The brokerage industry was thrown into a tizzy when Charles Schwab, E*TRADE, Fidelity, Interactive Brokers, and TD

Ameritrade recently cut online stock

trading commissions to zero. As this played out, executives at many full-service brokerages hid under their

desks, as their firms often charge

clients 2% or more to execute corporate bond trades and municipal bond trades. These financial advisor fees eat away at

investor returns and, for a bond yielding

3%, take away two-thirds of an investor's year-one interest income.

This fixed income blog post examines these two-point bond markups and the savings investors can achieve by buying bonds

online rather than paying financial advisor

fees. I also discuss how subscribing

to BondSavvy and using our recommendations to buy

bonds online provides investors with a greater level of bond investing expertise, higher potential returns,

and significantly lower investment

fees.

A $48,040 Financial Advisor Fee on One Bond Trade

Many investors believe that, to obtain the best bond

price available, they must buy bonds

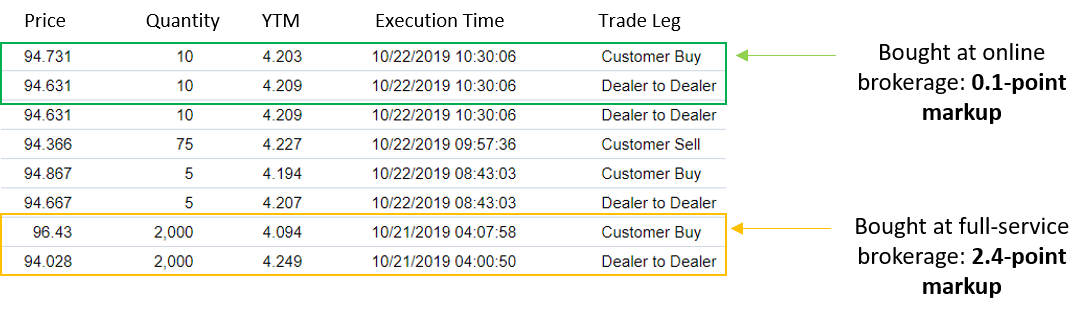

in large sizes. This simply is not true, and we have the data to prove it. Figure 1 shows how an

investor buying 10 bonds (or $10,000 in bond face value) achieved a better price than one purchasing 2,000 bonds (or $2,000,000 in face value). The

investor achieved a better price by executing

his trade through an online brokerage, which charges a far smaller markup than traditional commission-based

financial advisors. In this example, we

will show how the 2,000-bond investor paid an eye-popping $48,040 commission for the trade. Here's how this

works:

In Figure 1, we show a series of trades in the Kroger 3.875% 10/15/46 bond (CUSIP 501044DF5) over a

several-hour period during October 21

and 22, 2019. Corporate bond trades are reported to "TRACE," a pricing database managed by FINRA, an entity

that regulates broker-dealers and

is overseen by the U.S. Securities and Exchange Commission.

TRACE enables investors to compare quoted

corporate bond prices to those of recently

executed trades. Investors can also review TRACE data to understand the historical pricing range particular

bonds have traded. For each

row of the table, TRACE indicates the price of the trade (expressed as a percentage of the bond's $1,000 face value), the number of bonds traded ("Quantity"),

the yield to maturity ("YTM"), time of the trade, and the trade leg.

Figure 1: TRACE-Reported Trades for Kroger 3.875% 10/15/46 Bonds - CUSIP 501044DF5

In Figure 1, we have boxed series of trades in orange and green to illustrate the difference between buying

bonds through an online brokerage vs. a

full-service brokerage, which employs thousands of financial advisors and charges materially higher bond trading

commissions.

Advantages of Buying Bonds Online: The Green Box in Figure 1

Online brokerage customers are the beneficiaries of a competitive market with over 100 dealers providing live

bid and offer corporate bond quotes.

I covered this during my 2018 presentation to U.S. Securities and Exchange Commission.

