Bondsavvy's quarterly investment recommendation updates empower subscribers to maximize investment returns and to

mitigate risk. This fixed income blog post previews our January 8, 2026 edition of The Super Bondcast, where we updated the investment recommendations of the 61 corporate bonds we currently rate buy or hold.

These 61 bond recommendation updates are for our Premier investment service only. They include 28 bonds rated 'buy' and 33 rated 'hold.' We recommended 'sells' on three previously recommended bonds.

As of January 7, 2026, the median yield to worst of our 61 remaining bond recommendations was 5.47%. Of course, our active bond investing strategy seeks to generate corporate bond returns higher than purchase date bond yields.

It can be confusing for investors to know which bonds in their portfolios to buy more of, sell, or hold. We created

The Super Bondcast webinar series to solve this problem.

During each quarterly Super Bondcast, we update each of Bondsavvy's corporate bond buy/sell/hold recommendations based on

the issuing company's financial performance, the price and yields of each bond, interest rate and economic trends.

Why Did You Found Bondsavvy?

Steve Shaw founded Bondsavvy in April 2017 to make bond investing easy and more profitable for individual investors. We also seek

to put individual investors in control of their bond portfolios.

Bond funds and ETFs, on the other hand, take control away from individual investors and, typically, offer weak

performance. Our easy-to-understand individual bond recommendations take the guesswork out of bond investing and

empower our subscribers to make successful corporate bond investments.

61 Bond Recommendations Updated on January 8, 2026

Over time, bond prices change as does the financial performance of issuing companies. If we recommend buying a bond

at 90% of par value and the bond increases to 120% of par

value, it will typically make sense to sell the bond

before maturity. Bond prices must return to par value at maturity, so selling previously recommended bonds

priced materially above par value is a key part to maximizing total investment returns.

We may also recommend selling a previously recommended bond should the issuing company's financial performance

materially weaken with no improvement in sight.

Fine tuning bond portfolios is key to maximizing long-term performance. To do this, Bondsavvy updates its bond recommendations quarterly, with

each issuing company's latest financials and each recommended bond's updated price, YTM, and credit spread. We supplement these quarterly updates with regular subscriber

emails.

Bondsavvy Subscriber Benefit

Moody's and S&P bond ratings do not assess whether a bond is a good value and, therefore, have limited use.

Bondsavvy identifies corporate bonds that pay high coupons relative to their risk and offer capital appreciation

opportunities.

Get Started

This fixed income blog post reviews the exclusive analysis Bondsavvy subscribers receive during our quarterly Super Bondcast

investment webinars and how we put our subscribers in control of their bond investing portfolios.

Why Should I Subscribe to Bondsavvy and See the 61 Bond Recommendation

Updates?

Companies such as Fidelity, E*TRADE, Tradeweb, and others have made bond investing efficient and fair for individual

investors. When buying corporate bonds online, individual investors benefit

from a competitive market with narrow bid-ask spreads and fast trade execution. Often times, individual investors

buying bond investment

quantities of two, five, or ten bonds can execute trades at prices near or better than the world's largest

bond funds.

We founded Bondsavvy to make bond investing easy and more profitable for individual investors. Individual investors

need a way to narrow down the 11,000-bond corporate bond universe to a select number of bonds to hold in their

portfolios. Corporate bond ratings are not regularly updated and do not

speak to whether a bond is a good investment. They ignore the most basic factors that impact whether a bond is a

good investment, including a bond's price, YTM, credit spread, and interest rate risk. "Other than that, Mrs.

Lincoln, how was the play?"

Luckily, Bondsavvy has created a list of thoroughly researched, high-conviction recommended bonds to buy. Without Bondsavvy, investors would have to spend hundreds of hours

researching and monitoring bond investments.

Bondsavvy updates its corporate bond recommendations after companies report quarterly financial results. During

The Super Bondcast, we provide our subscribers in-depth analysis of our issuers' most recent financial

performance; updated yields, credit spread, and pricing metrics; and the

investment rationale for each recommended bond. After watching The Super Bondcast, Bondsavvy subscribers can decide which of our recommended bonds to buy,

hold, or sell.

How Many Bonds Does Bondsavvy Currently Rate Buy?

As of January 8, 2026, Bondsavvy rated 28 bonds 'buy' and 33 as 'hold.' Read our blog post to see a preview of

our most recently recommended corporate bonds.

