Selling bonds before maturity is a key part of maximizing income and total returns. It also helps reduce risk. Many investors prefer holding bonds to maturity through bond ladders, but we have a different approach. Selling bonds before maturity enables investors to:

- Achieve returns higher than a bond's yield to maturity

- Lock in capital appreciation, which is taxed at lower rates than interest income in the United States

- Maximize compounded interest by investing appreciated capital in new bond investments

- Manage bond price ceilings, which require a different approach than buy-and-hold-style investing

- Maximize investment returns and minimize losses for companies with weakening financial results

This fixed income blog post examines the six factors impacting how we decide when to sell bonds. While we do advocate an active investment strategy, we are not bond traders but rather long-term investors, holding a number of prior recommendations over four years. This includes the Albertsons 7.45% '29 bond, where we achieved a 79.52% return, as discussed below. Our goal is to make our list of recommended corporate bonds as profitable as possible over the long term.

When to sell bonds: Corporate bond investing case studies

Providing real-life examples is the best way to show investors how important it is to monitor corporate bond investments and to sell bonds before maturity to maximize investment returns. Figures 1a and 1b are examples of what can go right when selling bonds before maturity and what can go wrong if you don't capitalize on selling opportunities.

A High Yield Bond Case Study: Albertsons 7.45% '29

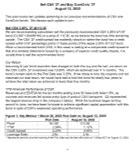

The Albertsons 7.45% '29 bond was part of the first set of bond recommendations we made September 26, 2017. The bond's price had fallen in the wake of Amazon purchasing Whole Foods and Albertsons pulling its initial public offering. We recommended the bond at a price of 78.50% of par value and a 10.7% yield to maturity.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

Following our initial recommendation, Albertsons reported strong financial performance, which was bolstered by the Covid-19 pandemic. The Albertsons '29 bond kept rising to an all-time high of 120 in September 2021. There were limited buying opportunities at that point, so, given the bond's high coupon, we held the bond several more months until we recommended a sell on March 24, 2022 at a price of 107.45. During our 4.5-year holding period, we achieved a total return of 79.52% compared to a 15.18% return for the iShares HYG high yield corporate bond ETF. Our average annual return was 17.7%, significantly higher than the bond's 10.7% yield to maturity on the date we made the initial investment. View our corporate bond returns page to see the performance of all previous Bondsavvy recommended bonds.

Figure 1a: When to Sell Bonds Before Maturity -- Albertsons 7.45% '29

Source: FINRA market data.

