On Saturday, September 10, BondSavvy updated its 48 buy/hold corporate bond recommendations during The Super Bondcast, a subscriber-only fixed income webinar. We host The Super Bondcast four times each year, shortly after companies report quarterly earnings. The Super Bondcast is in addition to The Bondcast fixed income webinar series, where we present new corporate bond recommendations to BondSavvy subscribers every quarter.

This fixed income blog post discusses the following:

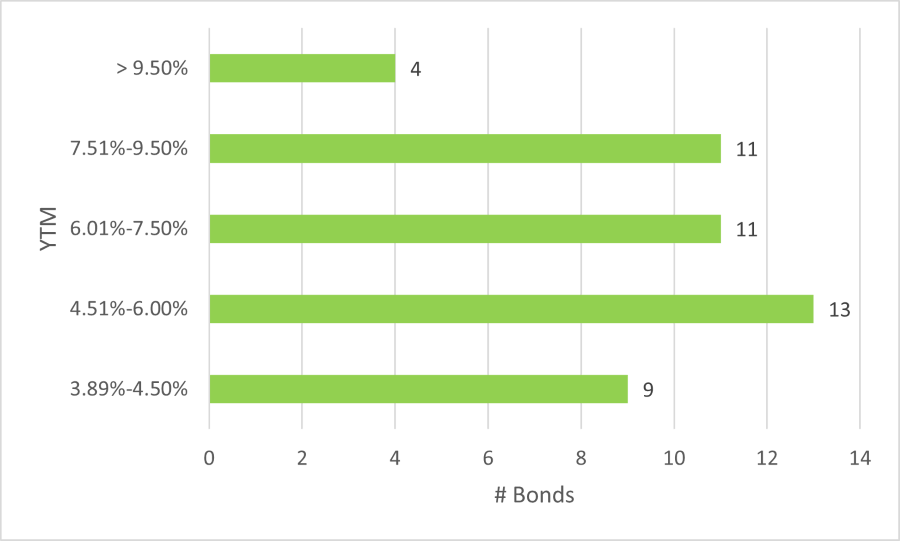

- The range of corporate bond YTMs among BondSavvy's 48 bond recommendations as of September 10, 2022

- The credit quality of our corporate bond recommendations, including their leverage ratios, bond ratings, and year-to-date financial performance

- The size (by revenue) of our recommended bond issuers

- The corporate bond research we include in The Super Bondcast fixed income webinar series

What Are the YTMs of Our Corporate Bond Recommendations?

Providing BondSavvy's subscribers with a variety of investment opportunities is central to the BondSavvy service. BondSavvy recommends corporate bonds across 14 industries and varying yields, maturities, and credit quality. On September 10, 2022, 35 of our 48 recommended corporate bonds had YTMs between 4.51% and 9.50%. As shown in Figure 1, the split out of these 35 bonds was fairly even between YTMs of 7.51% to 9.50%, 6.01% to 7.50%, and 4.51% to 6.00%. We recently recommended our best short term bonds on June 16, 2022, and four of these bonds had yields to maturity of 3.89% to 4.50% on September 10.

Figure 1: Range of YTMs for BondSavvy's Recommendations - September 10, 2022

Source: YTM information provided by Fidelity.com.

This has been a difficult year for bondholders, as many YTMs of our bond recommendations have increased throughout the year. This has created bond buying opportunities we haven't seen in years. Many corporate bonds are trading at all-time lows despite the financial performance of our bond issuers generally being strong.

While the YTMs shown in Figure 1 are compelling on their own, our goal is to achieve corporate bond returns higher than YTMs by selling bonds before maturity to maximize total returns. The analysis we review during our Super Bondcast fixed income webinars lays the foundation for our updated buy/sell/hold recommendations.

What Is the Credit Quality of BondSavvy's Recommendations?

Many bond investors believe that the corporate bond ratings provided by Moody's and S&P are the final word of a bond issuer's credit quality. While corporate bond ratings are important to understand, they are biased toward large companies and do not speak to whether a corporate bond is a good potential investment since they ignore a bond's price, YTM, credit spread, and interest rate risk. Our corporate bond research reviews over 15 factors to determine if we should recommend a bond to BondSavvy subscribers.