View our corporate bond returns page to see the

performance of our previous investment recommendations.

What Do You Cover During The Super Bondcast Investment Webinar?

We present our bond recommendation updates each quarter during The Super Bondcast, an exclusive subscriber

webcast hosted on Zoom. These update presentations include four sections:

- Overarching investment themes and economic conditions

- Bond issuer financial performance updates

- Buy/sell/hold recommendation updates for each bond

- Written reviews of issuer financial performance

We discuss each of these sections -- and provide sample PowerPoint slides -- below:

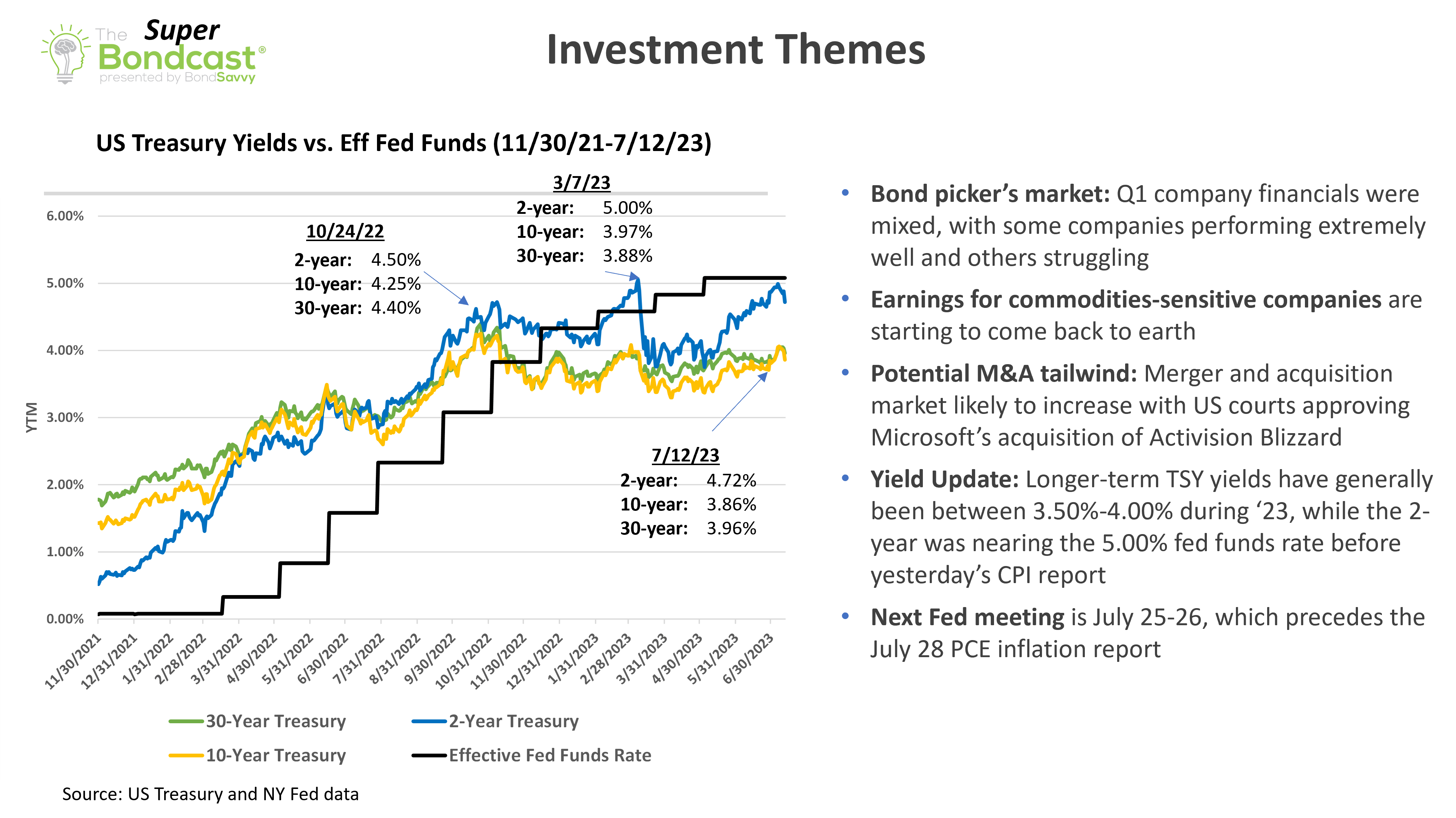

Section 1: Overarching Investment Themes and Economic Conditions

Before diving into the financial performance of our issuing companies, we need to understand the overall corporate

bond investment landscape. We therefore kick off each edition of The Super Bondcast with a brief discussion

on recent bond yield trends, Fed action, the economy, and other factors we expect to impact the performance of our

corporate bond recommendations.