Investment Grade Bond Case Study

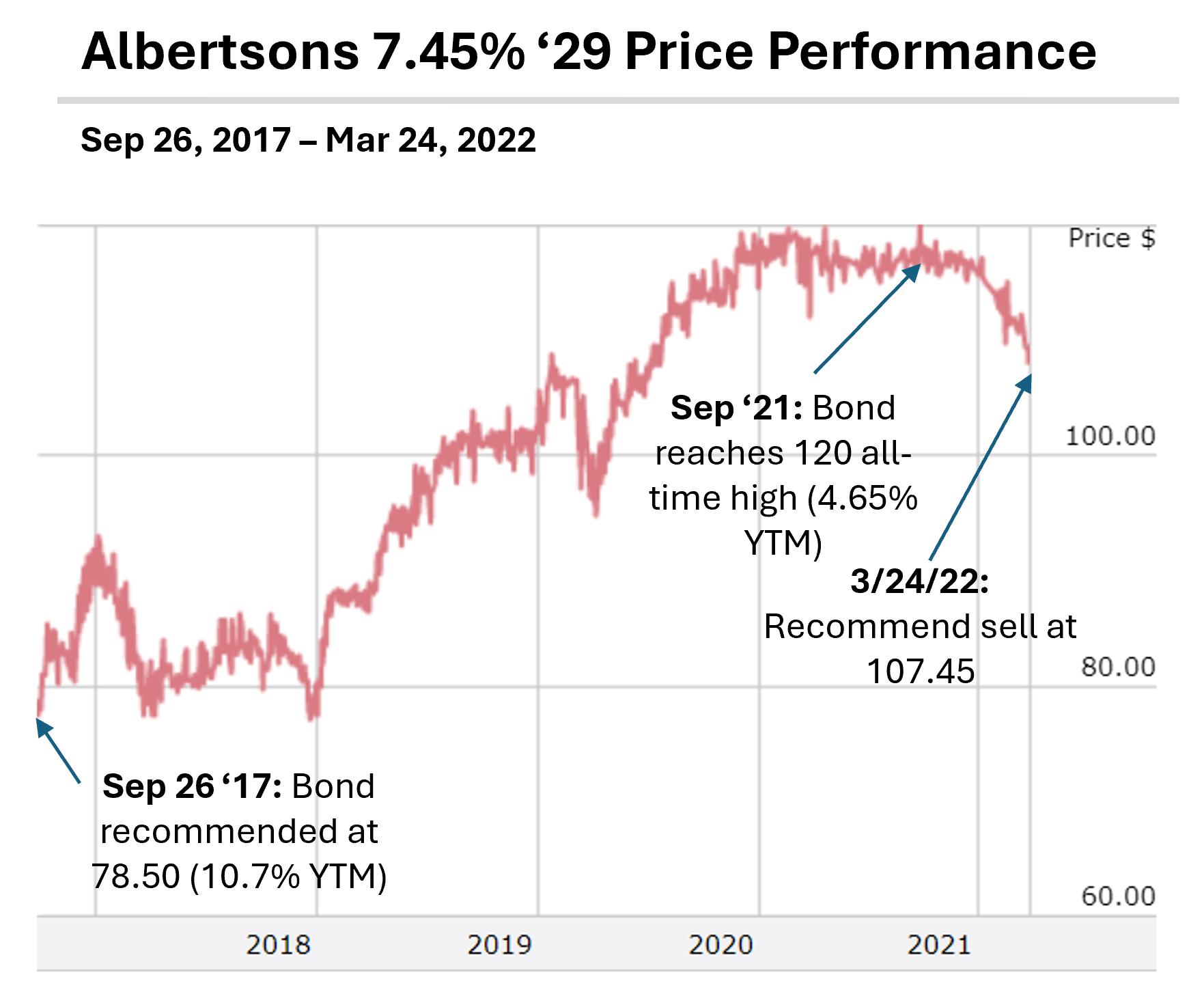

Even though we stayed in six months too long with the Albertsons bond, we still achieved a significant investment return. Figure 1b shows an example of a bond that should have been sold but was not, which has significantly reduced our investment return.

On May 31, 2019, we recommended a long-dated investment grade bond issued by a leading retailer at a price of 86.44. Since that pick date (other than a short drop during the Covid-induced March 2020 crash), the bond performed well, reaching an all-time high of 122 on August 4, 2020. With 35 points of capital appreciation over 14 months, the bond should have been sold. Unfortunately, given the low-interest-rate period, we did not find better substitute investments and elected to hold the bond. This strategy worked until the end of 2021.

Then, given how sensitive long-dated investment grade corporate bonds can be to changes in US Treasury yields, the bond fell significantly during 2022, as US Treasury yields spiked. The bond fell all the way down to near 70, a 50-plus-point drop from its all-time high. While the bond has since recovered a portion of its value, it is nowhere near the 122 all-time high. Not selling this bond at its peak was a painful mistake that has informed how we handle recommendations with significant price growth over short periods of time.

Figure 1b: A Mistake Not to Sell a Bond -- Long-Dated Investment Grade Bond

Source: FINRA market data

These examples not only show the importance of investing in bonds with compelling values but also deciding when to sell bonds once we believe we have

maximized our capital gain. We believe that income investing and active investing can go hand in hand, as active investing can increase the income investors earn.

An investor buying 10 5% bonds at par value would receive $500 per year in interest. Over time, the investor could invest the interest received to buy more bonds. If the bond appreciated to, say, 120.00, however, the investor could sell the bond and plow the interest income and appreciated proceeds into a greater number of bonds. This was possible for investors who sold appreciated bonds in 2021 and then invested in lower-priced, higher-yielding bonds in 2022 and 2023.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

When Bondsavvy presents new corporate bond investment opportunities during The Bondcast financial webinar, it is only the first step of maximizing a corporate bond's investment return. Once

we make a new investment recommendation, we closely monitor bond price changes and the financial performance of the issuing companies. We also

evaluate changes in Treasury yields and how these are impacting the bond prices of the investments we recommend.

The above examples are just two case studies for when to sell bonds. Through October 31, 2024, Bondsavvy had sold 66 of its previous 129 corporate bond recommendations, outperforming the iShares corporate bond ETFs 76% of the time, as shown on our corporate bond returns page.

