We founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. As of November 30, 2025, our recommended corporate bonds included 64 bonds, with 27 rated 'buy' and 37 rated 'hold.

We have exited 85 prior investment recommendations, as shown on our corporate bond returns page. These bonds achieved a median annual return of 9.40% vs. 6.39% for the iShares LQD and HYG corporate bond ETFs.

This fixed income blog post compares Bondsavvy to Stansberry Credit

Opportunities, a competing investment newsletter

published by Stansberry Research that previously recommended bonds but now recommends mostly preferred stocks and

'hybrid' securities.

Why Choose Bondsavvy over Stansberry Credit Opportunities

Figure 1 lists ten reasons to subscribe to

Bondsavvy rather than the Stansberry Credit

Opportunities investment newsletter. Later in this fixed income blog post, we discuss the key differences

among Bondsavvy, Stansberry Credit Opportunities, and another investment newsletter known as the Forbes Lehmann

Income Securities Investor. Later, we review the details of each of the ten reasons investors should choose

Bondsavvy over Stansberry Research.

Figure 1: Ten Reasons to Subscribe to

Bondsavvy over Stansberry Credit Opportunities

Bondsavvy Reviews vs. Stansberry Credit Opportunities Reviews

This fixed income blog post provides our perspective on the advantages of Bondsavvy vs. Stansberry Credit

Opportunities. In addition to our analysis, an investor who subscribed to both Bondsavvy and Stansberry Credit

Opportunities wrote the following on the Bondsavvy reviews page:

|

"I searched long and hard for a service to help me with

corporate bond investing. I have been VERY pleased with Bondsavvy. Overall, the recommendations have

been good. The educational component is outstanding. And Steve is VERY responsive to

subscriber needs and questions. FWIW....I am also a

subscriber to Stansberry's bond newsletter. This product is head and shoulders above

theirs."

-- Eric S., Michigan |

Bondsavvy vs. Stansberry Credit Opportunities

While there are several income investing newsletters, investors should not be led to believe that "income" means

bonds. For example, the Forbes Lehmann Income Securities Investor peddles common stocks, preferred stocks,

closed-end funds, MLPs, etc. In the sample Income Securities Investor newsletter for March 2021, it did not

have a single new individual bond recommendation.

Bondsavvy Subscriber Benefit

About 11,000 individual corporate bonds are available

for online investing each day. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started

Figure 2 provides a brief comparison among Bondsavvy, Stansberry Credit Opportunities, and the Forbes Lehmann Income

Securities Investor newsletter. After the table, we discuss the ten reasons investors should choose Bondsavvy over Stansberry Credit

Opportunities.

Figure 2: Comparison of Bondsavvy to Competing Investment Newsletters

TEN REASONS TO SUBSCRIBE TO BONDSAVVY VS. STANSBERRY CREDIT

OPPORTUNITIES

REASON #1

Stansberry Research does

not disclose investment returns for all of its recommendations. Bondsavvy does.

Bondsavvy's corporate bond returns page

shows the

investment returns for the 150 corporate

bond recommendations Bondsavvy made since the first edition of The Bondcast on September 26,

2017 through October 31, 2025. We disclose the names and CUSIPs of all exited recommendations and investment returns details

for current buy/hold

recommendations. This provides full transparency to prospective investors so they can see the types

of individual corporate bonds we have previously recommended and

the returns the recommendations have achieved.

Through

October 31, 2025, 65% of Bondsavvy's 85 exited investment recommendations have beaten iShares LQD and HYG, the leading

corporate bond ETFs. Twenty-three (23) of these 85 exited recommendations have beaten the iShares

corporate bond ETFs by at least ten percentage points.

In addition to showing our investment

returns, we provide

prospective subscribers with a free sample edition of

The Bondcast,

where investors can see the fixed income investment analysis that accompanies new Bondsavvy corporate bond

recommendations.