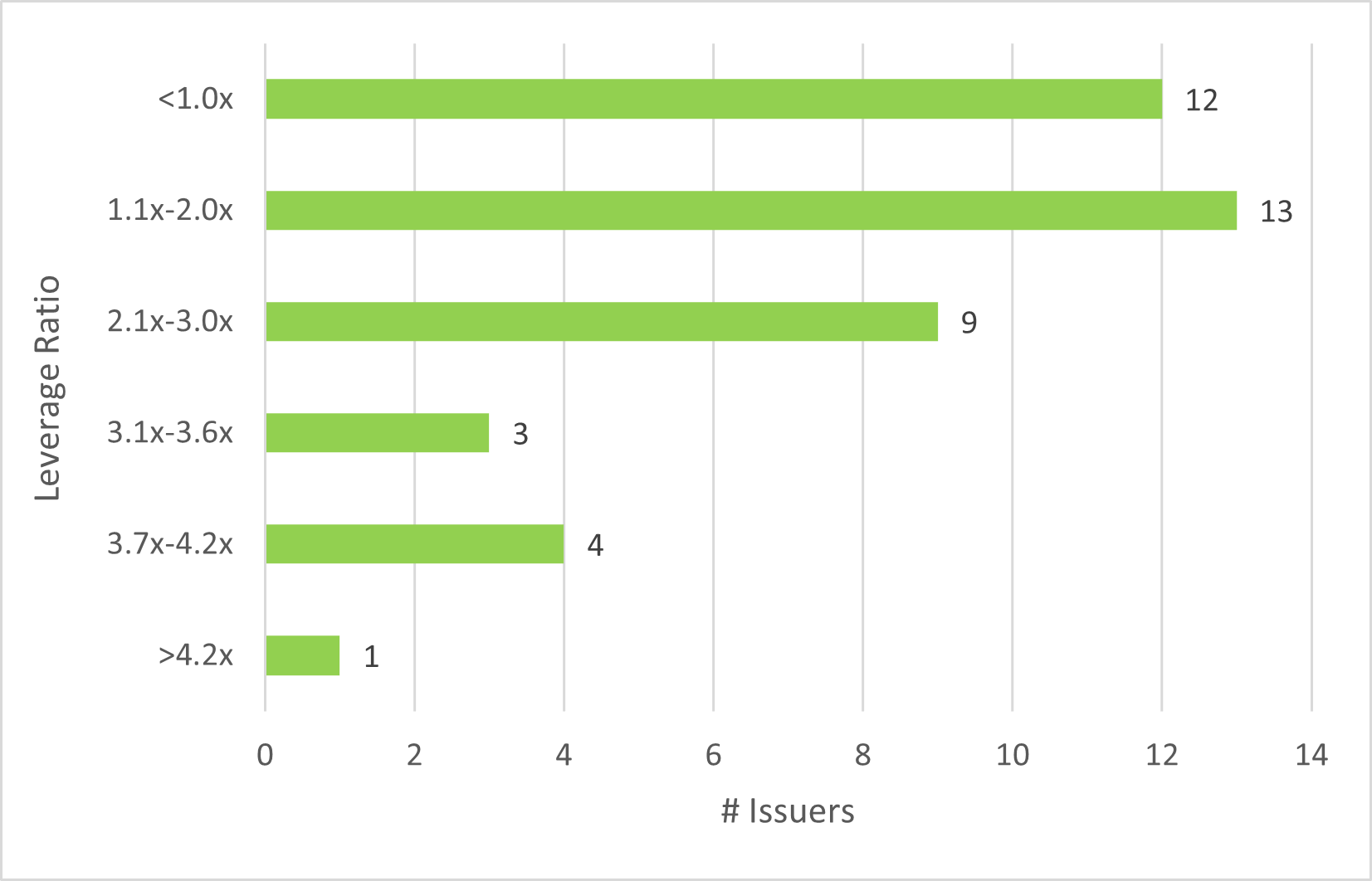

Issuer Leverage Ratios

A key part of our investment analysis is calculating the leverage ratios of bond issuers. A leverage ratio is a company's total debt divided by its EBITDA, or earnings before interest, taxes, depreciation, and amortization. A low leverage ratio (usually 3.0x and lower) means the company has a low level of debt relative to its earnings and, therefore, should, generally speaking, be able to meet its financial obligations. Figure 2 shows the leverage ratios of our 42 bond issuers (Note: for six of our issuers, we recommended two of their bonds, which is why our total bond recommendations numbers 48).