In one previous corporate bond recommendation, our Tiffany bonds blog post shows how we achieved a 26% investment return after holding the bonds

slightly over four months, as the value of the bonds was bolstered by LVMH's announced acquisition of Tiffany.

Factors impacting when to sell corporate bonds

Our goal is to generate as much investment return from each corporate bond recommendation over as long of a time period as possible. In certain cases, we

may hold corporate bonds to maturity, but, generally speaking, we recommend selling bonds before maturity to lock in capital appreciation and maximize investment returns. Our typical bond investment holding period is between one to five years, but holding periods can vary, as was the case

with our investment in Tiffany bonds. Below are factors we evaluate when selling bonds before maturity.

1) How is the overall bond market priced and are there opportunities for further capital appreciation?

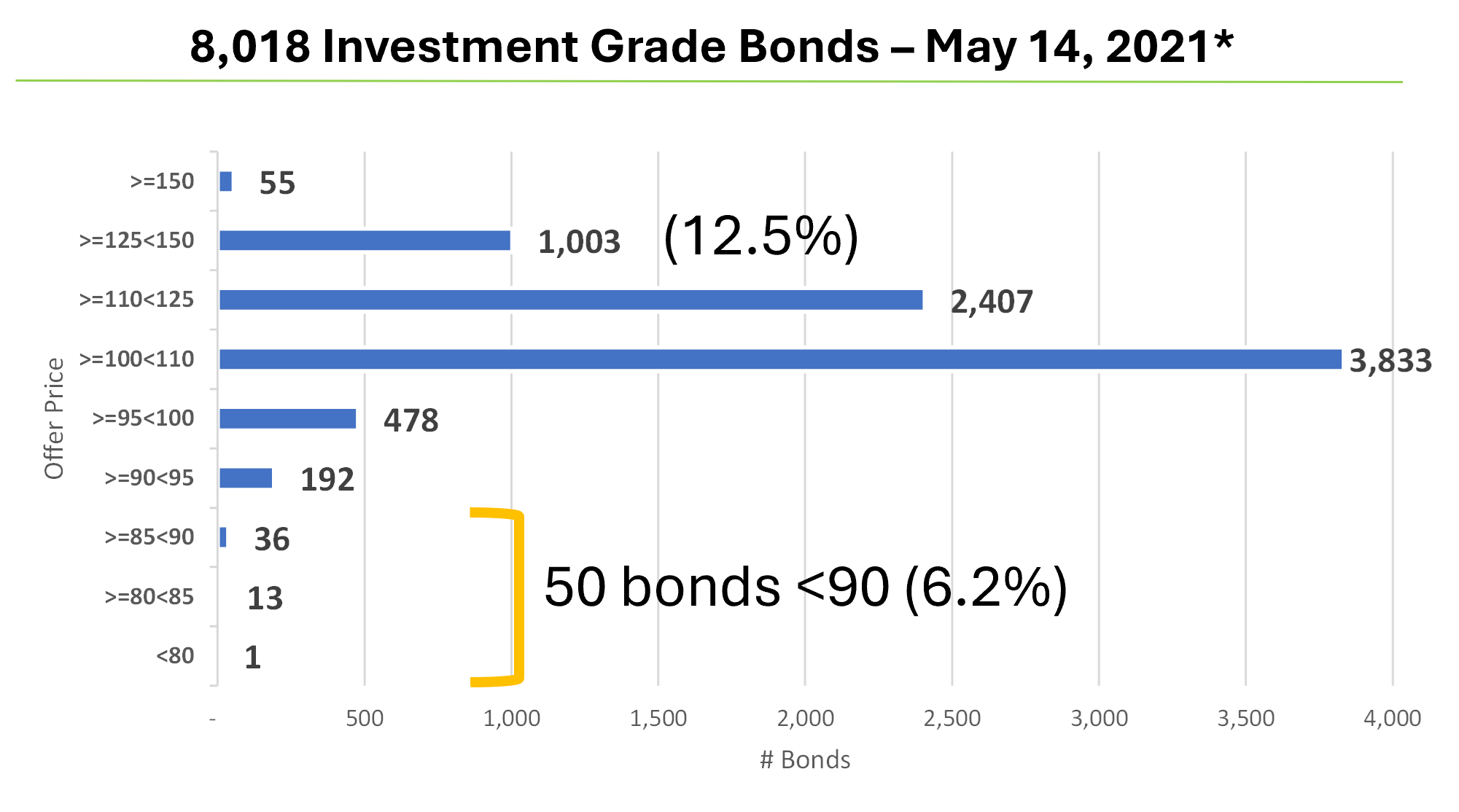

Figures 2a and 2b show the investment grade corporate bond pricing distribution on May 14, 2021 and April 25, 2022, respectively. May 14, 2021 was a relatively frothy time in the bond market, characterized by extremely low market interest rates and high bond prices. It is a helpful data point, as it shows the limits for how high bond prices can go.

