BondSavvy Launches Additional Investment Strategy Focused on Short Term Corporate Bonds.

What has been surprising about the 2022 bond bear market is how far many short term investment grade corporate bond prices have fallen. While some long-dated investment grade corporate bonds have fallen 20+ points, many short term corporate bonds have fallen 15 points from their peaks.

These bond price declines have driven many short term corporate bond yields to 4% and higher. In late-July 2021, these short term bond yields were generally around 1%. These short term corporate bonds have become buying opportunities and are now part of an additional BondSavvy investment strategy we discuss in this fixed income blog post.

How the Best Short Term Bonds Have Become Buys

On June 16, 2022, BondSavvy recommended its four best short term corporate bonds during The Bondcast, a quarterly subscriber webcast. Figure 1 shows the historical bond price and YTM of a short term bond we recommended that had a 2025 maturity date. Subscribe to BondSavvy to learn the name, CUSIP, and investment rationale for this corporate bond and all 48 individual corporate bonds we currently rate buy or hold.

Figure 1: Historical Bond Prices and YTMs of Bond BondSavvy Recommended June 16, 2022

Source: FINRA TRACE market data

This short term bond price peaked at 116 during November 2020. Since then, the bond has been on a steady decline, falling to around 98 in mid-June 2022. We made the short term bond shown in Figure 1 a "buy" on June 16, 2022. From September 2020 until September 2021, this bond had a YTM of 1.00% to 1.50%, keeping it far away from our bond recommendations list.

Short Term Bonds: A New Opportunity for Bond Investors

As noted above, many short term corporate bonds, for a large part of 2020 and 2021, had YTMs of around 1%. As BondSavvy's primary fixed income investment strategy focuses on maximizing total returns, these bonds had not previously been of interest to us.