Figure 1 shows a slide from a previous Super Bondcast, where we discussed how US Treasury yields had been

trending, some mixed financial performance of certain issuers, and the regulatory environment that was impacting

merger-and-acquisition activity.

Bondsavvy founder and fixed income expert Steve Shaw leads

each Super Bondcast investment webinar and provides a voice-over for each presentation slide.

Figure 1: Slide from Previous Super Bondcast on Overarching Investment Themes

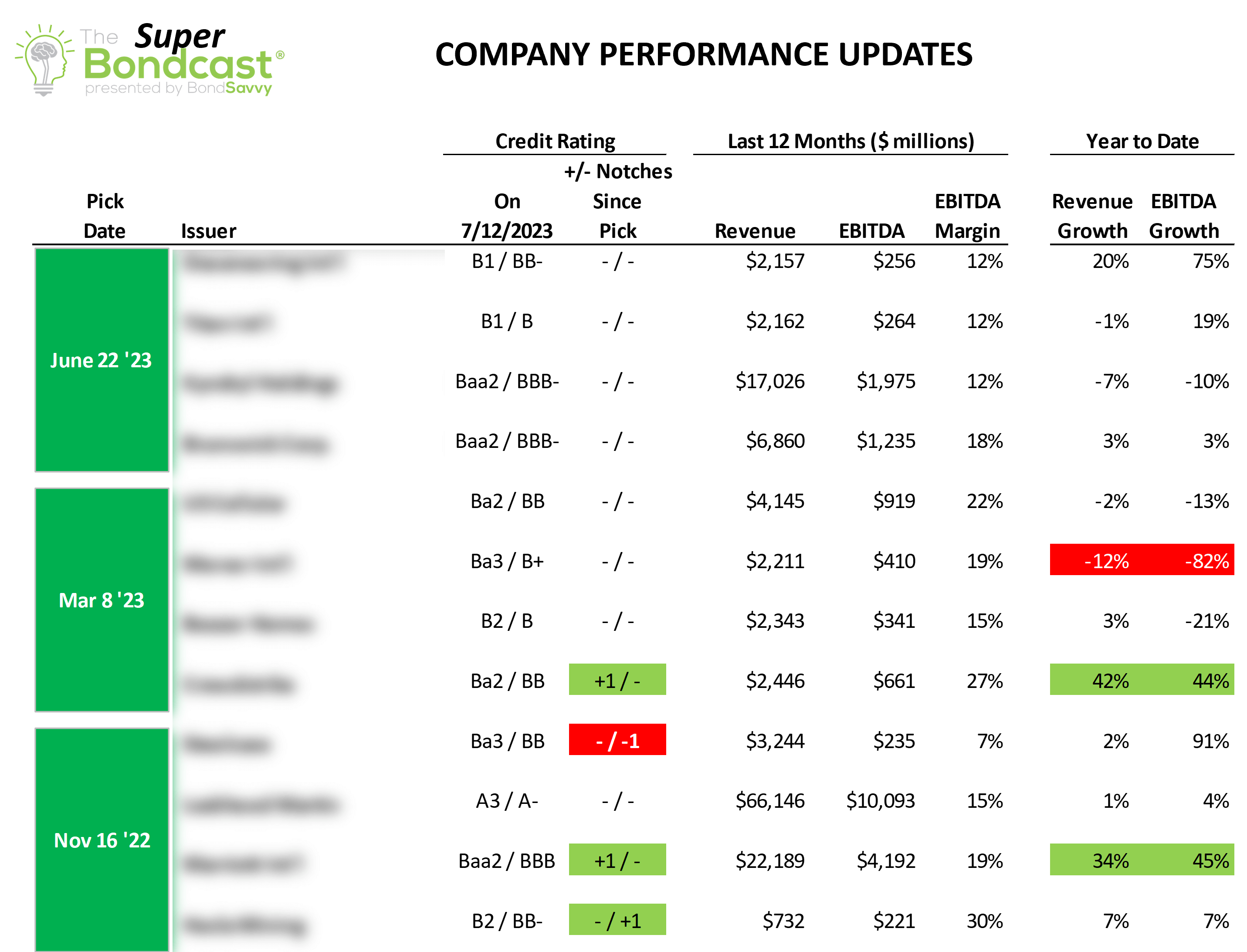

Section 2: Bond Issuer Financial Performance Update

After reviewing the overarching bond investment themes, we discuss the recent summary financial performance of our

issuing companies. We group the issuing companies across pick dates and then discuss revenue and EBITDA growth,

EBITDA margins, and any changes in bond ratings.

While we believe bond rating methodologies are flawed in many ways, changes

in bond ratings can impact bond prices. They also provide a third-party opinion on a bond issuer's creditworthiness

that is separate from the corporate

bond research Bondsavvy provides its subscribers.

As shown in Figure 2, Bondsavvy's corporate bond recommendations include bonds with both investment grade and high

yield bond ratings and a range of issuing company sizes. View the Picks at a Glance tab on the Bondsavvy subscription page to learn more about the YTM and

maturity-date ranges of our corporate bond recommendations.

Figure 2: Summary Financial Performance Slide from Previous Super Bondcast

The slide represented in Figure 2 covered the financial performance of 12 issuing companies from our November 16,

2022, March 8, 2023, and June 22, 2023 bond pick dates. The one outlier, which showed a drastic drop in Q1 2023

EBITDA, was a pulp manufacturer, Mercer International. Given this company's weak Q1 2023 financial performance, on

July 13, 2023, we issued a sell recommendation on the Mercer bond we recommended March 8, 2023.

View our corporate bond returns page to see the

performance of previous and current Bondsavvy corporate bond recommendations.

Bondsavvy Subscriber Benefit

Approximately 11,000 individual corporate bonds are available

for online investing each day. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started

Section 3: New Buy/Sell/Hold Ratings for Each Bond Recommendation

Our bond recommendations are a big step up from traditional Wall Street fixed income research, as they are at the individual bond,

or CUSIP, level. Most corporate bond research is at the issuer level and simply deals with whether an issuer's

creditworthiness is getting better or worse.

Our recommendations identify specific bonds we believe are good values and can outperform the leading corporate bond

