As US Treasury yields have been rising the last several weeks, there are corporate bond buying opportunities we haven't seen in years. Certain corporate bonds of the world's best companies are now trading between 77% to 85% of their par value. The lion's share of corporate bonds trade between 80.00 to 125.00, so, as bonds fall toward and below 80.00, it can often be a compelling bond buying opportunity.

As we update our bond recommendations following companies reporting Q4 earnings, we are likely to move a number of HOLD recommendations to BUY, making now a great time to become a new BondSavvy subscriber.

How Have Rising US Treasury Yields Impacted Corporate Bond Prices?

As we discuss in our credit spreads blog post, changes in US Treasury yields impact some bonds more than others. For example, long-dated investment grade corporate bonds are typically highly sensitive to moves in US Treasury yields, whereas high yield corporate bonds generally are not.

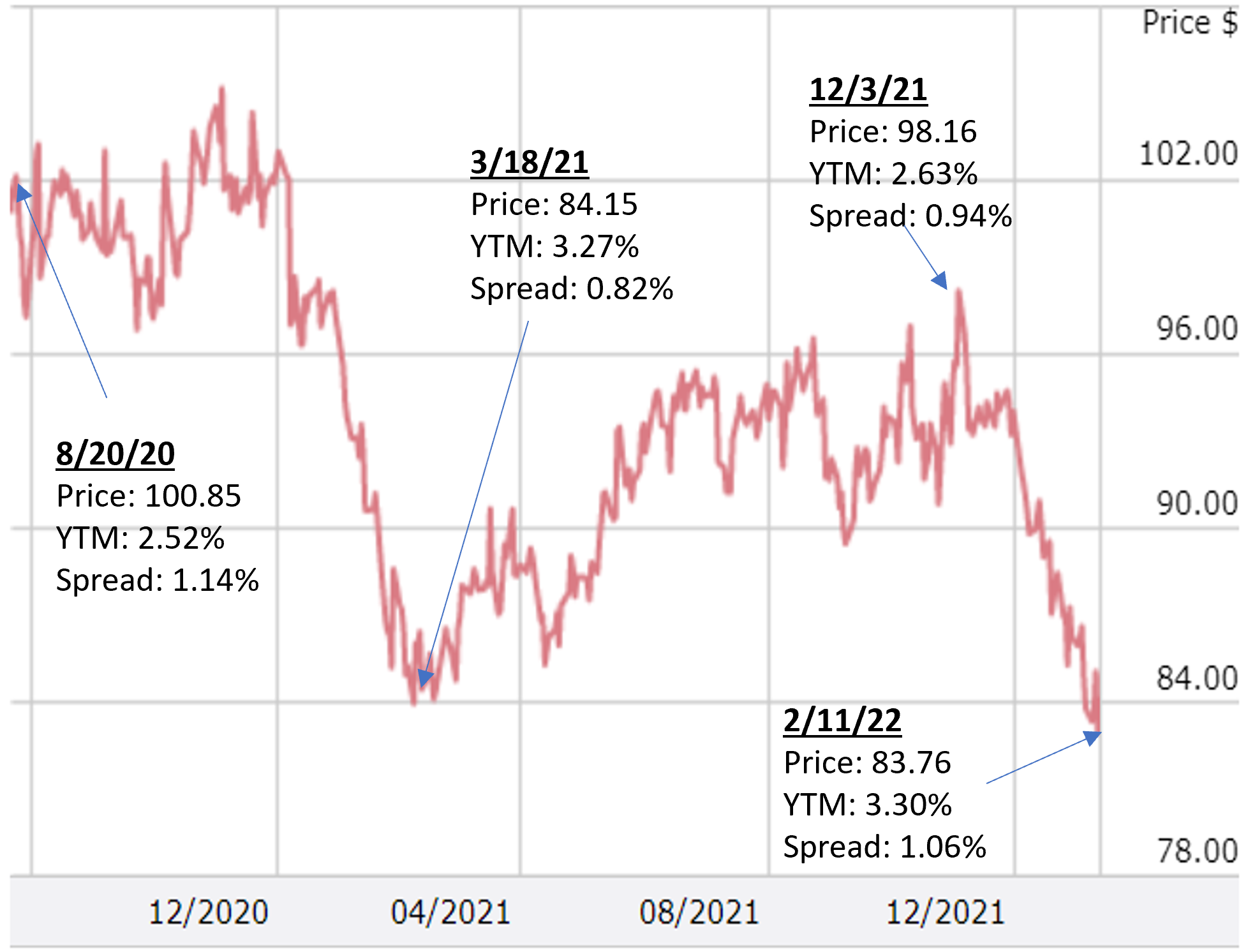

We show an example of a long-dated investment grade corporate bond in Figure 1. In August 2020, Apple issued $1.75 billion of Apple 2.550% 8/20/60 bonds (CUSIP 037833EA5). The initial rise in US Treasury yields immediately following the bond's issuance, as shown in Figure 2, had limited impact on the Apple bond's price, as a fall in credit spreads muted the impact of rising US Treasury yields. That said, as US Treasury yields continued rising until March 18, 2021, hitting a 2.45% peak on the 30 year Treasury yield, the Apple bond price fell nearly 17 points to 84.15.

