The 5% yields money market fund investors enjoyed from mid-2023 until fall 2024 are now a thing

of the past. Money market yields move in lockstep with the fed funds rate, and as the Fed cut

rates one percentage point since September 2024, the Vanguard VMFXX 7-day yield fell to 4.23% on

May 7, 2025 from 5.30% on August 1, 2024.

The March 2025 Fed dot plot projected an additional one point of Fed rate cuts through 2026. Should this happen, the Vanguard VMFXX

yield would fall to approximately 3.23%.

The $350 billion Vanguard VMFXX fund worked for investors when the fed funds rate was over 5%,

but there are now more compelling alternatives. These include individual corporate

bonds, which enable investors to lock in income for longer time periods, to pay lower

fees, and to benefit from capital appreciation opportunities.

This fixed income blog post discusses the eight reasons investors should NOT invest in Vanguard

VMFXX and alternatives investors may want to consider.

Key Takeaways

- The much-advertised VMFXX 7 day yield misleads investors. It takes the fund's accrued

interest over the last week and multiplies it by 52. The VMFXX yield does not accurately

represent an investor's expected annual return in the way yields of individual corporate

bonds do.

- According to the March 2025 Fed dot plot, the US Federal Reserve is projecting an additional one percentage

point of Fed rate cuts by the end of 2026. Should this occur,

Vanguard VMFXX investors would see their income plunge and would not benefit from the

rising bond prices that would likely accompany such a move.

- Vanguard VMFXX is not as safe as investors believe it is, as only 28.1% of its

investments were in US Treasury obligations as of April 30, 2025. The rest were in

repurchase agreements and agency obligations, two sectors previously bailed out by the

US government, and "Yankee/Foreign" securities.

- Vanguard VMFXX is not a fixed income investment given its ultra-short-term nature

and the lack of visibility investors have in its future income distributions. As of

February 28, 2025, 73% of VMFXX's investments had maturity dates between one and thirty

days, creating significant reinvestment risk and uncertain future returns.

- The VMFXX management fee is understated, as it does not include the significant

transaction costs VMFXX incurs to buy and sell securities. Owning individual bonds can

drive significant savings compared to the recurring fees and costs incurred by VMFXX.

- In June 2023, Vanguard

was fined and censured by the Financial Industry Regulatory Authority (FINRA)

for overstating projected yields and annual income on nine money market funds along with

other errors that went uncorrected despite 100 customer complaints.

- The Vanguard VMFXX website misleads investors by indicating that, as of April 30, 2025,

38.8% of VMFXX holdings were "Government Obligations," when, instead, these investments

were Federal Home Loan Banks bonds and Federal

Farm Credit Banks bonds, which are not guaranteed by the US government.

- There are compelling alternatives to VMFXX that offer investors higher potential

returns, fixed coupons for long durations, lower fees, and a higher level of

transparency.

REASON 1 NOT TO INVEST IN VANGUARD VMFXX

The VMFXX Yield Misleads Investors

As shown in Figure 1, the VMFXX 7 day yield was 4.24% on May 6, 2025. This VMFXX yield is the

first performance-related number investors see when they visit the Vanguard VMFXX website, but

it's not a real number. This "yield" is misleading, as the figure multiplies the fund's

previous-week's income by 52 to arrive at an annualized "yield." Imagine buying a stock and

making 10% in one week. In the land of money-market lingo, you would have a 7 day yield of 520%.

The VMFXX yield was 4.23% on May 1, 2025, 1.07 percentage points lower than it was on

August 1, 2024. The VMFXX yield is a "hypothetical" number, as discussed below, and does not

represent the income investors will receive over the next year -- or even the next month. All

bond fund investors must understand that income from these investments is not contractual. Bond

funds, including Vanguard VMFXX, are not a substitute for individual bonds that pay a specific amount of coupon

interest every six months.

Figure 1: "Above-the-fold" Area of Vanguard VMXX Website

Source: Numbers provided by Vanguard.com. Graphics created by Bondsavvy.

Source: Numbers provided by Vanguard.com. Graphics created by Bondsavvy.

VMFXX Dividends Are Paid Monthly -- Not Weekly

We sometimes hear investors say: "Why would I want to own bonds when VMFXX is paying over 4%

interest?" The problem with this question is that it makes two incorrect assumptions. First, it

assumes that the VMFXX 7 day yield is a fixed interest rate that will be paid over the course of

the year. Second, it assumes that the credit quality of VMFXX is equal to, or better than, a

portfolio of individual bonds. We'll discuss the first point in this section and the second

point in Reason 8 of this fixed income blog post.

VMFXX investors receive distributions each month, which makes the relevance of the VMFXX 7 day

yield a headscratcher.

Figure 2 shows the monthly VMFXX dividend history from January 3, 2022 to May 1, 2025. Over the

course of the month, VMFXX collects income from the investments it owns (more on this later),

which it then pays out on the first trading day of the following month. For example, on May 1,

2025, the VMFXX dividend payable per share was $0.003473, which came from income earned during

the month of April 2025.

Click here to get four prior bond pick updates.

The VMFXX distribution yield of the May 1, 2025 payment was calculated by dividing $0.003473 by

30, the number of days in April 2024. The quotient ($0.000116) was the implied daily per-share

VMFXX dividend for April 2025. Vanguard then multiplies $0.000116 by 365 days to arrive at a

4.23% annualized VMFXX distribution yield for its May 1, 2025 VMFXX dividend payment.

Of course, during any month, there will be multiple VMFXX 7 day yields, and these figures can

differ from the distribution yields shown in Figure 2. As discussed earlier, due to the one

percentage point of rate cuts that began September 2024, the VMFXX yield has fallen in lockstep,

from 5.30% on August 1, 2024 to 4.23% on May 1, 2025.

Figure 2: VMFXX Dividend History-- January 3, 2022-May 1, 2025

Source: Vanguard

Source: Vanguard

Bondsavvy Subscriber Benefit

Money market funds are not sufficient for long-term income investors. Individual bonds

enable investors to lock in income for several years to several decades.

Get Started

VMFXX Dividends Can Vary Significantly from Month to Month

Corporate bond issuers have a contractual obligation to bondholders to pay a specific amount of

coupon interest on specific dates. This provides security on which income investors can depend

and plan.

VMFXX dividends, on the other hand, are unreliable and inconsistent -- not what the doctor

ordered for an income investment. When interest rates were low, the VMFXX yield was close to

zero, as shown in Figure 2. While the VMFXX yield is higher now, the distribution yields shown

in Figure 2 are monthly figures that can change quickly.