Figure 2: Leverage Ratios for BondSavvy's 42 Recommended Bond Issuers - September 10, 2022

Source: BondSavvy calculations based on publicly available financial information

BondSavvy's goal is to recommend corporate bonds that offer high potential returns relative to the issuing company's risk. On September 10, 2022, over 80% of our bond issuers had leverage ratios of 3.0x or less, signifying a high credit quality for these issuers. Leverage ratios will change based on the financial performance of the issuing companies, which is why we monitor these ratios every quarter. While an issuing company with a 3.0x leverage ratio generally has a low risk of default, several quarters of poor performance could drastically increase this ratio and make us question a company's long-term creditworthiness.

The bond issuer that has the highest leverage ratio across our 42 bond issuers had a 1.1x leverage ratio when we first recommended one of its bonds in September 2017.

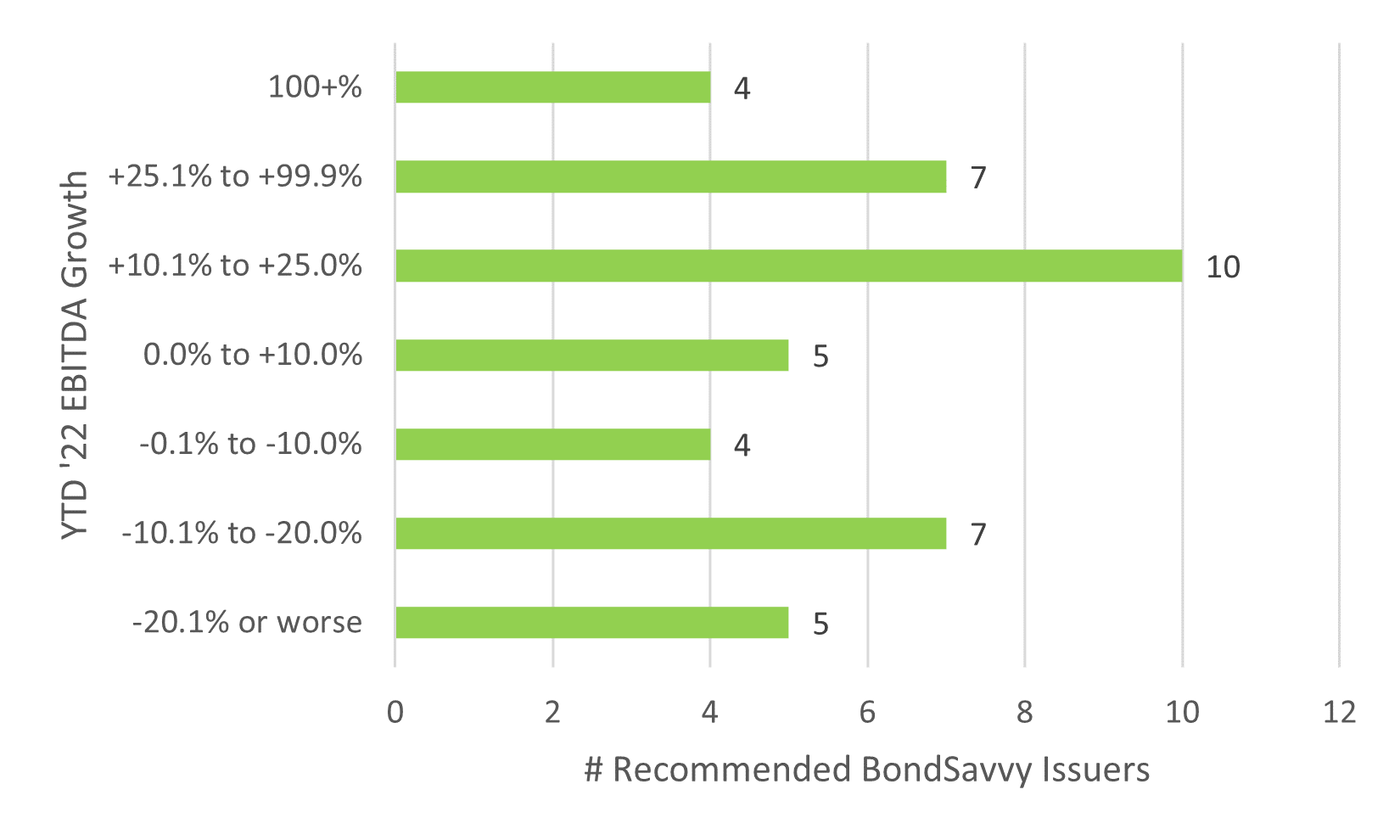

Year-to-Date Issuer Financial Performance

As noted above, BondSavvy has corporate bond recommendations across 14 different industries. Many of these, including oil & gas, have continued to perform well so far in 2022. Industry diversification among our recommended bond issuers is a key part of our investment strategy, as it can enable select groups of bonds to perform well even through difficult times. It also helps limit how closely our recommended bonds' returns are correlated.