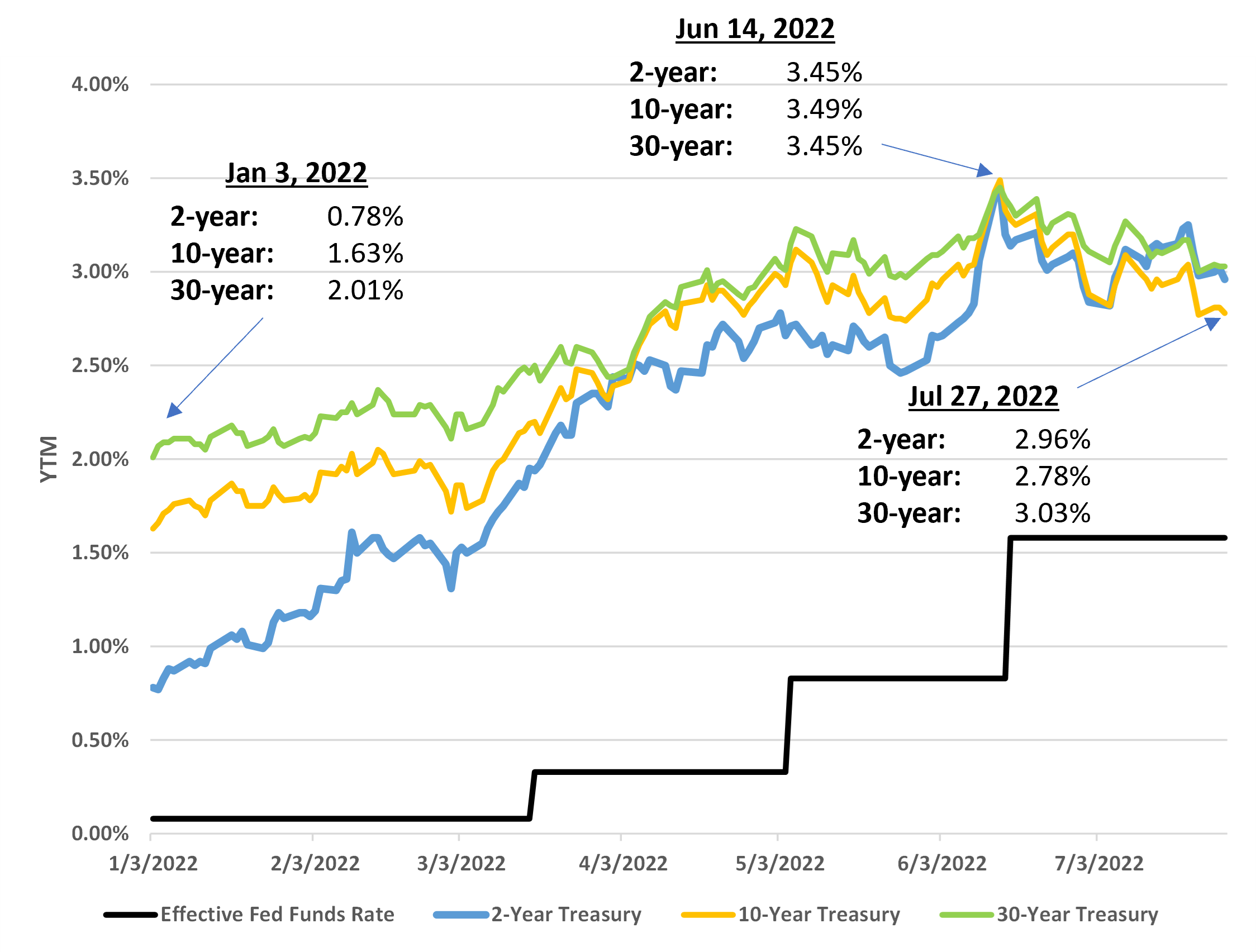

This all changed as 2022 progressed, and short term corporate bond yields began approaching 4%. Investment grade corporate bonds trade as a spread to US Treasurys, as we discuss in our credit spreads blog post. As US Treasury YTMs surged during the first half of 2022, this caused the YTMs of many corporate bonds to spike. As shown in Figure 2, the two-year US Treasury YTM increased from 0.78% on January 3, 2022 to 3.45% on June 14, 2022, a 2.67 percentage point (or 267 basis point) increase. The increase in the two-year US Treasury YTM was the key driver for many short term corporate bond yields increasing to 4%.

Figure 2: US Treasury Yields and Effective Fed Funds Rate -- Jan 3 - Jul 27, 2022

Sources: US Treasury and New York Federal Reserve Bank data.

While short term bonds' near-term maturity dates limit their potential upside and investment return, we like their reliability and lower volatility. In addition, BondSavvy currently has subscribers in approximately 45 U.S. states and 10 countries. Each BondSavvy subscriber has different bond investing objectives. This additional investment strategy will enable us to serve a broader group of investors while empowering our subscribers to add exposure to bonds with steady income and less volatility.

Diversification Within a Corporate Bond Portfolio

While BondSavvy does not provide personalized advice on bond portfolio construction, we do have some guiding principles on bond portfolio diversification.

We first believe it's important to own both investment grade and high yield corporate bonds, as these bonds are driven by a variety of factors, some of which are not correlated.

