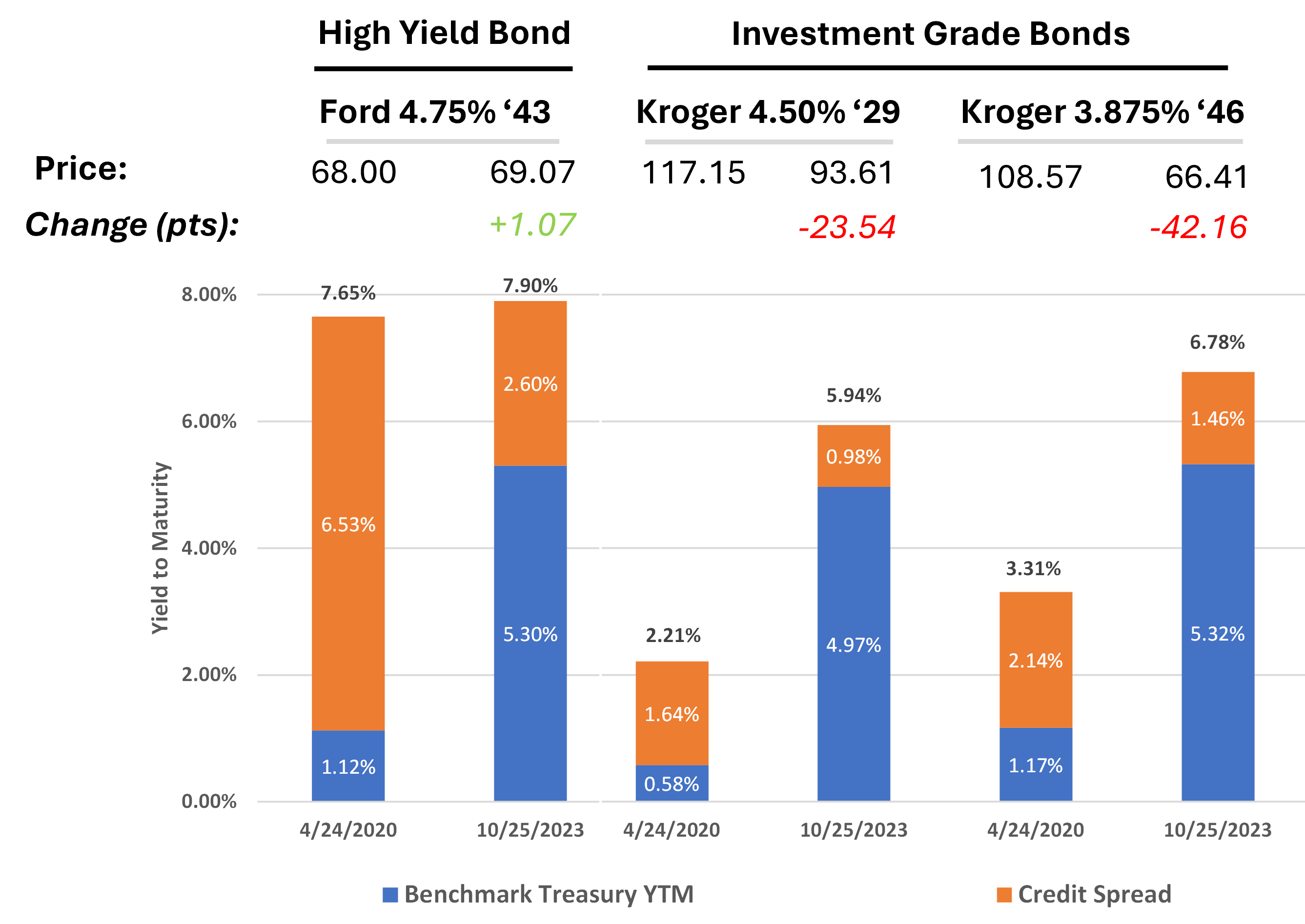

Figure 2 compares one bond issued by Ford, rated Ba1 by Moody's, and two bonds issued by Kroger, an

investment-grade-rated grocer, to show investors how high yield bonds and investment grade bonds react to higher

interest rates. For each bond, we show the bond price and YTM for a low-interest-rate date (April 24, 2020) and a

higher-interest-rate date (October 25, 2023).

We also break out the components of each corporate bond's yield to maturity ("YTM"), which include the benchmark US

Treasury YTM and the credit spread. The benchmark US Treasury

YTM is the YTM of a US Treasury bond or note that has a comparable maturity date to a corporate bond. For example,

per Figure 2, on April 24, 2020, the YTM of a US Treasury bond due in 2043 (the maturity year of the Ford '43 bond)

was 1.12%, as shown in the blue bar.

The Ford '43 bond had a YTM of 7.65% on April 24, 2020. The difference between the Ford '43 bond's YTM and the

benchmark Treasury YTM is known as the credit spread. It represents the extra yield a corporate bond investor

receives over a comparably dated US Treasury.