As shown in Figure 3, 21 of our 42 issuers (50%) have achieved year-to-date EBITDA growth exceeding 10%, with four achieving EBITDA growth over 100%. On the other hand, there have been 12 issuers that posted year-to-date 2022 EBITDA declines of over 10%.

Figure 3: YTD EBITDA Growth of BondSavvy-Recommended Issuers

Source: BondSavvy calculations based on publicly available financing information.

It's important to keep in mind that weak financial performance over several quarters means different things to different bond issuers. Companies with low leverage ratios, significant cash, and limited upcoming bond maturities can often weather financial performance downturns well. This is why we focus on identifying bond issuers that have strong financials and can take a punch to the gut.

That said, we do recommend high yield bonds, and some of these issuers have materially less cushion than certain of our other recommended bond issuers. This is a key reason why investing in individual corporate bonds is not a "set it and forget it" investment approach. The regular investment monitoring BondSavvy provides subscribers is crucial to successful corporate bond investing.

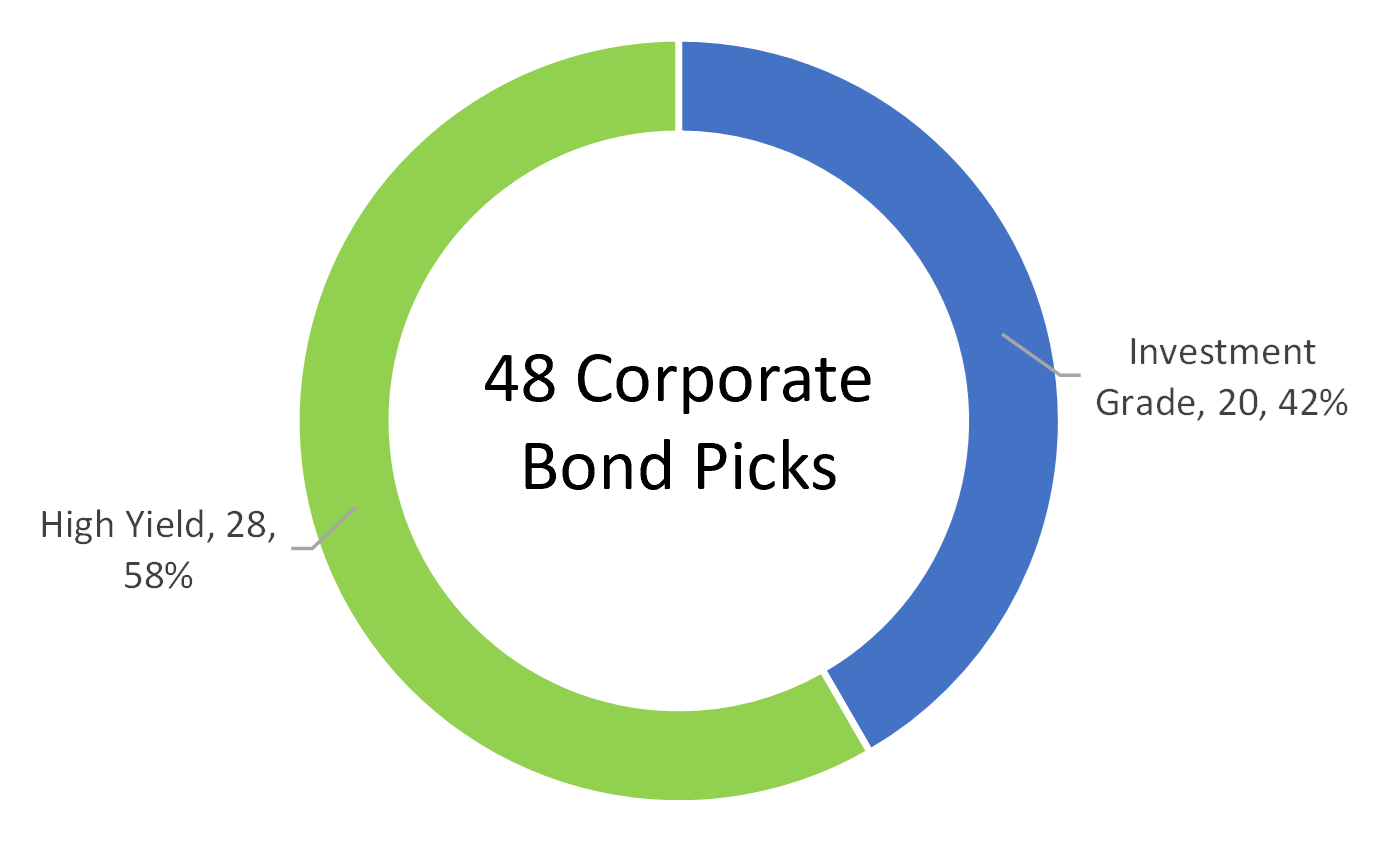

Bond Ratings of Our Recommended Corporate Bonds

While over 80% of our bond issuers had leverage ratios of 3.0x or less, as shown in Figure 4, only 42% of our recommended bonds had investment grade bond ratings as of the September 10, 2022 fixed income webinar. A key reason for this is that, in many cases, corporate bond ratings place a heavy weighting on the size and geographic diversification of bond issuers, with larger and more global companies typically receiving higher bond ratings than smaller, US-focused companies.