As shown in Figure 2a, less than 1% of bonds were priced at or above 150% of their $1,000 par value, and only 12.5% were priced from 125.00 to 149.99. This chart shows how bond prices have ceilings and, given these ceilings, the need to incorporate an active bond investing strategy.

Bond prices don't go to 200. As bonds increase materially in price, the likelihood of further price increases diminishes. Since all bond prices return to par at maturity, we seek to sell bonds at a high point when possible. Therefore, if we recommend a corporate bond at par (100) and it increases to 125, we are likely to recommend selling this bond so we can lock in our capital gain.

Figure 2a: Range of Investment Corporate Bond Prices on May 14, 2021

*Source: Fidelity.com

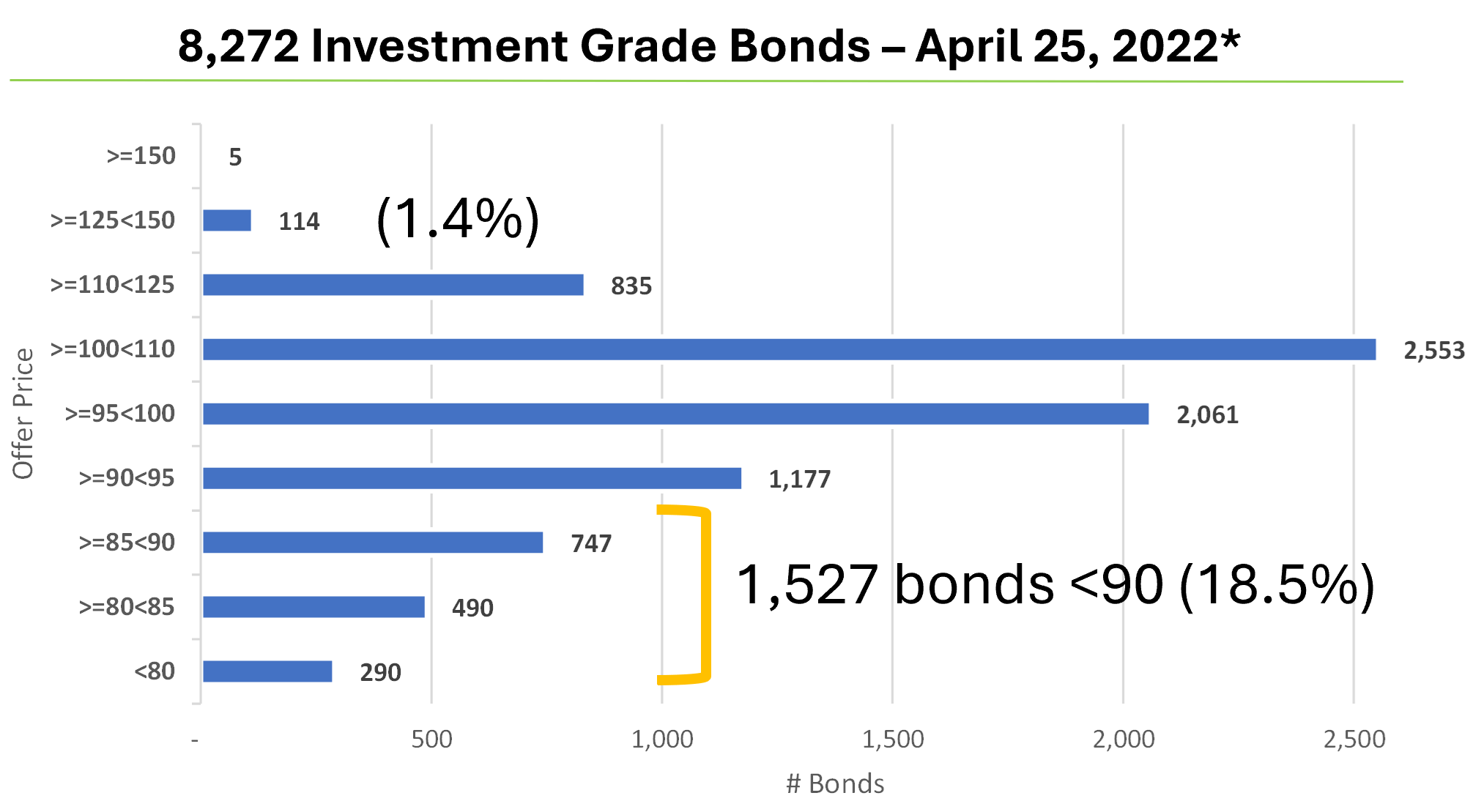

During 2021, Bondsavvy recommended the sales of 12 previously recommended corporate bonds to take advantage of high bond prices. As the US Federal Reserve began hiking interest rates in March 2022, US Treasury yields surged, which caused many investment grade corporate bond prices to fall. As shown in Figure 2b, the distribution of corporate bond prices shifted lower, as, on April 25, 2022, only 1.4% of investment grade corporate bonds shown on Fidelity.com (114 bonds) were priced from 125.00 to 149.99. With this price reduction, we didn't sell any investment grade bonds in 2022 or 2023. The four bonds we sold in 2022 were all high yield bonds and included one bond that matured, one that was called, the Albertsons '29 bond, and Laredo Petroleum 9.500% '25.

Figure 2b: Range of Investment Grade Corporate Bond Prices on April 25, 2022

* Source: Fidelity.com

Investors who sold bonds in 2021 could then take advantage of bonds trading at much lower prices in 2022 and 2023. Taking advantage of these opportunities is a key reason why we advocate building bond portfolios over time as opposed to putting a lot of money to work all at once, as is often done with bond ladders.

Locking in capital appreciation is especially important when holding a low-yielding, investment-grade corporate bond. For example, if you own a corporate

bond that increased from par to 120 and the bond pays a 4% coupon, a significant fall in the bond's price could wipe out an investor's interest income

for several years. With high yield corporate bonds, we can be somewhat less 'trigger-happy' in deciding when to sell bonds, as these bonds can often

'out-yield' a reduction in the bond's price.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

This active investing approach differs significantly from traditional bond ladders,

