What if you could build a high-performing bond portfolio but didn't have to spend hours researching bonds and monitoring bond issuer performance? What if you could make these investments at competitive prices online and avoid paying a percentage of your hard-earned money to bond funds or other investment services?

We founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. In December 2025, we launched the Bondsavvy Basic service recommending a select list of 10 investment grade corporate bonds, which had a median YTM of 5.60%. These bonds are available on online bond investing platforms such as Fidelity.com, Schwab, E*TRADE, Interactive Brokers, and others.

Bondsavvy Basic is separate from Bondsavvy Premier, a service we launched in 2017 that recommends both high yield bonds and investment grade bonds. The 89 Premier bond recommendations exited through January 15, 2026 had achieved a median annual return of 9.22% vs. 6.36% for the iShares LQD and HYG corporate bond ETFs.

This fixed income blog post previews the Bondsavvy Basic investment grade bond service and covers the following:

- Key differences between investment grade bonds vs. high yield bonds

- As of January 29, 2026, the original Bondsavvy Basic recommended bonds were available at prices near the December 12, 2025 pick date prices

- Summary of newly recommended investment grade bonds in Bondsavvy Basic, including yields, maturity dates, and industry groups

- Excerpts of our investment presentation that empower subscribers to make successful bond investments

Investment grade bonds vs. high yield bonds

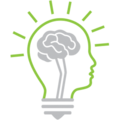

We have limited the scope of Bondsavvy Basic to include only investment grade bonds. For a bond to be deemed investment grade, it must have a minimum bond rating of Baa3 by Moody's and BBB- by S&P. Bonds with ratings below these thresholds, as shown in Figure 1, are high yield bonds.

Bondsavvy Subscriber Benefit

Over 10,000 individual corporate bonds are available

for online investing each day. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started Bondsavvy never relies on corporate bond ratings but rather conducts its own bond investment analysis when making new bond recommendations. That said, bond ratings do impact how bond prices move, and bond rating upgrade and downgrade thresholds are an important investment consideration.

Key Differences Between Investment Grade Bonds and High Yield Bonds

For the year ending November 30, 2025, US investment grade corporate bond issuance has been about five times greater than high yield bond issuance, as shown in Figure 2. Other key characteristics of investment grade bonds include longer initial tenors (the time until maturity), more favorable call provisions, and higher interest rate risk.

Figure 2: Investment grade bonds vs. high yield bonds

| Consideration | US Investment Grade Bonds | US High Yield Bonds |

|---|

| Term at issuance | Often 20 to 30 or more years | Typically 5 to 10 years |

| Call risk | Low - typically subject to bondholder-friendly

make-whole-call provisions | Typically subject to call schedules,

which limit bond price upside |

| Available bonds | About 10,000 bonds available when

buying bonds online | About 1,000 bonds available when

buying bonds online |

| 12 Months Ending 11/30/25 Issuance | $1,729 billion | $343 billion |

| Financial covenants | Typically limited | More restrictive, but deal dependent |

| Interest rate risk | Generally higher, but can be mitigated by

shorter-dated and higher-coupon bonds | Generally lower due to shorter maturities

and higher coupons (exceptions exist, however) |

Sources: SIFMA market data, Fidelity.com, and Bondsavvy

Summary of New Bondsavvy Basic Recommendations

On December 13, 2025, Bondsavvy presented 10 new investment grade bond recommendations for the Bondsavvy Basic service. This included a 75-minute recorded presentation that supports each recommendation. Key characteristics of these investment grade bonds included:

- Recommendations included investment grade bonds issued by companies in the technology, retail, energy, aerospace & defense, and pharmaceutical sectors

- Six issuing companies, with four issuing companies having two recommended bonds each

- 5.60% median yield to maturity of the 10 investment grade bonds. Please note, however, that we seek to generate corporate bond returns higher than quoted yields to maturity by regularly updating our recommendations and typically selling bonds before maturity

- Three bonds mature in fewer than 10 years, two bonds mature between 11 and 17 years, and five bonds mature in over 18 years

Regarding maturity dates, it's important to note that Bondsavvy subscribers are not limited to investing in the specific CUSIPs we recommend. Most of our issuing companies have issued multiple other bonds with different maturity dates. Bondsavvy subscribers can use the investment analysis we conduct on specific issuers and decide to invest in bonds of different maturity dates offered by the same issuing company.

