Steve Shaw founded Bondsavvy, the leading provider of corporate bond recommendations to individual investors, in 2017 to make bond investing easy and more profitable for individual investors. A key part of this is educating investors on aspects of bond investing that can cause confusion.

This fixed income blog post seeks to improve investors' understanding of bond indentures, which are agreements between the bond's issuing company and bondholders on the key terms of the bond issuance. These terms generally work in the bondholders' favor and provide a level of security not available to stockholders.

By reading this article, you will learn:

- What are the key terms included in a bond indenture

- Where to find bond indentures

- The difference between a base bond indenture and a supplemental bond indenture

Importantly, investors do not have to scour bond indentures to find every key term of a bond. For example, Bondsavvy shows bond call provisions for all of its corporate bond recommendations. In addition, many bond provisions are consistent across similarly rated bonds. For example, many high yield bonds have similar bond indentures to other high yield bonds.

What Is a Bond Indenture?

A bond indenture is an agreement between an issuing company and investors laying out the key terms of the bond

issuance. Since there could be hundreds -- if not thousands -- of different investors in a single bond issuance, a

trustee appointed by the issuing company signs the agreement on behalf of bondholders.

The Trust Indenture Act of 1939 ("Trust Indenture Act"), as amended, requires companies issuing $50 million or more

in bonds to file bond indentures. As we will discuss later, the bond indenture typically includes a base bond

indenture and a supplemental bond indenture. Both of these documents are qualified by, and pursuant to, the Trust

Indenture Act. The ATI Inc. '29 bond indenture we discuss in this fixed income blog post contained 48 separate

references to the Trust Indenture Act.

A Friendly Caveat on Bond Indentures

Bond indentures are not easy reads. They are written by attorneys who, in many cases, do all they can to ensure that

only other attorneys can understand what is written. To illustrate, contained in the ATI '29 bond indenture was one

sentence that was 585 words.

Luckily, Bondsavvy founder Steve Shaw

spent 14 years advising on and executing corporate mergers and acquisitions. He has encountered and decoded many

500-word sentences and simplifies these concepts for the benefit of Bondsavvy subscribers and

website visitors.

What Documents Must Bond Issuers File?

New corporate bond issuances include three key documents: the prospectus, the underwriting agreement, and the bond

indenture. There is also a registration statement, which includes the offering prospectus as well as additional

disclosures required by the US Securities and Exchange Commission.

The prospectus is one of the key marketing documents, which lays out key terms of the issuance; the issuing company's

business and financials; and risk factors. While it lays out key terms, it is not an agreement in the way a bond

indenture is between the issuing company and bondholders.

Bondsavvy Subscriber Benefit

Bondsavvy's corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started

Below, we explain bond indentures by using an example of an eight-year bond issued by ATI Inc., a global producer of

specialty materials for the aerospace, defense, and energy sectors. In the case of the ATI bond, there was an

underwriting agreement between ATI Inc. and the underwriting dealers, including BofA Securities, which led the deal.

The underwriting agreement lays out the conditions under which the underwriters will purchase the bonds from ATI and

then offer them to buyers.

Where to Find Bond Indentures

Finding bond indentures can require a little digging and perseverance. Below is an example of how we found the bond

indenture for the ATI Inc. 4.875% 10/1/29 corporate bond (CUSIP 01741RAL6).

Step 1 to finding a bond indenture: Obtain the bond's issue date

Bondsavvy conducts searches for its corporate bond recommendations on online bond

trading platforms.

After we conduct our initial search, we begin narrowing down the field of potential bond recommendations by

evaluating our 17 bond investment

considerations. While we rely heavily on company SEC filings, earnings releases, and earnings call

transcripts, there is also key information within online brokerages such as Fidelity.com.

One of these key pieces of information is finding a bond's issue date, as that will enable us to search for SEC

filings around this date, including filings that include bond indentures.