where investors buy bonds of various bond maturities and hold all bonds until maturity. These bond ladders cap investor returns at a

bond's yield to maturity and make a bond's maturity date the fundamental investment criterion. A bond's maturity date, isolated from other investment considerations, tells investors little about whether a bond is a worthwhile investment. Our corporate bond research evaluates 16 different investment criteria when making new bond recommendations for Bondsavvy subscribers.

2) Has a bond's risk/return profile significantly changed?

During each edition of The Super Bondcast, a quarterly subscriber investment webinar, for each of our currently recommended corporate bonds, we provide updates to each bond issuer's financial

performance as well each bond's price performance. We also discuss the drivers of bond price changes and whether they were driven primarily by changes

in comparable Treasury yields and / or changes in credit spreads. Credit spreads are the difference between a corporate bond's yield to maturity and the yield to maturity of a Treasury bond with a comparable maturity date. They reflect the extra yield corporate bondholders receive to compensate them for the supposed higher default risk a company has vs. the US Treasury.

Our goal

with The Super Bondcast is to determine whether previously recommended bonds continue to present a compelling risk/return profile relative to other

bonds available in the US corporate bond market.

A key input in this analysis is comparing the credit spreads,

leverage ratios, and other financial metrics of our recommended

bonds to other US corporate bonds. As we discuss in our Tiffany bonds blog post, the credit spread of the Tiffany bonds we previously recommended had fallen close to the credit spread of Apple bonds with similar maturities.

Since Apple, at the time, was a superior credit than Tiffany, we didn't believe Tiffany's credit spread could tighten further, which limited the

upside of the Tiffany bonds. We, therefore, decided to sell the Tiffany bonds and achieved a 26% corporate bond return over a 4 1/2 month period.

In cases when a bond issuer's credit quality has improved but the bond price has fallen, we will typically recommend subscribers buy more of such bonds,

as they are better values than when we originally recommended them. While bond prices can rise and fall quickly, changes in a company's credit profile

often take several quarters and, at times, a number of years, to manifest themselves. Bondsavvy therefore monitors both performance of the issuing

company and the recommended bonds to assess whether a bond's risk/return profile has changed.

3) Where Are US Treasury Yields and Where Could they Be Heading?

