Bond investing is not only for high rollers and the ultra-wealthy. By investing in bonds online, individual investors can buy and sell bonds in small quantities and at prices often better than those enjoyed by large institutional investors. We encourage those who believe individual investors get "ripped off" in the bond market to open an online brokerage account and see for themselves.

- With many bonds trading at all-time lows, the minimum bond purchase amount has fallen significantly.

- The face value of a bond is typically $1,000; however, with many corporate bonds trading between 50-65% of their face value, investors can buy many individual bonds for $500 to $650 per bond.

- Online minimum corporate bond purchase amounts are typically two bonds, or $2,000 in face value. This amount can vary by bond.

- Trade size can impact the price at which individual investors transact when buying bonds online.

- Minimum Treasury bond purchase amounts can often be materially higher than minimum investments for corporate bonds.

What Is the Minimum Investment for Corporate Bonds?

In our Where To Buy Corporate Bonds Online article, we discuss the many benefits of using online brokerages such as Fidelity.com, E*TRADE, Interactive Brokers, Schwab.com, and Vanguard to invest in bonds. Two of the key benefits include seeing the largest number of corporate bond price quotes and generally narrow bid-offer spreads. We'll illustrate these benefits in the corporate bond depth of book examples we provide below.

Minimum Bond Purchase Amounts

Corporate bonds trade as a percentage of their face value. Therefore, a bond trading at 100.00 (or "par") has a market value of $1,000, equivalent to 100% of its $1,000 face value. A bond trading at 75.00 would be worth $750, or 75% of its $1,000 face value.

The minimum investment amount for corporate bonds is typically two bonds for investors who buy bonds online. If a corporate bond was trading at its $1,000 face value, the two-bond purchase would cost $2,000 plus accrued interest from the last interest payment date until the trade settlement date.

In the bond market of 2023, however, the minimum bond purchase amount (in dollar value) can be much less, as many bonds are trading at significant discounts to their par value. Throughout most of the year, bonds of some of the world's most profitable companies such as Apple, Microsoft, Wal-Mart, and Alphabet have traded between 50% to 70% of their face value. Buying a quantity of two bonds trading at 60.00 would cost the investor $1,200 ($600 per bond) plus accrued interest.