When online brokerages such as Fidelity and E*TRADE execute a trade for a customer, they typically don't already own

the bonds, as this would require

online brokerages to hold thousands of bonds on their books, an expensive and risky proposition.

Instead,

market-making dealers, including Bank

of America, Morgan Stanley, Sierra Pacific Securities, and others post live bid-offer quotes that online brokerages

show their customers. When

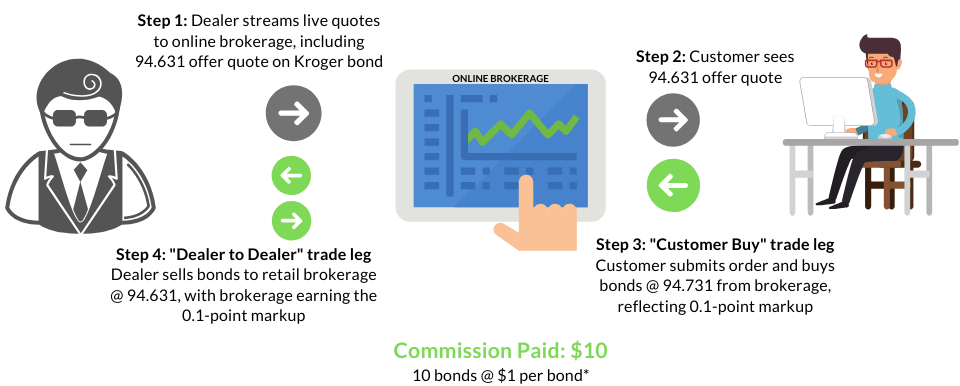

an online brokerage customer clicks "Submit" to complete a trade, two "trade legs" occur: a "Customer Buy" leg (Step

3) and a "Dealer to Dealer" leg

(Step 4) as illustrated in Figure 2:

Figure 2: Illustration of Self-Directed Investor Buying Bonds Online

* Since bonds are quoted as a percentage of their $1,000 face value, a 0.1-point

markup is equivalent to $1.00.

In this example, the online brokerage customer saw a price of 94.631 when he was considering purchasing the

Kroger '46 bonds. When he submitted

his order, his brokerage added a 0.1-point markup to the bond. In dollar terms, a bond quoted at 94.631 is

94.631% of the bond's $1,000 face value, or $946.31. When the online brokerage adds the 0.1-point markup, the customer pays $947.31 for the

bond, equivalent to a $1-per-bond markup.

In the trade shown in Figure 1 above, the customer purchased 10 Kroger bonds. With the $1-per-bond markup, he

incurred a $10 commission to execute

the trade.

Online Brokerage Fees for Bonds

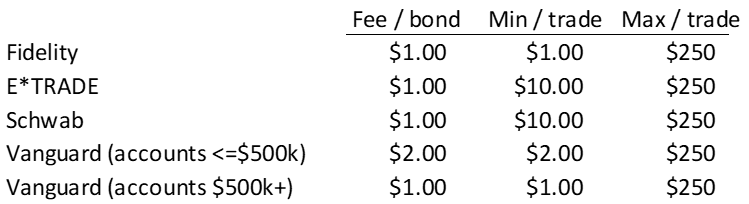

While bond trading commissions vary slightly across online brokerages, they are generally within the same

ballpark, with the exception of Vanguard,

which has fees that are double its competitors for accounts up to $500,000. All of the brokerages shown below

cap corporate bond trading commissions

at $250 per trade.

Please note that these online bond trading fees are for individual corporate bonds. Typically, investors can purchase US Treasurys with no trading fees.

Figure 3: Comparison of Online Corporate Bond Trading Commissions

Buying Bonds Through a Full-Service Brokerage: Orange Box in Figure 1

The above $10 bond commission is a far cry from financial advisor fees paid to execute bond trades

through a full-service brokerage. Investors

who are clients of full-service brokerages are generally charged one of two ways: 1) as a percentage of assets the

brokerage firm manages (a "fee-based

account") or 2) through commissions generated when the brokerage executes trades on a client's behalf (a

"commission-based account").

