Bond investors are generally familiar with the term 'accrued interest;' however, many may not know the exact accrued interest calculation that determines

the accrued interest buyers pay -- or sellers receive -- as part of a corporate bond trade. This blog post seeks to change this.

What Is the Accrued Interest on Bonds?

The accrued interest calculation is a key component of the money exchanged when buying and selling corporate bonds. While corporate bond coupon

payments are made semi-annually, bondholders earn interest every day. This interest accrues on corporate bonds until the two coupon payment dates,

which are typically a) the month and day of a bond's maturity date and b) six months from this date.

For example, if a bond had an August 1, 2025 maturity date, it would pay interest February 1 and August 1 every year. On the maturity date, the

bond issuer is obligated to return your $1,000 par value per bond and to make the final interest payment, provided the issuer has not called the bonds

prior to the maturity date.

Since bond coupon payments are only made twice per year, there's a 99% chance a bond trade will settle on a date other than the bond coupon payment

date. Since the selling bondholder earns interest until a bond trade's settlement date, we must calculate the bond's accrued interest to determine

the amount of accrued interest the purchasing bondholder must pay the seller at trade settlement.

Accrued Interest Calculation Example

The best way to understand the accrued interest calculation is through an example of a corporate bond BondSavvy previously recommended: M/I Homes 5.625%

8/1/25 (CUSIP: 55305BAQ4). We recommended our investment newsletter subscribers buy the bond at 95.98 on March 15, 2019 and then sell the bond at 103.15 on January 9, 2021, which was a Saturday. As shown in our corporate bond returns page, this investment achieved an 18.18% total return compared to an 11.66% return for the

iShares HYG bond ETF, a leading high-yield corporate bond ETF.

Since the M/I Homes bond matures 8/1/25, the bond coupon payments are February 1 and August 1 of each year. We recommended selling the bond on

Saturday, January 9, 2021, so the next trading day was Monday, January 11, 2021. Below we show an example of an investor who sold five M/I Homes

bonds on January 11, 2021, including the amount of accrued interest on bonds he owned.

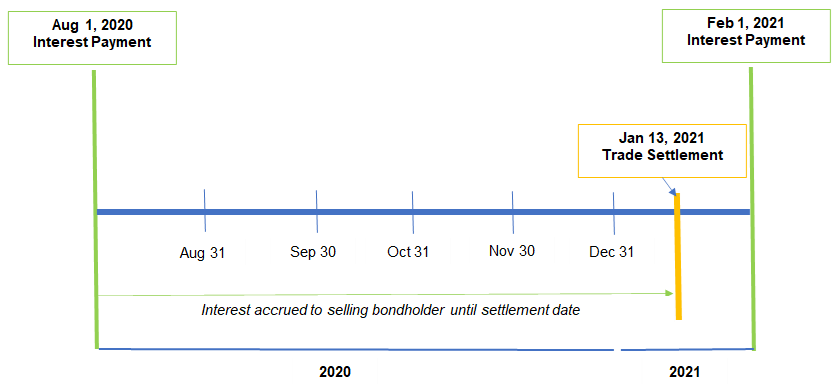

In Figure 1, the M/I Homes bond made a coupon payment on August 1, 2020. The investor then sold five bonds on January 11, 2021 at a price of

103.15, as we show in Figure 2. From the trade date, corporate bonds take two business days to settle (known at "T+2"), or to transfer bond ownership

and exchange funds to complete the trade.

The selling bondholder is owed the accrued interest on the bond from the date of the most recent bond coupon payment until the date on which the trade

settles, which was January 13, 2021 in this case. This is called the "accrued interest" of the bond, as the interest has been earned by the bondholder

but not yet paid by the bond issuer.

Since the selling bondholder sold the M/I Homes bond prior to the February 1, 2021 interest payment date, the purchasing bondholder needs to make the

selling bondholder 'whole' by paying him the accrued interest.

Figure 1: Accrued Interest Illustration for M/I Homes 5.625% 8/1/25 Corporate Bond