Where To Find Minimum Bond Purchase Amounts When Buying Bonds Online

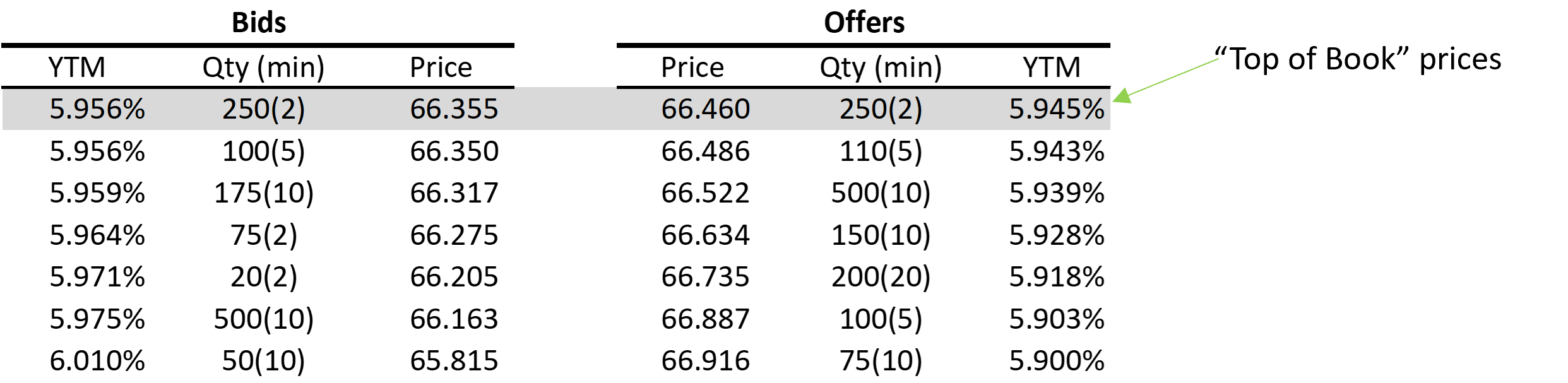

Figure 1 below provides an example of Exxon Mobil bonds (CUSIP 30231GBM3) that have a 3.452% coupon and an April 15, 2051 maturity date. As we discuss in our Fidelity bond search blog post, when investors enter a CUSIP and see the "Bond Results" screen, they will initially see a one-line summary of information on the bond. This will include the bond's name, bond rating, maturity date, bid-and-offer prices, and bid-and-offer yields. Please keep in mind that the prices and yields shown on the summary Bond Results screen are for the "top-of-book" prices, or the best prices available.

Corporate Bond Depth of Book

There is a separate column in Fidelity's Bond Results called "Depth of Book." If you click on the "book" icon in the Depth of Book column, you will see something similar to what is in Figure 1.

Figure 1 shows the available bid-and-offer quotes for the Exxon Mobil 3.452% '51 bond on November 1, 2023. The depth of book on this Exxon Mobil bond shows a competitive market with seven quotes on both the bid and offer sides. The bid-offer spread on a yield to maturity (YTM) basis was only 1 basis point (or 0.01 percentage points), reflecting the difference between the top-of-book bid and offer YTMs, which were 5.956% and 5.945%, respectively, on November 1, 2023.

Figure 1: Exxon Mobil Bonds Depth of Book on November 1, 2023

Source: Fidelity.com. Bond shown is the Exxon Mobil 3.452% '51 bond

Where Is the Minimum Bond Purchase Amount in the Depth of Book?

Investors buy bonds at the offer price and sell them at the bid price. Investors looking to purchase the Exxon Mobil '51 bond could have done so at a price of 66.46 on November 1. The column labeled "Qty (min)" indicates the total quantity related to a specific price, as well as the minimum order required for that price. On this day, an investors buying two bonds would have paid $664.60 for each bond, or $1,329.20 for both bonds. Accrued interest on November 1, 2023 would have been minimal since the Exxon Mobil bonds just paid interest on October 15, 2023.

As shown in Figure 1, all bond quotes had a minimum order size of at least two bonds. Of all 14 total bid and offer quotes, 13 had minimum quantities between 2 and 10 bonds.

While it is not always the case, both top-of-book bid and offer quotes had minimum quantities of two bonds. In this example, an investor buying two bonds would execute at the same price as one buying 250 bonds.

What if My Order Doesn't Satisfy the Top-of-Book Price's Minimum Quantity?

Some bond investors grow concerned when looking at the Bond Results summary and only seeing the top-of-book price. In some cases, investors may see a top-of-book minimum quantity of 10 bonds, but their trade size is only 5 bonds.

In such cases, investors must click on the depth of book to see all bond quotes available.