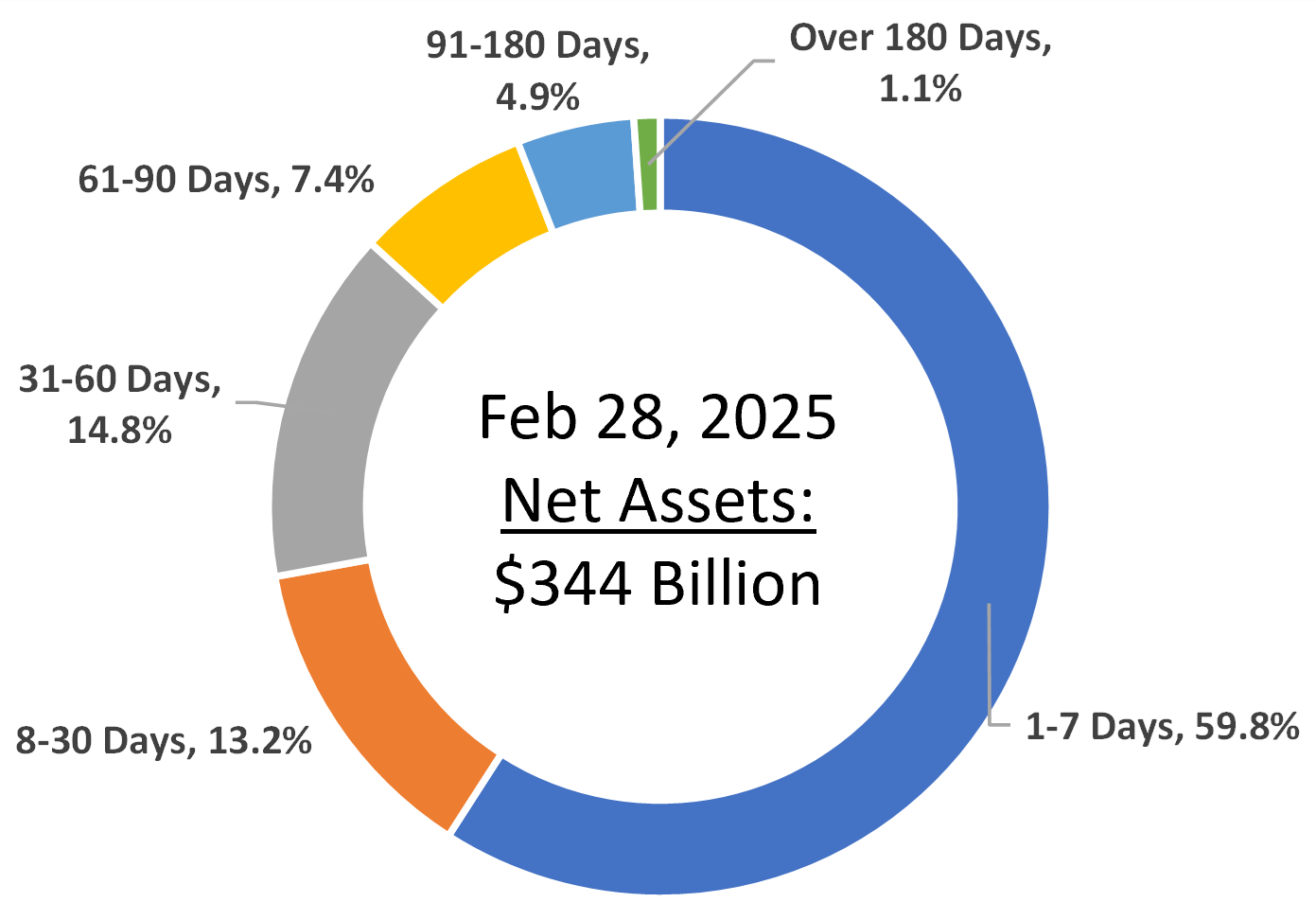

As of February 28, 2025, 59.8% of VMFXX holdings had maturities of one to seven days. Therefore,

a significant portion of VMFXX investments are replaced during the month. As this happens, the

monthly VMFXX distribution yield shown in Figure 2 could vary from the advertised VMFXX 7 day

yield.

Changing interest rates and the mismatch between the VMFXX 7 day yield and actual VMFXX dividends

paid create a high level of uncertainty for Vanguard Federal Money Market Fund investors.

The VMFXX 7 Day Yield Is Based on "Hypothetical Income" per Vanguard

As shown in Figure 1, there are blue hyperlinks regarding the "7 day SEC Yield" Vanguard VMFXX

site visitors can click for more information. These hyperlinks provide the following information

on the VMFXX yield. If you need to read it multiple times for it to make sense to you, you're

not alone. We have added italics to emphasize certain areas.

Figure 3: Vanguard's explanation of the VMFXX 7 Day SEC Yield

SEC Yield

"A non-money market fund's SEC yield is based on a formula developed by the SEC. The method

calculates a fund's hypothetical annualized income as a percentage of its assets.

A security's income, for the purposes of this calculation, is based on the current market yield

to maturity (for bonds) or projected dividend yield (for stocks) of the fund's holdings over a

trailing 30-day period. This hypothetical income will differ (at times, significantly) from the

fund's actual experience. As a result, income distributions from the fund may be higher or

lower than implied by the SEC yield.

The SEC yield for a money market fund is calculated by annualizing its daily income

distributions for the previous 7 days."

Got all that?

As noted above, advertising the Vanguard VMFXX 7 day yield is tantamount to an investor owning a

corporate bond that went up 10% in one week and touting a 520% investment return. The only

difference being that the bond investor with the 10% one-week return achieved an actual

return, and the investor could sell her bonds after one week at a 10% profit.

Yes, Vanguard does disclose how it calculates the VMFXX yield in a hyperlink; however, given the

prominent position Vanguard accords the VMFXX yield in its advertising materials, it's no wonder

many investors falsely believe the VMFXX yield and a bond's YTM are similar metrics.

Bondsavvy Subscriber Benefit

While some individual bond prices can be volatile, their income is contractual and fixed

until the maturity date.