Figure 1: Historical Prices of Apple 2.550% '60 Bond from August 20, 2020 to February 11, 2022

Source: FINRA market data.

After March 18, 2021, 30 year US Treasury yields moved lower, reaching a trough of 1.69% on December 3, 2021, as shown in Figure 2. With these lower US Treasury yields, the Apple bond increased in price from 84.15 to 98.16. The 30 year US Treasury yield then changed course again, rising from 1.69% on December 3, 2021 to 2.24% on February 11, 2022. During this time, credit spreads increased as well, with the credit spread on the Apple '60 bond increasing from 0.94% on December 3, 2021 to 1.06% on February 11, 2022. The rising US Treasury yields combined with the increased credit spread caused the Apple bond's YTM to rise to 3.30% and its price to fall 14.7% to 83.76 on February 11, 2022.

Figure 2: 30-Year US Treasury Yields from August 20, 2020 to February 11, 2022

Source: US Treasury.

Why Is This Important?

BondSavvy has had success recommending long-dated investment grade corporate bonds that are priced at discounts to par value. We believe it's important for BondSavvy subscribers to take advantage of these opportunities, as they offer high potential returns relative to the risk.

For example, we recommended BondSavvy subscribers initially purchase the eBay 4.00% '42 bonds at 92.27 on December 13, 2017. Then, when the eBay bonds fell to 76.40 on November 19, 2018, we recommended subscribers buy more of the eBay bonds. We then recommended selling the eBay '42 bonds at 115.27 on December 4, 2021, achieving investment returns of 42.16% and 66.80%, respectively. These returns compare to 25.21% and 31.24% achieved by the BlackRock iShares LQD corporate bond ETF during the same time period.

Please visit our corporate bond returns page to see the investment returns of all BondSavvy recommendations made through May 2021.

Is the Federal Reserve Causing Rising US Treasury Yields?

Many believe that US Federal Reserve policy controls the US Treasury market. While Fed policy does have an impact on movements in US Treasury yields, it is one of many factors that drive the $20+ trillion US Treasury market.