While the

trend has been favoring investors migrating to fee-based accounts, as we will show below, the $48,040 commission

paid for the 2,000-bond Kroger '46

investment is a fraction of what the investor would have paid to invest $2,000,000 in a fee-based brokerage account

between now and the bond's 2046

maturity date.

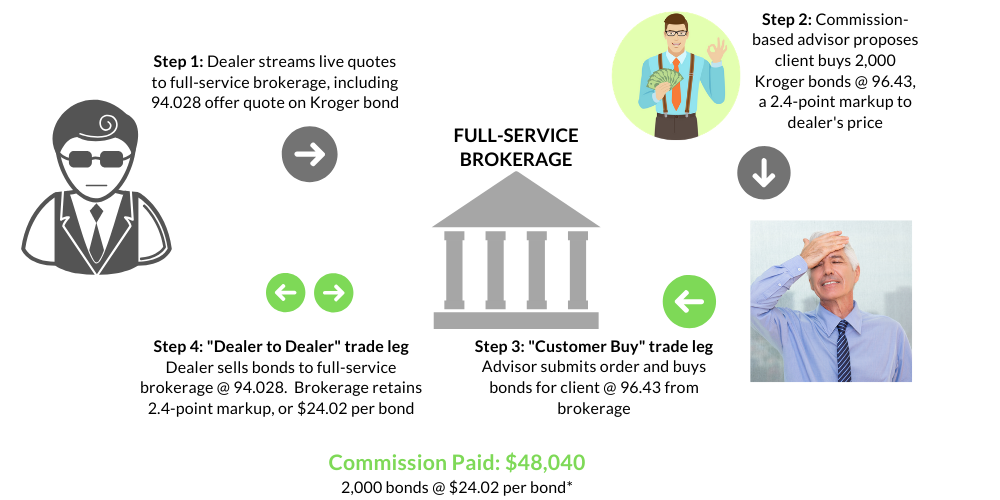

Figure 4 shows how investing through a commission-based financial advisor increases investors' commissions

relative to investing in bonds online.

Figure 4: Illustration of Investor Buying Corporate Bonds Through a Full-Service Brokerage

* Since bonds are quoted as a percentage of their $1,000 face value, a

2.402-point markup is equivalent to $24.02 per bond.

In the case of the Kroger '46 bond, this investor purchased 2,000 bonds at a price of 96.43, paying a commission

of $48,040 as a result of the 2.4-point

markup on the bond. Had this same investor bought bonds online, he would have saved $47,790, as, per Figure 3,

online corporate bond trading

commissions are capped at $250 per trade by the leading online brokerages.

This is a big price to pay, especially when investors opt to sell bonds prior

to maturity to increase the total

return of their bond investment.

Why We Picked a 2,000-bond trade

Ninety-nine percent of the readers of this post likely do not transact in $2 million lot sizes. I sure don't.

The reason this example is so important is that, investors often assume that, the more money you

have to invest, the better "deal"

you are going to get. In this case, an everyday investor buying 10 Kroger bonds achieved a price significantly

better than a larger investor

because he invested in bonds online and paid a fraction of the financial advisor fee charged by a

full-service brokerage.

Comparing Bond Trading Commissions to Fee-Based Accounts

I believe it's hard to justify a $48,040 commission for one bond trade, especially in light of the many other advantages provided to online bond investors.

That said, the 2,000-bond

investor could have fared much, much worse.