Stansberry Credit Opportunities provides no detailed investment returns data

In

reviewing its website, Stansberry Research does not provide one example of a previous recommendation and its

return. Nada. It shows an alleged annualized return, but the time period is not clear, and we don't

know how it's calculated. Since it annualizes its returns, it could have a few past recommendations with

mega returns and a bunch of duds. We also don't know the amount of defaults across the investment

newsletter's previous recommendations. With Stansberry Research, investors are left in the dark.

REASON

#2

Bondsavvy issued sell recommendations at prices a combined 109 points higher than

Stansberry Research for the two known recommendations we have in common.

In reviewing the Stansberry Credit Opportunities website,

we are aware of two bonds where we both recommended buying and then later selling the same bond:

- Tupperware 4.75% 6/1/21 (CUSIP 899896AC8)

- Monitronics 9.125% 4/1/20 bond (CUSIP 609453AG0)

While neither of these bond picks will make the Bondsavvy Hall of Fame, we exited the Tupperware '21 bond

approximately 59 points higher than Stansberry Research and the Monitronics '20 bond approximately 50 points higher

than Stansberry Research. Below are case studies on the Tupperware and Monitronics bond recommendations:

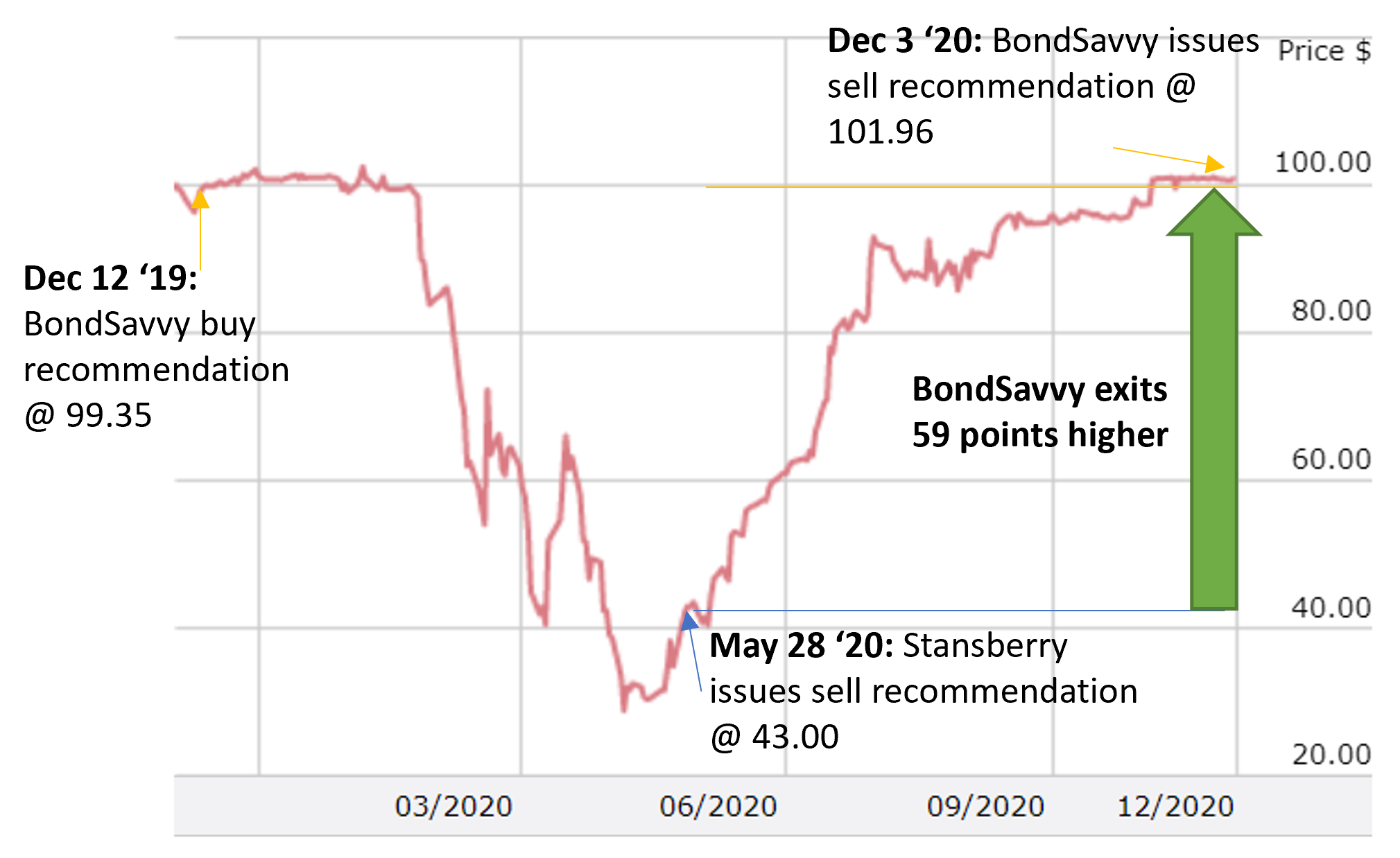

Tupperware '21 Case Study

Both Bondsavvy and Stansberry Research

recommended the Tupperware 4.75% 6/1/21 bond (CUSIP 899896AC8). We recommended the Tupperware bonds December

12, 2019 at 99.35 and sold them December 3, 2020 at 101.96 for a total return of 7.30% compared to a 4.40% return

for the iShares HYG corporate bond ETF. Per Figure 3, Stansberry Credit Opportunities issued a 'sell' of the

Tupperware '21 bonds on May 28, 2020, at which time the bonds were trading at 43.00.

Figure 3: Tupperware '21 Bonds -- Comparison of Bondsavvy vs. Stansberry Research Sell

Recommendations

Pricing data provided by FINRA

market data.

Pricing data provided by FINRA

market data.

During 2020, we issued six updates on the Tupperware bonds. While the first part

of 2020 was ugly for the company, it did start to improve performance and, on November 2, 2020, it received a

financing commitment so it could redeem the 4.75% '21 bonds.