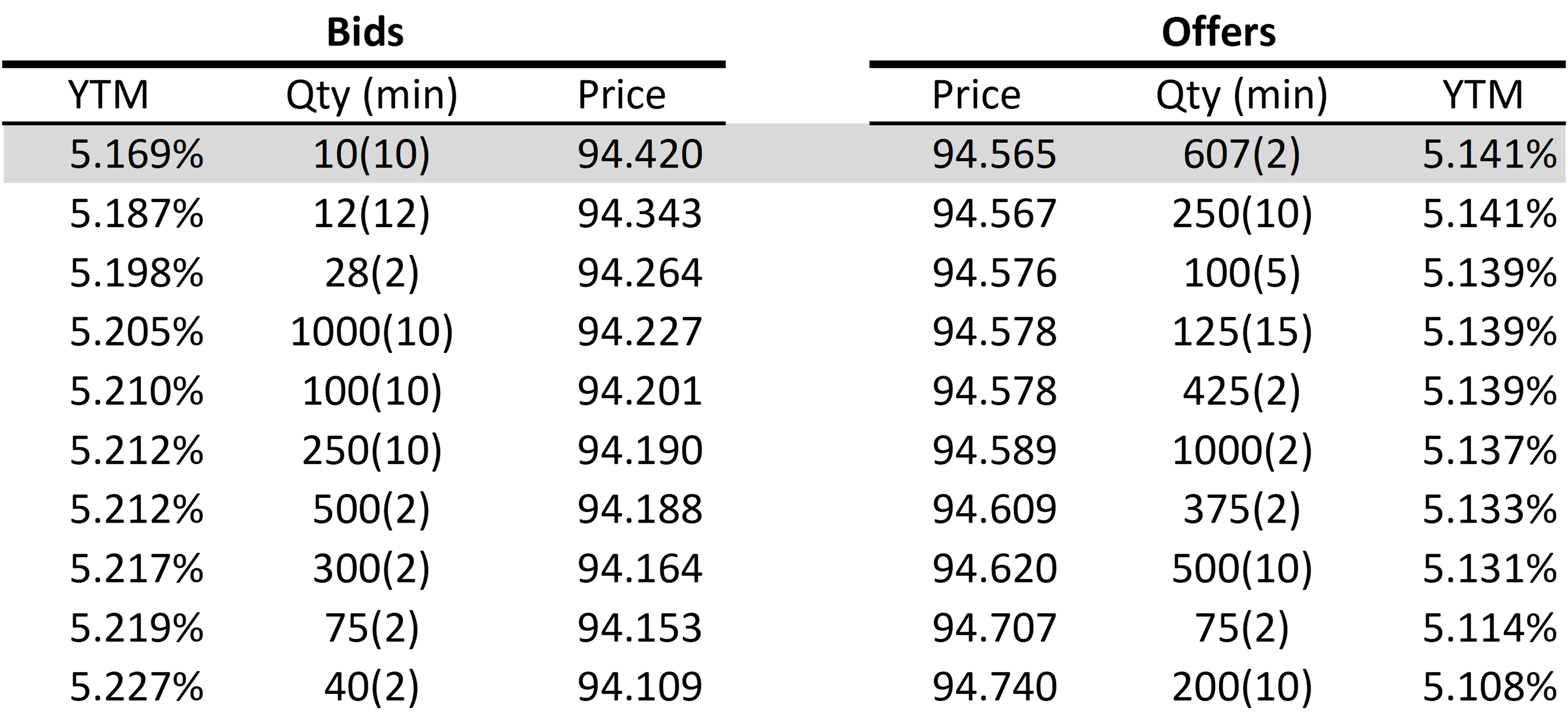

In Figure 2, we show an example of Apple bonds with a 4.15% coupon and a May 10, 2030 maturity date (CUSIP 037833EU0). In this example, while the top-of-book offer-side minimum quantity was two bonds, the top-of-book bid-side minimum quantity was 10 bonds.

If an investor wanted to sell five bonds, she would need to sell those bonds at the third-best bid price of 94.264, as that quote had a minimum quantity of two bonds. On Fidelity.com, she would need to enter the 94.264 price when completing the bond order form.

Figure 2: Apple Bonds Depth of Book on November 1, 2023

Source: Fidelity.com. Bond shown is the Apple 4.15% 5/10/30 bond.

In the Apple bonds example, the bid-offer spread on a YTM was three basis points and was 0.145 points on a dollar-price basis. These low bid-offer spreads are driven by the competitive nature of online bond investing.

In the Figure 2 Apple bonds example, there were 10 bond price quotes on both the bid and offer sides. The difference between the best and worst bid quotes was 0.311 points compared to 0.175 for the offer quotes. This level of competition ensures dealers make quotes that ultimately reduce bid-offer spreads and drive high-quality trade execution for individual investors.

As we'll discuss in the following section, this level of competitive, quality pricing is a far cry away from when investors use full-service brokerages and often only see bond prices held in that brokerage firm's bond trading inventory.

