We founded BondSavvy in 2017 so more individual investors could benefit from the income, capital growth, and relative safety individual corporate bonds can provide. Few investors take advantage of owning corporate bonds and, instead, favor bond funds, stocks, and even -- yikes -- cryptocurrency. We believe the advantages of corporate bonds are too important for investors to overlook; however, it's important investors also understand corporate bonds disadvantages.

Evaluating both corporate bonds advantages and disadvantages is the purpose of this fixed income blog post.

Corporate Bonds Advantages and Disadvantages

This bond investing article is not a sales pitch. We first discuss corporate bonds advantages vs. bond funds, municipal bonds, and stocks. After reviewing these, we then discuss corporate bonds disadvantages. Not all of the disadvantages apply to the other asset classes, which is why we discuss corporate bonds advantages and disadvantages separately.

Based on the information we present, readers can decide whether increasing their exposure to individual corporate bonds makes sense for them.

We will shortly be drafting a fixed income blog post comparing corporate bonds vs. CDs. Many believe a three-year corporate bond with a 4.50% YTM is the same thing as a three-year CD with a 4.50% APY. Since many CDs lock up cash and do not pay investors anything until maturity, they are a much different investment than corporate bonds that pay interest semi-annually and can be sold immediately.

A dollar earned today from a corporate bond interest payment is worth more than a dollar earned by a CD that pays out in three years -- especially in a time of high inflation. More to come on corporate bonds vs. CDs in a later article.

Corporate Bonds Advantages

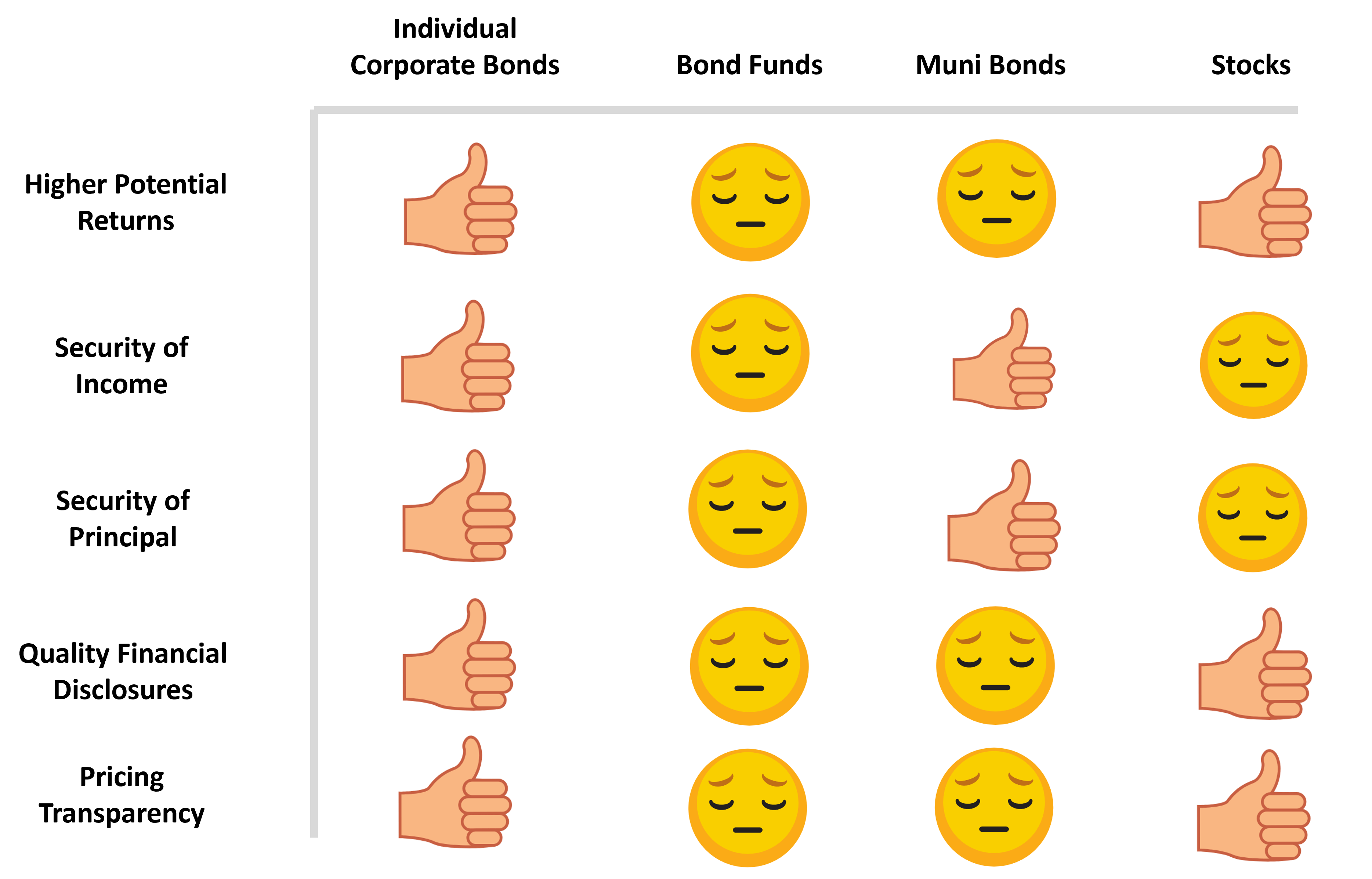

The best way to evaluate corporate bond advantages and disadvantages is to compare corporate bonds to other asset classes across key investment considerations. In Figure 1, we compare individual corporate bonds vs. bond funds, municipal bonds, and stocks.

We evaluate each asset class across five criteria:

- Higher potential investment returns

- Security of income

- Security of principal

- Quality financial disclosures

- Pricing transparency

A 'thumbs up' in Figure 1 means an asset class compares favorably to the others, while a sad face indicates the opposite. For example, security of principal and income are strong across corporate bonds and municipal bonds but less so for stocks and bond funds.

Individual corporate bonds are the only asset class to receive a thumbs up across all five criteria, as shown in Figure 1. Below the graphic we discuss how we arrived at our conclusions and discuss certain caveats.

Figure 1: Corporate Bonds Advantages vs. Bond Funds, Muni Bonds, and Stocks

One caveat we will discuss later relates to the security of principal and income of individual corporate bonds vs. bond funds. In this case, we compare a portfolio of investment grade bonds with a similar duration to the leading investment grade bond funds (typically 6-7 years). Given historical investment grade corporate bond default rates are near zero, we believe investment grade bonds maturing in 6-7 years have a higher security of principal than leading bond funds, as bond funds have no guarantee to be worth a certain amount on a certain date.

In addition, bond fund interest distributions are variable, and certain of these funds have recently seen drastic reductions in investor distributions. We therefore believe a select portfolio of high quality individual corporate bonds can have a higher level of income security than bond funds.

These are general conclusions and should not imply that all individual corporate bonds have a higher security of principal and income than all bond funds.

Corporate bonds advantages: Higher potential investment returns

We will start by acknowledging that, while individual corporate bonds have greater security of income and principal vs. stocks, stocks do have higher potential investment returns. A primary reason for this is that, since stocks don't trade relative to their par value -- like bonds do -- they can increase in price without an upward bound. Therefore, a stock can increase from $25 to $250. A corporate bond may be able to increase from 85.00 to 135.00, but it's uncommon for corporate bonds to increase in price above 150.00. Please note that, as discussed in our par value of a bond blog post, a bond priced at 85.00 is worth 85% of its $1,000 face value, or $850.00.

Higher potential investment returns: Individual corporate bonds vs. bond funds

BondSavvy presents new corporate bond recommendations each quarter during The Bondcast, an exclusive interactive subscriber webcast. From the 9,000 available corporate bonds, we typically recommend between four and six new corporate bond CUSIPs. We strongly believe in quality over quantity to increase investment returns. We look under the microscope to identify investment opportunities that can outperform the leading bond funds and ETFs.

