On April 6, 2022, Bondsavvy founder and fixed income expert Steve Shaw presented the best high yield bonds to

Bondsavvy subscribers. Some high yield corporate bonds are trading at all-time lows while many issuing-company

profits are at all-time highs. We believe our recommended high yield bonds can appreciate above par value and

achieve annual double-digit total returns.

Subscribe to

Bondsavvy to learn these six best high yield corporate bonds, as well as all 64 corporate bonds we rated either buy or hold as of March 7, 2024. Please note we originally wrote this fixed income blog post on April 10, 2022, and there are references to the 44 bonds we had on our recommended list as of that date.

WHAT'S IN THIS BEST HIGH YIELD BONDS BLOG POST

Bondsavvy publishes the leading blog focused on investing in individual corporate bonds. Click the "Back to

Main Blog" or "Corporate Bond FAQs" buttons to read our other fixed income blog posts. This best high yield

bonds blog post contains the following:

|

SECTION 1:

Preview of the best high yield bonds we recommended April

6, 2022 |

|

SECTION 2:

Why Buy High Yield Bonds Now |

|

SECTION 3:

Summary of BondSavvy's Current 44 Buy / Hold Corporate Bond

Recommendations |

SECTION 1

OUR BEST HIGH YIELD CORPORATE BONDS PREVIEW

During the April 6, 2022 edition of The Bondcast, we presented the six best high yield bonds to BondSavvy

subscribers. We post recordings of this and all subscriber webcasts in the BondSavvy subscriber area.

Figure 1 provides a summary of the high yield bonds we recommended and select details of each recommendation.

Subscribe to

BondSavvy to learn the names and CUSIPs of each recommended high yield bond, key financial and pricing

metrics, credit

spreads, investment rationale, the businesses of our issuing companies, capital structure, capital

allocation, and other key considerations included in our corporate bond research analysis.

Please note that High Yield Bonds 1 and 2 were issued by the same company, as were High Yield Bonds 3 and

4.

Figure 1: Select Details of Best High Yield Bonds Recommended April 6, 20221

|

April 6, 2022 Offer Price |

April 6, 2022 YTM

|

April 8, 2022 EOD

Offer Price |

Leverage Ratio |

|

| High Yield Corporate Bond 1 |

94.01 |

5.07% |

93.00 |

1.1x |

|

| High Yield Corporate Bond 2 |

91.50 |

5.08% |

91.50 |

1.1x |

|

| High Yield Corporate Bond 3 |

94.47 |

6.09% |

94.25 |

1.2x |

|

| High Yield Corporate Bond 4 |

88.94 |

5.72% |

88.27 |

1.2x |

|

| High Yield Corporate Bond 5 |

88.68 |

4.53% |

88.06 |

1.0x |

|

| High Yield Corporate Bond 6 |

92.25

|

6.30% |

91.95 |

1.8x |

|

1 Offer prices and YTM data were from

Fidelity.com. BondSavvy calculates leverage ratios from information provided by issuing company SEC

filings and earnings releases.

Corporate bonds are quoted as a percentage of their $1,000 par value. For example,

High Yield Corporate Bond 1 was quoted at an offer price that was 94.01% of the bond's $1,000

face value, giving it a market value of $940.10.

Attributes of Our Best High Yield Bonds Picks

We have published this blog post so prospective BondSavvy subscribers can get a flavor for

the high yield bonds we recommended April 6, 2022. Key attributes of our best high yield bonds recommendations

include the following:

Strong Risk/Reward Opportunities

High yield bonds with mid-single-digit YTMs, priced in the 80s and 90s, and issued by companies with leverage ratios

less than 2.0x are compelling buys. We believe these bonds can appreciate above par value and achieve

double-digit annual total returns.

There has been a large sell-off in corporate bonds thus far in 2022, with bonds issued by Alphabet and Amazon trading

in the 70s. While many corporate bond prices have fallen, credit quality has generally been improving.

When high yield bond prices go down and default risk decreases, it is often a compelling buying

opportunity.

As shown in Figure 1, all of the best high yield bonds are issued by companies with leverage

ratios below 2.0x, with most right around 1.0x. This is an extraordinarily low number for high yield

bond issuers.

