BondSavvy founder Steve Shaw, the leading expert on recommending individual corporate bonds to individual investors, presented the best corporate bonds to BondSavvy's investment newsletter subscribers on May 20, 2021.

This fixed income blog post contains summaries of the four recommendations and key investment themes informing our investment analysis and recommendations.

Apart from these four best corporate bonds we recommended, as of the date of this article, BondSavvy had twenty other corporate bonds rated 'buy.'

On June 3, 2021, we will update all current buy/sell/hold recommendations during The Super Bondcast based on each bond issuer's financial performance

and the trading performance of each recommended corporate bond.

The Best Corporate Bonds: Recommendation Summary

Figure 1 shows a summary of our May 20, 2021 corporate bond recommendations, our view of the best corporate bonds available to self-directed retail investors.

Subscribe to BondSavvy to learn the names and CUSIPs of these best corporate bonds so you can add them to your bond portfolio.

Figure 1: Best Corporate Bonds Presented May 20, 2021*

|

|

Industry |

|

Leverage Ratio |

|

Pick Date

Offer Price |

|

May 28

Offer Price |

| Bond recommendation 1 |

|

Media |

|

3.7x |

|

98.50 |

|

99.95 |

| Bond recommendation 2 |

|

Technology |

|

1.1x |

|

92.42 |

|

94.03 |

| Bond recommendation 3 |

|

Retail |

|

1.4x |

|

87.02 |

|

88.66 |

| Bond recommendation 4 |

|

Healthcare |

|

2.7x |

|

97.07 |

|

97.52 |

* Leverage ratios calculated by BondSavvy based on information contained in company financial filings. Offer price data sourced from Fidelity.com.

In Figure 1, we have indicated broad industry groups to provide prospective subscribers a flavor of the industries in which we recommend corporate

bonds. Since our first set of corporate bond recommendations in September 2017, we have recommended corporate bonds across 12 industry groups, including

retail; grocery; transportation; auto; food & agriculture; travel & leisure; natural resources; homebuilders and related; infrastructure; manufacturing;

healthcare; and media, communications, and technology.

Of our four new best individual corporate bonds, two had investment grade bond ratings while

the other two were rated below investment grade (also known as high yield bonds). While bond ratings do not tell investors whether a bond is

a good investment (only BondSavvy does that), they do influence how sensitive corporate bond prices are to rising interest rates,

which impacts bond selection as we discuss below.

Price movements of best corporate bonds since May 20

As we discussed in our impact on corporate bond trading blog post, we have taken several steps to limit the market impact of our corporate bond recommendations. For example, beginning on the March

11, 2021 edition of The Bondcast, we presented new recommendations when the market closed at 5:00pm EDT to help disperse the trading activity

of our recommended bonds.

Our goal is for our subscribers to be able to buy the best corporate bonds at prices at or near the pick date price. As shown in Figure 1, the prices

of our recommended bonds had increased slightly since our May 20 recommendation date. That said, the newly recommended bonds remained 'buys'

at their May 28, 2021 prices.

As shown in our 'Best Bonds to Buy 2021'

blog post, our March 11, 2021 recommendations were, generally speaking, available at prices close to the originally recommended price two months after

the pick date.

Key Themes Informing Our Best Individual Corporate Bonds Recommendations

We begin each edition of The Bondcast with a review of the key themes that were part of our investment selection process. Our bond investing strategy is to identify corporate bonds that can increase in value and achieve

strong total returns. Our corporate bond returns have shown how a select portfolio of the best individual corporate bonds can achieve investment returns higher than the leading bond funds and ETFs.

Our key investment themes for the May 20, 2021 edition of The Bondcast included:

Carefully weigh upside potential with interest rate risk

Since high yield corporate bonds are generally not as sensitive to rising interest rates as investment grade bonds,

the high yield corporate bond market has continued to perform well even as US Treasury yields rose in 2020 and continued increasing in the first part

of 2021. While this has been a good thing for many of the corporate bonds we previously recommended, many high yield corporate bond prices have

increased above par value, which has made finding compelling values difficult. Our goal is to identify these needle-in-a-haystack investments

for BondSavvy subscribers.

Image licensed by Canva

Many investment grade corporate bonds, on the other hand, have seen their prices recently fall given how sensitive investment grade corporate bond

prices can be to rising interest rates. This is especially the case for long-term investment grade corporate bonds, some of which have fallen

20% over the last several months.

Over BondSavvy's history, some of our most successful investments have been when we recommended long-term investment grade corporate bonds at a discount

to par value. We continued this strategy on May 20, 2021, with one investment grade bond recommendation priced at 92.42 and another at 87.02.

The YTMs on these two bonds were between 3.0% and 3.5%, which was par for the course among long-dated investment grade corporate bonds when we conducted

our bond searches. US Treasury yields could continue drifting higher, which is why, to mitigate interest rate risk, we split our four recommendations

evenly between investment grade and high yield corporate bonds. In addition, the YTMs on our two high yield bonds, both of which mature within

10 years, were higher than those of the two long-dated investment grade corporate bond recommendations.

While, after taxes (in the United States), one dollar of capital appreciation is generally worth more than a dollar of interest income, an important focus of ours is selecting bonds

with strong yields relative to their risk.

Beware of low first call date call prices for many high yield corporate bonds

Many investors would be surprised to learn that high yield corporate bonds can have less upside than investment grade corporate bonds. The

reason for this is the different call features of high yield and investment grade corporate bonds.