Mega bond funds such as VBTLX and iShares AGG take the opposite approach. These bond funds are so big that they have to own virtually every bond in the market. As more money pours into these funds, they have to buy more bonds, regardless of whether the bonds are worth owning. For bond funds, it is quantity over quality.

Many bonds owned by bond funds are priced well above par value and have little if any capital appreciation opportunities. Many others do not represent compelling risk-reward opportunities relative to other available bonds. Since, due to their size, bond funds seem to own virtually every bond in the market, they own thousands of bonds set to underperform.

Our corporate bond returns page compares the investment returns of our individual corporate bond recommendations vs. those of the iShares HYG and LQD corporate bond ETFs. Through November 30, 2022, our exited recommendations had outperformed the iShares ETFs for 75.5% of our picks. In addition, in 17 of 53 exited recommendations, BondSavvy outperformed iShares by at least 10 percentage points. In only two recommendations did iShares outperform BondSavvy by at least 10 percentage points.

Higher potential investment returns: Individual corporate bonds vs. municipal bonds

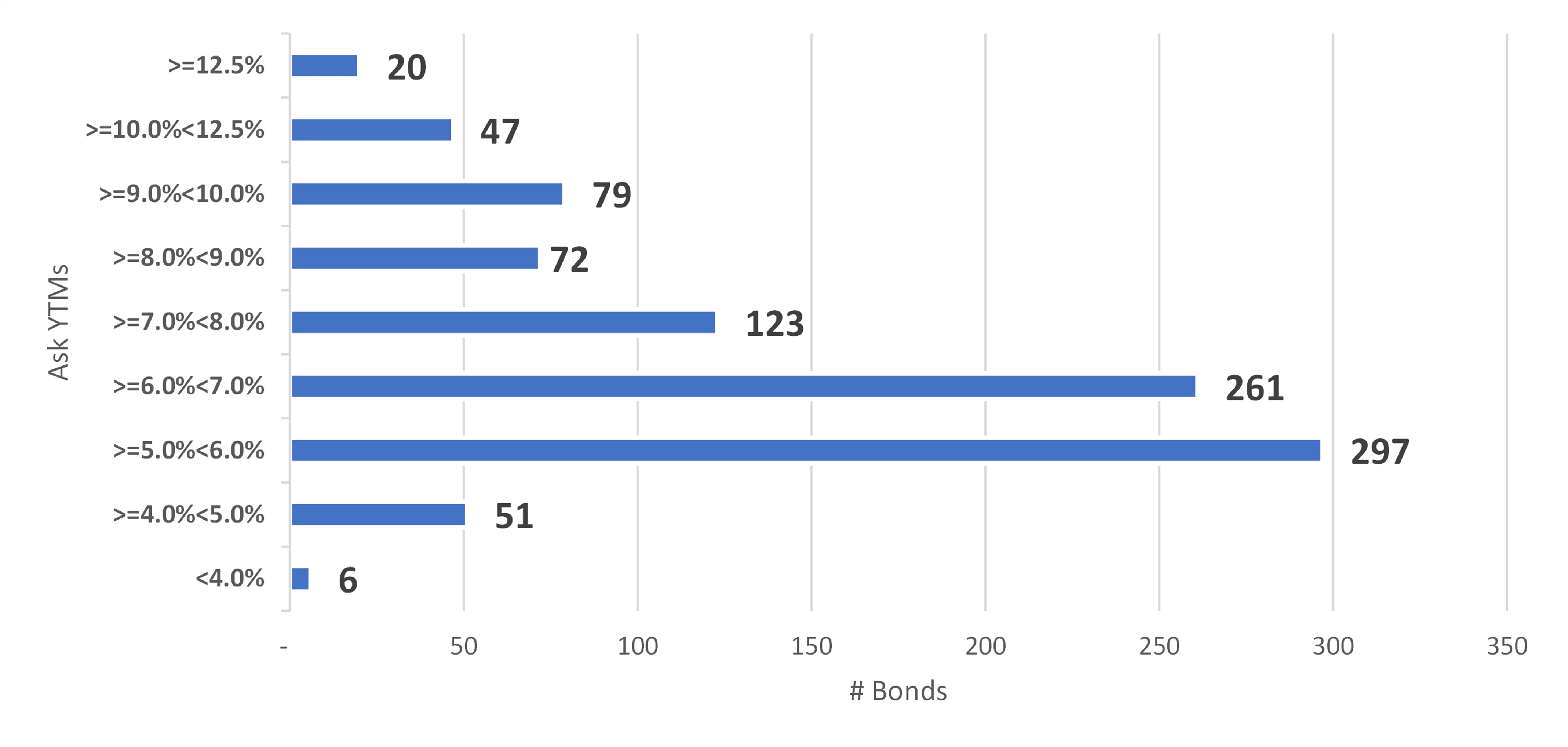

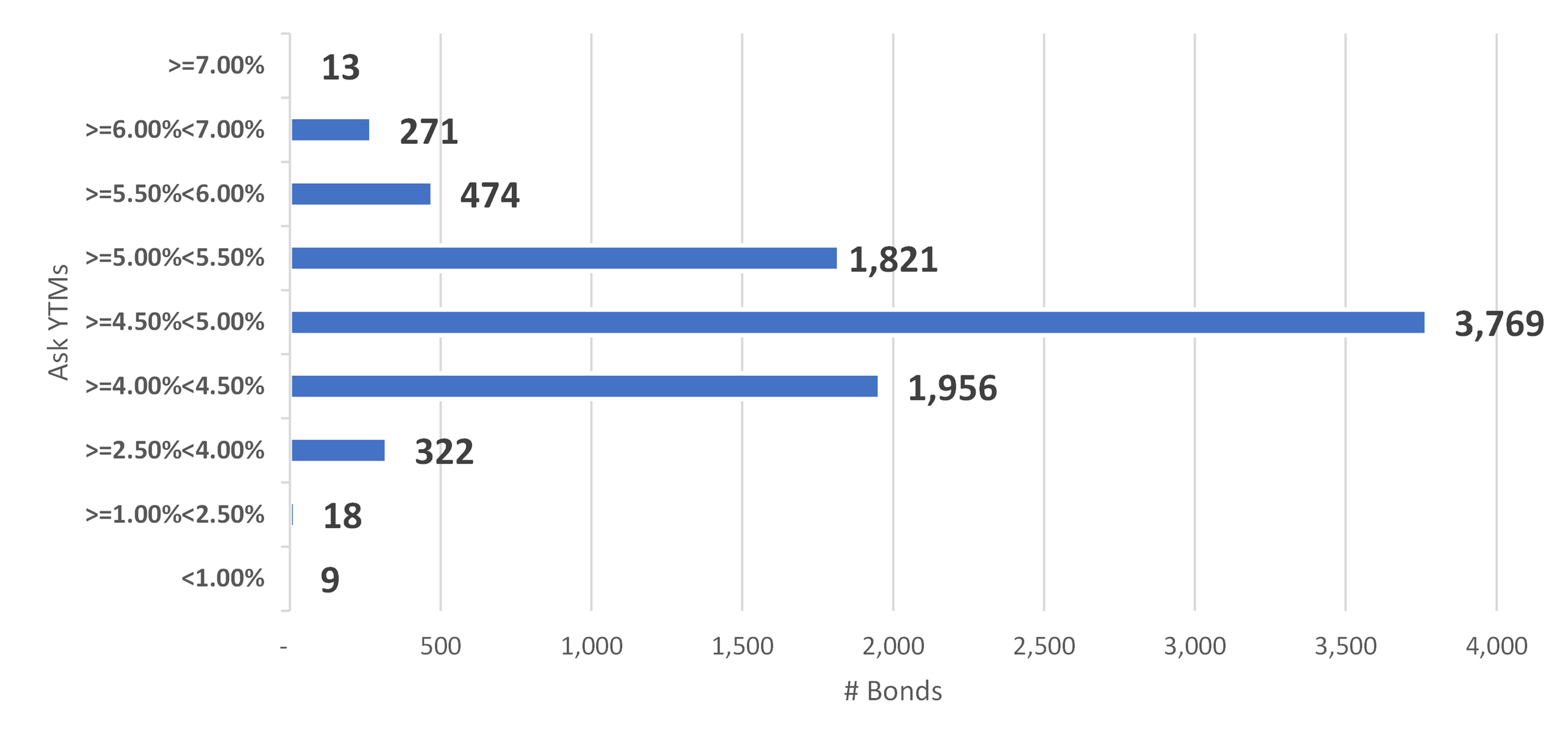

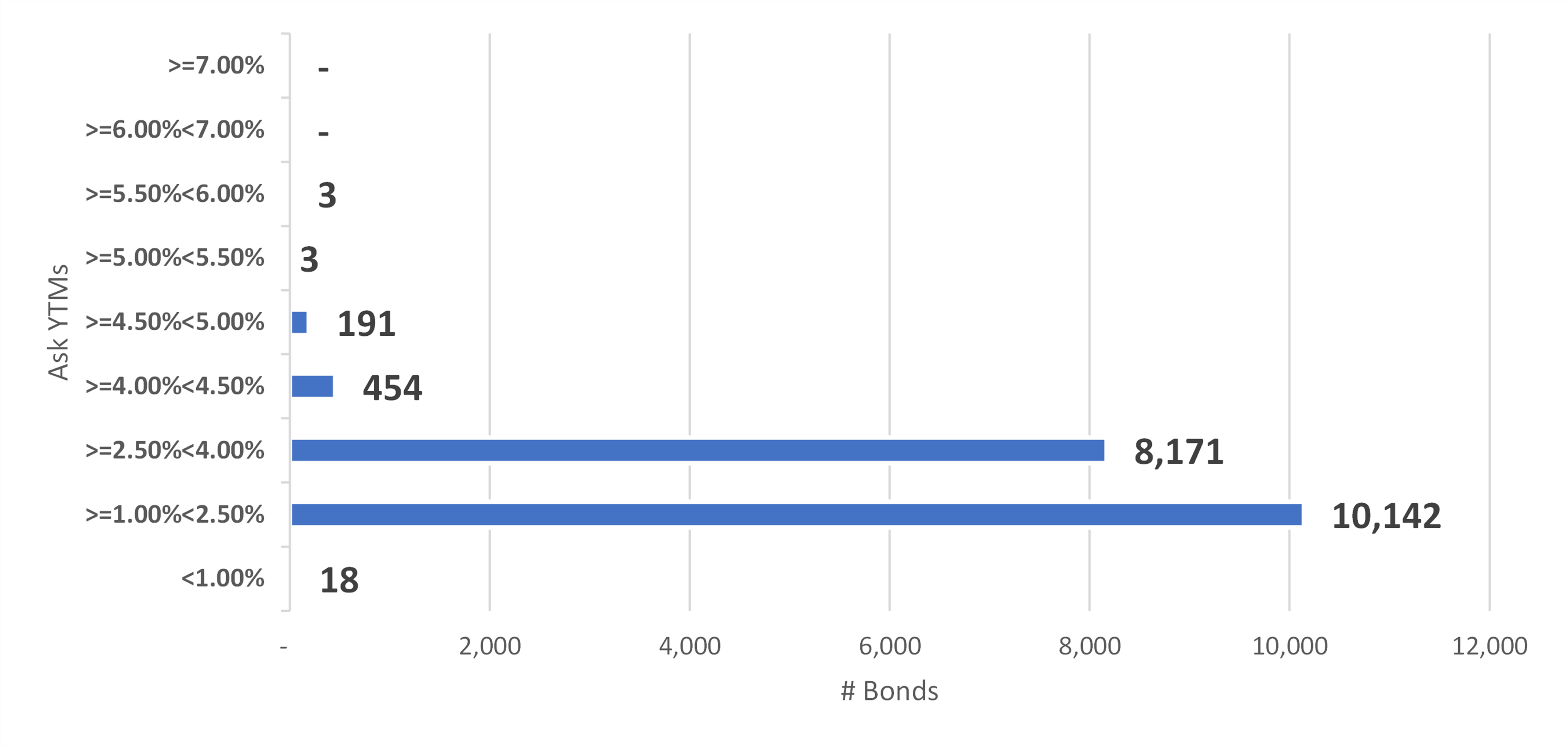

There are a much larger quantity of corporate bonds with higher yields and return opportunities than municipal bonds. Figures 2 through 4 compare the bond YTMs for high yield corporate, investment grade corporate, and municipal bonds. The analysis covers bonds available for trading on Fidelity.com on February 1, 2023. In total, we analyzed 28,591 bonds, which included 956 high yield corporate bonds (Figure 2), 8,653 investment grade corporate bonds (Figure 3), and 18,982 municipal bonds (Figure 4).

Each figure shows the distribution of YTMs for the specific bond type. For example, in Figure 2, there were 123 high yield corporate bonds that had YTMs of at least 7.0% and less than 8.0%. In Figure 3, there were 1,821 investment grade corporate bonds with YTMs of 5.00% to 5.49%. Figure 4 shows the dearth of municipal bonds with YTMs above 5%, as only 6 out of 18,982 municipal bonds had yields this high. Fidelity.com does not offer trading in "high yield" municipal bonds; however, as we discuss further below, this is a very small part of the municipal bond market.

Please note that Figure 2 uses a different y-axis scale than Figures 3 and 4 to show greater detail for high yield corporate bonds with yields above 7%.