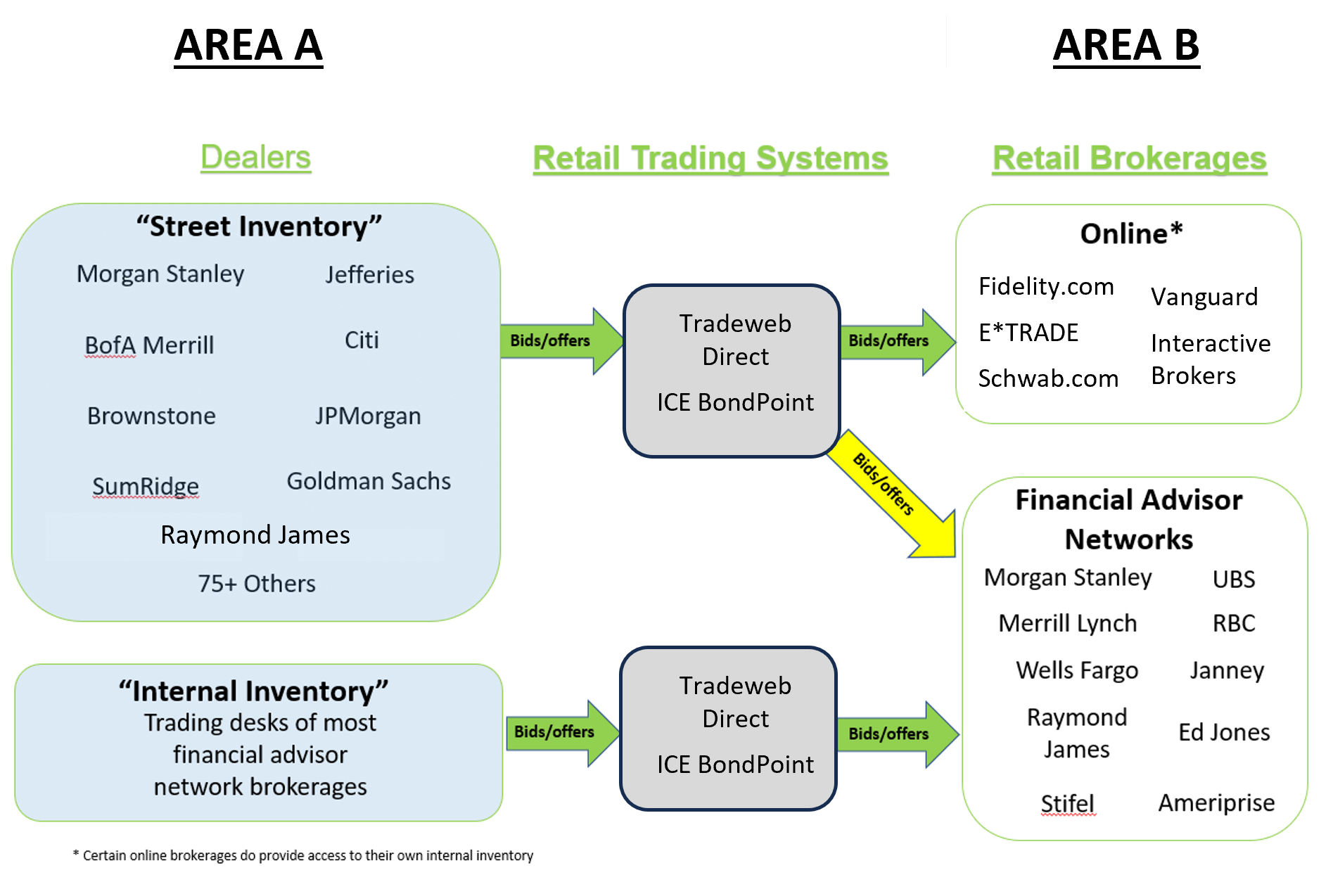

How Online Bond Trading Platforms Work

Figures 1 and 2 showed the high quality of corporate bond quotes individual investors enjoy. But how did those prices get to online bond trading platforms in the first place? Figure 3 shows how bond quotes provided by over 80 dealers initially flow into online retail trading systems such as Tradeweb Direct and ICE BondPoint. These quotes are then sent to online brokerages such as Fidelity, E*TRADE, and Schwab, which consolidate the quotes and create the depth of book bond quotes shown in Figures 1 and 2.

