Corporate bonds trade as a percentage of their $1,000 par value, and it's a big advantage individual corporate bonds have over bond funds. In this bond investing FAQ article, we

explain how investors can use the way individual bonds are priced to assess the value of new corporate bond

investments. We also discuss why investors cannot assess the value of bond funds and ETFs, as these

investments trade off an arbitrary net asset value per share and lack the underlying financial metrics of individual

corporate bond issuers.

For an introduction, please watch this 2-minute video from Bondsavvy founder Steve Shaw (aka "Bondsavvy Steve"), who compares par on a golf course to the par value of corporate bonds. If you enjoy the video, please hover your cursor over the video and click "YouTube" at the bottom. There, you can give the video a "like" and subscribe to the Bondsavvy YouTube channel.

What is the par value of a bond?

The par value of a corporate bond is $1,000 and represents the amount a bond issuer must pay

bondholders for each bond owned on a bond's maturity date. It's similar to par on a golf course only you get

money in your pocket rather than personal satisfaction. In golf, a good player should make par or better on a

hole. In bonds, a 'good bond' (one where the issuer doesn't default prior to a bond's maturity date) pays the

holder the par value of the bond at maturity.

Bondsavvy founder Steve

Shaw and his Dad, Robert Shaw, playing in the annual Father's Day tournament at the course Steve grew up

playing, Allentown Municipal Golf Course, in Allentown, PA. Their red team color represented all the

birdies they hoped to make in the two-man-scramble event.

Bond investors use the terms par value and face value interchangeably. The par value of a bond is the same for

the entire life of the bond, which is very different than the market value of the bond, which can fluctuate

regularly.

How are corporate bonds quoted relative to the par value of a bond?

Individual corporate bonds are quoted as a percentage of their par value. For example, a corporate bond quoted

on an online bond

trading brokerage at 98.00 would be worth $980, or 98% of the $1000 par value of the bond. Since this

bond is quoted below the $1,000 of a par value bond, it is called a discount bond. A corporate bond quoted at

105.00 is worth 105% of the bond's par value, or $1,050. Bonds priced above par value are known as premium

bonds.

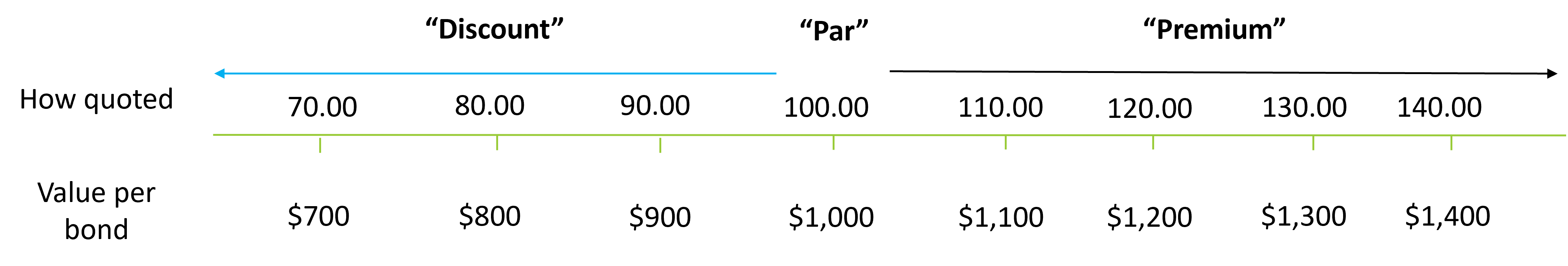

As shown in Figure 1, par value is the anchor of the bond pricing scale. Throughout the life of a corporate

bond, the market price can fluctuate to where the bond becomes a discount bond or a premium bond. The key rule

around bond pricing, however, is that, on the bond's maturity date, the bondholder receives the bond's $1,000 par

value.