Figure 2: Range of High Yield Corporate Bond YTMs on Fidelity.com on February 1, 2023

Across 956 Available Bonds

Source: Fidelity.com and BondSavvy calculations.

Figure 2 shows 218 high yield corporate bonds with YTMs of at least 8%. While there are cases where, due to flaws in bond ratings, high yield corporate bond issuers can have better financials than investment grade issuers, comprehensive fixed income analysis is a must before investing in these bonds. As shown below in the Security of Principal section, high yield bond default rates are higher than investment grade bond default rates. A key benefit of investing in corporate bonds vs. municipal bonds is that, for investors willing to take on the additional risk of high yield corporate bonds, there are higher returning opportunities than those in municipal bonds.

Figure 3 shows the range of investment grade corporate bond YTMs available on Fidelity.com on February 1, 2023. The largest concentration of bonds is those with YTMs of 4.50% to 4.99%, which accounted for 3,769 bonds, or 44% of all available investment grade bonds. Additionally, there were 2,579 bonds (30% of total) with YTMs of at least 5.00%.

Figure 3: Range of Investment Grade Corporate Bond YTMs on Fidelity.com on February 1, 2023

Across 8,653 Available Bonds

Source: Fidelity.com and BondSavvy calculations.

In corporate bonds, there are a variety of risk and reward opportunities for investors to consider. In municipal bonds, it's more of a homogeneous landscape with respect to investment returns. Figure 4 shows the 18,982 municipal bonds available on Fidelity.com on February 1, 2023. As shown, only 6 bonds had YTMs of at least 5%. The sweet spot for muni bonds was YTMs between 1.00% to 2.49%, which accounted for 10,142 bonds, or 53% of total.

Some investors may point to the tax-exempt status of many muni bonds; however, even if you tax adjust the investment grade corporate bond YTMs, you still arrive at YTMs that are generally higher than muni YTMs. Then, you have to factor in what state you live in, its tax rate, and whether your state has muni bonds worth owning. Lastly, investors should consider the type of investment accounts where they hold bonds, as tax-deferred IRA accounts would generally negate the tax benefits associated with owning municipal bonds.

We discuss in the "Corporate Bonds Advantages: High Quality Disclosures" section how it can be difficult to assess the relative value of municipal bonds given their limited financial disclosures and opaque pricing.

Figure 4: Range of Municipal Bond YTMs on Fidelity.com on February 1, 2023

Across 18,982 Available Bonds

Source: Fidelity.com and BondSavvy calculations.