Figure 2: Impact of Higher Interest Rates on Ford and Kroger Bond Prices

Sources: Market prices, yields, and credit spreads were from Fidelity.com. Other calculations were from Bondsavvy.

US Treasury yields increased significantly during 2022 and 2023, and, on October 25, 2023, the US Treasury due in

2043 had a YTM of 5.30%. While this increase had a big impact on the YTMs and prices of the two Kroger bonds, the

impact to the Ford '43 bond was negligible. In fact, the Ford '43 bond price actually went up 1.07 points, from

68.00 on April 24, 2020 to 69.07 on October 25, 2023.

The Kroger '46 bond fell an astounding 42.16 points to 66.41 on October 25, 2023.

Why do high yield bonds such as Ford '43 generally have lower interest rate risk than investment grade bonds?

On April 24, 2020, the Ford '43 bond's credit spread was a wide 6.53% vs. 2.14% for the Kroger '46 bond. As a result,

as US Treasury yields rose, the Ford bond's wide credit spread had enough room to shrink and offset the 418-basis-point

increase in the benchmark US Treasury yield, from 1.12% to 5.30%. The Kroger '46 credit spread shrunk from 2.14% to

1.46% (68 basis points), but the bond's April 24, 2020 credit spread of 2.14% was small relative to the Ford '43

credit spread and could not act as a 'shock absorber' to higher US Treasury yields. Therefore, the Kroger '46 YTM

shot up from 3.31% to 6.78%, and the bond price fell over 42 points.

Default risk isn't the only risk bondholders face, as shown by how severely many corporate bonds, especially

investment grade bonds, were punished when the US Federal Reserve hiked interest rates in 2022 and 2023. As the US

Federal Reserve hiked interest rates, US Treasury yields followed suit. Investment grade corporate bonds can be

highly sensitive to movements in US Treasury yields, so certain bonds issued by the world's most profitable

companies fell as much as 40%.

How do investment returns compare between high yield bonds and investment grade bonds?

While the higher coupons and shorter maturity dates of high yield bonds can protect them when US Treasury yields

rise, conversely, they will generally benefit less than investment grade bonds when US Treasury yields fall. View

our corporate bonds returns page to view the investment performance of our

previous high yield bond and investment grade bond recommendations.

One of our most successful past recommendations was the Vital Energy 10.125% 1/15/28 high yield corporate bond, which

we recommended at a price of 83.10 on December 17, 2020. The bond was redeemed by the company on March 29, 2024 at a

price of 105.12, which generated an investment return of 66.49% compared to 5.68% for the iShares HYG high yield

bond ETF.

There will be times when a high yield bond is priced at a significant discount to its par value and pays a high coupon, similar to the Vital

Energy '28 bond. How plentiful such opportunities are will vary over time.

On July 11, 2024, Bondsavvy presented four new corporate bond recommendations during The

Bondcast, an exclusive subscriber webcast. We recommended two investment grade bonds and two high

yield bonds. The investment grade bonds had coupons between 4.00% and 4.50% and yields to maturity between 5.70% and

6.15%. The high yield bonds had coupons between 6.50% and 7.00% and yields to maturity between 5.65% to 6.00%.

In this case, the yields to maturity of the investment grade and high yield bonds were similar since both investment

grade bonds were priced well below their par values. The high yield bonds were priced near par, but they offered

higher coupons and current yields than the investment grade bonds. The benefit of owning the high yield bonds we

recommended July 11, 2024 is their higher coupons and less Treasury-market-driven pricing volatility.

2. High Yield Bonds Can Have Stronger Financials Than Certain Investment Grade Bonds

As discussed in our "Why We're Pouring Ketchup on Bond

Ratings" fixed income blog post, high yield bonds can be issued by companies with stronger financials than

many investment grade bond issuers. This situation is due, in large part, to flawed bond rating methodologies.