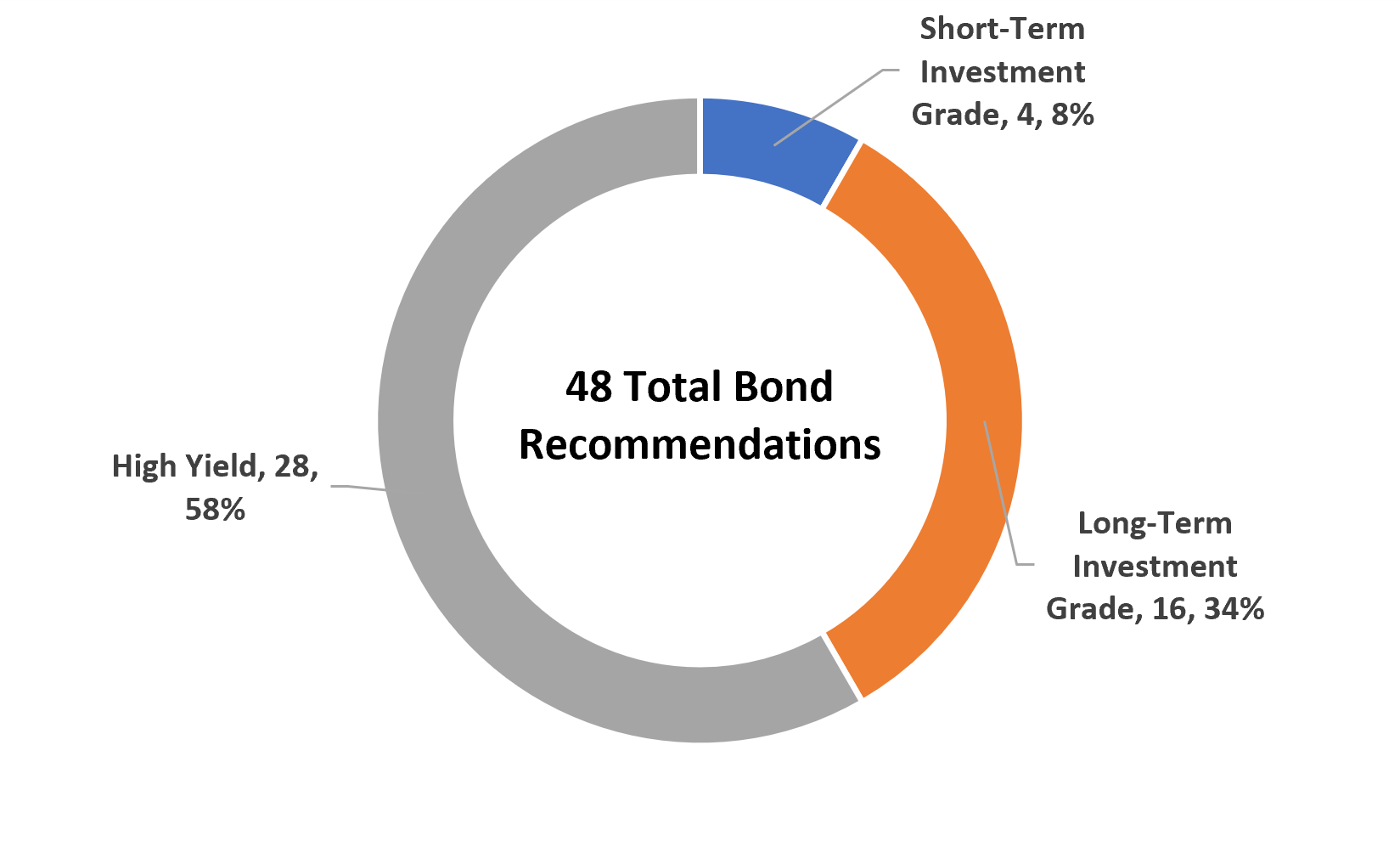

Figure 3 shows the breakout of BondSavvy's 48 corporate bond recommendations rated either buy or hold on July 26, 2022. Of our recommendations, 58% (28 bonds) have high yield bond ratings while 42% (20 bonds) have investment grade bond ratings. Over time, the composition of these recommendations may change based on opportunities in the market and which recommendations we sell. In the near term, we hope to add more short term corporate bond recommendations; however, that will depend on whether opportunities currently available are here to stay.

Figure 3: Breakout of BondSavvy's 48 Corporate Bond Recommendations as of July 26, 2022

Owning a variety of corporate bonds can position investors to navigate across changing market conditions. For example, if a recession causes the Fed to lower interest rates and US Treasury yields fall, this would benefit investment grade corporate bonds, which are heavily impacted by changes in US Treasury yields. If the recession were severe and hurt the financial performance of bond issuers, the impact would generally be felt more heavily on high yield bond prices, which typically have a greater sensitivity to issuing company financial performance. As a result, investing solely in high yield corporate bonds heading into a recession could result in weak near-term investment performance.

Industry Diversification of Corporate Bond Recommendations

We believe investors should also own corporate bonds across a variety of industries. As of the date of this writing, our 48 bond recommendations rated either buy or hold represented 14 industry groups. While there can be bond market sell-offs that cause bonds across industries to fall in price, there will be bonds within certain industries that can hold up. For example, during the Q1-Q2 2022 bond market sell-off, our high yield oil & gas bonds have generally held their values.

Preview of Our Best Short Term Corporate Bond Recommendations

During the June 16, 2022 edition of The Bondcast, BondSavvy founder and fixed income expert Steve Shaw presented our four best short term corporate bonds to BondSavvy subscribers. The bond recommendations included issuing companies from four industries: aerospace & defense, agriculture, technology, and healthcare. Three of the best short term bonds had maturity dates in 2025-2026 and the fourth bond had a 2028 maturity date.

As shown in Figure 4, these short term bonds have slightly increased in price since the June 16, 2022 recommendation date. We evaluate a bond's value, in part, by comparing its YTM and credit spread to its leverage ratio. While revenue and EBITDA growth of the issuing companies has varied, leverage ratios between 0.6x and 2.2x are on the conservative end of bond issuers with investment grade bond ratings. Companies with low leverage ratios are well positioned to weather everchanging economic conditions.