Figure 3: How Online Bond Trading Works

The following is a brief description of the retail bond trading workflows:

Area A

Liquidity-providing dealers send live-and-executable bond price quotes to retail trading systems such as Tradeweb direct and ICE BondPoint. This “bond inventory” provided by these dealers is split into two groups:

- “Street Inventory”: Street inventory includes bond price quotes provided by dealers that may or may not have a captive financial advisor distribution network. In many cases, these dealers’ primary business is market making, and they generate revenue from the bid-offer spreads of corporate bonds. Since retail corporate bond trading is primarily electronic, dealers grow their business by providing competitive quotes for actively traded bonds.

- “Internal Inventory”: Retail brokerages that have large financial advisor networks often have a trading desk that provides "liquidity" (or bond price quotes) for the clients of the financial advisors. When a financial advisor recommends a bond from his firm’s own trading desk, that bond is said to be from the firm’s “internal inventory.” Note that, in many cases, this trading desk may also be a provider of Street inventory.

Area B

Through connectivity with the retail trading systems, retail brokerages ingest bid-and-offer quotes that are then shown to either self-directed investors or the firm’s financial advisors. Generally, the online brokerages listed in the "Online" bucket have an ‘open architecture’ model, where substantially all Street inventory is shown to self-directed investor clients.

Some online brokerages enable the submission of limit orders that are inside the bid-offer spread. When these orders are submitted, they become part of the depth of book. For example, if the top-of-book bid-offer quotes were 95.00 / 96.00, an investor could enter a limit order to buy bonds at 95.50. This order would then be shown as a new bid quote that would narrow the bid-offer spread to 95.50 / 96.00.

Financial Advisor Network brokerage firms may or may not allow Street inventory to be shown to their clients, which is why we show a yellow arrow to these firms between Areas A & B. As discussed in the Area A commentary, many of these firms have their own trading desks and may only permit orders against that firm’s internal inventory. The level of Street inventory available to the clients of the Financial Advisor Network brokerages varies from firm to firm. In addition, access to Street inventory at Financial Advisor Network brokerages can depend on the type of account an investor has.

Minimum Treasury Bond Purchase

In addition to investing in corporate bonds online, investors can also buy and sell US Treasurys and municipal bonds. Trading in the US Treasury market is more concentrated than it is in US corporate bonds, as the number of actively trade US Treasury CUSIPs is typically around 560 compared to approximately 9,000 individual corporate bonds. There are also a smaller number of dealers that trade in US Treasurys vs. corporate bonds.