funds and ETFs

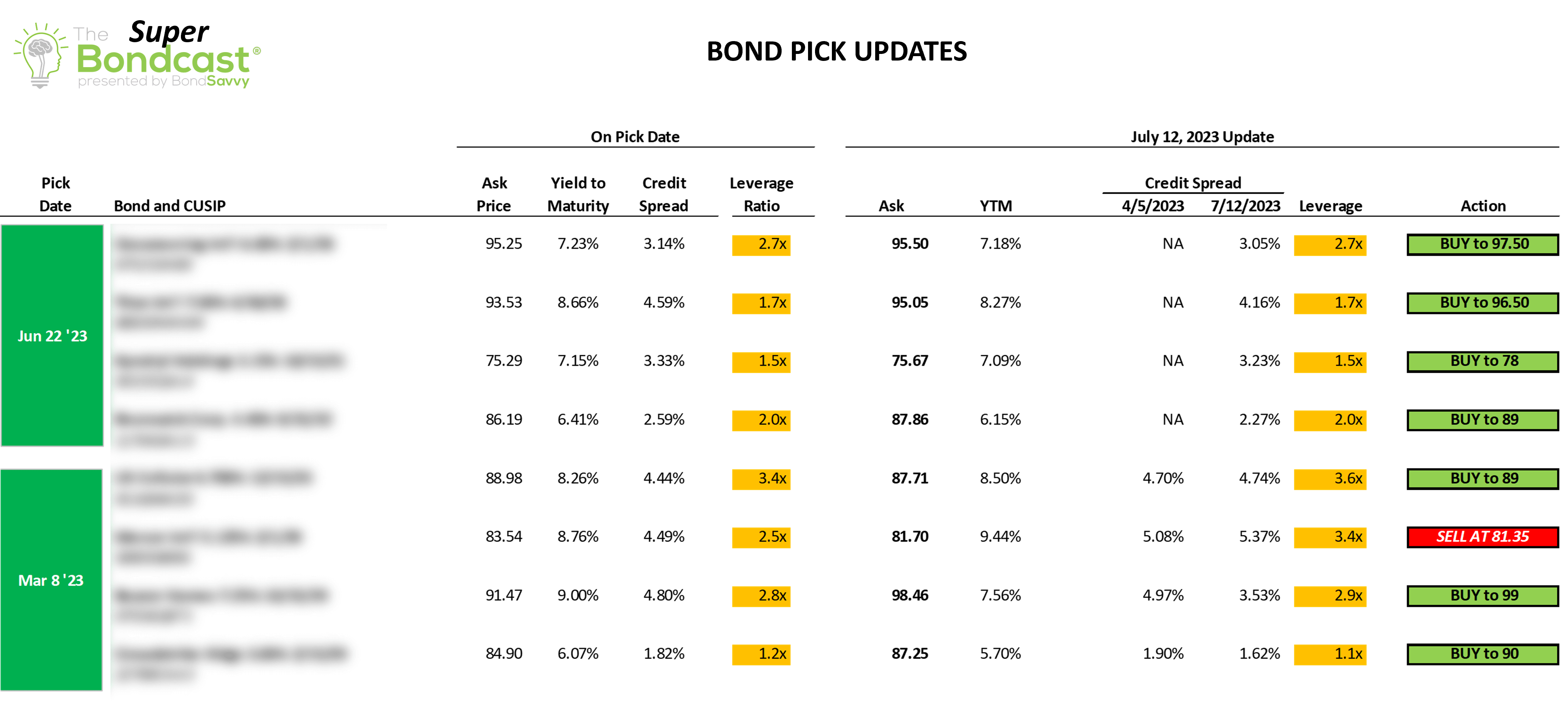

Figure 3 shows a slide from a previous Super Bondcast that reviewed key bond price and financial metrics, as

well as the updated buy/sell/hold recommendations. We show the financial and bond price metrics on the pick date, as

well as the day immediately before The Super Bondcast. This enables us to assess whether a corporate bond

is a better or worse value than it was on the pick date and impacts whether a bond is a buy, sell, or hold.

Figure 3: Previous Super Bondcast Bond Pick Updates Slide

Section 4: Brief Written Reviews of Each Bond Issuer

Since The Super Bondcast investment webinar lasts only 60 minutes, we have limited time to spend on each

recommendation. In cases when an issuer has reported weak financial results, we will typically spend additional time

discussing such issuers at the beginning of The Super Bondcast.

We will typically end the webcast version of The Super Bondcast after Section 3. Then, after we post the

recording of The Super Bondcast in the Bondsavvy subscriber area, we will complete written individual

summaries for each bond recommendation.

Watch Steve Shaw present “What to Know Before Investing in Bonds.”