Get Started

REASON 2 NOT TO OWN VANGUARD VMFXX

The Fed Is Projecting Interest Rates To Fall 1% by

Year-End 2026, Which Would Further Lower the VMFXX Yield

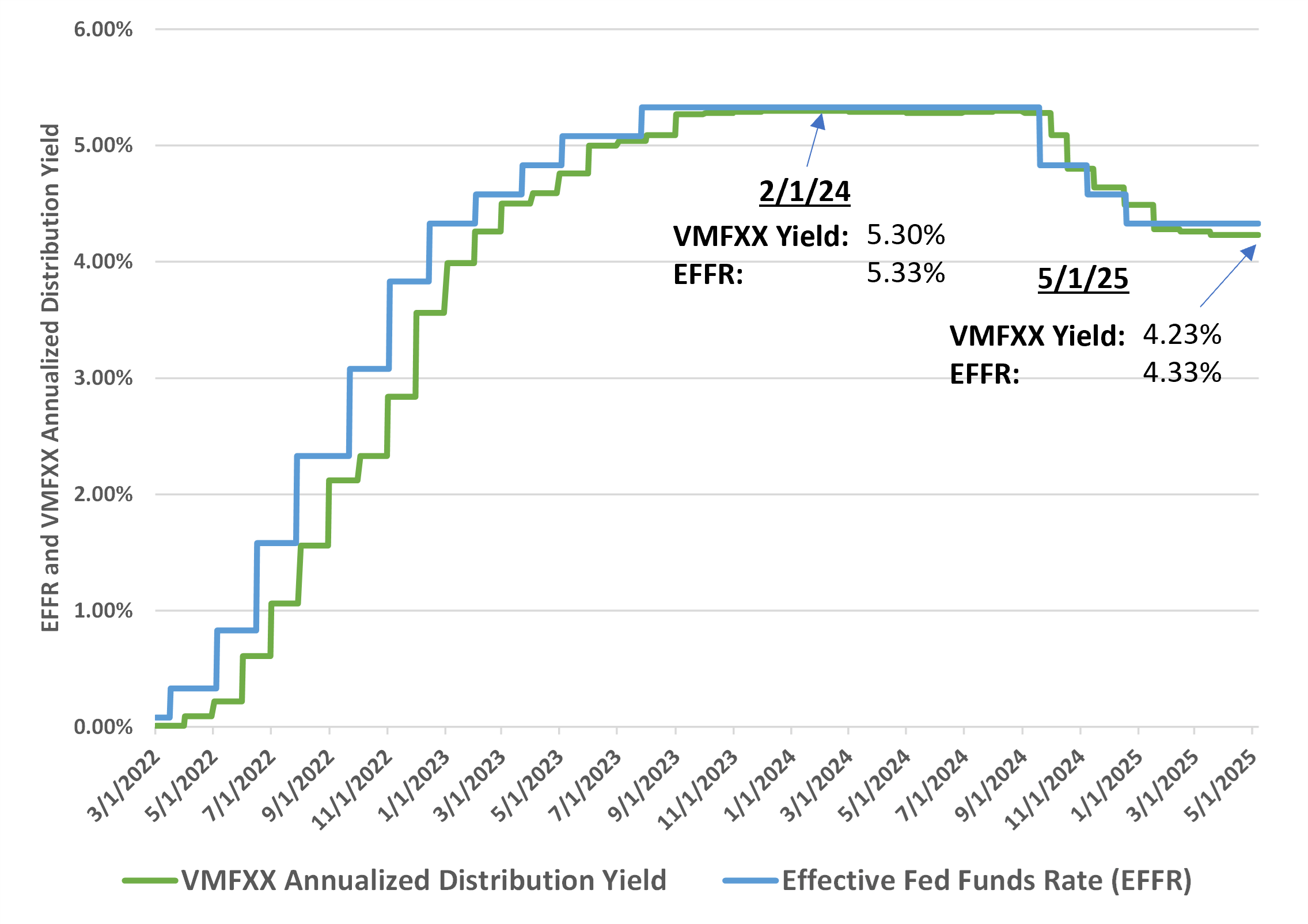

The VMFXX yield is closely tied to the US federal funds rate, which is set by the US Federal

Reserve's Federal Open Market Committee ("FOMC"). As the US Federal Reserve raised the target

fed funds rate 5.25 percentage points (or 525 "basis points" or "bps") from March 2022 to July

2023, the VMFXX yield followed suit, as shown in Figure 4. When the Fed then lowered the target

range of the fed funds rate by 0.5 points on September 18, 2024, the October 1 and November 1,

2024 VMFXX distributions also fell. The November 1, 2024 VMFXX dividend fell 0.50 points from

5.30% on August 1, 2024 to 4.80% on November 1, 2024. The VMFXX yield also fell after the

0.25-point Fed rate cuts on November 7 and December 18, 2024.

As shown in Figure 4, the VMFXX yield has fallen 107 basis points from 5.30% on February 1, 2024

to 4.23% on May 1, 2025. This yield is variable and will change over time. As discussed later in

this section, the Fed, per the March 2025

Fed dot plot, is projecting the fed funds rate to fall to 3.25% to 3.50% by year-end

2026. Given the close correlation between the fed funds rate and the VMFXX yield, the VMFXX

yield would fall to approximately 3.23% should the Fed follow through with these interest rate cuts.

Figure 4: VMFXX Distribution Yield vs. Effective Fed Funds Rate ("EFFR") -- March 1,

2022-May 1, 2025

Sources: Vanguard.com and the Federal Reserve Bank of New York.

Sources: Vanguard.com and the Federal Reserve Bank of New York.

Not only would reductions in the fed funds rate lower the VMFXX yield, but also VMFXX investors

would not benefit from any bond price increases potentially driven by lower interest rates.

VMFXX Returns Are 100% from Income

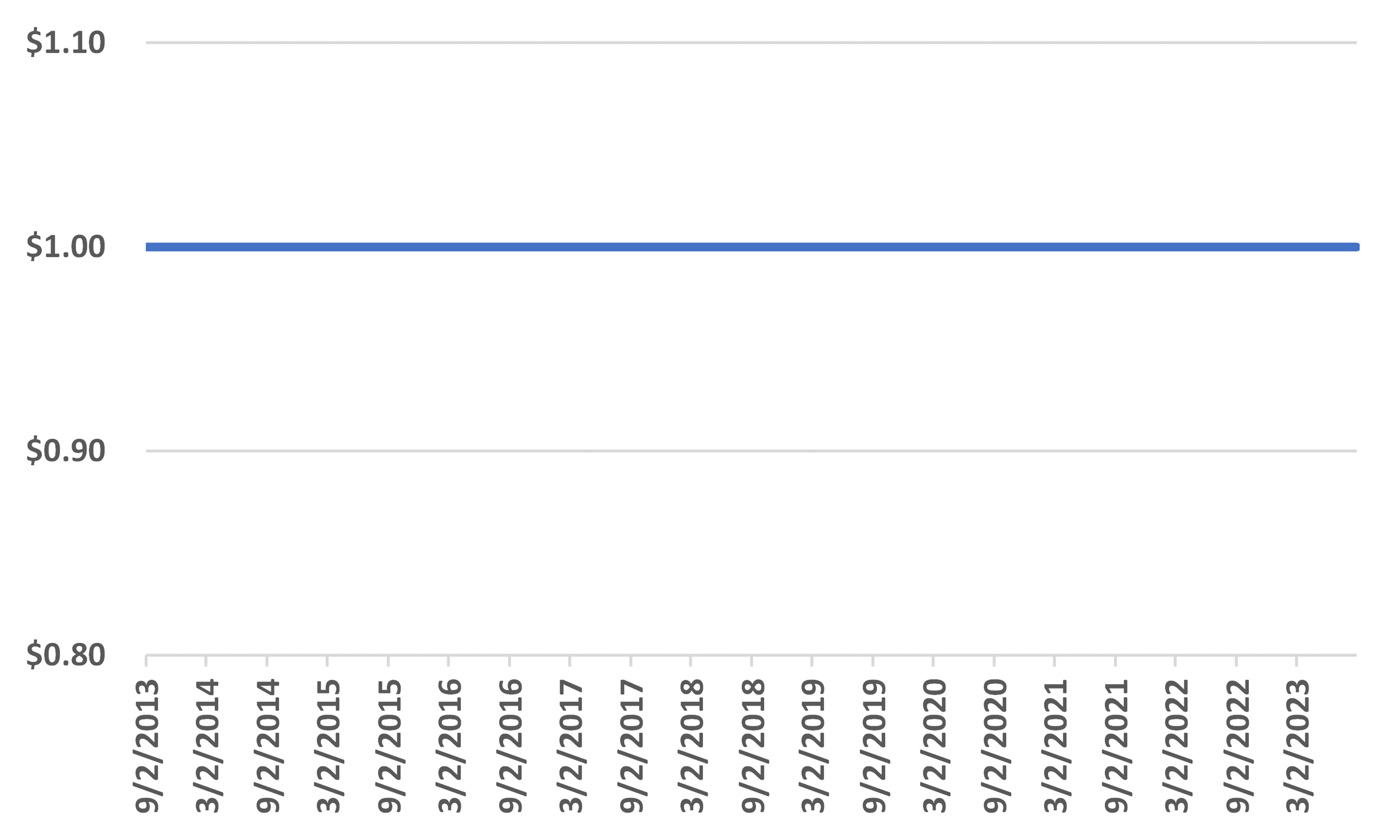

With Vanguard VMFXX, the only return it generates is from income, as the fund seeks to maintain a

$1.00 net asset value per share every day. There is no such thing as capital appreciation

opportunities with Vanguard VMFXX.

Figure 5 shows the daily closing price of Vanguard VMFXX for the ten years ending September 2,

2023:

Figure 5: Vanguard VMFXX Closing Price -- September 2, 2013-September 2, 2023

While VMFXX lacks the upside of bonds, especially those trading at a significant discount to par value today, they also generally

lack the pricing volatility. That said, since income generates 100% of VMFXX returns, the

variability of VMFXX dividends can make VMFXX less compelling than individual bonds, which offer

fixed coupon payments until a specified maturity date.