Bondsavvy's recommended bonds include both high yield and investment grade bonds. High yield corporate bonds can have lesser sensitivity to changes in Treasury yields, as their performance is generally driven, in large part, by the underlying financial performance of the issuing company. Investment-grade corporate bonds, on the other hand, can be highly sensitive to changes in US Treasury yields. Therefore, when evaluating when to sell bonds, we assess US Treasury yield trends and whether we see material changes in US Treasury yields over the near term.

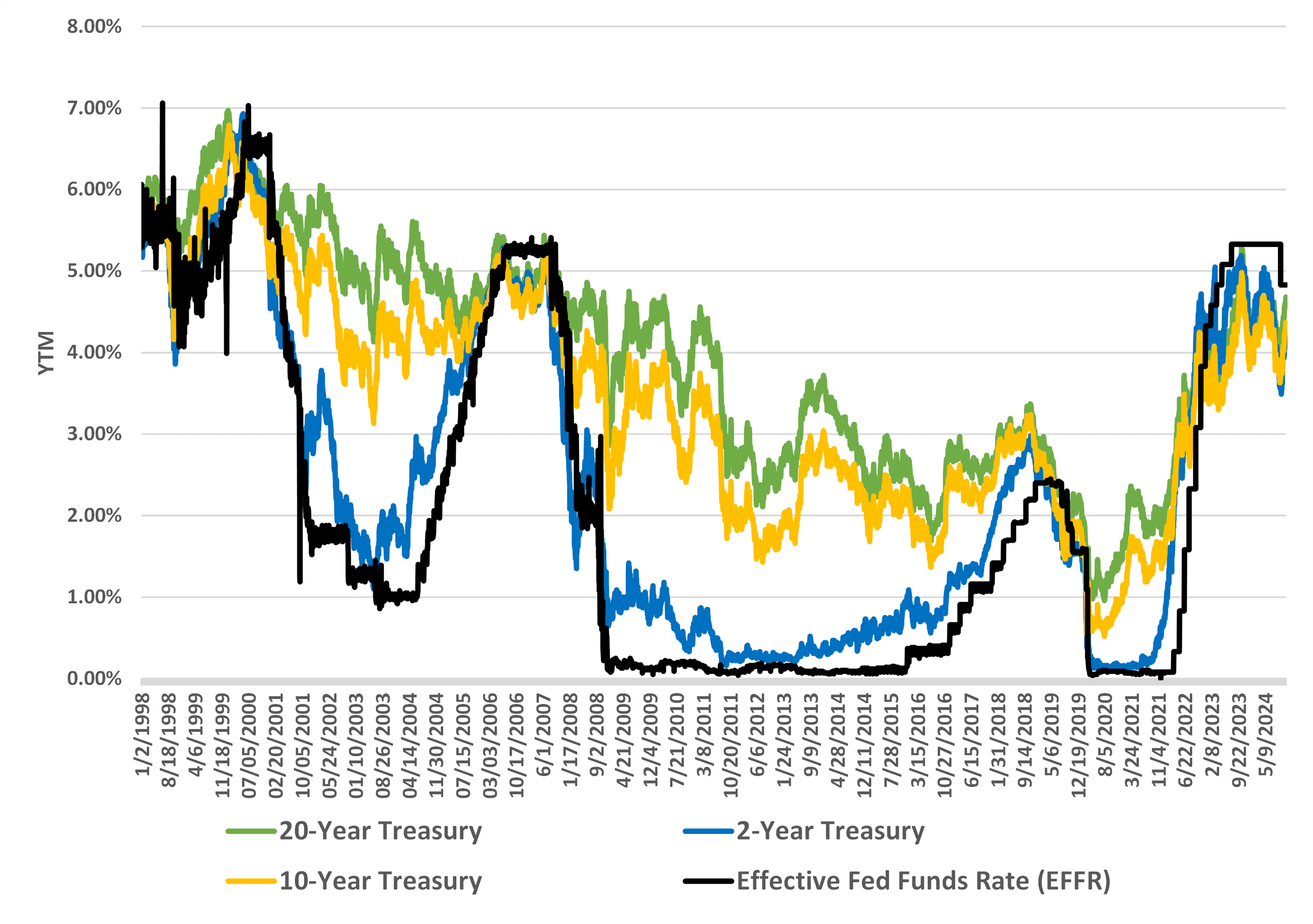

Figure 2c shows 2-, 10-, and 20-year US Treasury yields compared to the effective fed funds rate since 1998. This chart helps us assess the overall value in the US Treasury market. As noted above, the impact of US Treasury yields will vary across corporate bonds. That said, for investment grade corporate bonds, a sell decision will not only be impacted by where US Treasury yields are today but also where they were when you originally bought a bond. For example, for investment grade bonds bought when US Treasury yields were low in 2020 and 2021, the higher yields of 2023 and 2024 have generally not provided many selling opportunities for these bonds.