This rule has a major impact on how corporate bonds trade, as, generally speaking, bonds that are very

close to their maturity dates will typically have limited pricing volatility compared to bonds that have a long time

to maturity. In addition, there is effectively a ceiling placed on how high a corporate bond price can

increase since the bond has to return to par value on the bond maturity date.

Figure 1: Premiums and Discounts to the Par Value of a Bond

In extremely rare circumstances, a corporate bond could soar above 150.00. That said, this is a key difference

of corporate bonds vs. stocks, as stocks don't have a maturity

date and their prices can increase without an upper limit. The ceiling on corporate bond prices is a big

reason why we advocate selling bonds before

maturity to secure upside and maximize our total investment return. For example, if we recommend

purchasing a corporate bond at 90.00 and the price increases to 130.00, unless we believe a catalyst remains for the

bond price to continue increasing, we will likely recommend selling the bond.

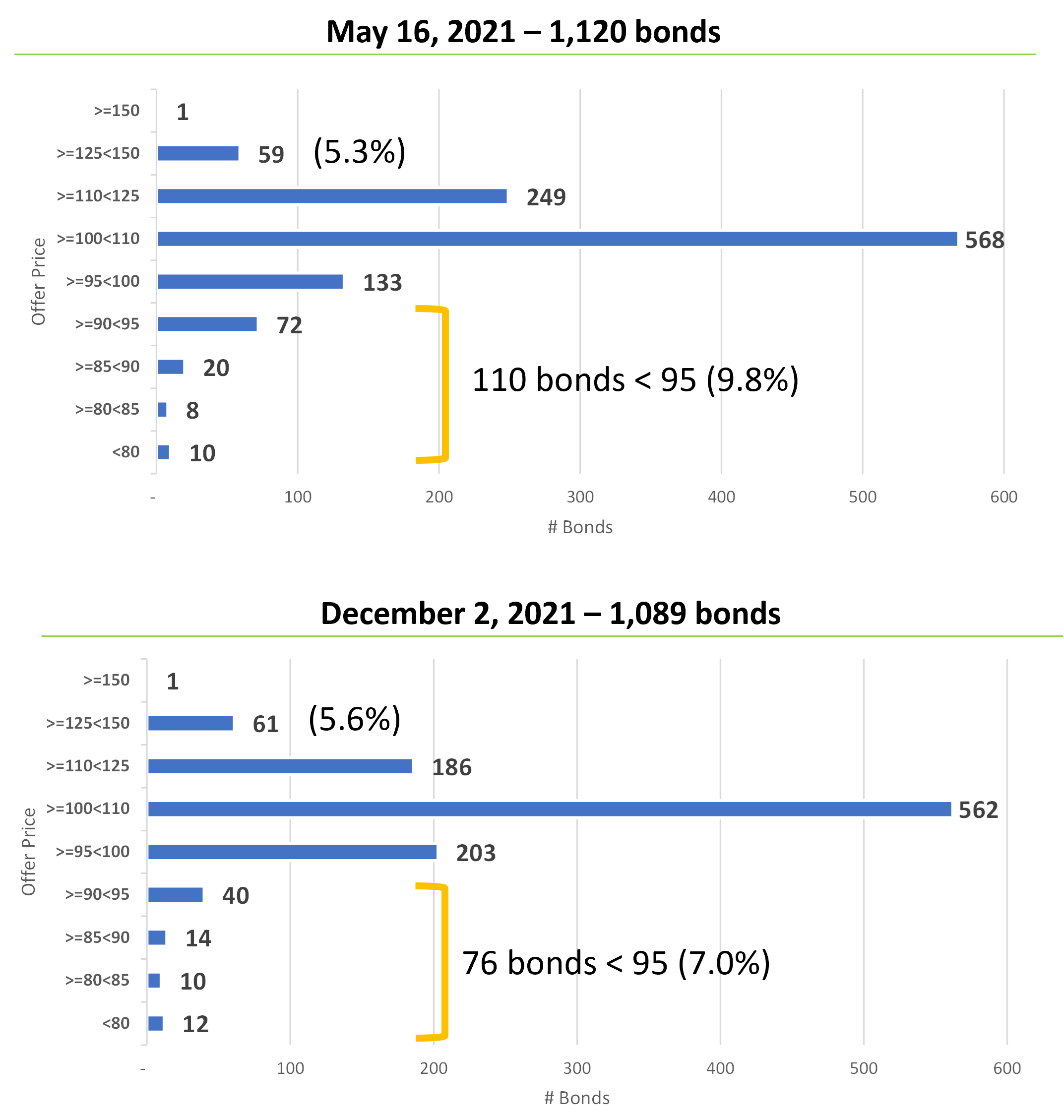

To illustrate the ceiling on corporate bond prices, Figure 2 shows the distribution of high yield corporate bond

prices from two Fidelity bond searches: one on May 16, 2021 and another on December

2, 2021. In both cases, there was only one bond priced above 150: the Ford Motor 9.980% 2/15/47 bond (CUSIP

345370BW9), which was issued way back in 1998 at a high coupon. As Figure 2 illustrates, as a bond moves

farther up the bond pricing scale, the opportunity for the price to keep increasing gets smaller.

Figure 2: Distribution of High Yield Corporate Bond Prices Relative to Par Value of a Bond

Source: Fidelity.com corporate bond searches.

There is one other important conclusion we can draw from this bond price chart: it was slightly easier to find

bargains on May 16, 2021 vs. December 2, 2021. Bondsavvy's bond investment strategy is focused on maximizing long-term income and total returns. Similar to stocks, we want to buy low and sell high. The bars bracketed in orange show