Corporate bonds advantages: Security of income

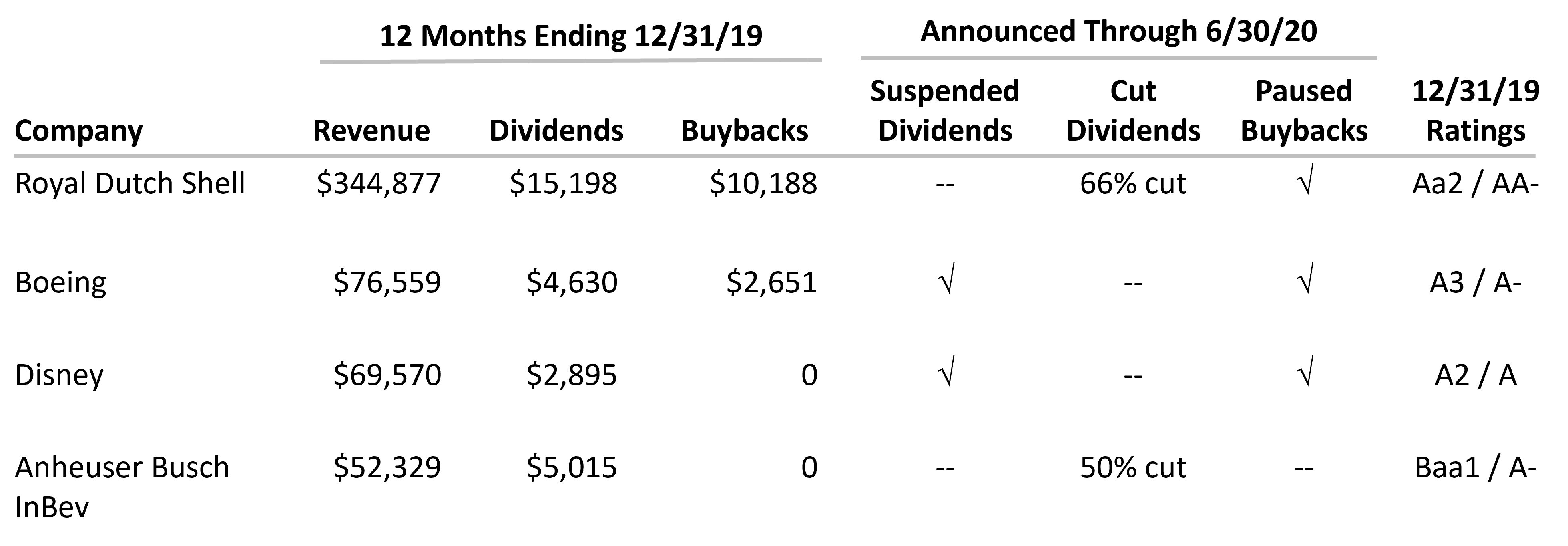

Many investors compare stock dividend yields to bond yields and believe they are the same thing. They are not. Company dividends can be reduced or eliminated at a moment's notice via press release. This happened in the wake of Covid-19 in 2020, as many blue-chip companies either stopped paying dividends or significantly reduced them.

These companies included some of the largest companies in the world such as Boeing, Disney, Royal Dutch Shell, and GM. During these difficult Covid times, all of these companies continued making their bond coupon payments. Figure 5 shows a sampling of major companies that suspended dividends, cut dividends, and/or paused stock buybacks in the wake of Covid-19.

Figure 5: Sample of Dividend and Buyback Cuts During 2020

$ in millions

Sources: Company SEC filings and news releases.

Some might ask: "But can't a company go bankrupt and stop making interest payments?" While speculative grade corporate bond issuers (those with corporate bond ratings below Baa3 / BBB-) can go bust at times, investment grade corporate bonds have annual default rates close to zero, as shown in Figure 6 further below. Since all of the companies shown in Figure 5 were rated investment grade, it's appropriate to compare their cut in dividends to default rates of investment grade corporate bond issuers.

Security of income across fixed income investments

While fixed income investments provide higher income security than stocks, there are some differences across corporate bonds, municipal bonds, and bond funds.

The income security of investors owning individual corporate bonds and municipal bonds will depend, in large part, on the creditworthiness of the bond issuer and the number of bonds held in an investor's portfolio. As you might expect, a 10-CUSIP portfolio filled mostly with high yield corporate bonds could have a lower level of income security than a 30-CUSIP portfolio containing bonds of higher credit quality.

Please note that a CUSIP is a nine-digit code that identifies each corporate bond issuance. CUSIPs are needed for corporate bonds since companies often issue more than one bond. Some companies might have more than 100 CUSIPs outstanding.

Individual corporate bonds vs. bond funds

It can be difficult to compare the security of income of individual corporate bonds vs. bond funds, as there are many types of individual corporate bonds and bond funds. That said, bond funds are more fungible, as most of them, such as Vanguard Total Bond Market Index Fund (VBTLX), attempt to replicate a broadly followed index.

Many might assume that, given their massive size, bond funds would have greater income security. Recent events, however, have shown that not to be true. In a January 12, 2023 article in The Wall Street Journal titled "For Closed-End Fund Investors, Paper Losses Turn Real," Heather Gillers explains how a PIMCO California municipal bond fund cut dividends by 45%. In 2022, a BlackRock municipal bond fund cut dividends 38%.

That the income of a bond fund can fall that much is astounding and should cause bond fund investors to think twice about investing in such vehicles.

This is not to say that most bond funds made or will make such drastic cuts; however, it should tell investors that bond fund income is not as safe as many might believe.

With individual bonds, investors know the precise amount of, and date on which, they will be paid for each bond CUSIP they own. With bonds issued by highly profitable companies such as Apple and Wal-Mart, interest payments are generally money in the bank. There can be cases where companies file for Chapter 11 and cease making interest payments, but such cases are rare. We discuss corporate bond default rates in the Security of Principal section of this fixed income article.

Corporate bonds advantages: Security of principal

Corporate and muni bond issuers have an obligation to pay bondholders the par value of a bond on a bond's maturity date. This obligation to pay a specific amount at maturity provides these investments with a higher level of principal security than stocks and bond funds. Individual bonds, bond funds, and stocks can all fluctuate in value over time. Some can be quite volatile. That said, if we buy a 5-year bond issued by Wal-Mart or an issuer of similar credit quality, we know exactly the amount of principal we will receive in five years. The same cannot be said for a stock or a bond fund, which could be either higher or lower at that point.

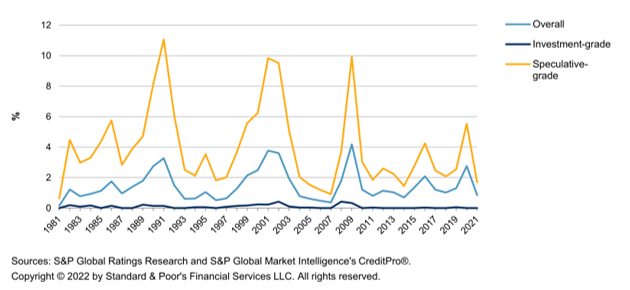

Investment grade corporate bond default rates

When comparing the security of principal between individual corporate bonds and bond funds, we must compare apples to apples. Figure 6 shows S&P's analysis of global corporate bond default rates from 1981-2021. As shown by the bottom dark line, investment grade corporate bond defaults are close to zero. According to S&P, from 2010-2020, the default rate for bonds rated A and higher was zero each year. During this 10-year period, for bonds rated BBB by S&P, default rates were zero every year other than 2011 (0.07%), 2016 (0.06%), and 2019 (0.11%).

VBTLX is known as an investment grade bond fund, as it can only hold bonds rated at least Baa3 by Moody's Investors Service. Since investment grade default rates are historically near zero, a corporate bond portfolio with investment grade individual corporate bonds has a high security of principal. Since this portfolio owns bonds with maturity dates, we believe it has a higher security of principal than the VBLTX fund, which has a price untethered to a maturity date or par value.

Figure 6: Global Corporate Bond Default Rates: 1981-2021

High yield corporate bond default rates

While historical investment grade corporate bond default rates have been near zero, high yield corporate bond (also known as speculative grade corporate bonds) default rates have been higher. While high yield corporate bond default rates can be as low as 2%, they have also neared 10% during economic downturns such as the 2008 financial crisis. BondSavvy seeks to mitigate the default risk of its recommended corporate bonds by updating its buy/sell/hold recommendations each quarter based on the financial performance of our issuers and the price, YTMs, and credit spreads of our recommended corporate bonds.