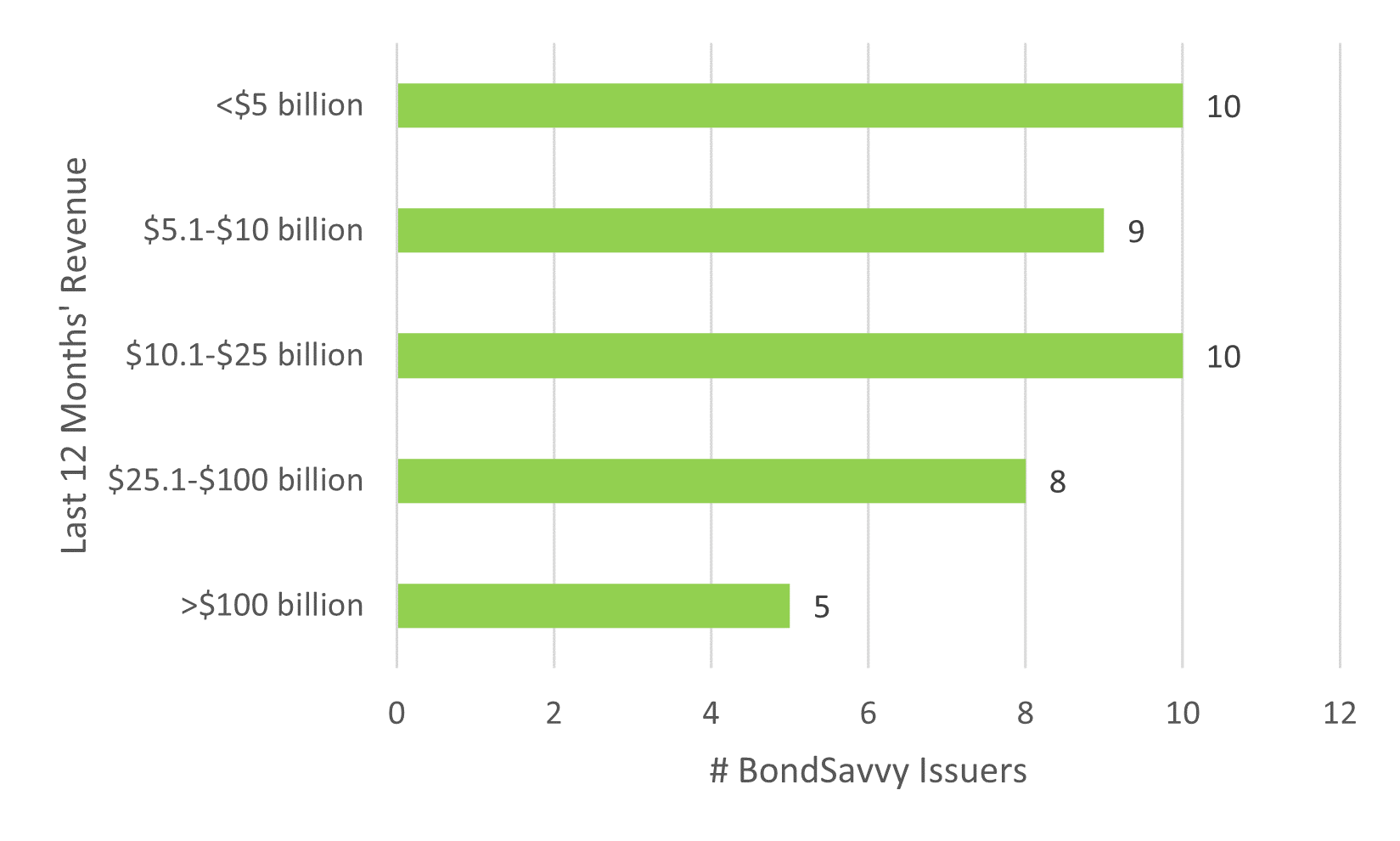

While BondSavvy does recommend a number of bonds issued by global behemoths, as shown further below in Figure 5, only five of our forty-two issuers have annual revenue of more than $100 billion. In addition, a significant portion of our bond issuers generate the majority of their revenues in the US and North America.

High yield corporate bonds are generally less sensitive to changes in US Treasury yields than investment grade corporate bonds. As US Treasury yields have been rising in 2022, our new bond recommendations have generally been either high yield corporate bonds or short term investment grade corporate bonds.

Figure 4: Corporate Bond Ratings of BondSavvy's Recommendations - September 10, 2022

The Size of Our Bond Issuers

As noted above, while a number of our recommended bond issuers have global businesses, a significant portion of them generate most of their revenues from the United States and North America. Since smaller companies often have lower bond ratings, we have found many compelling corporate bond investments of companies that have either single-B or double-B bond ratings but often have stronger financials than many corporate bonds issued by investment grade issuers.

As shown in Figure 5, 29 of our 42 bond issuers (69%) had annual revenue of up to $25 billion while only five (12%) had annual revenues exceeding $100 billion.

Figure 5: Last Twelve Months' Revenues of BondSavvy's Recommended Issuers*

* Represents trailing twelve months' revenue based on each company's most recently reported financials as of September 10, 2022. Information is from BondSavvy calculations based on public financial filings.

What Is The Super Bondcast Fixed Income Webinar?

During each edition of The Super Bondcast, we review the financial performance of each of our bond issuers, the performance of each recommended bond, and the relative value of each corporate bond recommendation. This culminates in an updated buy/sell/hold rating for each of our recommended individual corporate bonds.

The Super Bondcast fixed income webinar series is in addition to The Bondcast and BondSavvy Live webinars BondSavvy provides its subscribers. BondSavvy presents new corporate bonds recommendations during The Bondcast and BondSavvy founder Steve Shaw answers subscriber bond investing questions during BondSavvy Live.