Bonds Still Available Near Original Pick Date Prices

On January 29, 2026 at 10:15am EST, the original Bondsavvy Basic recommended investment grade bonds could be bought at prices very close to the pick date price. Per Figure 3, the 10 investment grade bonds had a median price increase of 0.17 points since the original pick date. On January 29, the median yield to maturity of the recommended corporate bonds was 5.58%. As noted earlier, we use an active bond investing strategy that seeks to generate total returns that exceed a bond's purchase date yield to maturity.

Figure 3: January 13, 2026 Yields of Bondsavvy Basic Recommended Investment Grade Bonds

| January 29, 2026

Price Change Since Dec 12, 2025

Pick Date (Points) | January 29, 2026

Updated Yield to Maturity |

|---|

| Recommended Investment Grade Bond 1 | -0.04 | 5.54% |

| Recommended Investment Grade Bond 2 | -0.14 | 4.76% |

| Recommended Investment Grade Bond 3 | +1.34 | 5.93% |

| Recommended Investment Grade Bond 4 | +0.72 | 5.16% |

| Recommended Investment Grade Bond 5 | +0.07 | 6.18% |

| Recommended Investment Grade Bond 6 | +0.22 | 5.82% |

| Recommended Investment Grade Bond 7 | -0.31 | 4.97% |

| Recommended Investment Grade Bond 8 | +0.12 | 5.73% |

| Recommended Investment Grade Bond 9 | +0.62 | 5.63% |

| Recommended Investment Grade Bond 10 | +0.37 | 5.09% |

| Median | +0.17 | 5.58% |

Source: Fidelity.com

Investment Analysis Supporting Our Investment Grade Bond Recommendations

Bondsavvy simplifies bond investing by presenting easy-to-understand corporate bond recommendations. For Bondsavvy Basic's initial 10 investment grade bond recommendations, we recorded a 75-minute presentation covering our financial, investment, and business analysis supporting each recommendation. Below, we provide excerpts of the information we provide in Bondsavvy Basic.

Recommended Investment Grade Bonds to Buy

Upon logging into the Bondsavvy Basic investment service, subscribers will see the list of investment grade corporate bonds to buy. On this page, we show the bond's name, CUSIP, and ISIN (for non-US subscribers), as well as key pricing and financial metrics such as credit spreads and leverage ratios. To view our financial, investment, and business analysis for each investment grade bond recommendation, subscribers would click on the buttons underneath the "Related Presentation" column.

Figure 4: Bondsavvy Basic User Interface

After clicking the green video play button, Bondsavvy Basic subscribers will access a chaptered 75-minute webcast. On the slide shown in Figure 5, Bondsavvy founder Steve Shaw is reviewing certain key financials of our issuing companies, including revenue and EBITDA growth, margins, cash vs. debt balances, and upcoming bond maturities. Subscribe to Bondsavvy Basic to learn each recommended bond and CUSIP number.