In Fidelity.com, under "Accounts & Trade," click "Trade" from the dropdown menu. In the upper-left-hand box

labeled "TRADE," select "Fixed Income" from the dropdown menu. We then enter our CUSIP number under "Search by

CUSIP." Upon clicking the "Search" button, we will see the bond we selected. We then click the link under the

"Description" heading, which takes us to the "Overview" screen.

Under the "Issuer Information" header, we will see the "Issue Date," which, in the case of the ATI '29 bond, was

September 9, 2021.

Step 2 to finding a bond indenture: Search the issuing company's investor relations website

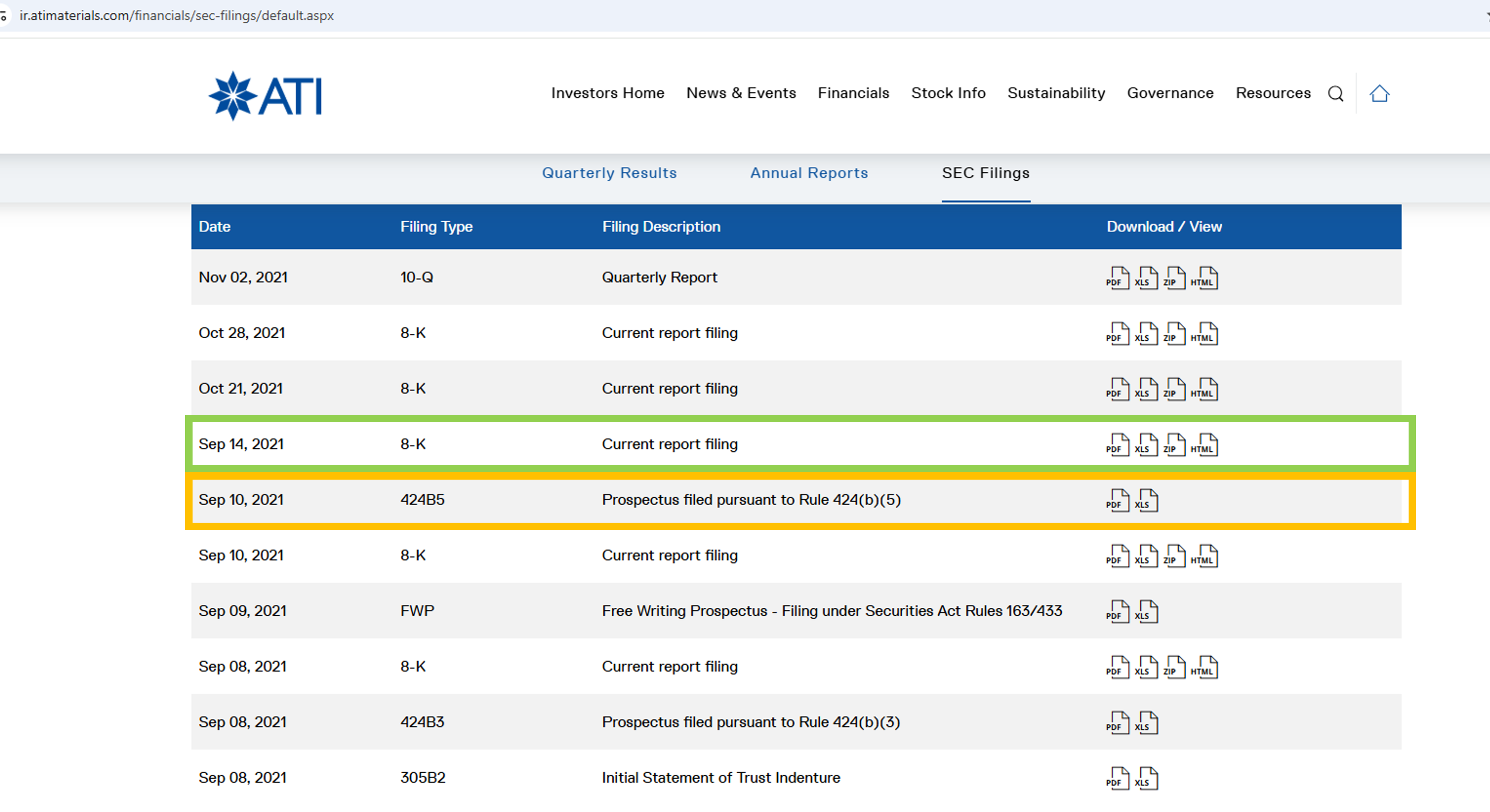

Since we know the date the ATI '29 bond was issued, we can search the ATI investor relations website for documents