the bonds priced below 95.00. On May 16, 2021, 9.8% of the 1,120 bonds were priced below 95.00 compared to

7.0% on December 2, 2021.

As many high yield corporate bond issuers reported strong financial performance during this time period,

the high yield corporate bond market had generally performed well, with many bond prices increasing significantly

after reaching Covid-induced depths in March 2020. Bond selection becomes even more important in periods of higher bond prices, as

there are, unfortunately, more mistakes that can potentially be made.

Advantages of Corporate Bonds Being Priced Relative to the Par Value of a Bond

Since corporate bond prices trade relative to a bond's par value, bond prices enable investors to assess their

relative value compared to other corporate bonds. Investors cannot assess the relative value of bond funds and

ETFs since they trade based on a value per share that is not anchored to a metric similar to a bond's par

value.

With individual corporate bonds, investors can compare trading metrics such as YTM, the bond's price

relative to par value, and credit spread to credit metrics, such as leverage

ratios, to determine whether a bond is a good value. Such credit and pricing metrics do not exist in

the world of bond funds and bond ETFs.

Figure 3 provides an example of how select bond funds, bond ETFs, and individual corporate bonds were priced as of November 7, 2024. The pricing

of the two individual bonds -- Walmart Inc. 4.75% 10/2/43 (CUSIP 931142DK6)

and Netflix 5.875% 11/15/28 (CUSIP 64110LAT3) -- was

straightforward. Both bonds were priced as a percentage of their face value, with the Walmart bond trading

at 95.20% of its par value and the Netflix bond trading at 104.42%.

We could also see that the credit

spreads for both bonds were fairly narrow: near 0.50% for both bonds. With the bond price information in hand, we can apply our bond

investment analysis to determine whether either the Walmart bond or the Netflix bond represented a

compelling value.