The Fed Dot Plot Shows the Fed Funds

Rate Falling 1 More Percentage Point by Year-End 2026

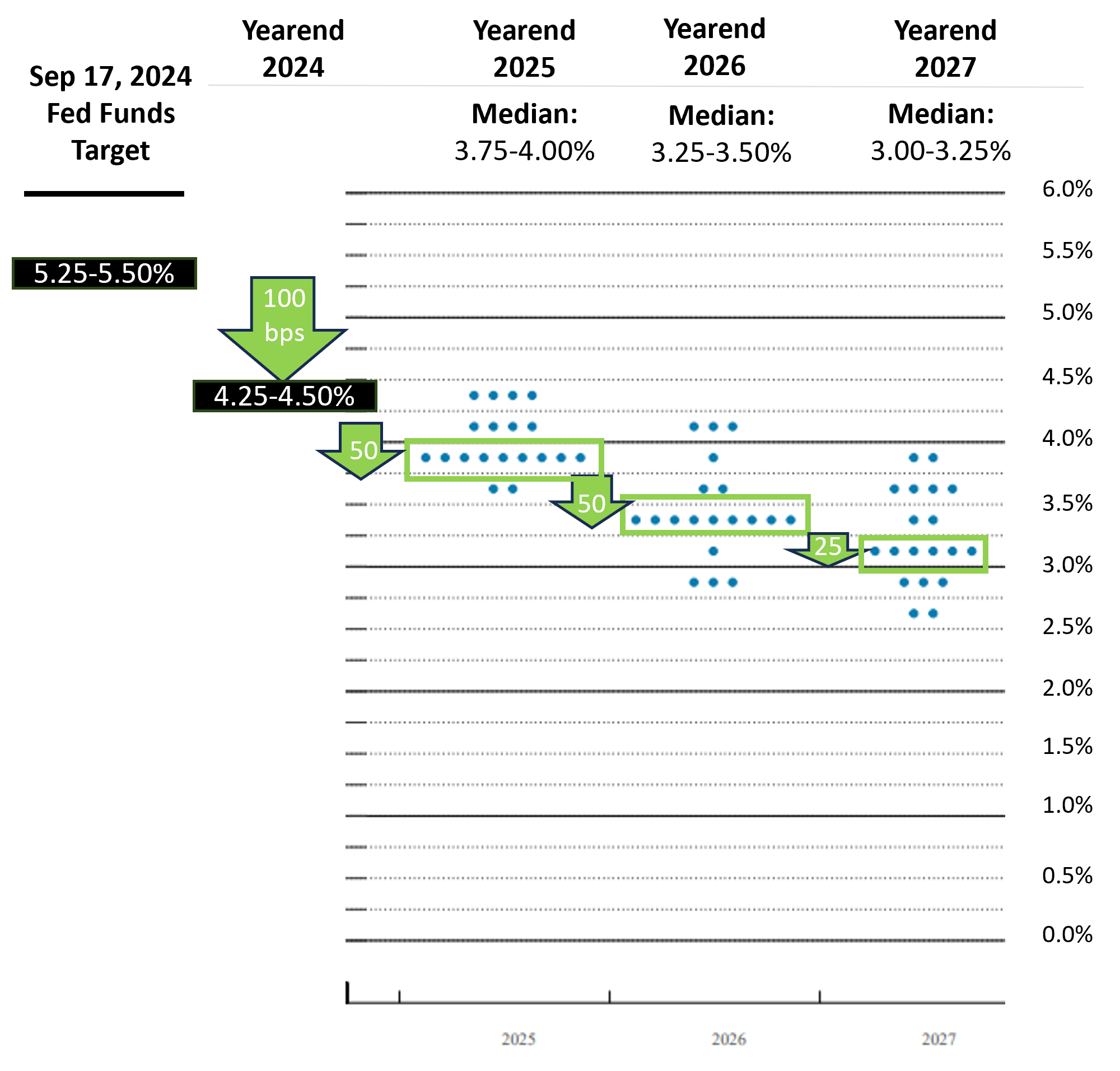

Each quarter, the US Federal Reserve publishes the FOMC Summary of Economic Projections, the most

recent of which it released March 19, 2025.

While there are only 12 voting members of the FOMC at any given time, all 19 FOMC participants

provide economic projections that are summarized in the FOMC Summary of Economic Projections.

Included in these projections are 1) changes in GDP, 2) the unemployment rate, 3) PCE inflation,

4) Core PCE inflation, and 5) the fed funds rate.

Click here to get four prior bond pick updates.

Figure 6 shows the FOMC participants' projections for the fed funds rate, which are also known as

the Fed dot plot. Each dot represents an estimate from one FOMC participant. Above each set of

dots, we show the median projection for each year-end. Per the March 2025 Fed dot plot, the

median estimate for the fed funds rate falls from 4.25-4.50% at yearend 2024 to 3.25-3.50% at

the end of 2026.

Figure 6: Midpoint Estimate of Federal Funds Target Range for Each FOMC Participant -- the March 2025 Fed Dot Plot

Source: March 19, 2025 US Federal Reserve Summary of Economic Projections.

Source: March 19, 2025 US Federal Reserve Summary of Economic Projections.

Of course, within the 19 Fed dot plot dots, we do not know which 12 will vote at future meetings,

but this gives us the best estimate of where all FOMC participants' heads were at on March 19,

2025. Based on the March 2025 Fed dot plot, the Fed is expected to drop the fed funds rate by 50

basis points in 2025 and 2026.

As the fed funds rate falls, we expect the VMFXX yield to fall in lockstep.

Bondsavvy Subscriber Benefit

Investors owning a 10-year bond know the exact amount of income they should receive until

maturity. The same cannot be said for Vanguard VMFXX investors, who live at the whim of

the fed funds rate.

Get Started

REASON 3 NOT TO OWN VANGUARD VMFXX

Vanguard VMFXX Is Not as Safe as Many Think It

Is

We believe investments in individual US Treasurys and the highest-quality US corporate bonds

(think Alphabet, Microsoft, and Wal-Mart) represent a higher credit quality than that of