Generally speaking, a leverage ratio of 3.0x or less is typically enough for a corporate bond issuer to obtain an

investment grade bond rating. Due to bond rating methodologies, however, bonds issued by companies that are

smaller in size or are heavily influenced by commodity prices, typically receive bond ratings below investment grade. (Please see

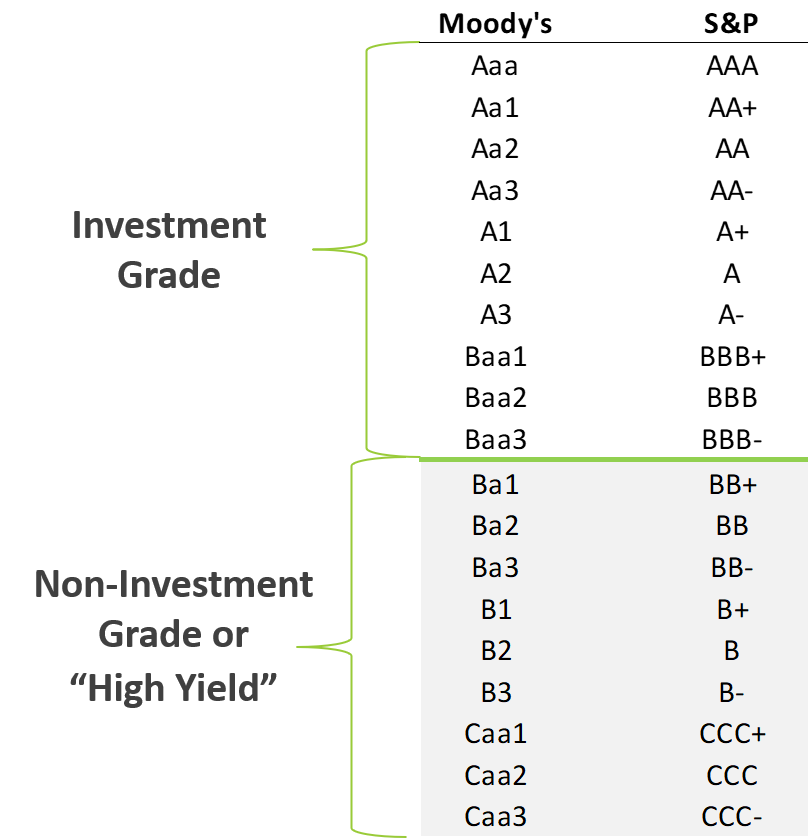

Figure 2 for an explanation of the bond ratings scale and the difference between investment grade and high yield

corporate bonds.)

High Yield Bond Picks Spread Across Four Different Industries

While BondSavvy does not believe in the overdiversification provided by large bond funds and ETFs, we do believe it's

important for corporate bond investors to diversify across industry sectors. Our four newly recommended bond

issuers compete in the chemicals, semiconductor, homebuilding, and manufacturing sectors.

BondSavvy's current 44 corporate bond recommendations contain issuing companies across 11 industries, including:

retail, grocery, transportation, auto, chemicals, healthcare, natural resources, homebuilding & related,

infrastructure, manufacturing, and media & technology.

Five of Six Bonds Have Maturity Dates Within Six to Nine Years

High yield corporate bonds generally have shorter maturity dates than investment grade

corporate bonds. Typically, high yield corporate bonds have maturity dates between 5 to 10 years from the

issuance date. Investment grade corporate bonds, on the other hand, are often issued with 30-year

maturities.

Five of our six best high yield corporate bonds had tenors (the time between the pick date

and the maturity date) of six to nine years, as they mature in 2028-2031. One of our best high yield bonds had

a maturity date in approximately 20 years. It has this longer-term maturity since the bond is a Fallen Angel,

a term for bonds that have been downgraded from investment grade to below investment grade.

Since corporate bonds typically maintain the same terms throughout the life of the bond,

this Fallen Angel bond has retained the long-term maturity characteristic of most investment-grade-rated corporate

bonds.

Recommended High Yield Bonds Still Available at Prices at or Below Pick Date

Prices

Our goal is for BondSavvy subscribers to be able to buy and sell individual corporate bonds at or near the prices at

which we recommend bonds. We have taken multiple actions to limit the market impact of our new bond

recommendations, and we have been pleased with the results thus far.

