Bondsavvy uses credit analysis to identify undervalued corporate bonds it believes can achieve higher investment returns

than the leading bond funds and ETFs. To evaluate potential corporate bond investments,

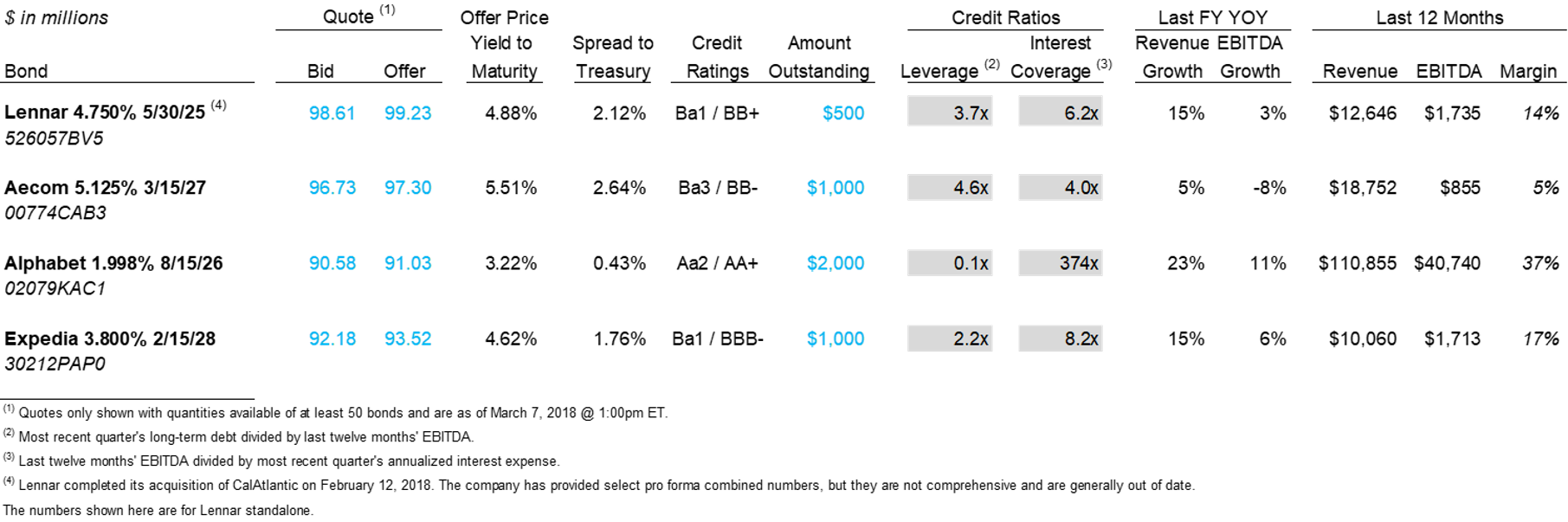

we must understand how bonds are priced relative to their credit risk and interest-rate risk. Please see Figure 1 below, which was part of a previous

edition of The Bondcast, a subscriber-only webcast series where we present new corporate bond

recommendations.

It reviews certain of the key metrics that are part of our credit analysis. Below the table is a description

of the select items our credit analysis

includes.

Click to view this

sample edition of The Bondcast and

read our bond investment

analysis overview for

a more comprehensive review of the factors we consider when evaluating new individual corporate bond

investments.

Figure 1: Preview of Bondsavvy Credit Analysis from Earlier Edition of The Bondcast

Comparing Bond Pricing to Credit Metrics

Due to the many weaknesses of corporate bond rating methodologies,

it's essential for bond investors to see how key credit analysis metrics such as leverage ratios and

interest coverage ratios compare to how a corporate bond is priced. Figure 1 shows us the dollar price of the

four recommended bonds, as well as

the yield to maturity and the spread to Treasury, also known as the credit spread.

Since maximizing the income and total investment return of

each corporate bond

recommendation is our goal, we want to identify bonds that have relatively high YTMs, high credit spreads, and low

prices relative to the corporate bond's

default risk. If a corporate bond's credit spread is high relative to the issuing company's default risk, the

credit spread could decrease over time,

which could cause the bond's YTM to fall, and the bond price to increase. In addition, with a high relative

yield, we would receive fixed, recurring income

that is generally higher than the variable distributions offered by bond funds and ETFs.

Finding corporate bonds with compelling relative values is possible for investors in individual corporate bonds since

a large portion of corporate bonds

are owned by large institutional investors, bond index funds in particular. These investors, in many cases,

blindly follow corporate bond ratings

to assess the default risk of a bond. Corporate bonds are regularly mis-rated due to the flawed methodologies

bond rating agencies employ, which creates

opportunities for individual corporate bond investors.