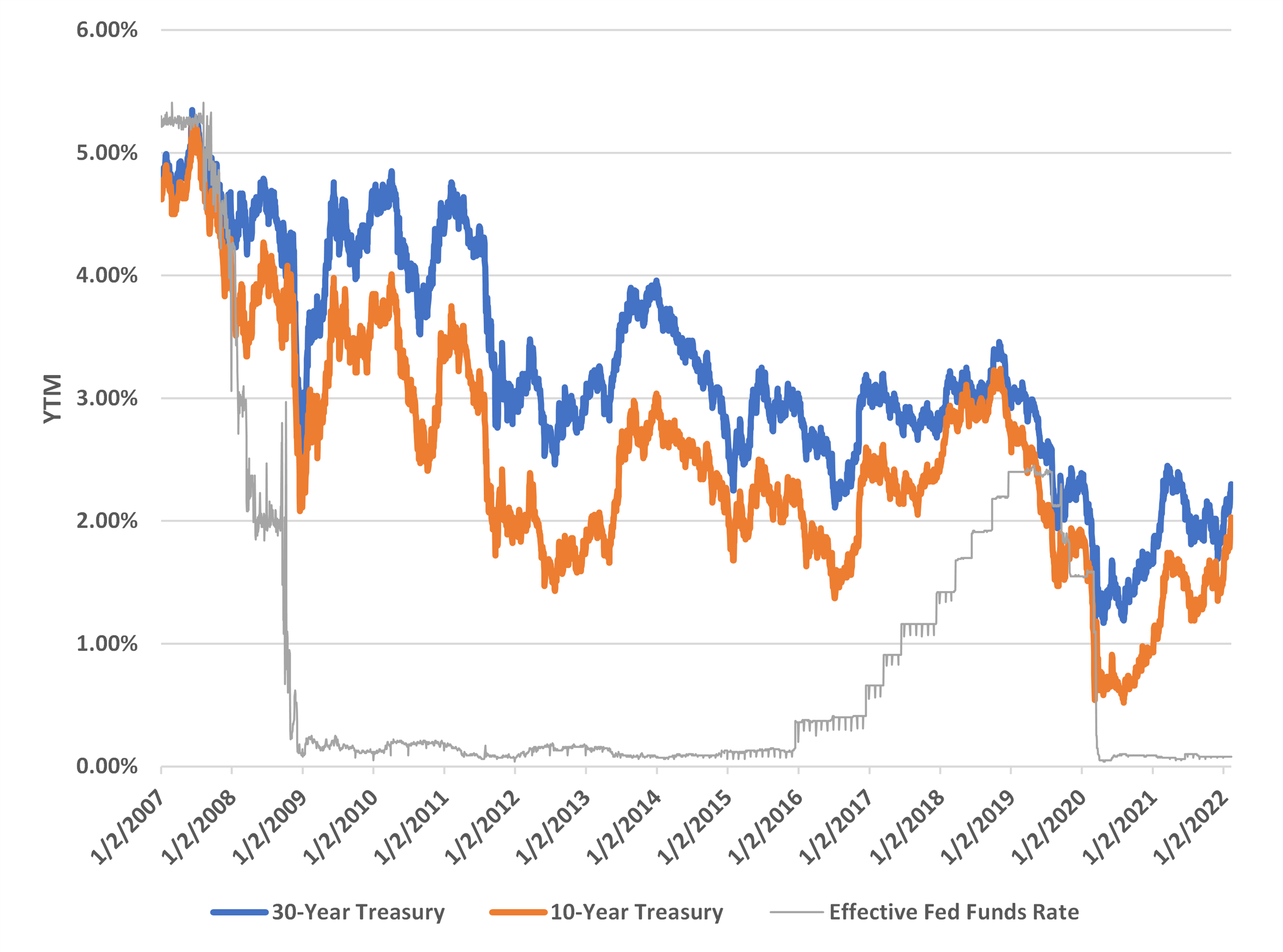

Figure 3 compares the 10-year US Treasury yield, the 30-year US Treasury yield, and the effective federal funds rate ("EFFR") since January 2, 2007. We show the yields of these three key benchmarks so we can see the relation among them and the extent to which the fed funds rate impacts long-term US Treasury yields.

Figure 3: US Treasury Yields vs. Effective Fed Funds Rate - 2007-Feb 11, 2022

Source: US Treasury yield data are from the United States Treasury Department. Effective federal funds rate data are from the Federal Reserve Bank of New York.

Most investors are familiar with the term "federal funds rate;" however, this rate is a target range set by the US Federal Reserve. On February 11, 2022, this target range was 0.00% to 0.25%. According to the New York Fed, the EFFR "is calculated as a volume-weighted median of overnight federal funds transactions reported to the Federal Reserve." The EFFR is anything but volatile, ranging from 0.07% to 0.10% from June 5, 2020 through February 11, 2022.

The federal funds rate and US Treasury yields do not move in lockstep. As shown in Figure 3, while the fed funds rate was held near zero from December 2008 until mid-December 2015, US Treasury yields continued to rise and fall. During this time period, the 30 year Treasury traded in a range of 2.25% to 4.85%. In addition, as the fed funds rate has been held near zero since mid-March 2020, 30 year Treasury yields have traded within a 1.5-point trading range.

While the US federal funds rate can impact US Treasury yields, the two metrics do not move in lockstep. Photo source: Canva

The Fed increased the fed funds rate 0.25% on December 17, 2015, which had negligible impact on US Treasury yields, as the 30 year Treasury yield fell from 2.94% on December 17, 2015 to 2.11% on July 8, 2016. The Fed kept tightening, and the EFFR increased 2.30 percentage points between December 17, 2015 and July 31, 2019.

These additional increases in the fed funds rate did spill over into the US Treasury market, as 30 year Treasury yields increased, hitting a peak of 3.46% on November 2, 2018. US Treasury yields then began a downward trend and kept falling even when the fed funds rate increased 0.25% in December 2018.

The 30 year Treasury yield fell during 2019 in advance of the fed funds rate falling 0.25% on August 1, 2019. Thirty-year US Treasury yields slightly increased as the Fed lowered the fed funds rate by 0.25% on both September 19, 2019 and October 31, 2019.

Then, in advance of the Fed moving the fed funds target rate to 0.00% to 0.25% on March 16, 2020 in the wake of Covid-19, the 30 year Treasury yield hit its 0.99% trough on March 9, 2020.

How Is BondSavvy Approaching Rising US Treasury Yields?

A key advantage of owning corporate bonds vs. stocks is that investors can generate income and achieve growth but with lower risk than stocks. Bond investors seeking higher investment returns, however, need to embrace price volatility rather than run from it.

BondSavvy's investment approach has not changed since we published our How To Profit from Rising Interest Rates blog post in 2021. Key principles of our near-term approach include:

- Recommend a greater portion of high yield bonds, as prices of these bonds are more impacted by the issuing company's financial performance than rising US Treasury yields;

- As inflation has been ticking up, focus on issuers, such as certain oil and gas companies, that can be buoyed by higher inflation;

- Carefully recommend investment grade corporate bonds that have fallen 20+% below par value if and when the US Treasury market stabilizes.

As noted above, when bonds of the world's best companies trade in the 70s and 80s, it can be a good opportunity to buy bonds at compelling values and generate strong investment returns. We hope you will subscribe to BondSavvy and take advantage of this current market environment.

Get Started

Watch Free Sample