Get Free Video

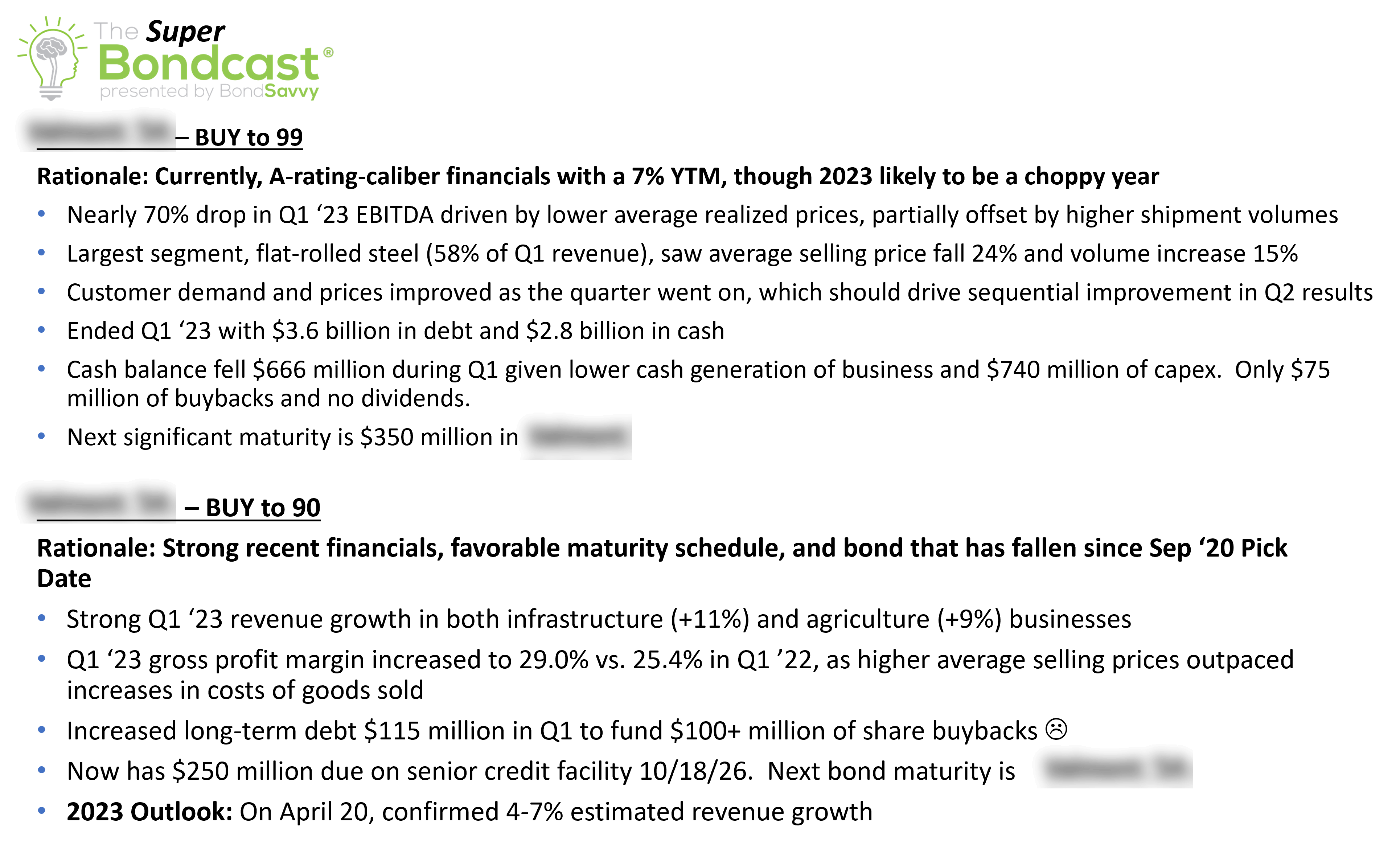

These summaries will include details on an issuing company's financial performance, business trends, capital

allocation, and upcoming debt maturities. They will also discuss forward guidance to the extent an issuing company

provides it. We include these written financial updates in a PDF version of The Super Bondcast that we post

in the Bondsavvy subscriber area.

Figure 4 shows a sample slide that covered brief written updates on two of our issuing companies:

Figure 4: Individual Company Written Update Sample

Are These Quarterly Updates the only Time Bondsavvy's Picks Are Updated?

No. In addition to providing quarterly bond recommendation updates through The Super Bondcast investment

webinar, we also regularly update our recommendations through the Bondsavvy corporate bond investment newsletter. We

notify our subscribers of these updates via email and post a PDF of each update in the "Updates" tab of the

Bondsavvy subscriber area.

These additional bond updates would cover things such as tender offers, exchange offers, merger-and-acquisition

activity, significant changes in a bond price, or any recommendation change that occurs between editions of The

Super Bondcast.

How Do I Gain Access to Live Bondsavvy Webinars?

In addition to the quarterly Super Bondcast, Bondsavvy hosts quarterly editions of The Bondcast,

where we present new corporate bond recommendations. Read a preview of our best corporate bonds to buy

investment webinar for more information on these subscriber webcasts.

In advance of each Bondsavvy investment webinar, we email Bondsavvy subscribers Zoom details and post the Zoom

information in the Bondsavvy subscriber area. Upon subscribing to Bondsavvy, you will gain immediate access to our

current corporate bond recommendations and be the first to learn our new bond recommendations and recommendation

updates.

Of course, we record all subscriber presentations and post them in the Bondsavvy subscriber area shortly after each live event concludes.

Get Started

Watch Free Sample