Our bond recommendations also focus on companies with low leverage ratios and with financials and businesses that can withstand difficult economic conditions. That said, while our recommendations, as of January 2023, covered 13 industries and both investment grade and high yield bonds, we have had one recommendation, a bond issued by JCPenney, that resulted in a complete investment loss, as shown in our corporate bond returns page.

Not all bond defaults result in a wipeout

It's important to understand that an event of default doesn't always mean a bondholder gets wiped out. According to S&P, in 2020, distressed exchanges and missed principal or interest payments each accounted for 37.6% of defaults (75.2% combined). Bankruptcies accounted for 24.8% of defaults.

In certain events of default, a bondholder can still receive full value. For example, Tupperware Brands had a technical event of default when, in 2020, it began a tender offer for the Tupperware Brands 4.75% 6/1/21 bond (CUSIP 899896AC8). Since these tender offers were for less than par value, it was deemed to have been an event of default, which was included in 2020's default statistics. BondSavvy recommended subscribers NOT participate in the Tupperware tender offers. Later in 2020, Tupperware announced a refinancing for its 4.75% '21 bonds. On December 3, 2020, it effected a call for the '21 bonds at a price of 101.96.

After this white-knuckle ride, our Tupperware '21 recommendation resulted in a total return of +7.30% compared to a +4.40% investment return for the iShares HYG ETF, a leading high yield corporate bond ETF.

Municipal bond default rates

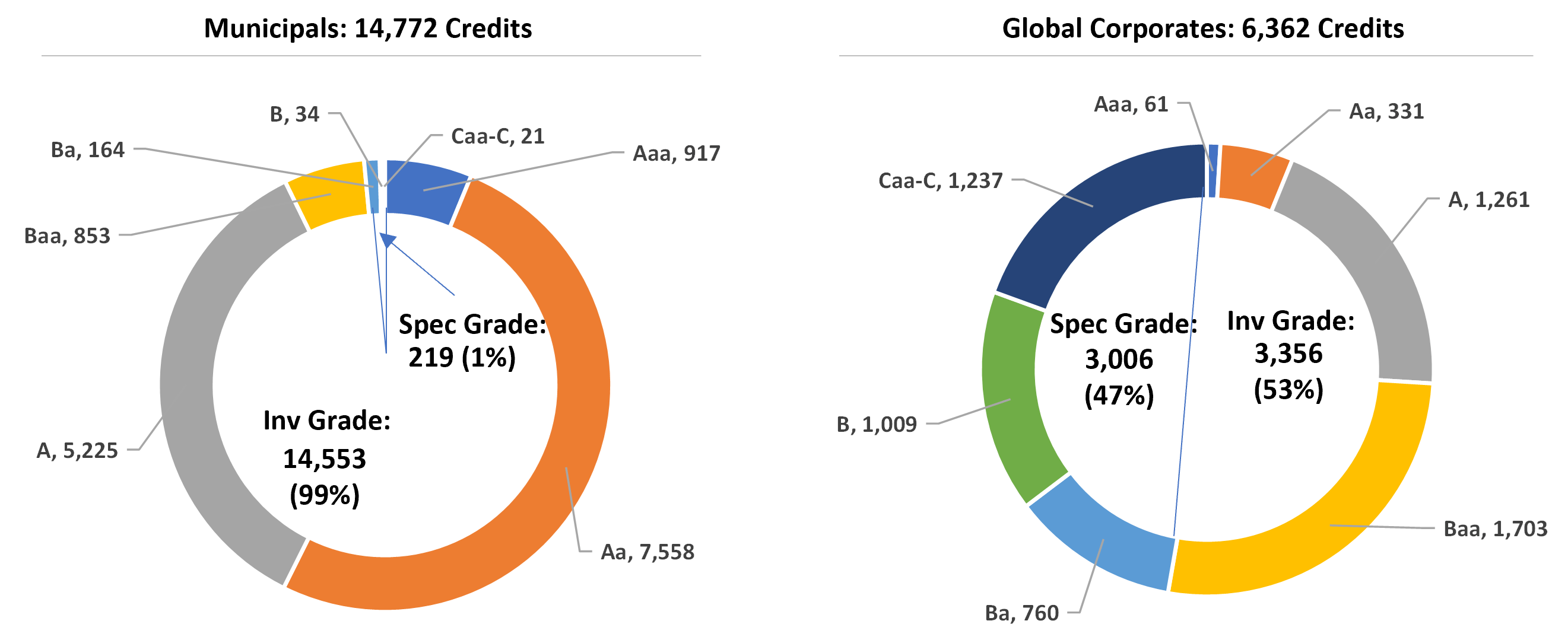

Historically, municipal bond default rates have been low, as we show later in this section. Context is important, however, when comparing municipal bond vs. corporate bond default rates. From October 2010 until 2021, 93% of municipal bond credits were rated A or higher, compared to 26% for corporate bonds. Of the 14,772 municipal credits rated during this time, 99% were rated investment grade, as shown in Figure 7. This compares to 53% of global corporate bonds being rated investment grade by Moody's. This variety of credit ratings and investment opportunities is provides corporate bond investments with higher potential returns, as we illustrated earlier.

Figure 7: Moody's Ratings of Municipal and Corporate Credits - October 2010 to 2021

Source: Moody's Investors Service and BondSavvy calculations.

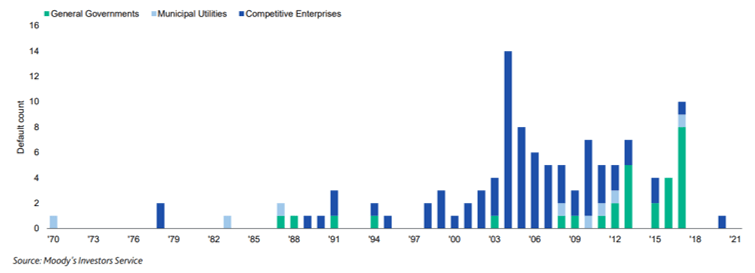

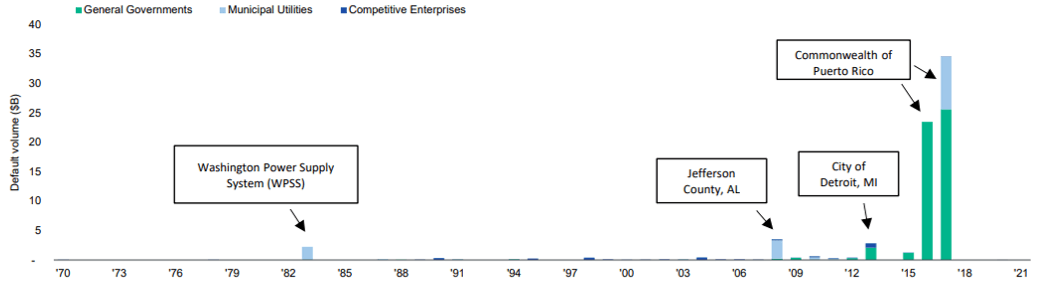

Figure 8 shows Moody's analysis of municipal bond defaults from 1970 to 2021 across the three main issuer types: general governments (state, city, county governments, and local school districts), municipal utilities (water/electric/sewer utilities, mass transit, and toll facilities), and competitive enterprises (charter schools, higher education, healthcare, hotels, and housing). While, historically, competitive enterprises have made up the largest number of defaults, these issuances have often been small, project-focused financings.

Figure 8: Number of Municipal Bond Defaults per Year by Issuer Type - 1970 to 2021

One example of a competitive enterprise default occurred in 2020: a $38 million default by the Archdiocese of New Orleans. As shown in Figure 9, this amount was so small that it didn't register on the chart. The largest recent defaults, as shown in Figure 9, have been governments, including the Commonwealth of Puerto Rico, the City of Detroit, and Jefferson County, Alabama.