Case Study: Comparing High Yield and Investment Grade Issuer Financials

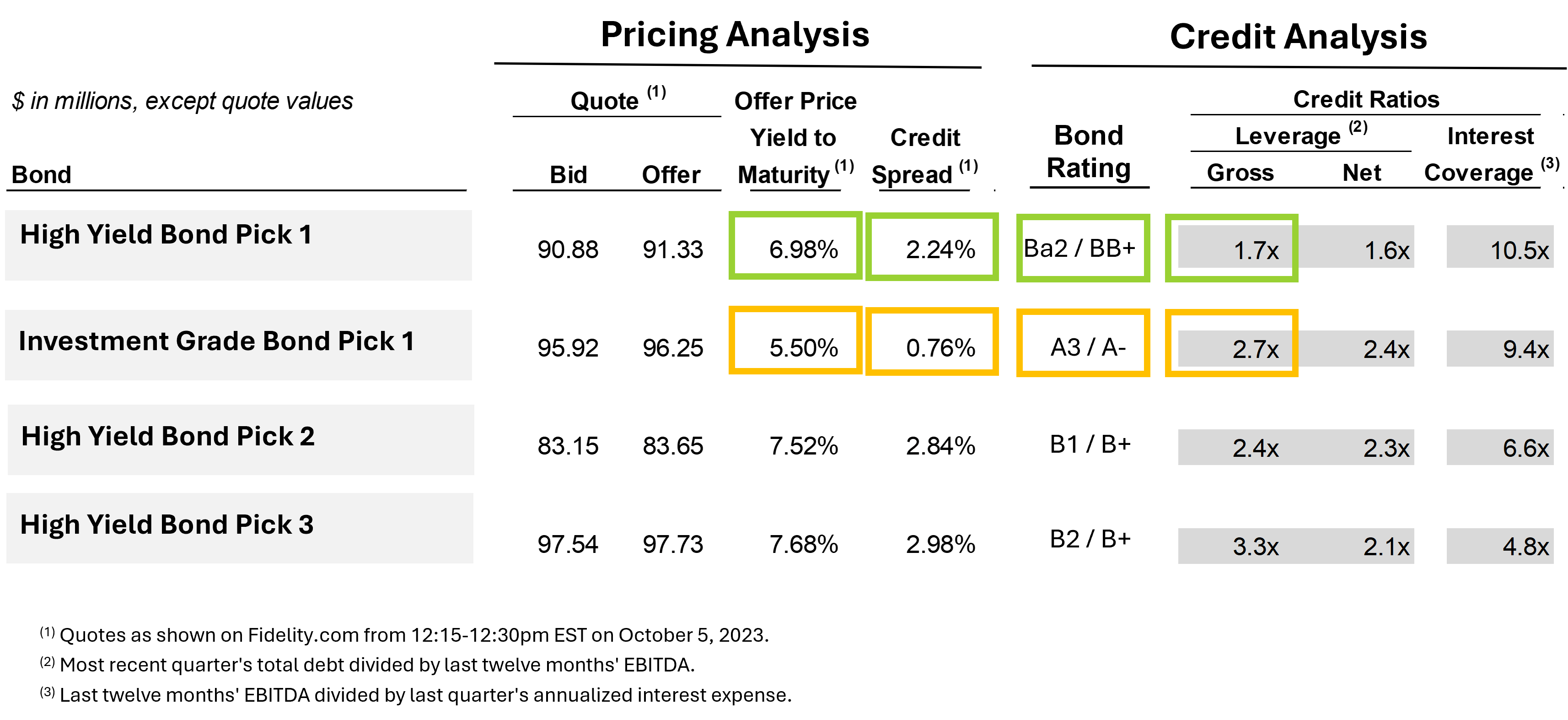

Figures 2a and 2b show parts of the investment analysis we present Bondsavvy subscribers when discussing new

corporate bond recommendations during The Bondcast, an exclusive subscriber webinar. This example comes from

four bonds we recommended October 5, 2023, which included three high yield bonds and one investment grade bond.

This case study focuses on High Yield Bond Pick 1 and Investment Grade Bond Pick 1, to illustrate how high yield bond

issuer financials can compare favorably to those of investment grade bond issuers. Subscribe to Bondsavvy to learn the identity of these and all of the 68

corporate bonds we rated buy or hold as of August 13, 2024.

As shown in Figure 2a, despite its lower bond rating of Ba2/BB+, High Yield Bond Pick 1 had a lower leverage ratio and a higher

interest coverage ratio than Investment Grade Bond Pick 1. These bonds had similar maturity dates, and the high

yield bond had a 6.98% yield to maturity, 148 basis points higher than Investment Grade Bond Pick 1.