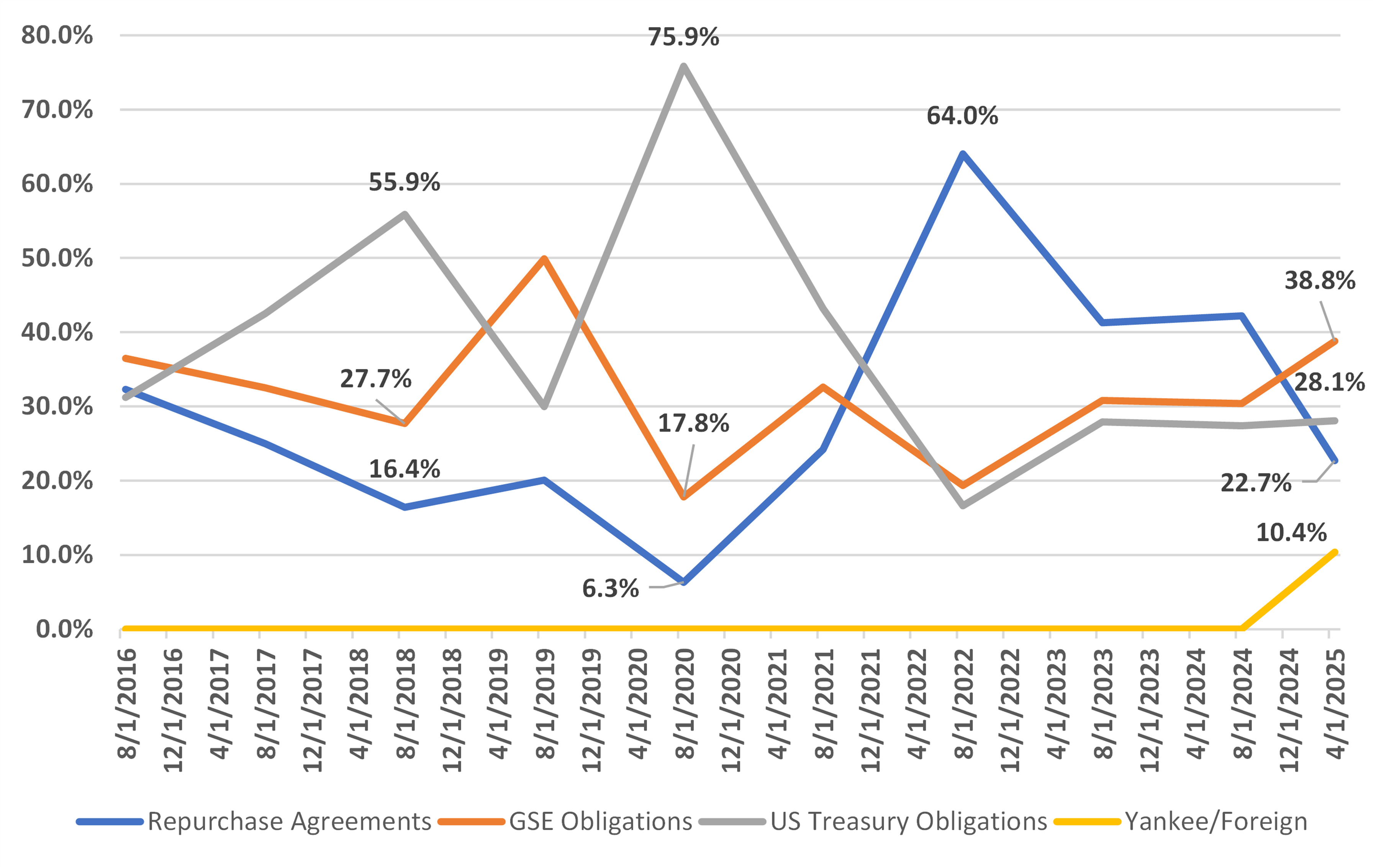

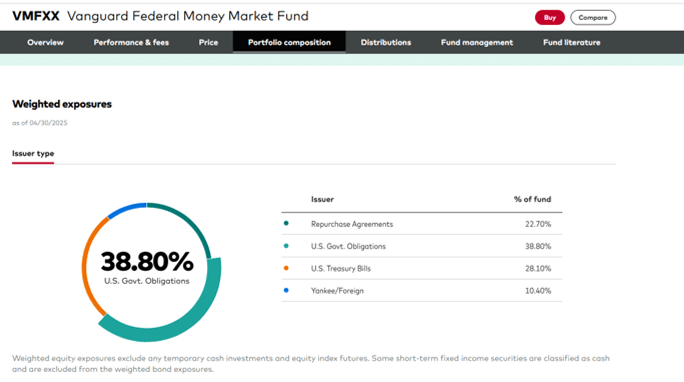

Vanguard VMFXX. As of April 30, 2025, 72% of VMFXX investments were held in either 1) repurchase

agreements (also known as "repos;" we will discuss more about these later); 2) bonds of

government-sponsored entities (GSEs) such as the Federal Home Loan Banks ("FHLB") and Federal

Farm Credit Banks Funding Corp. ("Farm Credit Banks"); and 3) Yankee/foreign bonds.

The repo market was bailed out by the US Federal Reserve in September 2019 and certain GSEs, such

as Fannie Mae, were bailed out by the US government during the 2008 Financial Crisis. The bonds

of GSEs such as FHLB and Farm Credit Banks are not guaranteed by the US government

despite Vanguard referring to them as "Government Obligations" on the VMFXX website.

US Treasurys Are Only 28% of VMFXX and Investments Can Swing Wildly Across Asset Classes

One of the many benefits of owning individual bonds vs. bond

funds is that individual bond investors know exactly what they are investing in.

Bond fund investors, on the other hand, are at the whim of money managers such as Vanguard, as

the composition of mutual funds and ETFs can change by the day.

As of April 30, 2025, the breakdown of VMFXX holdings by asset class was: repurchase agreements

(22.7%), GSE obligations (38.8%), US Treasury obligations (28.1%), and Yankee/foreign bonds

(10.45). As shown in Figure 7, the composition of Vanguard VMFXX has changed dramatically

through the years. In short, investors seldom know what they are getting.

Figure 7: VMFXX Holdings Breakdown by Asset Class -- August 31, 2016-April 30, 2025

Source: Vanguard SEC filings and public information. Bondsavvy calculated percentages for August

31, 2020, 2021, 2022, and 2024 based on Vanguard filings.

Source: Vanguard SEC filings and public information. Bondsavvy calculated percentages for August

31, 2020, 2021, 2022, and 2024 based on Vanguard filings.

Per Figure 7, repurchase agreements represented only 6.3% of VMFXX holdings on August 31, 2020,

but then repos skyrocketed to 64.0% of Vanguard VMFXX on August 31, 2022. US Treasury

obligations reached a high of 75.9% on August 31, 2020; however, by August 31, 2022, US Treasury

obligations accounted for only 16.6% of VMFXX holdings.

Bondsavvy Subscriber Benefit

Owners of individual bonds know exactly what is in their portfolios every day of the

week. Vanguard VMFXX investors have to play a guessing game, as the fund's holdings are

always changing.

Get Started

Few Individual Investors Understand Repurchase Agreement Risks

Before making any investment, individual investors must ask themselves if they truly understand

its risks and potential returns.

As shown in Figure 7, investors do not know, from day to day, what is held in VMFXX. The largest

holdings have recently been in repurchase agreements, which we believe are investments

understood by few individual investors. The Wall Street Journal has an excellent repo market explainer video for those looking to gain a better

understanding. The video also reviews how the Federal Reserve had to bail out the repo market in

September 2019.

Each repo agreement Vanguard VMFXX enters into is with a counterparty, whereby VMFXX lends cash

to either a commercial bank or the Federal Reserve Bank of New York. Like the holdings of VMFXX,

its counterparties are also changing over time. For example, on August 31, 2016, the Federal

Reserve Bank of New York was the counterparty in 26.3% of VMFXX repurchase agreement investments

compared to 95.0% on August 31, 2022.

Click here to get four prior bond pick updates.

Per Vanguard VMFXX's Form N-MFP2 filed with the US Securities and Exchange Commission ("SEC") on

September 8, 2023, select repurchase agreement counterparties included Credit Agricole Corporate

& Investment Bank SA, TD Securities (USA) LLC, Sumitomo Mitsui Banking Corp., and Standard

Chartered Bank.

While Vanguard VMFXX repurchase agreements are typically collateralized with US Treasury

obligations, there is still counterparty risk. The exposure to each counterparty regularly

changes, so it's quite difficult for investors to assess the risk of these repurchase

agreements. Given that repurchase agreements were Vanguard VMFXX's largest investment as of

August 31, 2024, individual investors must ask themselves whether putting money into such a

repo-heavy fund is a good move.

REASON 4 NOT TO OWN VANGUARD VMFXX

VMFXX Is NOT a Fixed Income Investment Given

Its Ultra-Short-Term Holdings

For an investment to be considered "fixed income," there needs to be some element of "fixed" to

it. Fixed income investments come in all shapes and sizes, from a 1 month US Treasury bill to a

30 year Microsoft corporate bond.