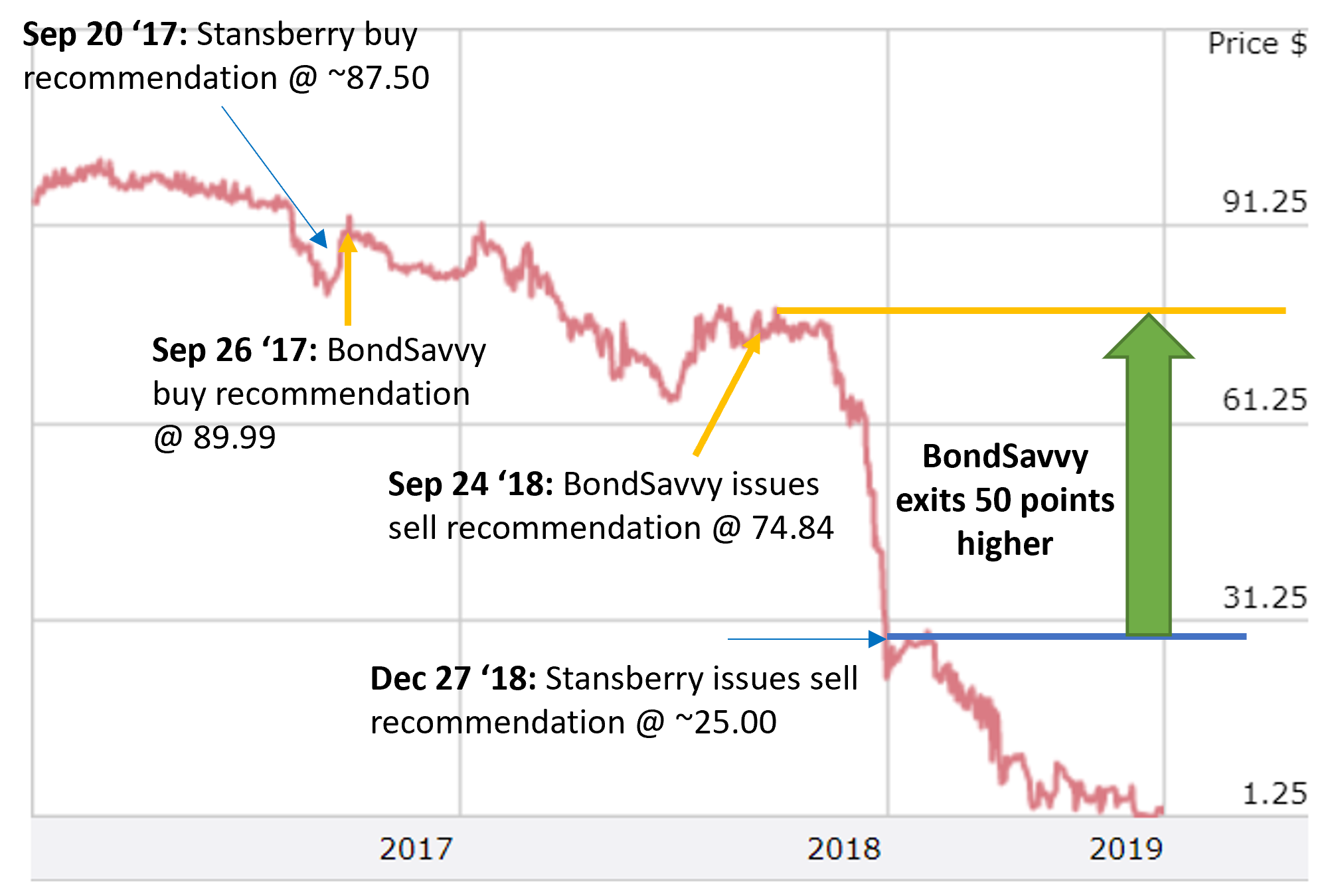

Monitronics '20 Case Study

Both Bondsavvy and Stansberry Research

recommended purchasing the Monitronics 9.125% 4/1/20 bond (CUSIP 609453AG0) in late September 2017. There were

terms in the company's bank agreements that required Monitronics to refinance the '20 bonds well in advance of the

April 1, 2020 maturity date. This shot clock and the company's weak performance put downward pressure on the

bonds, as shown in Figure 4.

After another quarter of weak performance and in the midst of attempted tender

activity for the bonds, Bondsavvy recommended selling the bonds on September 14, 2018 at a price of 74.84,

registering a total return of -7.13%, our fourth-worst return across the 49 bonds we have sold through December 31,

2021. Stansberry Research advised subscribers to keep holding the bonds until December 27, 2018, when it

finally issued a sell on the Monitronics bond, as shown in Figure 4. At this time, the bonds were trading at

approximately 25.00, approximately 50 points lower than the Bondsavvy sell recommendation.

Figure 4: Monitronics '20 Bonds -- Comparison of Bondsavvy vs. Stansberry Research

Sell Recommendations

Pricing data provided by FINRA market data.

From our reading of the Stansberry Research website, it does not appear that it provides quarterly updates on all of

its bond recommendations but rather provides updates on an ad hoc basis: often times, when it's too

late.