Figure 2a: Corporate Bond Pricing and Credit Analysis from Prior Edition of The

Bondcast

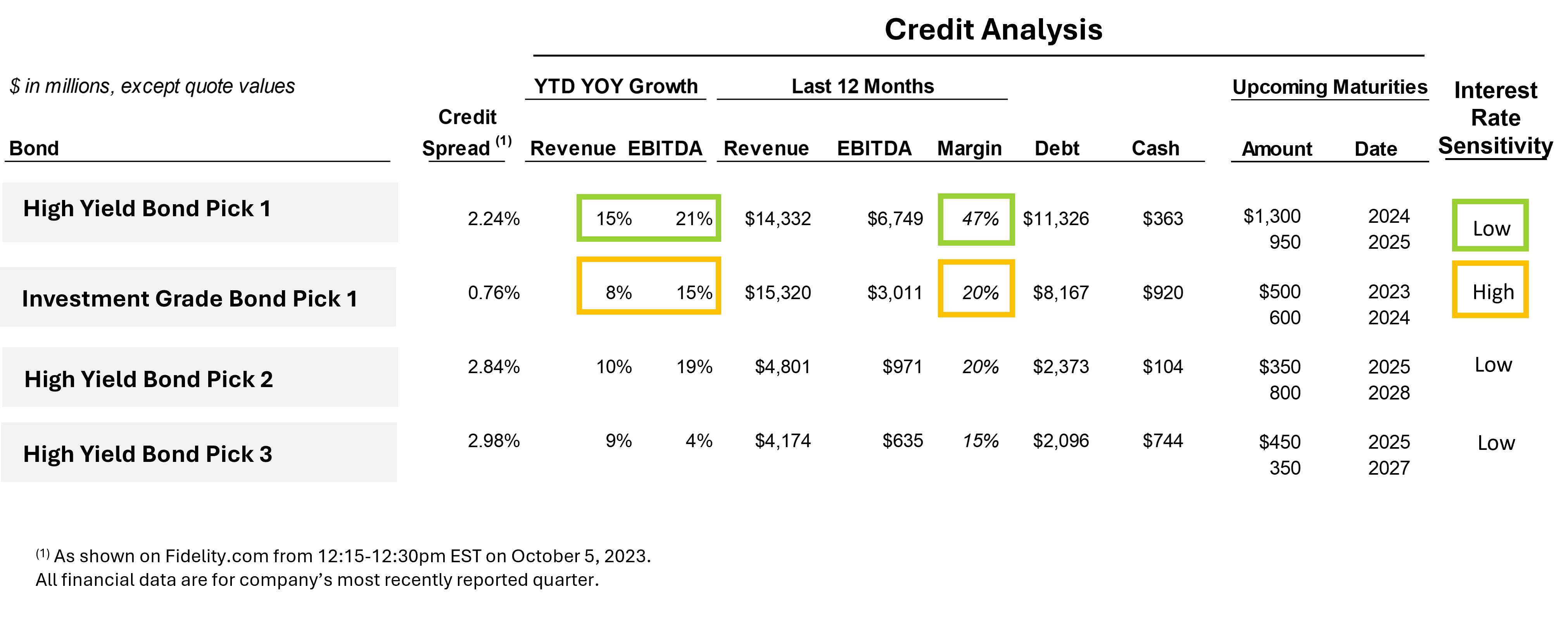

Of course, leverage ratios and interest coverage ratios are only two data points taken on a specific date. We need to

understand where each bond issuer is heading, as that will impact a company's future creditworthiness. Figure 2b

shows even greater advantages for High Yield Bond Pick 1 over Investment Grade Bond Pick 1. Its issuing company

reported higher revenue and EBITDA growth and had 47% EBITDA margins, more than double that of Investment

Grade Bond 1's issuing company. To top it off, High Yield Bond Pick 1 had materially lower interest rate risk than

Investment Grade Bond Pick 1.

This case study shows why investors should not blindly follow corporate bond ratings and how Bondsavvy's investment analysis can uncover investment opportunities often

overlooked.

Figure 2b: Corporate Bond Credit Analysis Case Study (Continued)

How is it possible for bond rating agencies to get bond ratings so wrong?

Flaws of Bond Rating Methodologies

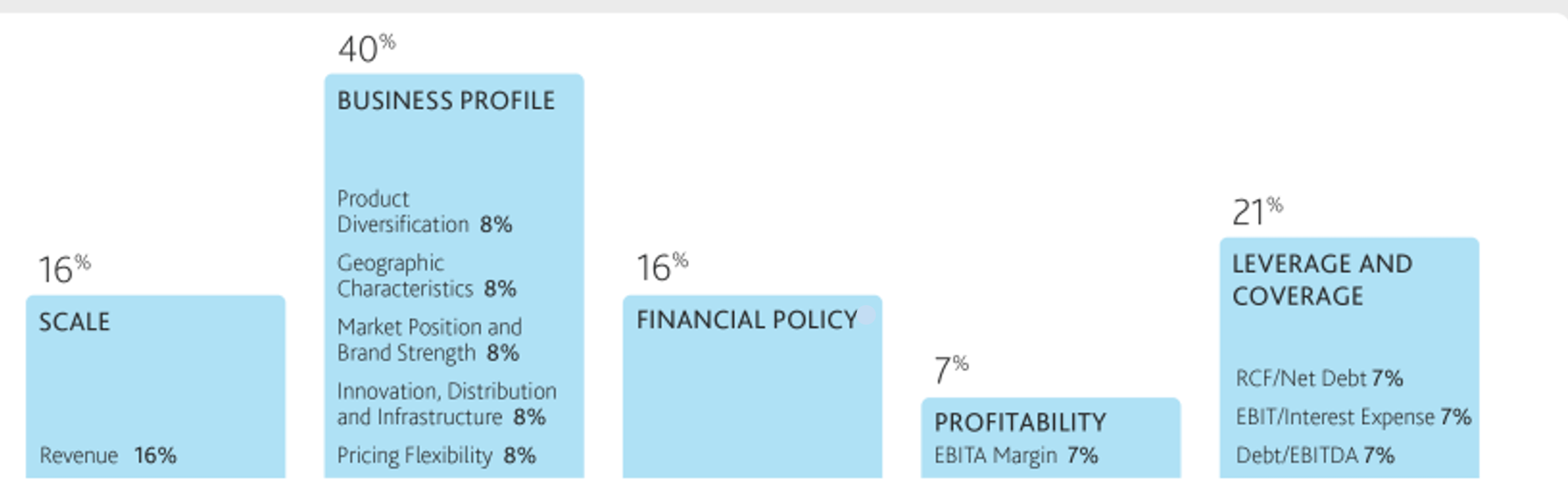

For each industry where it rates corporate bonds, Moody's Investor Service has a "scorecard" (see Figure 3), which

drives its preliminary bond ratings. There are other considerations in its

framework, but the industry scorecards are the nuts and bolts of bond ratings.