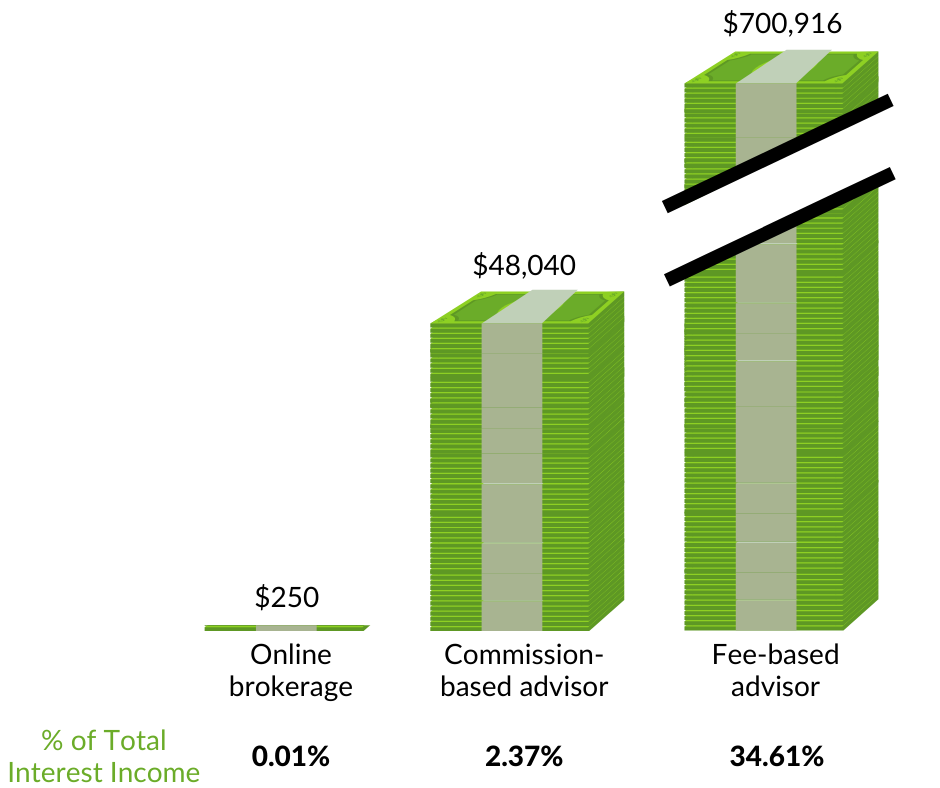

Suppose, instead of paying the $48,040 commission and buying 2,000 Kroger '46 bonds, the investor placed the

nearly $2 million with a fee-based financial

advisor who charged 1% per year. How did that turn out relative to the other scenarios?

The 1% fee charged by fee-based financial advisors has been sold as 'not a big deal' to many. What's 1%

among friends anyway? The problem

is that, over an extended period of time, these fees are consequential, as shown in Figure 5.

As discussed above, an investor purchasing 2,000 Kroger '46 bonds on October 21, 2019 paid 96.43 or $964.30 per

bond, for a total investment of $1,928,600,

which included a $48,040 markup. Had the investor opted to make this investment through an online brokerage,

his total markup would have been

$250. Assuming both investors held these bonds to the October 15, 2046 maturity date, these markups would be

the only trading-related fees charged

to the investor.

On the other hand, had the investor placed the $1,928,600 with a fee-based financial advisor who charged 1% per

year, the amount paid in fees between

now and the October 2046 maturity would be a staggering $700,916, an average of $25,960 per year over 27 years.

The coupon on the bond is 3.75%,

so our 2,000-bond investor would receive $75,000 in annual interest income, or approximately $2,025,000 between now

and the maturity date of the bond.

As shown below, the fee-based advisor will reap $700,916 in fees over the next 27 years and will keep 34.61% of the

investor's total interest income,

assuming the client invested in the same Kroger '46 bond. This isn't as bad as when advisors placing clients

into the oddly popular Vanguard

Total Bond Market Index Fund between 2015-2018 earned more than their clients,

but it's a close second.

Figure 5: Costs of Investing $1.9 Million in Kroger Bonds over 27 Years

Types of Brokerage Accounts To Invest in Bonds

With individual corporate bonds, it's not about how

much you have to invest but rather

how you invest. The first step in deciding how you invest is selecting the setup of your brokerage account

among three choices: 1) a self-directed

online brokerage account, 2) a commission-based financial advisor, or 3) a fee-based financial advisor. The

second step is to decide which bonds

to add to your portfolio. I recommend investors open a self-directed brokerage account at either Fidelity or

E*TRADE and then subscribe to

Bondsavvy to determine which bonds to buy.