We recommended the best high yield bonds at 5:00pm EDT on April 6, 2022. Our subscribers began purchasing these

bonds on April 7 and April 8. As shown in Figure 1, at the end of the day on April 8, 2022, the recommended

high yield corporate bonds were still available at prices at or slightly below the pick date price.

SECTION 2

WHY BUY HIGH YIELD CORPORATE BONDS NOW

Many investors will ask "why should I buy high yield bonds when interest rates are rising?" To answer this

question, it's important to understand that "the bond market" is not the monolithic asset class many talking heads

believe it to be.

High Yield Bonds Generally Have Less Sensitivity to Changes in US Treasury Yields

High yield corporate bonds are different from investment grade corporate bonds. Individual corporate bonds are

different from Treasury bonds and municipal bonds. For example, investment grade corporate bond prices can be

highly sensitive to changes in US Treasury yields while high yield corporate bond prices generally are not.

For more discussion on this point, please read our credit spreads blog post, which reviews the different bond price movement

drivers for investment grade and high yield corporate bonds.

For those unfamiliar with what a high yield bond is, it is a bond that has Moody's and S&P bond ratings below

Baa3 / BBB- on the bond ratings scale, as shown in Figure 2

below:

Figure 2: Bond Ratings Scale for Moody's and S&P

Many refer to high yield bonds as "junk bonds," but that term does a great disservice to high yield bond issuers and

their employees. Due to how corporate bond ratings are calculated, there are many cases where bonds with lower

leverage ratios and superior financials have lower bond ratings than large, global companies rated investment

grade.

A key benefit of our best high yield bonds is that they are generally not sensitive to changes in interest rates and

rising US Treasury yields. High

yield corporate bond prices are most impacted by changes in the credit quality of the issuing companies and taxable

bond fund flows.

If there are large bond fund inflows, bond funds must purchase additional bonds, which can drive up corporate bond prices. The opposite

can happen when there are bond fund outflows, which has been a big driver of recent bond price declines.

As a general rule, lower-rated bonds are typically more sensitive to the financial performance of the issuing company

than highly rated bonds such as those issued by Apple. We discuss the key drivers of high yield bond and

investment grade bond price movements in our credit spreads blog post.

Opportunities for Double-Digit Annual Total Returns

BondSavvy seeks to maximize the total returns of each corporate bond we recommend. We look for corporate

bonds that have low prices, high credit spreads, and high YTMs relative to the issuing company's financials.

While three of our best high yield bonds are callable and, as a result, have price ceilings slightly above par,

three bonds are not subject to call schedules and can, therefore, increase higher in price.

With yields in the mid-single digits, recommended high yield bonds achieving capital appreciation of 10-15 points can

achieve strong double-digit annual total returns. To maximize the investment return of our high yield bonds,

we closely monitor our recommended bonds' price performance and the financial performance of our issuing

companies. We then update each buy/sell/hold recommendation quarterly during The Super

Bondcast.

View our corporate bond returns page to see the

investment performance our corporate bond recommendations have achieved.

Ability to Apply a Specific Investment Strategy

A key benefit of owning a portfolio of individual corporate bonds is that investors can create, apply, and modify a

specific investment strategy. This bond investment strategy could include owning bonds in particular

industries that benefit from higher inflation. It could include buying corporate bonds priced at material

discounts to par value. It could also include owning bonds of varying duration and credit quality to address

rising US Treasury yields. Lastly,

such a strategy could maximize total returns by selling bonds when additional capital appreciation was

limited. These are all key components of BondSavvy's investment strategy.

To illustrate, as commodities markets began to recover in mid-2020, BondSavvy began recommending bonds of a number of

energy companies. This included one high yield bond recommendation of the Laredo Petroleum 9.500% '25 bonds,

which we recommended December 18, 2020 at a price of 87.85.

As oil prices recovered, Laredo delivered improved financial performance, which was reflected in a climbing bond

price, as shown in Figure 3. The upside on the Laredo '25 bond was limited, however, as the bond was callable

at a price of 104.75 beginning January 15, 2022. With limited upside remaining and a greater number of buying

opportunities available in high yield corporate bonds, we recommended selling the Laredo bond at 103.71 on March 24,

2022 during The Super Bondcast.