For corporate bond ratings, size matters, and that's not always a good thing.

If a company has significant revenues -- regardless of their quality -- it gets 16% of the way toward a high rating.

Per Figure 3, the "scale" metric (16%) gets more than twice the value of the "profitability" margin metric (7%). As

a result, a company with $10 billion in revenue and $500 million in profit would be advantaged over a company with

$2.5 billion in revenue and $1 billion in profit, all else equal. That's bonkers.

Figure 3: Moody's Bond Rating Methodology Scorecard for Soft Beverages Industry

Source: Moody's Investor Service.

One of the silver linings of bond rating agencies mis-rating corporate bonds is that it provides investment

opportunities for Bondsavvy subscribers

overlooked by most investors. While we recommend both investment grade and high yield corporate bonds, a specialty

of our fixed income investment strategy is to find bonds issued by companies

with sub-investment-grade ratings and strong financials.

Across many Bondsavvy corporate bond recommendations, there are cases where high-yield-bond issuing company leverage ratios are

lower, growth and margins are higher, and capital allocation is more bondholder friendly than many

investment grade issuers.

Bankruptcies of Investment Grade Bond Issuers

Many bond investors avoid high yield corporate bonds due to their perceived higher default risk. Let's not forget,

however, that the two largest bankruptcies in US history -- Enron and Lehman Brothers -- had investment grade bond

ratings shortly before the companies filed for Chapter 11. The same was the case in other notable recent Chapter 11

cases, as we show in Figure 4.

Figure 4: Bond Ratings for Notable Chapter 11 Cases Shortly Before Filing

|

Moody's Rating (Date) |

S&P Rating (Date) |

Chapter 11 Filing Date |

|

|

|

|

| Silicon Valley Bank |

A3 (March 7, 2023) |

BBB (March 9, 2023) |

Mar 21, 2023 |

| Lehman Brothers |

A2 (Sept 10, 2008) |

A (September 10, 2008) |

Sept 15, 2008 |

| WorldCom |

A3 (Feb 7, 2002) |

BBB (April 22, 2002) |

Jul 19, 2002 |

| Enron |

Baa1 (Oct 29, 2001) |

BBB- (Nov 27, 2001) |

Dec 2, 2001 |

Source: Moody's and S&P.

While there are hundreds of very strong companies with investment grade bond ratings, investors should not assume an

investment grade "seal of approval" removes any chance of a bond issuer defaulting.

Capital Allocation for High Yield Bond Issuers Is Often More Bondholder Friendly

There is certainly Groupthink when it comes to capital allocation by large investment grade issuers, with mega stock

buybacks in virtually every CFO's playbook and bondholders typically playing second fiddle to stockholders.

"Capital allocation" is a fancy name for how companies spend the money they earn. A company with bondholder-friendly

capital allocation would invest in its business, pay down debt, increase its cash balances, and limit stock buybacks

and dividends to reasonable levels. Analyzing a bond issuer's capital allocation is a key part of the investment analysis Bondsavvy presents when making new bond

recommendations.

A company's financials may look great today, but if it spends billions on share buybacks and dividends, the company

could hit a cash crunch if its business slows. Just ask bondholders of Bed Bath & Beyond, a formerly

investment-grade-rated issuer, which bought back $12 billion of stock between 2004 and 2022. Since it lit a match to

its cash, the company did not have the financial resources needed when it faced operational challenges. It filed for

Chapter 11 in April 2023, resulting in likely no recoveries for bondholders and the loss of tens of thousands of

jobs.