The Super Bondcast's Investment Analysis

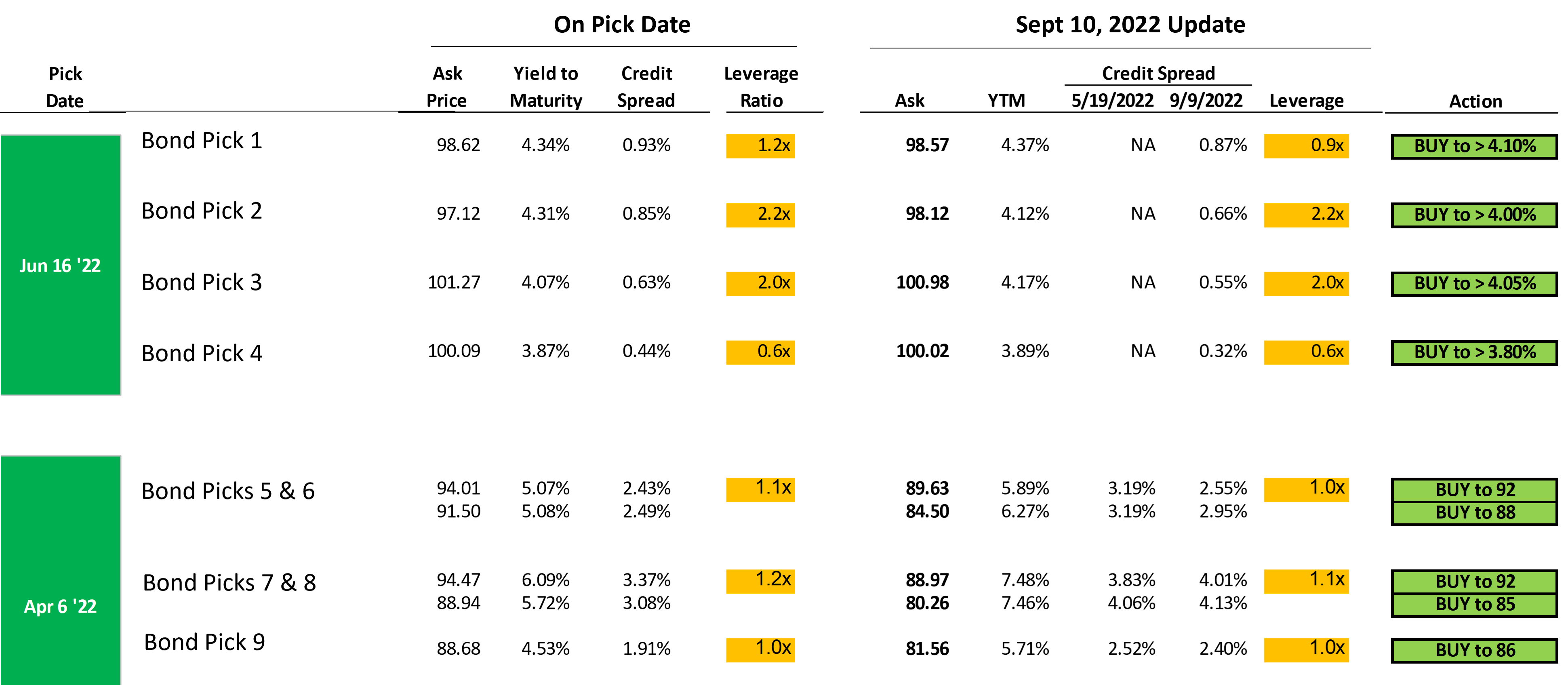

When BondSavvy makes an initial 'buy' recommendation during The Bondcast, our work is only beginning. We employ an active fixed income strategy that seeks to maximize the total return of each bond recommendation. During each edition of The Super Bondcast fixed income webinar, we review each company's recent financial performance. Then, as shown in Figure 6, we update BondSavvy subscribers on changes in a bond's price, its YTM, credit spread, and leverage ratio.

Figure 6: Review of Bond Pricing and Financial Metrics

The "Pick Date" column indicates the date on which we presented The Bondcast to subscribers. We generally recommend between four to six new corporate bonds during The Bondcast. Figure 6 shows 9 of BondSavvy's 48 corporate bond recommendations. Since we updated these metrics for the September 10, 2022 Super Bondcast, as expected, there wasn't much difference in leverage ratios between the Pick Date and September 10, 2022. The Super Bondcast included Q2 2022 financials, whereas the June 16, 2022 picks followed companies reporting Q1 2022 earnings and the April 6, 2022 picks followed year-end financial reporting.

On June 16, 2022, we recommended our best short term corporate bonds. As shown in Figure 6, these bond prices have hardly moved since the pick date given their short term maturities. As these bonds are still available at prices at or near the pick date price and the financials are largely unchanged, all four of our recommended bonds from June 16 are still "buys," as shown in the Action column. Since these are short term bonds with, typically, small price movements, we show a minimum YTM that a new bond purchase should have for each recommendation.

Many corporate bond prices have fallen since our April 6, 2022 edition of The Bondcast fixed income webinar. Similar to the June 16, 2022 picks, the updated leverage ratios are largely unchanged for the bonds shown in our April 6, 2022 recommendations. Since prices have fallen and credit risk is unchanged for these corporate bonds, they remained buys as of our September 10, 2022 fixed income webinar.

How Do I Learn Which Bonds BondSavvy Recommends?

We founded BondSavvy so more individual investors could benefit from the income, safety, and growth individual corporate bonds can provide. We also wanted to put investors in control of their portfolios by providing them the information they need to make sound bond investment decisions. With many bond prices at historic lows, there are many corporate bond investment opportunities that can drive strong, long-term investment returns.

BondSavvy's corporate bond recommendations are available exclusively to BondSavvy subscribers. Click the orange "Get Started" button to review our subscription options and benefits. You can also click the "Watch Free Sample" button to view a sample edition of The Bondcast. We hope to welcome you as a new BondSavvy subscriber.

Get Started

Watch Free Sample