As discussed above, the VMFXX yield is a hypothetical number given how quickly interest rates can

move and the short-term nature of its investments. Investors who own a 5 year corporate

bond with a YTM of 5.50% know the amount of interest they will receive between now and maturity,

the dates of such interest payments, and the date and amount paid at maturity.

All of these facts are unknown to Vanguard VMFXX investors. As shown in Figure 8, on February 28,

2025, 59.8% of Vanguard VMFXX's investments were in securities with maturity dates between one

and seven days. Since nearly two-thirds of the portfolio matures each week, these investments

will need to be replaced with other investments that are unknown to VMFXX investors. The yields

of these incoming investments are unknown to investors, making guesswork of future VMFXX

dividends.

Figure 8: Vanguard VMFXX Maturity Date Distribution on February 28, 2025

Source: Vanguard Money Market Funds Annual Report dated February 28, 2025. Figures sum to 101.2%,

as they do not adjust for -1.2% of "other assets and liabilities."

Source: Vanguard Money Market Funds Annual Report dated February 28, 2025. Figures sum to 101.2%,

as they do not adjust for -1.2% of "other assets and liabilities."

In addition to VMFXX's high portfolio turnover that limits visibility of the VMFXX yield, it also

significantly increases the transaction costs Vanguard VMFXX incurs to purchase new investments

and sell existing ones. Despite knowing what these transaction costs are, Vanguard does not

disclose them to investors.

While Vanguard likes to tout funds with 'low expense ratios' like the 0.11% VMFXX expense ratio,

we believe the actual costs investors incur to invest in Vanguard VMFXX are materially

higher than the VMFXX expense ratio, as we discuss further in Reason 5.

REASON 5 NOT TO OWN VANGUARD VMFXX

Vanguard Understates VMFXX Expenses by Not

Disclosing VMFXX's Transaction Costs

Vanguard has built its business on claiming to be a "low-cost provider" of mutual fund and ETF

products. The problem with this is that the VMFXX expense ratio of 0.11% for the year ended

August 31, 2024 excludes one of the most basic costs of operating a mutual fund: securities

transaction costs.

All bond fund managers know what these costs are, as they all have Transaction Cost Analysis

(TCA) reports that will show their transaction costs down to the penny. Somehow, however, the

Big Money lobby has convinced regulators that funds don't have to disclose this material cost of

doing business. Buying and selling securities is fundamental to managing money. Funds need to

disclose these costs so investors understand the true cost of investing in mutual funds

and ETFs.

Figure 9: Big Money Lobbyist Convinces Government That Bond Funds Shouldn't Disclose Transaction

Costs to Investors

In Vanguard VMFXX's case, there is a table in the fund's annual reports that shows calculations

of the VMFXX expense ratio. If you read the fine print, however, you will see "Note that the

expenses shown in the table are meant to highlight and help you compare ongoing costs

only and do not reflect transaction costs incurred by the fund for buying and selling

securities."

This is tantamount to a retailer not reporting the cost of transporting products to its stores.

Reporting the VMFXX expense ratio before transaction costs is a shameless practice that needs to

end.

How Much Is the Vanguard VMFXX Expense Ratio Before Transaction Costs?

On August 31, 2024, VMFXX reported a net asset value of $310 billion. It reported "total

expenses" of $317.7 million for the 12 months ending on the same date. These expenses included

$287.5 million of "Management and Administrative" and $21.3 million for "Marketing and

Distribution."

This, of course, excludes transaction costs, which are likely significant given the high VMFXX

portfolio turnover driven by the ultra-short maturities of its holdings.

Investors in Individual Bonds Can See All the Costs They Incur

When investors buy bonds online, they can see all the costs

they incur, including the bid-ask spread and any brokerage commissions. For most online

brokerages, buying and selling US Treasurys is free. If an investor is looking for a short-term

place to put money, short-dated US Treasurys that have no trading costs could offer advantages

compared to Vanguard VMFXX. Corporate bonds also offer advantages over VMFXX. We will compare

VMFXX to select US Treasurys and corporate bonds in Reason 8 of this fixed income blog post.

REASON 6 NOT TO OWN VANGUARD VMFXX

As reported in Investment News on May 23, 2023, FINRA ordered Vanguard to pay $800,000 for

"issuing misleading account statements to money market customers and failing to respond to [the

customers] when they indicated something was wrong." According to the May 2023 FINRA Order, Vanguard overstated the estimated yield and annual

income for certain money market funds on approximately 8.5 million account statements. This

occurred from November 2019 to September 2020.

Example of Vanguard VMFXX Yield Being Miscalculated

As noted in an example provided in the FINRA Order, in September 2020, Vanguard account

statements displayed an estimated VMFXX yield of 1.87%, when it was actually 0.06%, or 31 times

less. From November 2019 to October 2020, approximately 50 customers contacted Vanguard to alert

it of the miscalculated VMFXX yields.

Figure 10: Vanguard customer realizes VMFXX yield on his statement was 31x higher than actual

According to the FINRA Order, Vanguard "failed to promptly investigate whether the yield data

used to calculate the estimated yield and estimated annual income for money market funds on

account statements was correct." It wasn't until October 2020 -- 11 months after the first

customer complaint -- that Vanguard corrected the error.

Figure 11: Vanguard Management Ignored Repeated Calls from Customers on Incorrect VMFXX Yields

Other Vanguard Investment Returns Miscalculations

Vanguard was fined for errors in other investment returns calculations as part of the FINRA

Order.

In one set of errors, if a customer deposited a check into an account on the last business day of

the month, the statement's performance area recorded this deposit as an increase in market value

instead of an account deposit. The subsequent monthly statement would then record the deposit as

a loss in market value. This error, according to the FINRA Order, affected approximately 23,000

statements from at least October 2019 until May 2021.

From October 2019 to March 2021, Vanguard received 50 customer calls and emails regarding this

issue and one other related to account inaccuracies in the case of corporate actions such as

stock splits. Again, these myriad customer calls resulted in no action by Vanguard until it

finally corrected the errors in May and June 2021.

While we don't believe these errors are as serious as Vanguard misstating Vanguard money market

yields on over 8 million account statements, Vanguard's yearslong lack of prompt corrective

action should be of concern to investors.

Glacial Carriage of Justice and a Slap on the Wrist for Vanguard

From the first knowledge of money market yield calculation issues in November 2019, it took

nearly four years for Vanguard to have to pay a fine related to this matter. While some fine is

better than none, $800,000 seems light when compared to the $287.5 million Vanguard VMFXX

charged investors in "Management and Administrative" fees for the year ending August 31, 2024.

If an $800,000 fine and related censure is the only consequence, it's doubtful such 'punishment'

is enough to thwart similar behavior in the future. After all, Vanguard knew about its errors as

far back as 2019, but it elected to do nothing. This is inexcusable.

While 50 Vanguard customers contacted the company to alert it of the money market yield issues,

hundreds of thousands did not. They likely saw the high yields on their statements and may have

invested more money into Vanguard VMFXX. While we hope this episode caused Vanguard to address

these and similar issues, the long-delayed rounding-error fine and corresponding censure don't

seem like much of a deterrent.

REASON 7 NOT TO OWN VANGUARD VMFXX

Vanguard Misleads Investors by Calling GSE

Debt a "Government Obligation"

As feared and expected, Vanguard appears to be 'right back at it,' this time by referring to debt

issued by government-sponsored entities (GSEs) as "Government Obligations" when such debt is

not a government obligation. This is the classic Vanguard marketing machine, where it

seeks to have investors believe an investment's risk is lower than it actually is. If it has to

pay a small fine and have some professional embarrassment while getting people to invest

billions in VMFXX, so be it.