Figure 9: Annual Municipal Bond Defaults by Sector ($ Billions) - 1970-2021

Corporate bonds advantages: Quality financial disclosures

US corporate bond issuers have strict financial disclosure requirements mandated by the US Securities and Exchange Commission ("SEC"). They must submit detailed quarterly financials on Form 10-Q and Form 10-K, which review how the company has performed, how it is financed, key business developments, risks, etc. In addition, anytime a material event happens, such as an acquisition, divestiture, key personnel move, etc., it must file an 8-K with the SEC. Common stock issuers have similar disclosure requirements.

Investors can use this information to conduct fixed income analysis, such as comparing an issuer's leverage ratio to its credit spread, to evaluate whether a bond is a good value. Corporate bond investors have the tools they need to make educated investment decisions. In addition, since BondSavvy updates its recommendations each quarter, BondSavvy subscribers can decide whether to increase, hold, or sell existing positions.

Limited municipal bond financial disclosures

Municipal bond issuers are exempt from federal securities registration and reporting requirements. Municipal bond issuers will typically issue an annual report; however, that report often takes over six months to complete. Corporate bond issuers are required to file quarterly financials on Form 10-Q within 40 days of quarter end and annual financials on Form 10-K within 60 days of year end. Companies often file in advance of these deadlines.

While some municipal bond issuers do provide detailed financial reports and budgets, these disclosures vary from issuer to issuer. Infrequent and non-uniform financial reports make it difficult for investors to compare the relative value of one muni bond to another.

Bond fund disclosures do not enable investors to assess investment value

Bond funds do not have underlying financial metrics, such as revenue and cash flow growth, leverage ratios and interest coverage ratios, where investors can evaluate the financial wherewithal of the issuing company. It is, therefore, impossible to assess the relative value of a fund like you can with a corporate bond or stock. With individual corporate bonds, investors can compare the foregoing financial metrics to how a bond is priced and evaluate a bond's relative value. Stock investors can do a similar exercise by calculating price/earnings ("P/E") ratios.

Without underlying financial metrics, bond fund investors are limited to looking at a bond fund price chart to see if they are investing at a historically high or low price.

Corporate bonds advantages: Pricing transparency

Individual corporate bonds trade in a competitive and transparent market. Generally speaking, bonds available on online bond trading platforms such as Fidelity, E*TRADE, and Charles Schwab will have six to ten live quotes on both the bid and offer side. These price quotes are updated in real time throughout each trading day.

While there are exceptions, a significant portion of the 9,000 individual corporate bonds available for online investing regularly trade throughout the day. Corporate bond trades are reported to FINRA's "TRACE" system and disseminated to online brokerages. When making new corporate bond investments, investors can compare live corporate bond quotes to the prices of recently executed trades to confirm they are obtaining a fair price.

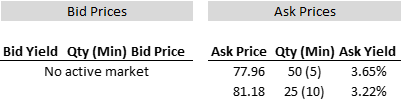

Infrequent trading and limited live quotes for municipal bonds

On the leading online bond trading platforms, municipal bonds will only show one or (at the maximum) two offer-side quotes compared to the many live-and-executable bid and offer quotes available for individual corporate bonds. In addition, since there are millions of municipal bonds outstanding, a municipal bond can go months -- even years -- without registering a new trade. Since muni bond issuers lack regular financials disclosures and muni bonds trade in an opaque market, it is difficult for investors to assess new investment opportunities.

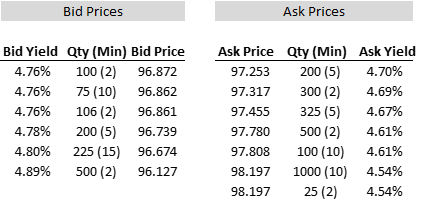

A bond's "depth of book" is the level of live bid and offer quotes for a specific CUSIP. If the depth of book is strong, this means there are many quotes on the same CUSIP and investors are trading in a competitive environment. Figures 10 and 11 show the difference in the depth of book between a municipal and corporate bond. Figure 10 shows the depth of book for the St. Louis County, Missouri general obligation 1.00% 2/1/33 bond (CUSIP 791298WW8). As shown in Figure 10, the bond had two live offer quotes and zero live bid quotes. The two offer quotes were over three points apart (77.96 vs. 81.18).

Figure 10: Sample Municipal Bond Depth of Book -- St. Louis County, Missouri GO Bond 1.00% 2/1/2033

January 27, 2023

Source: Fidelity.com

The above muni bond's depth of book is actually more than most, as the lion's share of muni bonds available for online trading typically only have one live ask price quote. This is very different from the robust depth of book enjoyed by most individual corporate bonds. Figure 11 shows the depth of book for the FedEx 4.25% 5/15/30 bond (CUSIP 31428XBZ8) available on Fidelity.com at the end of the day on January 27, 2023. As shown, this bond had six live bid-side quotes and seven live ask-side quotes. On the ask side, the difference between the best and worst quote was 0.94 points. The difference was even smaller on the bid side (0.75 points).

A competitive market can remove one of the key questions when investing in individual bonds: "Am I getting a fair price?". In the case of the FedEx bond, investors enjoy a highly competitive market and can compare these bond price quotes with historical trades reported to FINRA's TRACE database for corporate bond trades.

Figure 11: Sample Corporate Bond Depth of Book -- FedEx 4.25% 5/15/30

January 27, 2023

Source: Fidelity.com

Bond Funds Do Not Trade Intraday and Do Not Trade Relative to Par Value

If a corporate bond issuer reports earnings at 8:00am Eastern time, investors can use this information and purchase a bond issued by that company immediately after the earnings report hits the wire. There could also be cases where a bond falls based on information that doesn't necessarily make a bond a higher credit risk. Again, individual bond investors can capitalize on such opportunities.

Bond fund investors, on the other hand, cannot trade intraday, as bond fund trades are executed based on the fund's end-of-day net asset value per share. Being able to invest in something at only one point in a trading day is like moving back to the dark ages for investors. In addition, since bond funds don't have underlying financial metrics and don't trade relative to par value, bond fund investors cannot evaluate a bond fund price to the underlying risk of that investment to decide whether to make an investment.

Bond ETFs do trade intraday; however, they trade based on a share price. Similar to a traditional bond fund, bond ETFs do not have underlying financial metrics such as leverage ratios and credit spreads, which puts these investors in the dark.

Disadvantages of Corporate Bonds

While corporate bonds advantages are significant, new corporate bond investors must be aware of the risks and disadvantages.

Some corporate bonds have limited trading activity

Corporate bond investing has come a long way from the 1970s and 1980s, when most bond trades were done over the phone, and investors had little idea on whether they were getting a fair price. In our Where to Buy Bonds article, we discuss how corporate bond trading for individual investors is primarily conducted online in a competitive and efficient marketplace.

While corporate bonds trade online through brokerages such as Fidelity.com, Schwab, E*TRADE, and Schwab, there can be times when trading activity -- and the amount of live bid-offer quotes -- can be limited. A key reason for this is that, on any given trading day, there are approximately 9,000 individual corporate bonds available on online brokerages. Since trading activity can be spread across such a large number of bonds, there can be bonds that don't trade every day.

When BondSavvy makes new corporate bond investment recommendations, we evaluate a bond's trading activity and amount of live bid-offer quotes (the "depth of book") to ensure the market can accommodate the new order flow our bond recommendations create.

Corporate bonds can be volatile

Prior to 2022, many people heard the word "bonds" and likely thought they were investing in something super-safe and boring. While corporate bonds must return to their par value on their maturity date (assuming no issuer default), for certain bonds, it can be a rollercoaster ride.

The Federal Reserve's interest rate hikes in 2022 have shown investors how bond prices can fall in an extreme scenario.