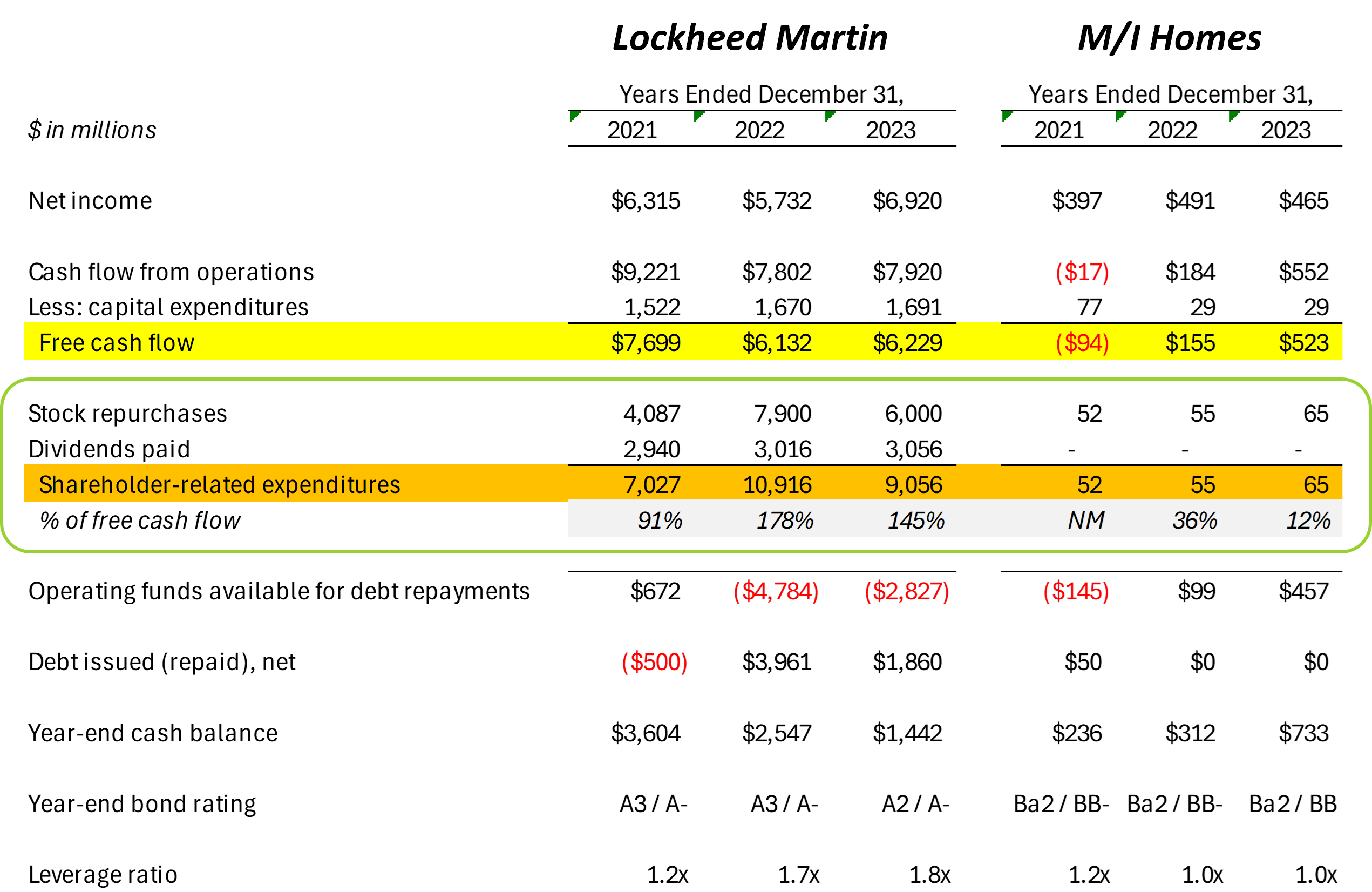

Capital Allocation Case Study: Lockheed Martin vs. M/I Homes

Figure 5 compares summary financials, capital allocation, and leverage ratios

for defense contractor Lockheed Martin (rated A2/A-) and homebuilder M/I Homes (rated Ba2/BB). While M/I Homes is a

much smaller company than Lockheed Martin, we give its capital allocation a grade of "A" and Lockheed Martin a grade

of "F." In our view, Lockheed Martin is the poster child of poor capital allocation run amok.

A company's free cash flow is its cash flow from operations less capital expenditures (highlighted in yellow). It's a

key metric that shows investors the amount of money a company generates that it can use to pay down debt, pay

dividends, and/or buy back stock. In Lockheed Martin's case, as highlighted in orange, the company spent 178% and

145% of its free cash flow in 2022 and 2023, respectively, on combined stock buybacks and dividends -- an egregious

and irresponsible sum. M/I Homes, in contrast, spent 36% and 12% on shareholder-related payments during those same

years.

Figure 5: Summary Financial Performance and Capital Allocation of Lockheed Martin vs. M/I Homes

Sources: Company SEC filings and Bondsavvy calculations.

The impact of the two companies' capital allocation policies is profound. Due to its careless levels of stock

buybacks, Lockheed issued $6 billion of new debt in 2022 and 2023 and saw its cash balance plummet 60% between

yearend 2021 and 2023. Its leverage ratio also increased.

M/I Homes, on the other hand, issued virtually no new debt, tripled its cash balance, and lowered its leverage ratio

to 1.0x. Unfortunately, M/I Homes' excellent credit metrics and increasing cash balance had negligible impact on its

credit ratings, which stood at Ba2/BB as of December 31, 2023, well below A-rated Lockheed Martin.

3. Certain High Yield Bond Issuer Capital Structures Can Disadvantage Bondholders

A key part of Bondsavvy's investment analysis is understanding where bonds sit in a company's

capital structure. "Capital structure" refers to all of a company's funding, including equity and debt, and the

relative seniority of each piece of capital.