Figure 5: Excerpted Investment Grade Bond Investment Analysis in Bondsavvy Basic

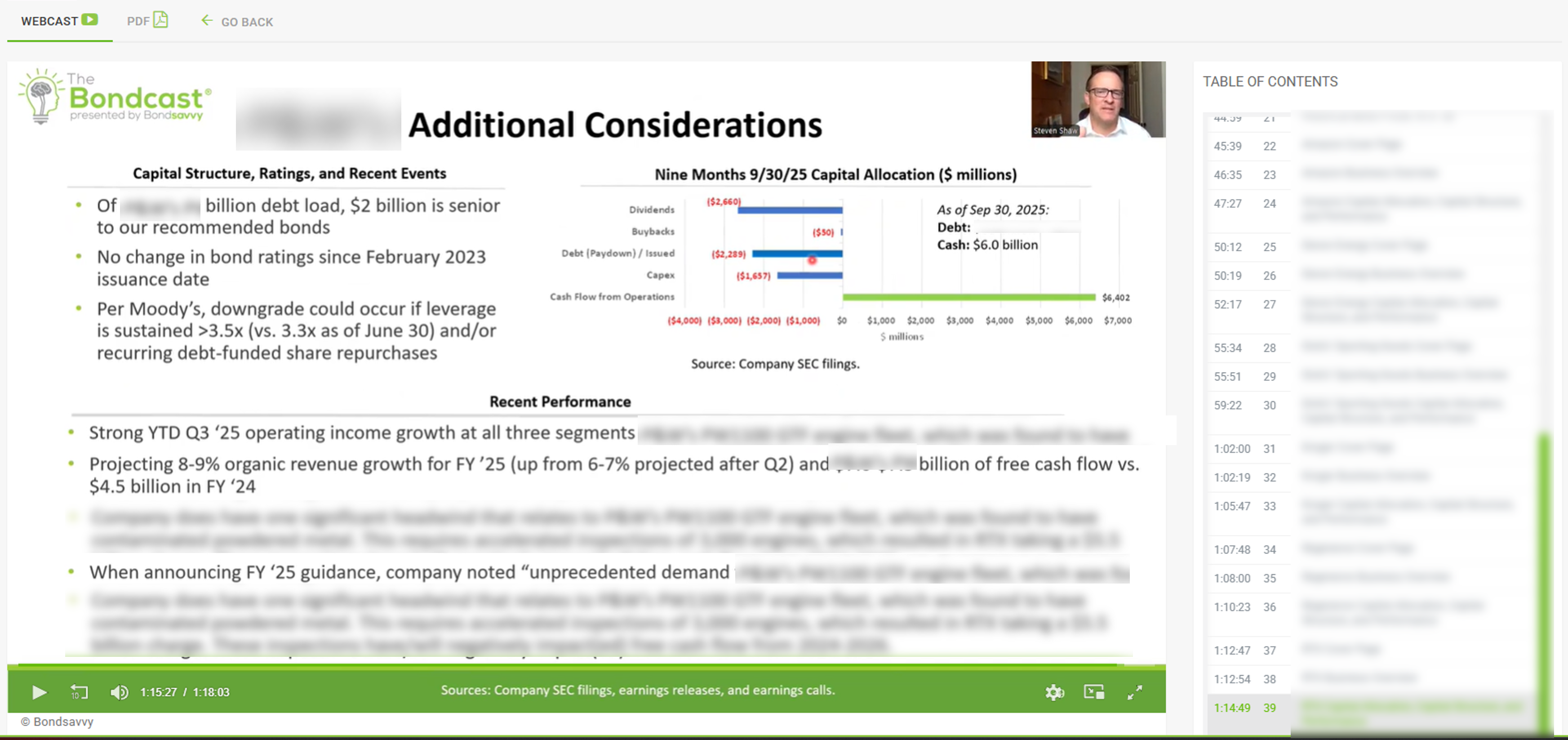

After comparing key financial ratios and metrics early in the presentation, we do a deep dive into each issuing company's business; trends; capital structure and capital allocation; and recent operating performance. We typically boil this down to two slides per issuing company, and we have attached a sample of one of these slides in Figure 6:

Figure 6: Bondsavvy Basic analysis of capital allocation, capital structure, and recent financial performance

Why Choose Bondsavvy Basic

Selecting among 10,000 investment grade corporate bonds is a daunting task for many investors, especially given that many bonds with high bond ratings are not worth owning. Our investment analysis simplifies the bond universe to a select number we believe can achieve strong long-term performance.

Of course, our work only begins when we make an initial bond recommendation. We update our recommended investment grade bonds quarterly with each issuing company's latest financials and the most up-to-date pricing, yields, and credit spreads. We present these quarterly updates during an interactive webcast with subscriber Q&A.

We launched Bondsavvy Basic so that more individual investors can take advantage of the income, principal protection, and capital appreciation opportunities corporate bonds can provide. It puts individual investors in control of their bond investing portfolios.

Get Started

Watch Free Sample