Vanguard's mischaracterizing GSE debt as a government obligation and its ignorance of the 100

customer complaints discussed in Reason 7 raise legitimate concerns over Vanguard's values and

culture.

GSE Debt Is NOT a US Government Obligation

VMFXX holds tens of billions in bonds issued by Federal Home Loan Banks ("FHLB") and Federal Farm

Credit Banks Funding Corp. ("Farm Credit Banks"). As explained on the Federal Housing Finance Agency website, in the "Consolidated

Obligations" section, the FHLB bonds "are not guaranteed or insured by the federal government."

Figure 12 shows a screenshot taken of the Vanguard VMFXX, which shows the fund's alleged weighted

exposures to different types of investments. As highlighted, it indicated 35.00% of the fund's

investments were "US Govt. Obligations" even though these were bonds issued by FHLB and the Farm

Credit Banks, which are not guaranteed by the US government.

Figure 12: Screenshot of Vanguard Website Showing Alleged Vanguard VMFXX Investment

Exposures as of April 30, 2025

Source: Vanguard VMFXX website

Source: Vanguard VMFXX website

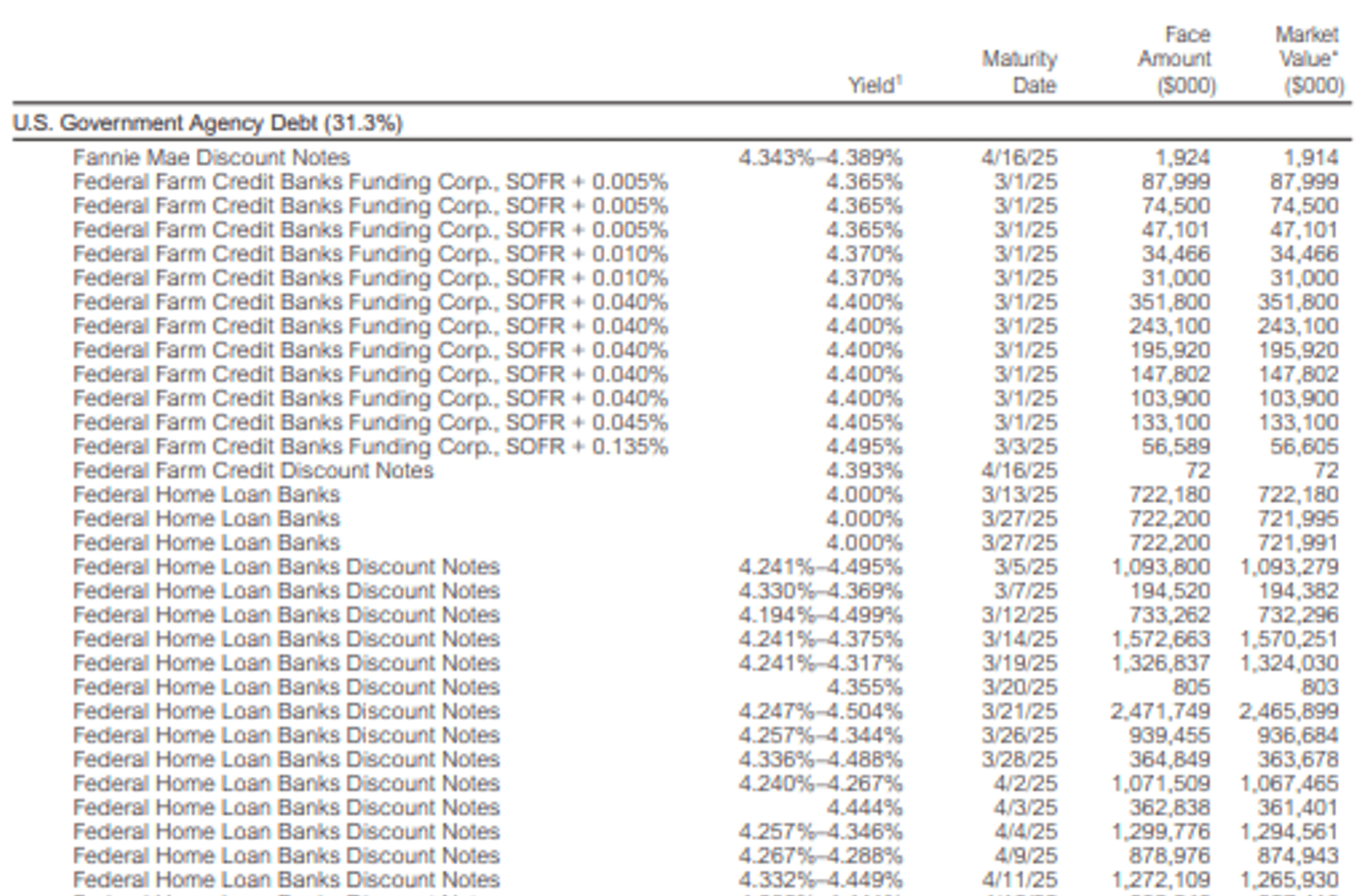

In Figure 13, we have excerpted a portion of the Schedule of Investments shown in the Vanguard

Money Market Funds February 28, 2025 financial statements. On other pages of its Schedule of

Investments, Vanguard provides detail on VMFXX's repurchase agreements and the US Treasurys it

owns. We show Figure 13 so that investors are clear on what investments, summarized in Figure

12, Vanguard is mischaracterizing as "US Govt. Obligations."

Figure 13: Excerpt of VMFXX Schedule of Investments -- February 28, 2025

Source: Vanguard Money Market Funds financial statements, February 28, 2025.

Vanguard VMFXX wants to appear as safe as possible, which is why its website refers to GSE debt

as a government obligation even though it is not. This misleads investors.

Click here to get four prior bond pick updates.

The VMFXX website is the most public place Vanguard provides information on VMFXX. We urge

Vanguard to correct this issue so it does not continue to mislead investors.

We are big proponents of understanding what you are investing in. Given the large concentration

of FHLB bonds within Vanguard VMFXX, we encourage investors to study FHLB financial information prior to making investments into VMFXX.

REASON 8 NOT TO BUY VANGUARD VMFXX

There Are Alternatives to VMFXX That Offer

Higher Potential Returns, Higher Credit Quality, and Lower Fees

All investments have weaknesses and drawbacks. We discuss corporate bonds advantages and

disadvantages relative to bond funds, muni bonds, and stocks in a separate Bondsavvy

fixed income blog post.

In this section, we will compare Vanguard VMFXX to other investment alternatives, including

select US Treasurys and individual corporate bonds. Bondsavvy does not provide personalized

advice, so certain pros and cons may be more or less applicable to different investors.

Select Corporate Bonds Offer Higher Potential Returns and Credit Quality Than VMFXX

Figure 14 shows yields to maturity (YTMs) of select corporate bonds of different maturity dates.

Since there is no Vanguard VMFXX maturity date or fixed coupon rate, there is no Vanguard VMFXX

yield to maturity. With the individual bonds, however, we can see there are compelling

alternatives to VMFXX.

Higher Potential Returns of US Treasurys and Select Corporates vs. VMFXX

For example, on May 8, 2025, an investor could purchase a 5-year Walmart bond (CUSIP 931142FN8)

with a 4.30% YTM. The Walmart '30 bond enables investors to lock in a yield of 4.30% for the

next five years and, should the price rise in the near term, achieve a higher return than the

quoted YTM. While the VMFXX 7-day yield was 4.23% on May 7, 2025, that yield is not fixed.