While bondholders are senior to common and preferred stockholders, there can be cases when a company issues debt that

is senior to its bonds. In such cases, should the company file for Chapter 11, senior debtholders would have

priority over bondholders. There have been myriad Chapter 11 cases where senior debtholders were paid in full (or

nearly in full) and bondholders received nothing.

How To Tell if a Company Has Debt Senior to Bondholders

Companies disclose the types of debts they owe in financial reports they file with the US Securities and Exchange

Commission (the "SEC"). Some companies provide better disclosures than others. For example, there are some issuers

that do not disclose their complete debt schedules, but, instead, provide a summary. Large, investment grade bond

issuers are notorious for this.

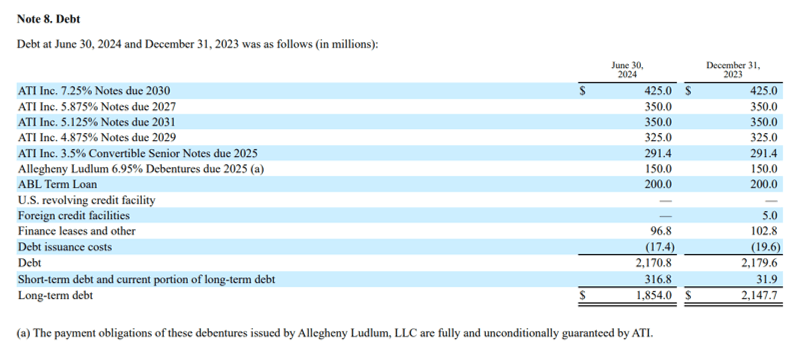

Typically, for high yield corporate bond issuers, they will disclose each debt they owe every quarter. To find this

information, go to a company's investor relations website and search for SEC filings. Once there, look for the most

recent Form 10-Q or Form 10-K. Figure 6 shows the debt schedule for ATI Inc., a specialty materials products

provider for the aerospace, defense, and energy industries. ATI's debt schedule can be found in the notes to its

financial statements.

As shown, most of ATI's debt is bonds, including the ATI Inc 4.875% '29 company bond. The only debt senior to ATI's

bonds is $200 million of "ABL Term Loan." "ABL" stands for Asset Based Lending and relates to a credit facility that

is secured by ATI's accounts receivable. Any time you see "term loan" or "credit facility" in a company's debt

schedule, it refers to debt that is senior to a company's bonds. Sometimes companies do issue bonds of varying

levels of security, and they, generally, will disclose a summary of such terms in its SEC filings.

Figure 6: Debt Schedule for ATI Inc.

Source: ATI Inc. June 30, 2024 Form 10-Q.

One important note is that, generally speaking, a company's 10-K, an annual filing, will contain a greater level of

financial disclosures than company 10-Qs, which are filed each quarter, other than the quarter in which a company's

fiscal year ends. That said, the information contained in company 10-Qs and 10-Ks is often summary in nature.

Investors can find even more comprehensive disclosures in the prospectuses that accompany each bond issuance.

How Risky Is Debt That Is Senior to Bondholders?

The risk of a company having debt senior to its bonds will vary issuer to issuer. If Google's parent company

Alphabet, which reported $13 billion of debt and over $140 billion in cash as of March 31, 2024, decided to issue a

small amount of senior debt, it wouldn't be a big deal. If, however, a company has a high leverage ratio, weak

operating performance, and/or significant unfunded upcoming debt maturities, debt senior to bondholders can be a big

issue.

The total amount of senior debt is another important consideration. For example, when JCPenney filed for Chapter 11

in 2020, it had $2.8 billion of senior bank debt, $900 million of senior secured bonds, and $1.3 billion of

unsecured bonds. The sheer magnitude of debt senior to the unsecured bonds resulted in virtually no recoveries for

unsecured bondholders.

4. High Yield Bond Call Schedules Can Hurt Investment Returns

High yield corporate bonds are typically subject to call schedules, meaning the issuer can redeem the bonds at a

specific price in advance of the maturity date. These call provisions effectively put a ceiling on a bond's price;

however, their impact on investment performance will depend on a number of factors, including the price at which an

investor purchases a bond, the financial performance and wherewithal of the issuing company, the financing markets,

and whether bond yields and credit

spreads have increased or decreased since the bonds were issued.

Callable Bond Example

Figure 7 shows the call schedule of a bond with a maturity date in 2030. Per the call schedule, the issuer can redeem

(call) the bond beginning August 15, 2026 at a price of 103.625% of the bond's par value. The reason call schedules

put ceilings on bond prices is that no bond investor in her right mind would buy this bond at a price of, say

115.00, since the company can redeem the bond at a price much lower. If the bond had a high coupon, it could trade

slightly above the first call price; however, as we get close to the first call date, any premium to the first call

price would likely be negligible.