On the other hand, Bondsavvy did recommend selling a select number of bonds in September 2024, as 10-year US Treasury yields reached 15-month lows and certain bond credit spreads had fallen.

Figure 2c: US Treasury Yields vs. Effective Fed Funds Rate -- January 2, 1998 to November 4, 2024

As shown in Figure 2c, during 2022, US Treasury yields rose sharply, which caused many long-dated investment grade corporate bonds to fall to between 55% to 65% of par value. We have generally found buying high-quality investment-grade bonds trading at these levels to be compelling investment opportunities.

4) How likely is a near-term upgrade or downgrade in the bond's credit rating?

When Bondsavvy makes an initial investment recommendation, we evaluate a bond issuer's momentum so we can assess how likely a credit ratings upgrade

or downgrade is. Most bond investors, especially institutional investors and index funds, are reactionary to bond ratings -- selling on downgrades

and buying on upgrades. This behavior can cause material changes to bond prices.

As we update our fixed income investment recommendations, we revisit how close a bond issuer is to ratings upgrade and downgrade thresholds and the likelihood

of the company to reach either. We also assess the likelihood of a company being acquired by a company with a higher credit quality. For example, if we

recommended a bond issued by a company with a B1 / B+ bond rating and it was acquired by a company with an investment-grade credit rating, the bond we

recommended should appreciate significantly in price since the higher-credit-quality acquiror would assume the company debt of the target company.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

If the

pro forma credit metrics continue to be strong, there is a high likelihood that our recommended bond would be upgraded to match the credit rating of the

acquiring company. Predicting who will buy whom can be a fool's errand, but we look to understand which industries are consolidating and which companies

are likely buyers.

5) Does the issuing company have default risk?

When we make initial bond purchase recommendations during The Bondcast subscriber webcast, we seek to recommend bonds that have low prices and high yields relative to the risk of the issuing company. While we generally recommend bonds issued by companies with low leverage ratios and low default risk, a company's default risk can change over time. When we make an initial recommendation, our work is just beginning, as, every quarter following a new recommendation, we update our buy/sell/hold recommendation based on our issuing companies' most recent quarterly financial results.

In assessing default risk, we evaluate business profitability and cash flow trends and assess upcoming key events. These key events could include an upcoming bond maturity date or interest payment. There could also be financial covenants to which the issuing company must comply.

In deciding when to sell bonds, we carefully monitor an issuing company's default risk and may elect to sell a bond recommendation if we believe an issuer will have difficulty turning the corner. That said, the market can often be merciless on bonds issued by companies having financial difficulty. These bonds are often downgraded by the major bond rating agencies, which can cause a free-fall in bond prices. Selling bonds in such panics is often unfavorable given the poor prices a seller is likely to receive.

In addition, a bond being in 'default' does not always mean bond investors get wiped out. For example, a bond issued by Tupperware had fallen to 20% of par value in 2020 given the company's weak financial performance and concern on whether the bond could be refinanced by its 2021 maturity date. Tupperware began tender offers, where it offered investors payment for the bonds at well below par value. This was technically a "default" since some bondholders were receiving less than par value for their bonds. We recommended subscribers hold onto their Tupperware bonds, as we believed the company was going to weather 2020 and be able to refinance the bonds. Fortunately, the company's business did turn around and it was able to execute a new financing. Our bonds were later called at a price above par value.

6) Is our recommended bond callable and at what price?

Most bond investors are familiar with a corporate bond's maturity date, which is the contractual date a bond issuer must pay back bondholders the $1,000

face value for each bond they own. While the maturity date can impact the price volatility of corporate bonds, it's important for bond investors

to understand how bond call schedules can impact a bond's opportunity for capital appreciation and its price ceiling.