Should the fed funds rate fall 100 basis points by year-end 2026 as projected by the March 2025 Fed dot plot, the VMFXX

yield would fall to about 3.23%, well below the Walmart '30 bond's yield to maturity.

As noted above, corporate bonds can achieve total returns that can exceed their YTMs, as

we discuss in our fixed income strategy and corporate bond

returns pages.

Figure 14: Comparison of VMFXX to Select US Corporate Bonds. Pricing as of 4:30pm EDT on

May 8, 2025

Investment |

Years to Maturity

from 5/8/2025

|

CUSIP |

YTM* |

Price as %

of Par

Value*

|

Bond

Rating

|

Min Quantity* |

| Vanguard VMFXX |

No maturity date |

922906300 |

N/A |

N/A |

N/A |

$3,000 |

| Walmart 4.35% 4/28/30 |

~5 years |

931142FN8 |

4.30% |

100.22 |

Aa2/AA |

$2,000

face value |

| US Treasury 3.00% 2/15/47 |

~22 years |

912810RV2 |

4.96% |

74.09 |

Aaa/-- |

$5,000

face value |

| Microsoft 4.25% 2/6/47 |

~22 years |

594918CA0 |

5.11% |

88.72 |

Aaa/AAA |

$2,000

face value |

| Fedex 4.40% 1/15/47 |

~22 years |

31428XBN5 |

6.59% |

74.91 |

Baa2/BBB |

$2,000

face value |

*Source: Fidelity.com

Investors looking to lock in yields for a longer time period and to have opportunities for

capital appreciation could evaluate longer-dated corporate bonds. Microsoft has a higher credit

rating than the US Treasury, and the Microsoft 4.25% 2/6/47 bond had a YTM on May 8, 2025 that

was 15 basis points (0.15 percentage points) higher than the US Treasury bond with a

similar maturity date. Should long-term US Treasury yields drop over the coming years, we would

expect both the Microsoft '47 and US Treasury '47 bonds to increase in value. Of course, this

upside potential does come with materially higher pricing volatility relative to shorter-dated

bonds.

For investors seeking a higher yield and who are willing to invest in bonds rated below the

highest-rated bonds, the Fedex 4.40% '47 bond offers a 1.5-point higher yield compared to the

Microsoft '47 bond. In addition, should long-term US Treasury yields fall by one percentage

point in the near term, assuming no change in credit spread, we would expect the

Fedex '47 bond price to increase approximately 10 points.

None of the investments in Figure 14 are currently on the Bondsavvy investment recommendation

list. Purchase a Bondsavvy subscription to see all

of our current and past corporate bond recommendations. Read our How To Build a Bond

Portfolio blog post for ten dos and don'ts on building a fixed income portfolio.

Higher Credit Quality of US Treasurys and Select Corporate Bonds vs. VMFXX

VMFXX does not have a bond rating; however, we believe individual

bonds issued by the US Treasury and high-credit-quality companies such as Microsoft have higher

creditworthiness than the repo- and GSE-debt-heavy VMFXX. Further, sometime between February 28,

2025 and April 30, 2025, Vanguard VMFXX introduced investments in Yankee/foreign bonds. We have

not seen any disclosures as to what specific bonds these are, which raises further questions on

what VMFXX investors are actually getting.

In the case of US Treasury and Microsoft bond investments, investors know exactly what

they are investing in and can assess the risk and potential return. As shown throughout this

article, the VMFXX holdings are always changing, and its credit quality has fallen as the amount

of US Treasury investments has become a lower percentage of the fund's investments.

Bondsavvy Subscriber Benefit

Evaluating credit quality is one of many pieces in Bondsavvy's investment analysis. Our

goal is to recommend corporate bonds trading at compelling values that can achieve

strong long-term total returns.

Get Started

US Treasurys and Corporate Bonds Offer Lower Fees Than VMFXX

Even as VMFXX's net asset value has grown from $38.8 billion on August 31, 2016 to $351 billion

on April 30, 2025, the VMFXX expense ratio has held steady at 0.11%. When adding in transaction

costs not disclosed by the fund, the actual expense ratio is likely closer to 0.15%.

These VMFXX fees are recurring and don't go away.

On the other hand, online

bond investors who own US Treasurys generally do not pay to buy and sell Treasurys and

do not incur recurring management fees. Corporate bond investors will pay transaction fees,

generally $1 per $1,000 face value per bond on online bond trading platforms. Of course, corporate

bond investors who hold bonds to maturity would only pay the transaction fee when they purchase

the bond.

Despite the Vanguard drumbeat of it being the "low-cost provider," as shown in Figure 15, VMFXX

fees are substantially higher than those incurred by investors in individual bonds.

Figure 15 shows an illustrative example of the fees incurred by online bond investors vs. those

of Vanguard VMFXX for an initial $50,000 investment. We show two cases for VMFXX: one with the

reported 0.11% VMFXX expense ratio and another with an illustrative 0.15% expense ratio, which

we believe closer reflects the all-in expense ratio when transaction costs are included.

Figure 15: Illustrative Investment Fee Analysis for Initial $50,000 Investment

Investment |

Fees Over

Five Years |

Assumptions |

| VMFXX Expense Ratio @ 0.11% |

$303 |

Annual year 1-5 returns of 5%, 4%, 3%, 2.5%, and 2.5%, respectively |

| VMFXX 0.15% All-in Expense Ratio |

$413 |

Same return assumptions; however, we assume a higher 0.15% VMFXX expense ratio

to account for VMFXX transaction costs |

| Online US Treasurys |

$0 |

Generally, online bond trading platforms do not charge transaction fees for US

Treasurys |

| Online Corporate Bonds: Hold to Maturity |

$50 |

$1 per $1,000 of face value paid at purchase |

| Online Corporate Bonds: Sell Bonds Before

Maturity |

$100 |

$1 per $1,000 of face value paid at purchase and sale |

Since Vanguard charges expenses on the total amount invested in VMFXX, we make five-year VMFXX

investment return assumptions. Individual bond fees are off the face value, so the transaction

fees do not change if the bond price increases or decreases in value.

As noted above, US Treasurys are generally free to trade on online bond platforms. For corporate

bonds, an investor holding a $50,000 investment to maturity would incur $50 of transaction costs

at purchase. An investor selling bonds before

maturity would incur the $50 charge during both the purchase and sale transactions.

Conclusion on Eight Reasons Not To Own

Vanguard VMFXX

Many investors assume that money market funds such as Vanguard VMFXX are money good and typically

an optimal place to invest short-term cash. Our analysis peels back the onion on Vanguard VMFXX

to show what it is and what it is not. We also show how certain alternatives to VMFXX could

generate higher returns at a lower cost.

As Vanguard VMFXX has grown about 9x in size since August 31, 2016, the fund faces the same

problems many other mega funds face: where to invest hundreds of billions of dollars at

attractive returns. In the case of Vanguard VMFXX, it has gone the repo agreement and GSE bond

route, which has worsened the fund's credit profile and reduced transparency.

Individual investors have a task simpler than Vanguard mega funds. They can identify a select

group of individual bond investments that match their risk tolerance and investment objectives

and can purchase these investments at a low cost on online

bond trading platforms. Every day they own these investments, they can look at their

brokerage accounts and know exactly what they are investing in.

VMFXX investors' 'set it and forget it' strategy can work up to a point; however, these investors

must be aware of the impact lower interest rates will have on VMFXX and the other investment

options available to them.