All four recommended corporate bonds shown in Figure 1 were priced below par value at the time we made this set of

bond recommendations. Bonds are

priced as a percentage of their par value, so the offer price of the Alphabet '26 bond (CUSIP 02079KAC1) was 91.03%

of the bond's $1,000 par value, making

the offer price of the bond $910.30. When possible, we prefer to buy corporate bonds at a discount to par

value, as these bonds, generally speaking,

can have greater upside than bonds trading at a premium to par value.

The leverage ratio equation is total debt divided by EBITDA. If this ratio is low (1-2x), it means the company

has a low amount of indebtedness (“leverage”)

relative to its earnings. Issuers with bond ratings below investment grade often have higher debt levels relative to earnings and have

leverage ratios typically between 3-6x. With a small number of outliers, over its history, Bondsavvy has generally recommended corporate bonds issued by companies with leverage ratios between 2-4x. For corporate bond ratings, leverage ratios often have less weighting than certain fuzzy metrics such as diversification and 'innovation.' Bond ratings' focus on certain 'feel-good' metrics causes many bonds to be mis-rated, so the savvy bond investor can find values often ignored by most investors.

Please note

that “EBITDA” is an acronym for Earnings Before Interest, Taxes, Depreciation & Amortization. It shows how much

cash a company generates from operations

and what it has to pay its interest, taxes, and capital expenditures.

Interest Coverage Ratio:

The interest coverage ratio equation is EBITDA divided by interest expense. The higher this is, the more cash flow a

company has to 'cover,' or pay, its interest expense. If interest coverage is low, a company may have difficulty paying interest if its business

hits a rough spot. Interest coverage

is often 2-5x for high yield bond issuers and often over 10x for investment-grade issuers.

Issuing Company's Financial Performance Trajectory

While corporate bond investors don't require the issuing company to grow rapidly, the company's growth trajectory can

impact the leeway we give bond

issuers on certain credit analysis ratios. For example, if we evaluated two bonds with similar pricing, we may

select a bond with marginally worse

credit ratios in the event the forward-growth picture of the issuing company is stronger than that of the other

issuer. In the wake of COVID-19,

many corporate bond issuers pulled their 2020 financial guidance. While we could understand this for Q2 2020,

those who continued to blame 'uncertainty'

for their lack of any forward guidance raised concern about future prospects of their business.

Southwest Airlines, a company that had its business crushed by COVID-19, was extremely transparent, as it regularly

filed 8-Ks with the SEC in 2020

to provide updates on its business and cash burn. The company was able to raise billions in new capital to

help it get through the crisis, and

the regular updates it provided enabled investors to assess the company's turnaround.

As shown in Figure 1, we review the company's recent revenue and EBITDA growth to evaluate its growth

trajectory. We also review any forward

guidance a company has provided to determine whether its credit ratios should improve

or worsen.

Capital Allocation

Capital allocation describes what a company does with the profits it earns from running its businesses. A

company could have strong credit ratios

today; however, if it wastes significant portions of cash flow on stock buybacks, such financial management

practices could come back to bite.

From a bondholder's perspective, we like to see capital allocation skewed toward debt paydown and capital

expenditures. Some level of merger-and-acquisition

activity can also be productive; however, we, at times, stay away from bond issuers that have recently announced or

completed mega deals, as these

can often take a fair bit of time to evaluate their success and can come with high levels of risk.

Upcoming Bond Maturities

We evaluate a corporate bond issuer's upcoming bond maturities in relation to its operating performance and cash on hand. While few and far between, there are companies, such as Google-parent Alphabet, that have substantially more cash than debt.

When a bond issuer has a bond maturity on the horizon, it can either refinance the bond (i.e., issue new bonds to raise money and pay off the maturity bond) or redeem it with cash on hand. A significant amount of cash on hand can provide issuers with wiggle room in the event they experience weakened operating performance. When companies file for Chapter 11 protection, it is often in connection with a debt maturity it cannot refinance or redeem with cash on hand.

Issuer's Liquidity

We want to understand all sources available to pay for interest expense, capital expenditures, and upcoming debt

maturities. To do this, we evaluate

the company's cash on hand, investments, and capacity on any bank lines of credit.

Importance of Monitoring Corporate Bond Investments

Investing in individual corporate bonds is not a 'set it and forget it' investment strategy. Company operating performance can vary quarter to quarter, and investors must use this information to assess how to adjust their bond investment portfolios. Bondsavvy regularly updates its buy/sell/hold investment recommendations, including each quarter during The Super Bondcast investment webinar. These updates reflect the latest issuer financial performance and bond pricing metrics. We supplement these quarterly updates with regular email updates in the event of changing market conditions or bond issuer material events.

We founded Bondsavvy to empower individual investors to make successful investments in individual corporate bonds. Our regular bond recommendation updates put our investment service subscribers in control of their corporate bond investments.

Get Started Watch Free Sample