that would contain the bond indentures. On the ATI investor relations website, we hovered over "Financials" on the

main menu and selected "SEC filings" from the dropdown menu. We then searched for ATI's SEC filings near the date of

the ATI '29 bond issuance.

Per Figure 1, the company filed the final prospectus for the ATI '29 bonds on September 10, 2021.

Figure 1: ATI Inc. SEC Filings Near ATI '29 Bond Issue Date

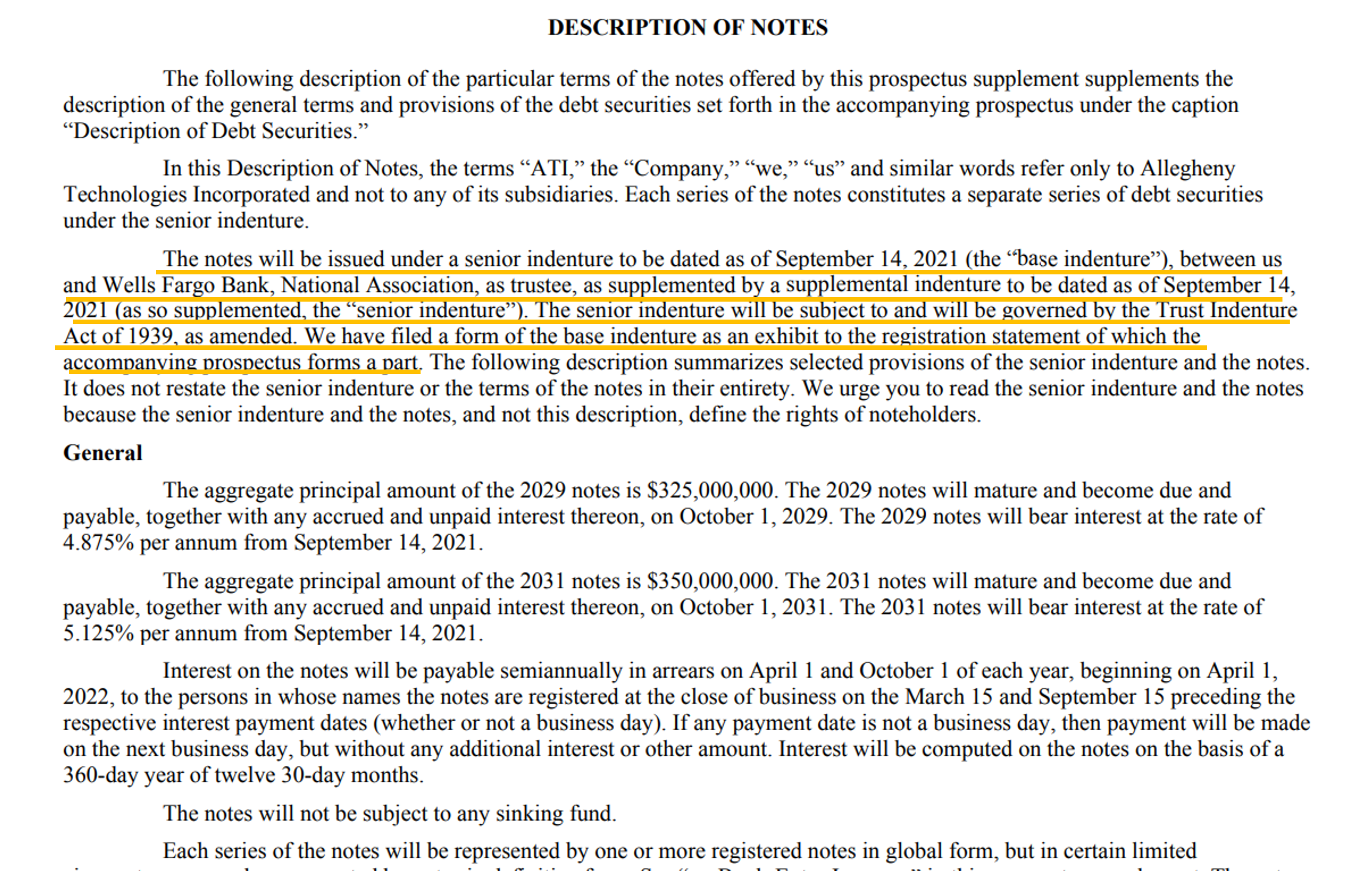

We then reviewed the September 10, 2021 prospectus and did a search for the term "indenture." We found information

related to the ATI '29 bond indenture in the Description of Notes section, which indicated the September 14, 2021

date of the base bond indenture and supplemental indenture, as we have underlined in Figure 2 in orange.

Figure 2: Excerpt from ATI '29 Prospectus "Description of Notes"

Step 3 to finding a bond indenture: Locating the indenture within the SEC filing

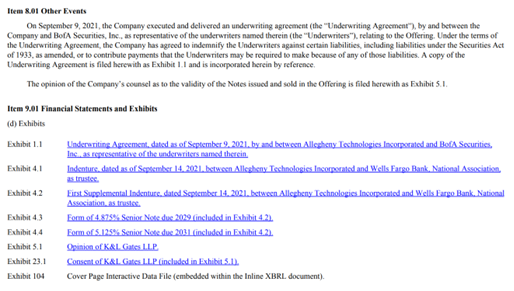

Per Figure 2, the ATI '29 bond indenture was dated September 14, 2021. Per Figure 1, there was an 8-K filed on that

date, which disclosed ATI's "entry into a material definitive agreement." Per Figure 2, the company filed the

indenture as part of an exhibit. Within the September 14, 2021 8-K filing, there is a list of exhibits in the

document, which we show below in Figure 3. Per Figure 3, Exhibit 4.1 contains the "base indenture" and Exhibit 4.2

includes the "supplemental indenture." We provide more color on these documents in the following section.

Figure 3: List of Exhibits in September 14, 2021 ATI Inc. 8-K Filing

Base Bond Indenture vs. Supplemental Indenture