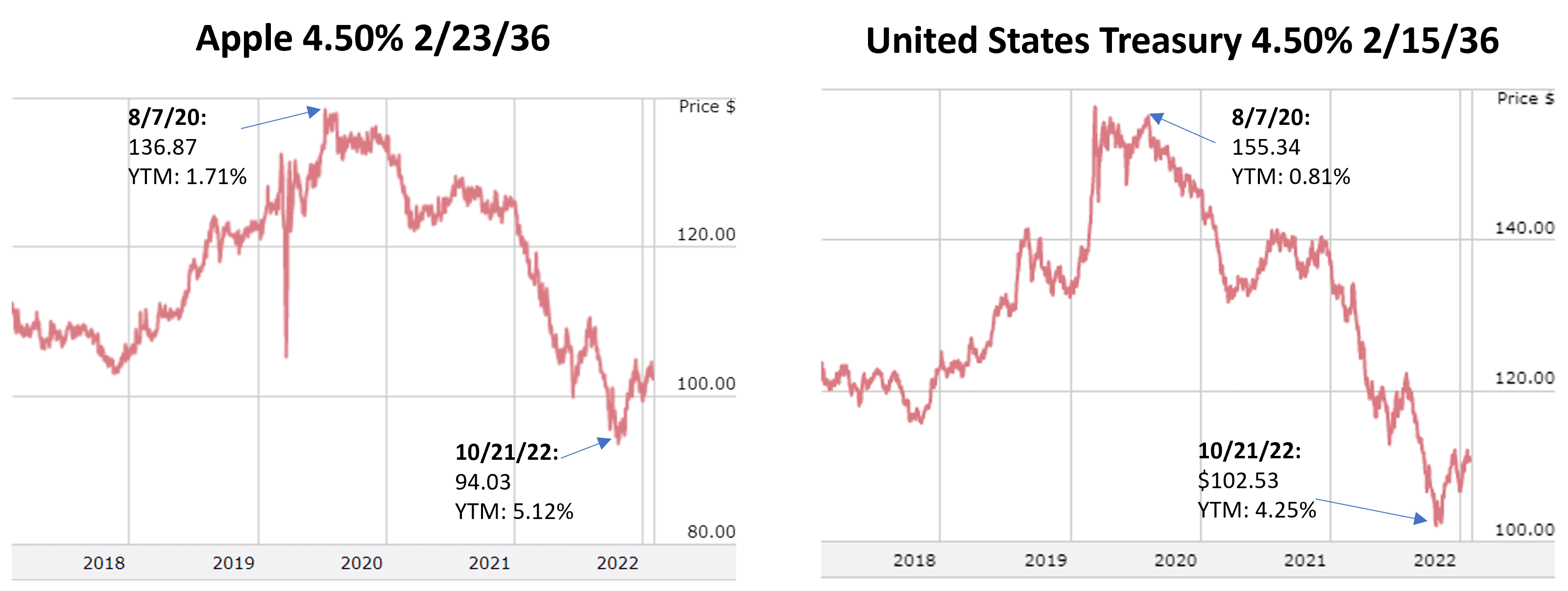

Some corporate bonds can be highly sensitive to movements in US Treasurys

As we discuss in our corporate bond credit spreads blog post, corporate bond prices movements are driven by two key metrics: 1) the YTM of the benchmark US Treasury (i.e., the US Treasury that has a similar maturity date to a corporate bond) and 2) the bond's credit spread. Investment grade corporate bonds, in particular, can be highly sensitive to movements in US Treasury YTMs, as the benchmark US Treasury YTM can often make up the lion's share of the corporate bond's YTM. In 2022, the financial performance of many investment grade corporate bond issuers was strong; however, due to rising US Treasury yields, it was one of the worst-performing years of all time for investment grade bonds.

Since US Treasurys do not have credit spreads, the prices of US Treasury bonds, notes, and bills are driven by changes in US Treasury YTMs. When US Treasury YTMs fall, US Treasury prices increase, and vice versa.

To illustrate how the US Treasury market impacts US corporate bond prices, we compare price performance of the Apple 4.50% 2/23/36 bond (CUSIP 037833BW9) to the US Treasury 4.500% 2/15/36 bond (CUSIP 912810FT0) bond in Figure 12. The Apple '36 bond hit a 5-year low price on October 21, 2022 of 94.03, with a YTM of 5.12%. On that same date, the US Treasury '36 bond had a YTM of 4.25%, giving the Apple '36 bond a credit spread of 0.87 percentage points or 87 "basis points." Since the benchmark YTM makes up the bulk of the Apple '36 bond's YTM, it is the primary driver of the Apple bond's price.

Per Figure 12, while the Apple '36 bond's peak was not as high as the 155.34 price reached by the US Treasury '36 bond on August 7, 2020, the directional trends of both bond price charts are similar. What might surprise investors is how the US Treasury bond fell 52.81 points from peak to trough vs. a 42.84-point drop for the Apple '36 bond.

Figure 12: Price Performance of Apple '36 vs. US Treasury '36 Bonds -- January 30, 2018-January 30, 2023

Source: FINRA market data.

Just as the Apple '36 bond price fell in 2022 due to higher US Treasury YTMs, the bond rallied approximately 30% from 2018 until reaching its August 7, 2020 peak. Individual bonds can often be more volatile than bond funds and ETFs. When prices of the highest-quality corporate bonds drop significantly, it can be an excellent opportunity for investors to lock in high yields and, over time, benefit from a bond's capital appreciation.

Corporate bonds can be heavily impacted by bond ratings upgrades and downgrades

While there are many advantages to owning individual bonds vs. bond funds, a significant portion of corporate bonds are still held by institutional investors such as bond mutual funds, bond ETFs, insurance companies, and pension plans. The bonds held by these entities are often determined by bond ratings, as many of these investment vehicles have restrictions on owning bonds below a specific corporate bond rating.

When corporate bond ratings are downgraded from investment grade (Baa3 / BBB- and higher) to below investment grade, forced selling can occur, as certain institutional funds have to sell the downgraded bonds. It is a smaller group of investors that can own high yield corporate bonds, so these price drops can often be significant.

That said, these "fallen angel" bonds can often be compelling investment opportunities, as many high yield corporate bonds can have stronger financials than bonds with higher bond ratings due to the many flaws of corporate bond ratings.

Corporate bonds aren't always a bond issuer's most senior debt

While corporate bonds are senior to common and preferred stock issued by a company, there can be debt that is senior to a company's unsecured bonds. This can be a big issue in the event a company files for Chapter 11 and the company cannot satisfy all of its obligations. This happened when JCPenney filed for Chapter 11 in 2020. It had a significant level of bank debt that was senior to the company's unsecured bonds. When the company emerged from Chapter 11, the senior debt had significant recoveries but the company's unsecured bonds were mostly wiped out.

In each new BondSavvy corporate bond recommendation, we review a company's capital structure to determine whether any debt is senior to our recommended bonds. This analysis is not always fool-proof, as, after a new recommendation, a company can incur debt that is senior to our bonds.

In such a scenario, our bonds can be downgraded by the rating agencies given their newly found junior position in the company's capital structure. Such downgrades can cause bond prices to fall.

If a company has a strong business and is operating well, the existence of senior debt isn't always a bad thing, depending on how the senior debt is structured. Some senior debt is in the form of revolving credit, which can be paid back at the company's option with ease. Such flexibility can be used by companies for working capital needs. Often times, these revolving credit facilities can be drawn down during a quarter and then repaid by quarter end.

Corporate bond investing is not "set it and forget it"

Lots of things can happen after investing in a bond -- some good, some not so good. A company could perform well operationally and, due to its lower credit risk, bonds issued by the company could rally. On the other hand, a bond issuer could hit a rough patch and incur debt that is senior to an unsecured bond. Macy's incurred senior debt in the wake of Covid-19 store shutdowns. Fortunately, the company's operations turned around quickly, and Macy's was able to pay down its senior borrowings.

Not every company will be able to stage a strong turnaround similar to Macy's. Such everchanging business dynamics require investors to keep up with events impacting a company and to adjust investments accordingly. A key part of the BondSavvy service is to update our recommendations every quarter based on how our bond issuers are performing financially and the long-term prospects of each bond recommendation.

Corporate bond prices have ceilings

While we believe corporate bonds possess a greater security of income and principal than stocks and bond funds, the provision that creates this security does have a drawback. Since bonds contractually pay bondholders the par value of a bond at maturity, their upside is limited. While corporate bonds can increase significantly in value, it's rare for bond prices to reach 150% of their par value. This is very different than a stock, which can increase with no upward bound.