REASON #3

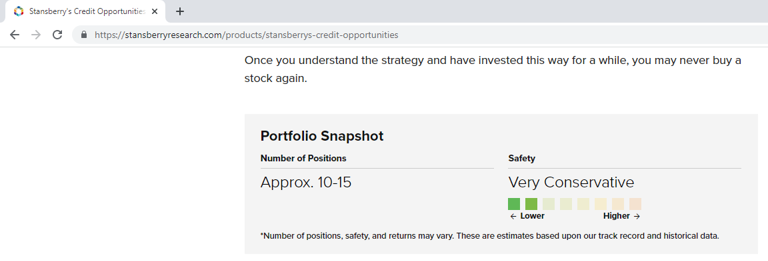

Stansberry Credit Opportunities only recommends 10-15 securities, many of which

are not bonds. Bondsavvy offers subscribers more choice, with a current recommended list of 64 individual

corporate bonds.

We believe it's important for investors to own both investment grade and high yield corporate bonds, as opportunities

arise in different types of bonds over time. Bond investors should not be one-trick ponies. Some of

Bondsavvy's highest investment returns have been from investment grade corporate bonds we recommended purchasing at

significant discounts to par value.

Bondsavvy Subscriber Benefit

Bond ratings do not assess whether a bond is

a good investment, as they ignore a bond's price, YTM, credit spread, and interest rate risk. Our bond recommendations evaluate these foregoing metrics and creditworthiness to identify bonds that can outperform bond funds and ETFs.

Get Started

But Stansberry Credit Opportunities only recommends a small portfolio of 10-15 securities, which includes preferred

stocks, convertible preferreds, tangible equity units, and a few high yield bonds. As of December 23, 2025, Bondsavvy's recommended corporate bonds included 64 individual corporate bonds across both investment grade and high yield bond

ratings.

Bondsavvy seeks to serve investors with a variety of risk appetites. While we take the universe of

approximately 11,000 tradeable corporate bonds down to fewer than 70, our list provides variety across credit

quality, industry sector, and maturity dates. As we write this fixed income blog post, we recommend corporate

bonds across 15 industry groups.

REASON #4

Stansberry Research does not appear to update each recommendation on a

regular basis. Bondsavvy updates its recommendations quarterly and provides

supplemental updates as needed.

For Bondsavvy, our work only begins

when we make an initial buy

recommendation during The Bondcast. Once we make a new bond recommendation, we update our

buy/sell/hold ratings every quarter based on each bond issuer's financial performance and the updated pricing of our

recommended bonds. We update these recommendations during The Super Bondcast, a quarterly

webcast series exclusively available to Bondsavvy's subscribers, which follows quarterly earnings releases. As

part of our bond recommendation updates, we post updated bond prices, YTMs, credit spreads, and leverage ratios in our subscriber dashboard

area.

In addition to our regularly scheduled quarterly updates, Bondsavvy may provide additional updates,

especially during times of market unrest. For example, during 2020, Bondsavvy provided subscribers with 30

email updates on its bond recommendations in addition to our regularly scheduled subscriber

webcasts.

Important to monitor all bonds on our recommended list

A key part of our fixed income investment strategy is

selling bonds before

maturity to maximize capital

appreciation and total investment return. Carefully monitoring the quarterly financial performance of each

Bondsavvy-recommended issuer enables us to determine the level of possible upside -- or downside -- in our

recommended corporate bonds.

REASON #5

Stansberry Credit Opportunities rarely recommends new bonds, favoring preferred stock and other equity

securities. Bondsavvy exclusively recommends individual corporate bonds.

Bondsavvy believes in full transparency. It starts with disclosing the investment returns of each bond recommendation

on the

public portion of the Bondsavvy website and in our subscriber area. We believe more individual investors need

exposure to individual corporate bonds given the advantages of bonds vs. bond funds and bonds vs. stocks. We founded Bondsavvy to empower

investors to benefit from the income, growth, and capital preservation individual corporate bonds can provide.

It's the primary mission of our company.

The name "Stansberry Credit Opportunities" is misleading and does

not accurately represent what the newsletter sells. In reviewing the Stansberry

Research website, of the nine recommendations it

described for 2021, six were for 'hybrid' securities (typically something like a tangible equity unit...Google it),

two were for preferred stock, and one recommendation was for a bond. The word "credit" implies debt.