As shown in Figure 3, there is the "Indenture" (also known as the base indenture) in Exhibit 4.1 and the "First

Supplemental Indenture" in Exhibit 4.2. The base indenture for the ATI bond was 46 pages long and forms the "base"

agreement between the company and bondholders. The supplemental indenture is a shorter document -- 16 pages in this

case -- that includes certain finalized terms that weren't part of the base bond indenture.

For example, in the base bond indenture, certain items are left blank, such as the bond's coupon, issuance size, call

prices, and call dates. Significant portions of the base bond indenture could certainly be deemed to be boilerplate.

The supplemental bond indenture is similar to a rider in a legal agreement, in that it includes additional terms

pertaining to the specific bond issuance. In the case of the ATI supplemental bond indenture, it included additional

defined terms; the final coupon; the date on which interest began accruing; the call dates and call prices; terms of

a Change of Control Repurchase Event; and myriad other final terms.

Click here to get four prior bond pick updates.

Click here to get four prior bond pick updates.

Key Terms in Bond Indentures

Many terms in bond indentures are consistent across similar bond issuances. For example, investment grade bonds are

typically subject to make-whole calls

while high yield bonds are subject to call schedules. Certain of these terms, such as call provisions, will

typically be shown within investor brokerage accounts; provided, however, that brokerages may not include

all call provisions details, as we discuss below.