Figure 7: Sample High Yield Bond Call Schedule

| Year Beginning August 15, |

Call Price as Percentage

of Par Value |

| 2026 |

103.625% |

| 2027 |

101.813% |

| 2028 |

100.000% |

Factors Impacting Call Risk

Many investors get nervous when they hear the term "call risk," but, in many cases, it's not much of a risk. For

example, if you purchase a bond substantially below par value, the call risk you have relates to your potential loss

of income between the call and maturity dates. If you buy a bond at 80.00 and it gets called in two years at

103.625, that's a win.

In addition, it has to be worthwhile for the bond issuer to call the bond. As shown, if the bond issuer in Figure 7

wanted to call the bond in September 2026, it would need to pay a 3.625% premium to the par value of the bond. For a

$500 million issuance, this call premium would be approximately $18 million. If it's a refinancing transaction, the

issuer would also incur financing costs associated with a new bond offering to replace the redeemed bonds.

Before calling the bond, the company must assess whether financing conditions have improved since it originally

issued the bond. Saving on interest expense is one factor, but it is not the only one. The company must also

determine whether it can obtain improved terms, such as financial covenants, and whether a newly issued bond would

improve a company's debt maturity profile.

High yield corporate bond issuance hit record highs in 2020 and 2021, as companies rushed to take advantage of low

market interest rates and a dovish US Federal Reserve. High yield bond issuance peaked at $487 billion in 2021 and

then fell 77% to $112 billion in 2022, according to SIFMA data.

Call risk is generally lower in periods of higher interest rates; however, there are certainly exceptions. For

example, the previously discussed Vital Energy 10.125% '28 bonds were called in March 2024, as, due to the company's

strong financial performance, it was able to issue new bonds at a coupon over two percentage points lower

than it did when it issued the '28 bonds.

Call Schedule vs. Make-Whole-Call Bonds

High yield bond call schedules are a provision that generally favors the bond issuer, as it enables an issuer,

potentially, to redeem bonds and issue new ones at improved terms for the issuer. This is different than the

make-whole-call provisions under which investment grade corporate bonds are typically issued.

In a make-whole-call, the issuer must pay the bondholder the present value of all future interest and principal

payments between the call date and the maturity date. Given how large this sum could be, especially for longer-dated

bonds, make-whole-call provisions are seldom invoked. As a result, investment grade bonds generally do not have the

price ceiling that call schedule bonds typically have. This is a significant advantage of investment grade bonds

over high yield bonds, and it can be the difference between making one bond recommendation over another.

5. Monitoring Bond Issuer Performance Is Crucial and Is a Central Part of the Bondsavvy Service

We believe the higher potential returns, fixed coupon payments, lower fees, and greater transparency individual

corporate bonds offer vs. bond funds make them a compelling choice for many investors. We support an active fixed income strategy to maximize returns and to reduce risk.

While our corporate bond returns demonstrate key benefits of owning individual

bonds vs. bond funds, corporate bond investing is not a 'set it and forget it' approach. Bond issuer financial

performance is not a given, and companies can run into difficulties. Market conditions can rapidly change, as they

did in 2022 when the US Federal Reserve began increasing interest rates. In addition, a company's capital structure

can change either due to the need for additional financing or in the context of a merger-or-acquisition transaction.

Fortunately, for corporate bond investors, companies report financials each quarter and must make additional SEC

filings upon any "material events," including experiencing a significant change in its business, hiring or firing

senior executives, or entering into an acquisition or sale transaction.

It goes without saying that, as time moves on, an investment's prospects can change either for the better or for the

worse. To monitor and address these changes, Bondsavvy regularly updates its corporate bond

recommendations, including each quarter during The Super Bondcast investment webinar. We supplement these updates

with regular email newsletter updates, which keep our subscribers apprised of developments at all of our issuing

companies.

During our quarterly updates, we compare each issuing company's updated financial performance to the price, YTM, and

credit spreads of each bond to determine our updated buy/sell/hold bond recommendations.

Why High Yield Corporate Bonds Are a Key Part of the Bondsavvy Investment Service

Many investors avoid owning high yield bonds due to fears over default risk. When investors do this, they are

deferring to bond rating agencies as the arbiters of credit quality. As we have discussed, bond rating agencies

often mis-rate default risk. In addition, bond ratings ignore interest rate risk; bond yields and prices; and

whether bonds are compelling investments.

We founded Bondsavvy in 2017 to empower individual investors to invest in individual corporate bonds. A key part of

this is identifying bonds our subscribers may not have considered on their own. With our comprehensive investment analysis and regular updates, we equip our subscribers to

decide which of our high yield bond recommendations are right for them.

As of August 13, 2024, 38 of Bondsavvy's 68 corporate bond recommendations rated buy or hold were high yield

corporate bonds. This composition changes over time and was impacted by Bondsavvy recommending a significant number

of high yield bonds as interest rates were increasing. We believe it's important for investors to consider owning

both investment grade and high yield bonds to position their investment portfolios to succeed across various and

ever-changing investment conditions.

Get Started

Watch Free Sample