As shown in Figure 3, the Laredo '25 high yield bond investment generated a 31.71% total return compared to a -0.93%

total return for the iShares HYG high yield corporate bond ETF.

Figure 3: Total Return Comparison of Laredo Petroleum 9.50% '25 to iShares iBoxx $ High Yield Corporate Bond

ETF (HYG)

Sources: Laredo Petroleum historical prices are from FINRA TRACE data. The iShares HYG ETF performance chart is

from the iShares website.

Active bond investing strategies are available to investors in individual corporate bonds. They are not,

however, available to bond fund investors, as bond funds own thousands of bonds, with many following a computerized

index rather than attempting to create a winning investment strategy. In addition, since bond funds do not

trade relative to par value and lack underlying financials, it is impossible for investors to assess the value of a

bond fund or ETF. Further, since bond fund prices are generally static, bond fund investors generally cannot

buy low and sell high like investors in individual high yield corporate bonds can.

Important to Invest over Time in High Yield Bonds

When we encourage investors to buy the six best high yield corporate bonds, we are not saying that the prices of

these high yield bonds will immediately go up. We are also not calling a bottom to the recent turmoil in the

US bond market, as prices could fall further.

High yield bond markets can be volatile. To mitigate risk and to capitalize on opportunities, we believe it's

important for bond investors to make new investments over time. With lower prices and strong issuing company

financials, now is a better time to make new investments than it was during many parts of 2021.

That said, if high yield bond prices further decline and issuer financials remain strong, there could be even more

compelling buying opportunities in the future.

SECTION 3

REVIEW OF BONDSAVVY'S 44 CURRENT CORPORATE BOND RECOMMENDATIONS

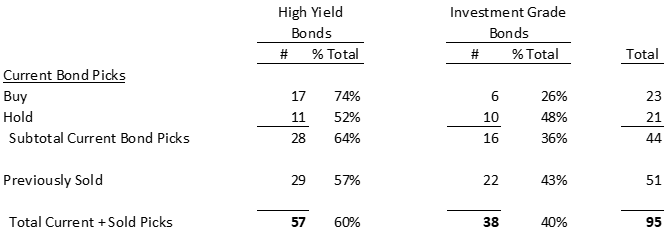

BondSavvy currently has 44 individual corporate bonds on its recommended list, available exclusively to BondSavvy

subscribers. This includes 23 corporate bonds rated "buy" and 21 bonds rated "hold." BondSavvy

recommends high yield corporate bonds and investment grade corporate bonds each quarter on a subscriber webcast

called The Bondcast. In addition, we update our buy/sell/hold recommendations each quarter

during The Super Bondcast, another webcast series available exclusively to BondSavvy

subscribers.

Through April 9, 2022, we have recommended selling 51 of our previous 95 corporate bond recommendations. Read

our when to sell bonds blog post to learn the factors we consider when

recommending subscribers sell corporate bonds previously on the BondSavvy "buy" list.

Figure 4 shows the breakout of the number of high yield corporate bonds and investment grade corporate bonds we

currently rate buy or hold plus the split of previous bond recommendations we have sold:

Figure 4: BondSavvy's Current and Past Recommendations -- High Yield Bonds vs.

Investment Grade Bonds

GAIN AN EDGE AS A BONDSAVVY SUBSCRIBER

With recently high inflation and the advent of a more hawkish Federal Reserve, many

investors have been selling bond funds. This has driven many high yield and investment grade corporate bond

prices lower, creating values we have not witnessed in years.

BondSavvy empowers subscribers to capitalize on these opportunities by:

- Providing approximately 20 new corporate bond recommendations each year (including both high yield bonds and investment grade bonds)

- Updating buy/sell/hold ratings on all current corporate bond recommendations through quarterly subscriber webcasts and regular email updates

- Identifying corporate bonds subscribers can buy online to ensure the best price and lowest fees

- Presenting subscribers with detailed but easy-to-understand corporate bond analysis they can use to make successful investment decisions

- Providing unmatched expertise to individual investors investing in individual corporate bonds

Our investment recommendations make bond investing easy and more profitable. We give

BondSavvy

subscribers an edge, especially in the highly volatile and unpredictable markets we are experiencing today.

Get Started

Watch Free Sample