If a bond is callable, it means that it can be bought back by the company prior to maturity. Callable bonds fall into two categories: 1) those deemed

to be 'make whole' calls and 2) those with a set call schedule. We will discuss each type of callable bond and its impact on when to sell bonds:

Corporate bonds with make-whole call provisions

Generally speaking, most investment-grade corporate bonds are subject to what is known as a 'make-whole' provision. This provision is in the favor

of the bondholder and is seldom exercised given the often onerous cost to the company. Suppose a company bond is issued with a 40-year maturity

and the company wants to call the bond after ten years. To execute the make-whole call, the issuer would have to pay the bondholder the present value of all future interest and principal payments due the bondholder from years 10 until the maturity date. As you can imagine, even with discounting the future interest and principal payments due on the bond, executing a make-whole

provision could be very expensive for the issuing company.

While bonds with make-whole provisions can be deemed "continuously callable," that term gives investors the wrong impression given that bonds with make-whole provisions are seldom called well in advance of maturity.

An alternative to executing the make-whole call provision is for a bond issuer to 'tender' for its bonds. In bond tenders, an issuing company offers

to buy corporate bonds back at a specific price on a specific date. Participating in the tender offer is at the option of the bondholder.

Tender offers present a way for bond issuers to redeem bonds early and not incur the substantial cost of effecting a make-whole-call provision.

Corporate bonds with a specific call schedule ("call schedule bonds")

Bonds not subject to a make-whole call will typically be subject to a specific call schedule that sets out the call dates and call prices for the particular

corporate bond. Most high-yield corporate bonds have call schedule provisions in their bond indentures, and it's a key part of corporate bond

investing. From the bond issuer's perspective, if the company's credit quality improves over the life of the bond, it wants to be able to redeem

the bonds and issue new bonds at a lower coupon rate. Since bondholders will be giving up coupon payments for a period of time that could last

from one to several years, certain call dates will be subject to a call premium to compensate bondholders for lost income. Here's how this works.

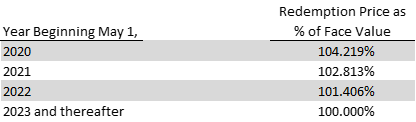

Figure 3 shows the call schedule for the Tennant 5.625% 5/1/25 bonds (CUSIP 880345AB9), a company that manufactures and sells industrial cleaning

machines. Tennant issued these bonds on January 22, 2018, and they mature approximately seven years later on May 1, 2025. The Tennant call

schedule works as follows:

- If Tennant calls the bonds from May 1, 2020 through April 30, 2021, it will redeem the bonds at a price of 104.219% of face value, or $1,042.19 per

bond;

- If Tennant calls the bonds from May 1, 2021 through April 30, 2022, it will redeem the bonds at a price of 102.813% of face value, or $1,028.13 per

bond;

- If Tennant calls the bonds from May 1, 2022 through April 30, 2023, it will redeem the bonds at a price of 101.406% of face value, or $1,014.06 per

bond;

- Anytime thereafter, the bonds may be redeemed at par

Figure 3: Tennant 5.625% 5/1/25 Call Schedule

As you can see, the further we are out from the maturity date, the higher the call premium, as bondholders must be compensated for lost coupon payments

for a longer time period.

We initially recommended the Tennant bonds at an offer price of 97.32 on December 12, 2018. As shown in Figure 3, starting May 1, 2020, the bonds

were callable at a price of 104.219% of par value. During September and October 2020, the Tennant bonds have hovered right around 104.00 in price.

It's doubtful the Tennant bonds will increase in price materially above the 104.219 call price, as investors buying the bonds on, say, October 30 at

an illustrative price of 106.00 would achieve a negative return if the bonds were called at 104.219 on November 13. This situation can happen,

which is why the Tennant bonds have been a 'hold' as the bond price has approached the May 1, 2020 call price. The call provision of the Tennant

bonds has put a ceiling on the bonds, and it's something we have to pay close attention to as we consider modifying our recommendation of the Tennant

bonds.

When to sell bonds conclusion

Buying good bonds at good prices is extremely important; however, it is only part of the bond investing puzzle. Investors need to maximize capital

gains from fixed income investments just like they would with stock market investments. Doing so enables investors to maximize income and total returns. Bondsavvy monitors all previously recommended corporate

bonds to evaluate the points covered in this post and to update Bondsavvy subscribers on when to sell bonds we previously recommended. We provide these updates during quarterly editions of The Super Bondcast, as well as regular subscriber email updates.

We put Bondsavvy subscribers in control of their corporate bond investments.

Get Started Watch Free Sample