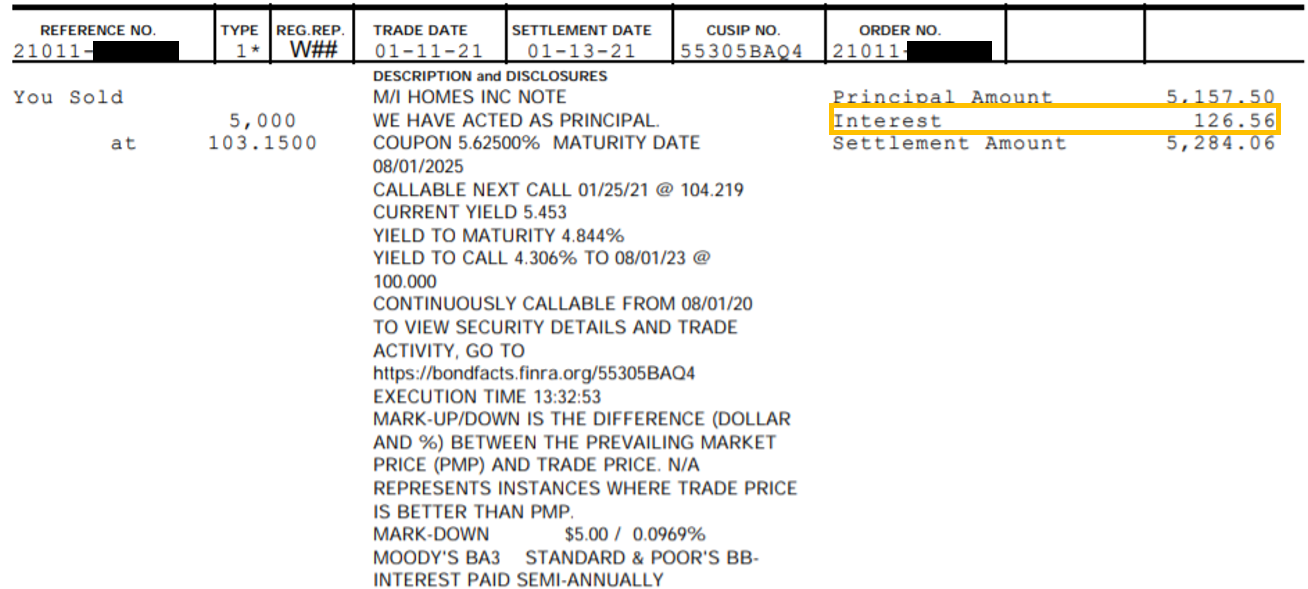

As shown in Figure 2, the investor's 'trade date,' the date on which his trade was executed, was January 11, 2021, and the bond trade settled two business

days later on January 13, 2021. On the left side of the trade confirmation, it says "You Sold 5,000 at 103.1500." All this means is that

the investor sold $5,000 in par value of corporate bonds, or 5 bonds, at a price of 103.15.

Corporate bond prices are quoted as a percentage of their face value (please note "face value" and "par value" are used interchangeably in bond investing). Since the face value of a corporate bond is $1,000, the value of each bond

sold was $1,031.50. The product of this number and 5 is $5,157.50, which is shown as $5,157.50 in "Principal Amount" on the right side of the

trade confirmation.

Since the investor was selling the bond, the purchasing bondholder paid him accrued interest from August 2, 2020 through January 13, 2021 in an amount

of $126.56 for five bonds (boxed in orange). We show the accrued interest calculations in Figures 3 and 4 below.

Figure 2: M/I Homes Bond Sale Trade Confirmation

How Was the $126.56 in Accrued Interest on Bonds Calculated?

The coupon on the M/I Homes '25 bond is 5.625%. Since corporate bonds have a face value of $1,000, the annual interest paid for each M/I Homes

bond was $56.25. Interest accrues evenly for each month of the year, regardless of how many days the month has. For the accrued interest

calculation, the bond prospectus indicates that we assume each year consists of 12 30-day months, or 360 days. As shown in Figure 3, assuming

interest is accrued evenly for each month of the year, there is $4.688 of monthly accrued interest on every M/I Homes bond. For five bonds, the

monthly accrued interest is $23.44.

Figure 3: Bond Coupon Payment for Five M/I Homes Bonds

| Par Value per Bond |

$1,000 |

| Bond Coupon |

5.625% |

| Annual Bond Coupon Payment |

$56.25 |

| # Months per Year |

12 |

| Monthly Accrued Interest |

$4.688 |

| Assumed # Bonds Owned |

5 |

| Monthly Accrued Interest for 5 Bonds ("A") |

$23.44 |

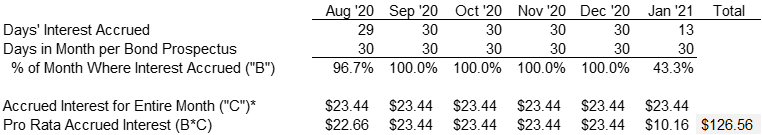

In Figure 4, we show the amount of accrued interest between the August 1, 2020 interest payment and the January 13, 2021 settlement date. Per the M/I Homes

bond prospectus, each month consists of 30 days regardless of how many actual days are in the month. For September through December 2020, interest was

accrued for the entire month, so the pro rata monthly accrued interest for the five bonds was $23.44 for each of these four months.

Since interest was paid August 1, 2020, the month of August 2020 accrued interest for 29 of its 30 days, so August's pro rata accrued interest was $22.66,

or 96.7% of $23.44. In January 2021, since the bond trade settled on January 13, 2021, we accrued interest for 13 days, or 43.3% of the 30-day month. The

pro rata accrued interest for January 2021 was $10.16. By adding all of the accrued interest from August through January, we arrive at the total accrued

interest of $126.56, which matches the accrued interest received in the orange box in Figure 2.

Figure 4: Accrued Interest Calculation for Five M/I Homes Bonds That Settled January 13, 2021

* See calculation of row "A" in Figure 3

Buyer Received Full Bond Coupon Payment February 1, 2021

To purchase the M/I Homes bonds from the selling bondholder, the purchasing bondholder paid the seller a total of $5,284.06 per the "Settlement Amount"

number in Figure 2**. While the buyer paid $126.56 in accrued interest to settle the trade January 13, 2021, on February 1, 2021, she received the

full bond coupon payment of $140.63 for the five bonds she now owns. We calculate this by multiplying $23.4375, the unrounded "Monthly Accrued Interest

for 5 Bonds" shown in Figure 3, by 6 months. Should she still own the five bonds on August 1, 2021, she would receive the full bond coupon payment

of $140.63 on this date.

Get Started

Watch Free Sample

** Please note that the buyer will pay slightly more than this amount to pay for any markups in the purchased bonds charged by his brokerage. When buying bonds online at

venues such as Fidelity and E*TRADE, the markup is typically 0.1 points, or $1 per $1,000 in face value per bond.