That the substantial majority of Stansberry Credit Opportunities' 2021 recommendations were for equity securities

speaks to Stansberry Research's lack of credibility and transparency.

REASON #6

Stansberry Research misleads investors by labeling distressed bonds and its

preferred stock and 'hybrid' recommendations as "Very Conservative."

Investment service providers,

including Bondsavvy and Stansberry Research, must provide

prospective subscribers with an accurate assessment of the risks associated with their recommendations.

Bondsavvy does this by disclosing the investment returns of its bond recommendations on its corporate bond returns page, where investors

can see

the range of investment returns we have achieved.

Our recommendations include corporate bonds with bond ratings below investment

grade. We also

recommend investment grade corporate bonds with, generally speaking, over 10 years to maturity. While these

investments are safer than stocks, they can be volatile. Examples of "very conservative" investments, in our eyes, are investments in short-dated investment grade corporate bonds.

It is, therefore,

inexplicable that Stansberry Research misleads prospective investors by labeling its strategy as "Very Conservative"

on its website, as shown in Figure 5. Distressed corporate bonds, Stansberry Credit Opportunities' alleged

focus, are the most risky part of the corporate bond market. These investments are anything but

conservative. In addition, based on our review of the Stansberry Research website, the company seems to have

recommended a fair number of bonds that have later defaulted.

Further, Stansberry Credit Opportunities

now recommends preferred stocks, convertible preferred stocks, and, on May 19, 2021, the tangible equity units of a

pet

pharmaceutical company. These investments, along with the company's distressed debt investments are all

high-risk investments. Stansberry Research labeling this strategy as "Very Conservative" is very

misleading in our book.

Figure 5: Snapshot of

Stansberry Credit Opportunities Risk Assessment

Source: Stansberry Research

REASON #7

A key Bondsavvy

goal is for our subscribers to be able to buy and sell corporate bonds at or near the prices at which we recommend

them. In 2021, we implemented several actions to limit the market impact our recommendations have on the

prices of our recommended bonds. We carefully monitor the prices at which corporate bond trades are executed

in the days following our recommendation dates.

Across 150 previous corporate bond recommendations, we have

seen a material market impact on two recommended bonds, both of which we recommended December 17, 2020. As we

took actions during 2021 to limit our market impact, we have been pleased to see limited market impact over the last several years.

Bondsavvy founder Steve Shaw

knows the inner workings

of how corporate bonds trade online from his experience leading Tradeweb direct and as a senior executive at

BondDesk Group, two leading online bond trading systems. He has presented the state of the US corporate

bond market

for individual investors to the US Securities & Exchange Commission.

Limiting market impact

will always be top of mind at Bondsavvy, and Steve Shaw's corporate bond market experience equips him well to

address this issue.

REASON #8

Stansberry Credit Opportunities' fees are expensive for what you

get. Bondsavvy

subscribers get

more and pay

less.

Bondsavvy's goal is for our

subscription fee to be a small portion of the investment returns our recommendations generate. We also

want our fee to be a small portion of the dollar amount a subscriber invests in individual corporate bonds.

Investment returns will vary over time, and keeping subscription fees at a reasonable level helps subscribers

maximize returns over the long term. As of this writing, Bondsavvy's one- and two-year fees were $825 and

$1450, respectively.

In reviewing the Stansberry Research website, it appears the Stansberry Credit

Opportunities newsletter has issued one or two corporate bond recommendations for all of 2021. At a $5000

annual subscription fee, subscribers are paying either $2500 or $5000 for each recommended bond. Ouch.

Stansberry Research appeared to issue 8-10 additional recommendations of either preferred stock, convertible

preferred stock, tangible equity units, and other equity instruments. We would hate to be the person who paid

$5000 thinking he was going to get bond recommendations and, instead, received a bunch of risky equity

recommendations.