Figure 4: Preview of BondSavvy's Best Short Term Corporate Bond Recommendations

Bond | Jun 16 '22 Offer Price | Jun 16 '22 Offer Price YTM | Jul 26 '22 Offer Price | Pick Date Leverage Ratio |

| Short Term Corporate Bond 1 | 98.62 | 4.34% | 100.45 | 1.2x |

| Short Term Corporate Bond 2 | 97.12 | 4.31% | 100.76 | 2.2x |

| Short Term Corporate Bond 3 | 101.27 | 4.07% | 102.34 | 2.0x |

| Short Term Corporate Bond 4 | 100.09 | 3.87% | 101.74 | 0.6x |

Sources: Offer price and YTM figures are from Fidelity.com. Leverage ratios are calculated by BondSavvy using publicly available company information.

Objective of Our Best Short Term Bond Recommendations

To use a baseball analogy, the goal with our new short term corporate bond recommendations is to hit singles and maybe some doubles. These bonds are currently priced close to their par value and, as we approach the bond maturity dates, the bond prices should stay close to par value. While the upside of these bonds is markedly less than many long-term investment grade corporate bonds now priced in the 70s, we believe it's important to own a portion of bonds that can deliver reliable, mid-single-digit returns over the near term.

Examples of Other Short Term Corporate Bonds

Without BondSavvy, individual investors have a daunting task to select among the 9,000 corporate bonds available when they buy bonds online. Our comprehensive corporate bond analysis narrows down the bond universe from thousands of bonds to a select number we recommend quarterly to our corporate bond newsletter subscribers.

Investors must subscribe to BondSavvy to learn the names and CUSIPs of our best short term bonds shown in Figure 4. To provide more context on recent movements of short-term corporate bond prices, we show, in Figure 5, examples of short term corporate bonds issued by well-known companies.

While these short term bonds are not currently on our recommended corporate bonds list, we had previously recommended and sold the Lennar '25 (CUSIP 526057BV5) and Marriott Int'l '26 (CUSIP 571903AS2) bonds as shown in our corporate bond returns page. For the Lennar '25 bond, we achieved a 27.18% investment return vs. 15.67% for the iShares HYG corporate bond ETF. For the Marriott Int'l '26 bond, we achieved an 8.89% investment return vs. 7.60% for the iShares LQD corporate bond ETF.

What's most noticeable in the below short term corporate bonds is how significantly the YTMs have increased and bond prices have fallen over the last year:

Figure 5: Examples of Additional Short Term Corporate Bonds (Not Current BondSavvy Recommendations)

Bond |

CUSIP | Aug 02 '21 Offer YTM | Jul 26 '22 Offer YTM | Aug 02 '21 Offer Price | Jul 26 '22 Offer Price |

| Lennar Corp. 4.75% 5/30/25 | 526057BV5

| 1.17% | 4.46% | 112.51

| 100.76 |

| Owens Corning 3.400% 8/15/26 | 690742AF8 | 1.29% | 4.35% | 109.74

| 96.50 |

| Oracle Corp. 2.65% 7/15/26 | 68389XBM6

| 1.25% | 4.26% | 106.39

| 94.19 |

| Marriott Int'l Inc. 3.125% 6/15/26 | 571903AS2

| 1.44% | 4.15% | 107.48

| 96.35 |

Sources: July 26, 2022 offer prices and YTMs are top-of-book prices from Fidelity.com. August 2, 2021 prices and YTMs are from FINRA TRACE market data.

What a Difference a Year Makes

One year ago, we would not have considered any of the bonds shown in Figure 5. While these investments did not make our best short term corporate bonds list on June 16, 2022, we want to show investors the types of bonds currently available. Depending on how the corporate bonds in Figure 5 compare to other potential corporate bond investments, we may add them to our bond recommendations list in the future.

Capitalize on Short Term Bond Buying Opportunities

With the US Federal Reserve increasing interest rates and recent sky-high inflation, many bond investors have packed it in and sold their bond investments. This has caused many bond prices to fall significantly despite continued strong financial performance of many corporate bond issuers.

In light of current bond market conditions, the key question for bond investors is: which bonds should I buy? BondSavvy takes the guesswork out of bond investing by presenting a select number of new corporate bond recommendations each quarter. These include recommendations across credit quality, maturity dates, and industry groups. All subscribers have to do is review our easy-to-understand recommendations and select the bonds they want to add to their bond portfolios.

We founded BondSavvy to make bond investing easy and more profitable. Click "Get Started" to learn about BondSavvy's subscription options.

Get Started

Watch Free Sample