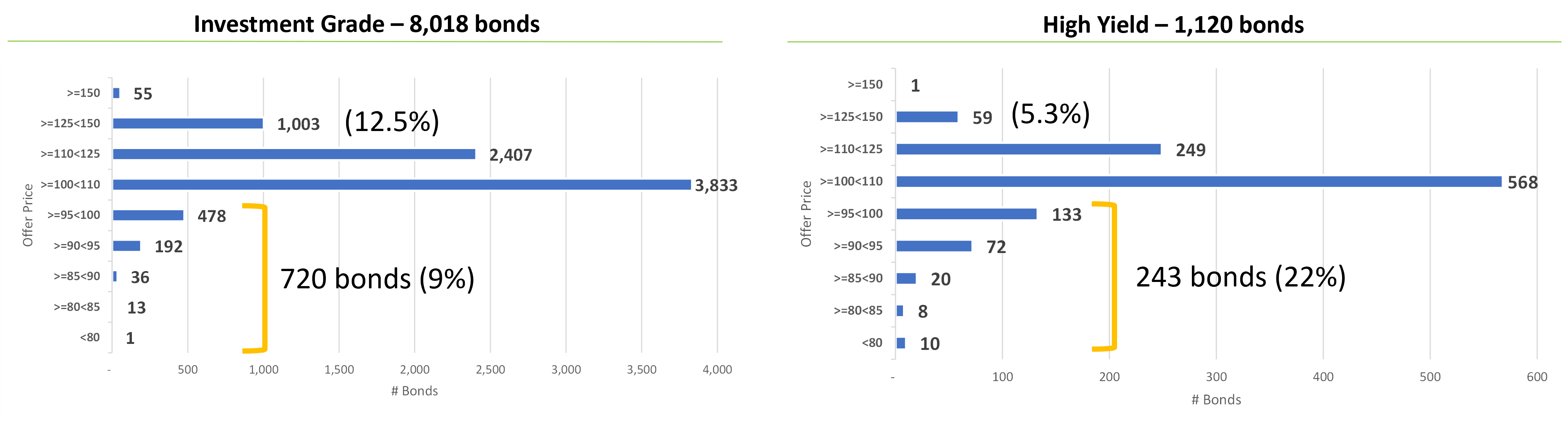

Figure 13 shows the distribution of corporate bond prices available on Fidelity.com on May 16, 2021. This was a time when market interest rates were much lower than they were in January 2023, when this article was re-published. Since market interest rates were low, many corporate bond prices were, generally speaking, higher than in January 2023.

On May 16, 2021, there were 8,018 investment grade corporate bonds and 1,120 high yield corporate bonds available on Fidelity.com. For more on the difference between investment grade and high yield corporate bonds, please read our corporate bond ratings blog post. To illustrate the concept of bond price ceilings, we examine the investment grade chart on the left side. On this day, of the 8,018 investment grade corporate bonds available, only 55 (0.7%) were priced at or above 150. For high yield bonds, only one out of 1,120 bonds was priced at or above 150.

Figure 13: Distribution of Corporate Bond Prices on Fidelity.com - May 16, 2021

In both the investment grade and high yield charts, the largest number of bonds were priced between par value (or 100) and less than 110. The higher above 110 we move in pricing, the fewer bonds there were that had such high prices. Bond investors must be mindful of these price ceilings. Often times, if a bond price increases from, say, 95 to 120, it can make sense to sell bonds before maturity so investors can lock in capital appreciation and maximize investment returns.

Bond price ceilings caused by corporate bond call provisions

While virtually all corporate bonds are callable (i.e., redeemable at the issuer's option before maturity), it is bonds with specific call schedules where investors' upside is often limited to a price just slightly above par value. Generally speaking, bonds issued with bond ratings below Baa3 / BBB- (known as high yield bonds or sub investment grade bonds) have these call schedules. Bonds initially rated investment grade are subject to 'make-whole calls,' a seldom-invoked bondholder-friendly provision where the issuer would need to pay bondholders the present value of all future principal and interest payments to call bonds prior to maturity.

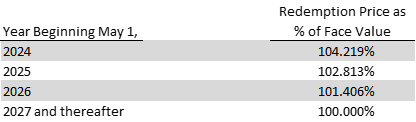

Figure 14 shows an example of a corporate bond call schedule. As shown, beginning May 1, 2024, the issuer can redeem ("call") the bonds at a price of 104.219. Since this bond is callable at this price, in 2023 and 2024, it's unlikely that this bond would trade materially higher than 104.219. The reason for this is that a buyer would not want to purchase the bond at, say, 108, only to have the bond called shortly thereafter at 104.219.

Figure 14: Example of Corporate Bond Call Schedule

A corporate bond's call schedule becomes more important for investors considering bond purchases above par value. If we purchased this bond at 102 in 2023, we might only be able to realize a point or two of capital appreciation. This can still be okay assuming the bond's coupon is compelling relative to the risk of the issuer.

Call schedules become less consequential when purchasing bonds well below par value. If we had purchased the above bond at 80 during 2023, we would be very pleased to have the bond called at 104.219 in 2024.

Stock buyback binges can advantage stockholders over bondholders

Perhaps one of the most difficult things to navigate as a corporate bondholder is the seemingly never-ending fascination of companies with stock buybacks. While bonds are supposed to be senior to common stockholders, these massive buybacks often seem like the opposite is true. Under the deceptive guise of "returning money to shareholders" -- a complete and dishonest mischaracterization -- companies burn more and more money on ill-fated stock buybacks to the detriment of all but a small number of company stakeholders.

Figure 15: Stock buybacks burn money and can damage the long-term future of companies

Stock buybacks can create a floor under a stock price and can, at least over the short term, create a bounce in a stock price. This can be a good thing for short-term stockholders (like so-called 'activist' investors) and executives looking to execute stock option grants.

Unfortunately, these buybacks can often put companies into a pickle in the event a business underperforms. The poster child for ill-fated company stock buyback binges is Bed Bath & Beyond, which bought back $12 billion in stock between 2004 and 2022. When Bed Bath ran into operational performance issues in 2022, it had to hurry to raise senior bank debt to fund operations.

Bed Bath now has debt that is senior to its unsecured bonds, which, along with the company's weak recent financial performance, caused certain company bonds to fall as low as 5% of their face value. The company, in October 2022, began effecting exchange offers for its unsecured company bonds. On January 5, 2023, the company issued a warning that it has substantial doubt that it can continue as a going concern.

Retailing is a tough business. It is highly competitive and consumer demands are constantly changing. Bed Bath should not have been permitted to get itself into the financial position it did by prioritizing shareholder buybacks of its bondholders, employees, and vendors.

For each BondSavvy recommendation, we evaluate a company's capital allocation, or how it spends each dollar of profits. Interestingly, it is often companies rated below investment grade that have more responsible allocation than buyback-addicted investment grade bond issuers.

For a highly profitable company with a lot of cash such as Apple, large buybacks do not make it a near-term default risk. That said, businesses and consumer demands are always shifting, and today's A-rated company can be tomorrow's CCC-rated company.

How BondSavvy Empowers Investors to Navigate Corporate Bonds Advantages and Disadvantages

Steve Shaw founded BondSavvy because, through his own investing experience, he benefited from the income, growth, and relative safety individual corporate bonds can provide. The problem he saw is that everyday investors seldom invest in individual corporate bonds, often confused with how bonds work and unable to select from the 9,000 bonds available for investing.

Steve founded BondSavvy to make bond investing easy and more profitable.

BondSavvy narrows the universe of 9,000 corporate bonds to a select number it recommends to BondSavvy subscribers. We make new recommendations every quarter after companies report financial results. We then update our buy/sell/hold recommendations each quarter based on issuing company financial performance and the price of our recommended bonds.

We typically recommend approximately 20 new corporate bonds each year and have between 35 to 55 bonds on our buy/hold recommended corporate bond list. Click the Get Started button to learn about subscription options or the Watch Free Sample button to view a previous edition of The Bondcast, where we present new corporate bond recommendations.

Get Started

Watch Free Sample