While we do not have investment returns data across all of Stansberry Research's corporate

bond recommendations, given its poor relative performance in the two bond picks we had in common (See Reason #2),

it's doubtful it is producing compelling investment returns across the few corporate bond recommendations it has

made.

REASON #9

The

jury is in, and subscribers strongly prefer Bondsavvy to Stansberry Research. Prospective subscribers can view the Bondsavvy reviews page to see what our subscribers

think of the Bondsavvy investment service. We believe they provide a good flavor for the experience our

subscribers receive.

Stansberry Credit Opportunities only posts about two subscriber reviews on its

site. More Stansberry Credit Opportunities reviews are available on the Stock Gumshoe website. Many of the reviews

voice similar concerns to those mentioned in this fixed income blog post, including that the marketing misrepresents

the service and there are a large number of defaults relative to the newsletter's small number of investment

recommendations.

REASON #10

Stansberry Credit Opportunities is continually bearish on corporate bonds,

regularly predicting "The Coming Credit Collapse."

After reviewing the Stansberry

Research website, we believe we have found why the company no longer recommends corporate bonds: they

don't believe in them. Investment websites are filled with experts and market gurus falling over themselves to

predict the next disaster. While these provocative titles stir panic and may sell subscriptions, they are

typically a disservice to investors.

Below is a list of recently published Stansberry Research

newsletters proclaiming the pending fall of the corporate bond market:

December 17, 2021: "Your Complete Guide to the Coming Credit

Collapse"

December 15, 2021: "Get Ready for the 'Mother of All

Crashes' in 2022

January 20, 2021: "Don't Let the Calm Fool You"

where Stansberry Research lays out its "strategy for surviving the next credit collapse"

April 24, 2020: "Mike DiBiase on the Corporate Debt Bubble"

April 15, 2020: "The Corporate Debt Bubble Is Popping"

November 21, 2018: "Preparing for the 'Volcano' to Erupt" where

Stansberry Research explains "that massive pressure is building beneath the surface of the corporate bond

market."

Bondsavvy's perspective on this is straightforward. There will be times when individual

corporate bonds outperform other asset classes and times when they underperform. Over the long term, however,

we believe individual corporate bonds will outperform bond funds and, in certain periods, stocks.

We

have been able to outperform the leading bond funds by identifying individual corporate bonds that offer strong

yields and potential returns relative to their risk. As of our last bond update on October 9, 2025, 55 of 64 recommended bonds were issued by companies that had leverage

ratios of 3.1x or lower as of the most recent financial reporting period.

Many market pundits have cited a so-called BBB bond bubble. There

are many bond issuers that are, admittedly, IGINO (investment grade in name only) and have financials that don't

support their lofty bond ratings. Our job is stay away from those bonds and others with high risks of

default.

We do not believe in blanket statements such as the ones regularly made by Stansberry

Research. The astute bond investor can find opportunities across a variety of market conditions.

CONCLUSION

Steve Shaw founded Bondsavvy so

more individual investors could benefit from the income, growth, and principal protection individual corporate bonds can provide.

Very few investors own individual corporate bonds, and Steve founded Bondsavvy to change this.

Through his work at Tradeweb and BondDesk Group, Steve saw firsthand how technology had made corporate bond investing

fair for individual investors. The corporate bond market has over 100 dealers that provide live bid-ask quotes for approximately 11,000 individual

corporate bonds each day. Bid-ask spreads are reasonably narrow, and, often times, someone buying 10 bonds can

get a price as good -- or even better -- than a large bond fund purchasing millions of the same bond.

We believe owning individual corporate bonds direct positions investors to maximize returns, limit fees, and know

exactly what is in their portfolios. Selecting among the 11,000 available individual corporate bonds can be a

daunting task for many investors, which is why Bondsavvy recommends a highly curated list of individual corporate

bonds investors can use to decide which bonds are right for them.

Get Started

Watch Free Sample

1Read

our investment

returns calculation page to see assumptions used in this calculation and relevant footnotes.