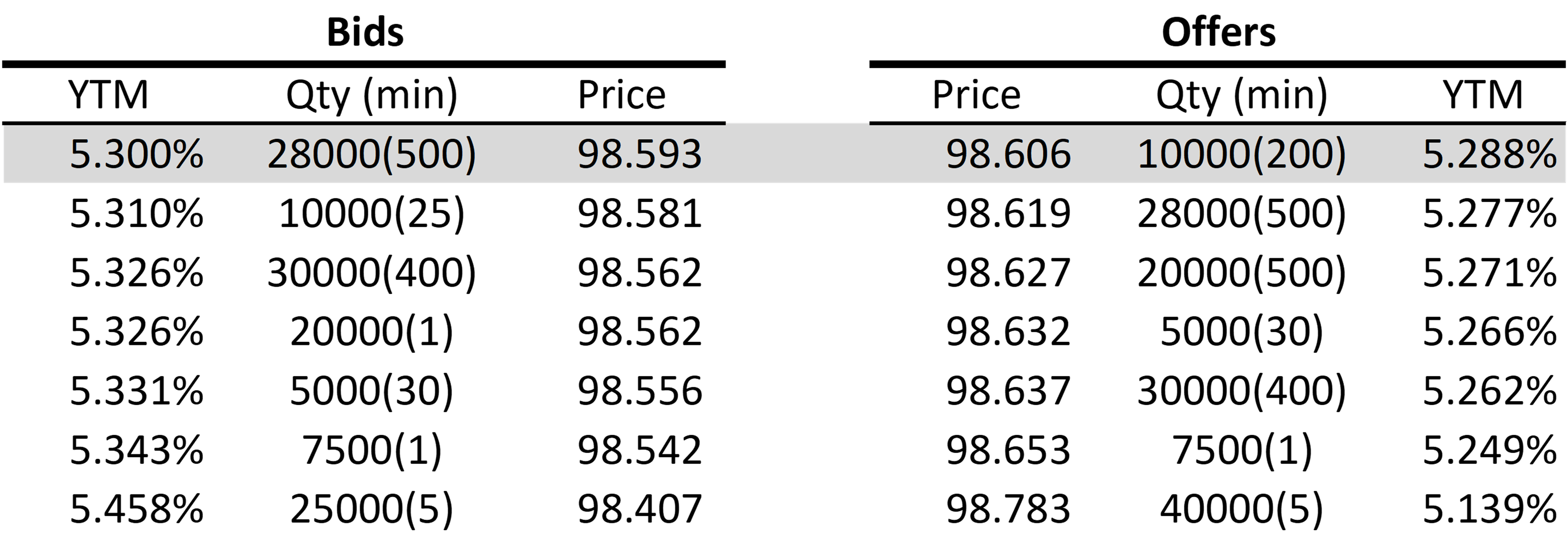

Figure 4 shows the depth of book for the US Treasury 4.125% 1/31/25 note (CUSIP 91282CGG0). As shown, the biggest difference between the US Treasury note quotes and those of the Exxon Mobil and Apple bonds above is the difference in the minimum quantity requirements and the total quantities behind each.

The top-of-book US Treasury offer quote had a minimum quantity of 200 bonds, or $200,000 face value, much different than the two-bond top-of-book offer minimums shown for the Exxon Mobil and Apple bonds. Given the level of liquidity concentration in US Treasurys, the quantities of each Treasury quote are materially higher than those in the corporate bond examples.

That said, investors could purchase minimum quantities of one Treasury note, provided they were willing to transact at an offer price that was 0.047 points higher than the top-of-book offer price of 98.606.

Figure 4: Depth of Book for US Treasury Note 4.125% 1/31/25 on October 31, 2023

Source: Fidelity.com

We understand investors can purchase bonds in smaller-than-$1,000 face value denominations on treasurydirect.gov; however, investors cannot sell bonds on the TreasuryDirect website. Selling US Treasurys must be done through a brokerage firm, in which case investors would be subject to the minimum Treasury bond purchase amounts set by retail brokerages.

Conclusion of "What Is the Minimum Bond Purchase Amount?" Blog Post

One of the most notable advantages of the US corporate bond market is the level of liquidity available across 9,000 bond CUSIPs. With individual corporate bonds, investors can build bond portfolios with bonds across industries, credit quality, YTMs, and maturity dates. With this diverse group of bonds available, investors can build bond portfolios suited to their investment objectives and risk tolerance.

US Treasurys, while they are the most liquid fixed income market, don't offer the level of diversification that corporate bonds can provide. US Treasurys are 'rates' investments and are driven, in large part, on market interest rates, the supply and demand of US Treasurys, and overall economic conditions.

We wrote this fixed income education article to show investors that their last name doesn't have to be Gates if they want to invest in individual bonds. Online bond brokerages such as Fidelity, E*TRADE, and Schwab -- along with the likes of Tradeweb Direct and ICE BondPoint -- have done a noteworthy job in democratizing bond markets. Investors do not need hundreds of thousands of dollars to build a bond portfolio. They can start small and build successful portfolios for the long term. They can do so with two, five, or ten bonds at a time and take advantage of many bonds trading at once-in-a-generation low prices.

Get Started

Watch Free Sample