Figure 3: Illustration of Pricing of Individual Bonds vs. Bond Funds

Security |

Ticker / CUSIP |

Price 11/7/24* |

Credit Spread* |

How Priced |

When Priced |

| iShares iBoxx $ Investment Grade Corp Bond ETF |

Ticker LQD |

108.15 |

NA |

$ per share, which can be

different than ETF's NAV/share |

Throughout the day |

| iShares iBoxx $ High Yield Corp Bond ETF |

Ticker HYG |

79.04 |

NA |

$ per share, which can be

different than ETF's NAV/share

|

Throughout the day |

| Vanguard Total Bond Market Index Fund |

Ticker VBTLX |

9.54 |

NA |

NAV / share |

End of day |

| Walmart Inc. 4.75% 10/2/43 |

CUSIP 931142DK6

|

95.20 |

0.50% |

% of Face Value |

Throughout the day |

| Netflix 5.875% 11/15/28 |

CUSIP 64110LAT3 |

104.42 |

0.51% |

% of Face Value |

Throughout the day |

*Prices for LQD and HYG are from the iShares websites. VBTLX price was from Yahoo! Finance. Prices for the Walmart and Netflix bonds are

top-of-book offer prices from Fidelity.com.

Since the three bond funds are not priced relative to par value, it is impossible for investors to determine whether

the prices shown are good value. We can't compare the bond fund's price to par value, the fund doesn't have a

credit spread, and we cannot calculate basic credit metrics such as leverage

ratios. Investors in individual corporate bonds have these corporate bond research arrows in their

quivers, which provide a significant advantage of individual bonds vs. bond funds.

Frequency of Bond Pricing Updates

There is another factor in how individual bonds, bond funds, and bond ETFs are priced, which provides a greater level

of transparency and accuracy for individual bonds. At any time during the trading day, investors can open

their online brokerage account and see the up-to-the-second price of an individual corporate bond they want to

buy.

While bond price volatility is typically less than that of stocks, corporate bond

prices move up and down based on factors such as bond issuer financial performance, Treasury yields, bond

fund inflows and outflows, and other bond market dynamics. The bond market is not perfectly efficient;

however, material events and market factors can and will cause bond prices to move over the course of a trading day.

Compare this to a traditional bond fund such as VBTLX, which price only gets updated at the end of the day. Worse are

bond ETFs, such as iShares LQD and iShares HYG, which have prices that move up and down during the day, but

the underlying value of the holdings in the fund only gets priced at the end of the day. Other than the

typically weak returns of bond funds, this lack of pricing transparency is another reason why we favor owning individual corporate bonds over bond funds and

ETFs.

How To Calculate Bond Coupon Payments Based on the Par Value of a Bond

Over the course of a corporate bond's life, its YTM, current yield, price, and credit spread move

throughout each trading day. The fixed parts of the bond investing equation are a bond's coupon, maturity

date, and par value. Since the bond's par value and coupon do not change between bond issuance and maturity

date, coupon payments for each bond remain the same.

Figure 4 shows the annual bond coupon payment calculation for the Walmart '43 bond we showed in

Figure 3. To determine how much bondholders receive each year, multiply the $1,000 par value of the bond by

the 4.75% coupon. This results in an annual coupon payment of $47.50 for each bond an investor owns.

Interest on corporate bonds is paid semi-annually: once on the month and day of the maturity date (October 2 for

this Walmart bond) and once on the date that is six months after this date (April 2 for this Walmart bond).

In the case of the Walmart '43 bond, an investor who owned 10 bonds would receive $237.50 every April 2 and $237.50 every October 2, for an annual coupon payment of $475.00. Should the investor sell a bond in between coupon payment dates, in addition to receiving

the market value of the bond sold, she would receive accrued interest from the most recent coupon payment date

until the date on which the trade settled.

Figure 4: Annual Bond Coupon Payment Calculation for Walmart 4.750% '43 Bond

| Par Value per Bond | | Coupon | | Annual Coupon Payment

per Bond |

| Number of Bonds

Owned |

| Total Annual Coupon

Payment |

|---|

| $1,000 | x | 4.750% | = | $47.50 | X | 10 | = | $475.00 |

While a corporate bond's annual coupon payment does not change, current yields and YTMs are ever changing. Our bond recommendations service evaluates these metrics along with bond issuer financial performance to determine our recommended corporate bonds to buy.

Get Started

Watch Free Sample

Copyright 2025 Bondsavvy