If a corporate bond is issued with bond ratings below investment grade,

it is typically callable prior to maturity. This means that the bond is redeemable, at the issuer's option, based on a call schedule that indicates

the dates on which, and the prices at which, the bond is callable. For high yield corporate bonds, these call prices create a ceiling on the price

of the bond, as investors would not want to buy a bond materially above the call price if a bond can be called within a short period of time at a price

lower than the purchase price.

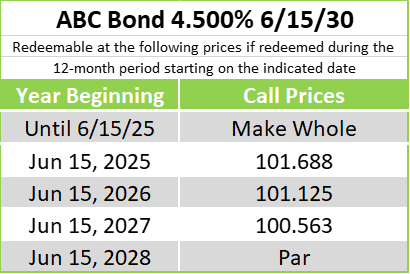

Figure 2 shows the call schedule of a high yield bond issued in June 2020. Technically, the bond is callable between the issue date and June

15, 2025; however, during this time, it is subject to a 'make-whole' call provision where the bond issuer would need to pay the bondholder the present

value of all future interest and principal payments to call the bond during the make-whole period. This is a very bondholder-friendly provision

and very expensive to the bond issuer, which is why bonds are seldom called during a make-whole period.

Of greater interest to the bondholder is the bond call schedule that begins June 15, 2025 at a price of 101.688. It's this call price that puts

a ceiling on the price of this bond. Suppose, on June 15, 2024, an investor was considering buying this ABC bond at a price of 105. At

this price, the bond's current yield would be 4.29% ($45 in annual coupon divided by the bond's $1,050 value). If the bond issuer called the

bond at 101.688 on June 15, 2025, the bondholder would have a 3.15% capital loss. This would take the bondholder's annual return to a paltry

1.13% should the bond be called at that price and on that date.

Figure 2: Sample High Yield Bond Call Schedule

Bond call schedules where the first call price is less than two points above par makes investing in certain high yield corporate bonds difficult, especially

those currently priced close to -- or slightly above -- par value. Many companies issued bonds in 2020 at very low yields. If a bond has

a low yield and little opportunity for capital appreciation, investing in such bonds is a hard case to make.

On the other hand, if a high yield corporate bond is priced at a significant discount to par value and/or it has a compelling yield, we can live with

a low call price, as we could be compensated in other ways. For example, during a recent edition of The Bondcast where we presented the best investments of 2021, we recommended a bond priced at 83.00 that had a YTM of

13.98%. This bond is callable in early 2022; however, should the issuer call the bond on the first call date, we would have achieved over 20

points of capital appreciation plus a mid-teens yield.

Use make-whole call provisions of investment grade corporate bonds to our advantage

Corporate bonds issued with an investment grade bond rating are typically not subject to call schedules such as the one shown in Figure 2. Instead,

these bonds are typically subject to make-whole call provisions for the life of the bond. The make whole call provisions of investment grade

corporate bonds are far more favorable to the bond investor, since, as noted above, the issuer would have to pay the bondholder the present value of

all future interest and principal payments on the bond to effect the call. For a bond that matures in, say, 20 or 30 years, this is a good chunk of

change. Generally speaking, it would not be economical for an issuer to invoke the make-whole call far in advance of a bond's maturity date.

This is why bonds issued with investment grade bond ratings often have greater upside than high yield bonds, as they are not subject to the price ceiling

created by high yield bond call schedules.

Identify the best corporate bonds with compelling relative value

The bedrock of our investment analysis is identifying companies with strong financials and whose bonds represent a compelling value relative to other bonds. In our view, 'value' is

represented by the credit spread, YTM, and price of a bond compared

to the bond issuer's financial strength, the bond's maturity date, and the bond's interest rate risk.

All four of our issuers weathered Covid-19 well, including two issuers that grew EBITDA 12.5% and 20% in 2020. The highest net leverage ratio

of our issuers was 2.5x. One of our issuers, as of March 31, 2021, had more cash than debt.

Our financial analysis is a key part of the puzzle, but we then need to identify the bonds that have the highest upside and yields relative to the

financial strength of the bond issuers we evaluate. We believe the bonds we recommended May 20, 2021 represented strong relative value compared

to other bonds in the corporate bond market.

No oil & gas corporate bonds in these best corporate bonds recommendations

We began recommending bonds issued by oil & gas operators in September 2020. We have been fortunate that these bonds have performed well,

as many of these companies cut costs in 2020 and now have wind in their sails given the recent surge in oil prices.

Investors conducting a Fidelity bond search would

see many high yield oil & gas bonds at low prices and high yields. We did not make additional oil & gas bond recommendations as part

of this presentation of the best corporate bonds. As noted above, we do believe in diversifying across industries and seek to limit concentration

of our recommendations in one particular industry. Over time, if we recommend sales of previously recommended oil & gas bonds, we may recommend

additional oil & gas bonds if we find new compelling investment opportunities.

Why Subscribe to Bondsavvy

We founded BondSavvy to empower individual investors to generate income, drive growth, and

preserve capital with individual corporate bonds. Stocks, bond funds, and muni bonds can potentially achieve one or two of these goals, but only

with BondSavvy's best corporate bonds recommendations can investors achieve all three over the long term.

A BondSavvy subscription provides bond investors:

- Unbiased corporate bond recommendations that have outperformed the most popular bond funds and bond ETFs

- Interactive subscriber webcasts where BondSavvy presents new and updated investment recommendations

- A flat subscription fee designed to be a small portion of the investment returns our best corporate bond recommendations achieve

- Unmatched expertise in seeking to identify the best individual corporate bonds for individual investors

We hope you enjoyed this best corporate bonds blog post and that we have the opportunity to welcome you as a new BondSavvy subscriber.

Get Started

Watch Free Sample