The State of Online Bond Trading Platforms

Online brokerages such as Fidelity and

E*TRADE have invested heavily in their

trading platforms to make them efficient, transparent, and investor friendly. Customers of these online brokerages

can view a bond's depth of book

to see the number and size of bid/offer quotes and enjoy trading commissions that are a fraction of financial

advisor commissions. They can also transact

in trade sizes of 2 to 100+ bonds and achieve similar, and often times better, prices than larger investors.

Please view my July 2018 presentation to the US Securities and Exchange Commission to understand the quality of corporate bond prices available to individual investors.

Buying corporate bonds online is easy. Bondsavvy subscribers enter the CUSIPs of our recommended bond

into their online broker, and the trades

are executed in a matter of seconds.

As discussed above, there is a huge cost associated with using a full-service brokerage, be it through a

commission-based financial advisor or a fee-based

financial advisor. On top of this, the financial advisors servicing your account likely have zero bond investing knowledge. Investors

are, in many cases, paying a lot of money for someone who is not “Bondsavvy.”

How Bondsavvy Gives Individual Investors an Edge

I believe the current financial advice

model is flawed and in need of a major

overhaul. Today, investors collectively spend billions on financial advisors; however, advisors typically lack bond investing expertise.

Investors need to ask themselves what they are getting in return for the fees they are paying, and it needs to

be

more than an invitation to a Member-Guest

golf tournament at a prestigious country club.

For each asset class, investors should demand the highest level of expertise available. For individual

investors investing in corporate bonds, Bondsavvy

provides the industry’s highest level of expertise, as we know how to evaluate corporate bond investments from

the

perspective of individual investors

better than anyone.

We are best in class for the following reasons:

- Analysis superior to bond ratings: Our investment recommendations are superior to Moody’s

and

S&P bond ratings, as we evaluate

all of the relevant factors that impact a bond investment’s rationale, including: the price of the bond, its

yield relative to comparable bonds,

its interest rate risk, the company’s financials relative to similar bond issuers, and which bond out of all

of

an issuer’s bonds presents the

most compelling value. Corporate bond ratings only measure credit risk, and they don’t do that

particularly well, as I discussed in this fixed income blog post on bond rating disadvantages. In addition, credit ratings do

not speak to the value

of an investment and are made at the issuer level. Bondsavvy's financial analysis evaluates whether bonds are a good value and is provided at the CUSIP level, so subscribers know which bonds to buy.

- 100% focus on individual corporate bonds: I founded Bondsavvy because corporate bonds offer individual investors income, relative safety vs. stocks, and opportunities for capital appreciation. Individual corporate bonds is where we devote

all of our time and how we identify

investments that have strong corporate bond returns. Traditional

financial advisors spend their time gathering assets and managing their accounts. Our 100% focus on

individual corporate bonds provides a

significant advantage over financial advisors.

- Intimate knowledge of online brokerages: I was previously Head of

Tradeweb Direct and a senior executive

of BondDesk Group, companies that build systems for individual investors and financial advisors to buy and

sell

bonds online. Fidelity,

Charles Schwab, E*TRADE, and Interactive Brokers were all clients of these companies, and I know how their

systems work for the benefit of investors.

These online brokerages provide significant information on each bond available, and, as Bondsavvy's chief

investment analyst, I know how to use the

information provided to narrow down investments to those that can outperform the market.

- Higher potential

returns:

As shown above, financial

advisor commissions eat into a significant portion of an investor’s return, especially if it is a fee-based

financial advisor, which extracted

over one-third of an investor’s interest income in the above example. You earned the money you are

investing. Bondsavvy empowers investors

to grow their money at a faster rate and with significantly lower fees than traditional financial advisors.

Get Started

Watch Free Sample