The Definitions

I once heard a lawyer say, "The other side can write the agreement, so long as I get to write the definitions." In

Article I, Section 101 of the ATI '29 base bond indenture, we have the definitions section, which defines specific

terms used throughout this agreement. Since defined terms are typically used multiple times throughout a document,

it's best to define key terms once rather than having to explain the meaning of a defined term multiple times

throughout the bond indenture.

While all of the defined terms are typically listed in the definitions section, many terms will get defined in

specific sections later on in the bond indenture.

The Trustee

In a corporate bond issuance, the issuing company appoints a trustee to handle payment of interest and principal,

record transfers of bond ownership, and to provide notices such as in the case of redemptions and events of default.

In the case of the ATI '29 corporate bond indenture, the trustee was Wells Fargo.

For the ATI '29 bond, to bring proceedings against the company for an event of default, bondholders representing at

least 25% of the outstanding bonds must provide written notice to the trustee. The trustee is responsible to record

notices received from bondholders and to bring proceedings on their behalf. This is done, in part, to ensure the

issuing company is not constantly dealing with one-off notices provided by a small number of bond investors.

In Article VI Section 607 of the ATI '29 base bond indenture, the company indemnifies the trustee for losses, claims, damages,

etc. related to the "acceptance or administration of its duties" under the bond indenture.

Events of Default

Bondholders have rights upon an "event of default," including making the principal amount and any accrued and unpaid

interest immediately payable by the company.

Events of default, per Article V Section 501 of the ATI '29 base bond indenture include but are not limited to:

- Default in the payment of interest or principal;

- Default in the performance of, or breach of, any covenant contained in the bond indenture and the continuance of

such default or breach for 90 days;

- Commencement of bankruptcy proceedings.

The ATI '29 supplemental bond indenture added two additional events of default, including the failure of the company

to repurchase the bonds following a "Change of Control Repurchase Event," which we discuss later.

Covenants

Bond indenture covenants are promises an issuing company makes to bondholders. As noted above, a breach of a covenant

is an event of default.

The covenants contained in Article X of the ATI '29 base bond indenture are fairly limited. The supplemental bond

indenture has a few more meaningful bond covenants.

Select covenants in the ATI '29 base bond indenture include:

- Payment of Principal and Interest: The company will "duly and

punctually pay the principal of and any premium and interest" on the bonds.

- Corporate Existence: The company will do "all things necessary to

preserve and keep in full force and effect its corporate existence," rights, licenses and franchises.

- Waiver of certain covenants: The company can waive any term,

provision, or covenant in its bond indenture upon the consent of bondholders representing at least 50% of the

bonds outstanding.

The ATI' 29 supplemental bond indenture included three additional covenants in Article III:

- Limitations on liens: The company may not "issue, assume or

guarantee" any debt secured by a lien upon ATI's manufacturing facilities.

- Limitations on sale and leaseback transactions: With two

exceptions, the company and its subsidiaries are prohibited from entering sale-leaseback transactions. One of

these exceptions is that the company can effect a sale-leaseback transaction provided it applies the proceeds to

paying down principal of the ATI bonds or debt that is senior to the bonds.

- Limitations on guarantees: ATI's domestic subsidiaries may not

guarantee the payment of debt incurred by the company unless they provide a similar guarantee to the ATI bonds.

As there are no covenants requiring maintenance of leverage ratios below a

certain number or minimum interest coverage ratios, the ATI bond

indenture would be deemed "covenant-lite."

Optional Redemption

While online bond trading

platforms such as Fidelity.com provide information on callable bond provisions, they may not always have every detail. For example, per the

"overview" screen in the Fidelity.com bond investing area, clicking on "View Schedule" in the "Call Protection" row

will indicate the ATI '29 bond was callable at a price of 102.438 beginning October 1, 2024. It was then callable at

101.219 beginning October 1, 2025 and then at par value of the

bond beginning October 1, 2026.

While no longer relevant beyond October 1, 2024, Section 4.01 of the ATI '29 supplementary bond indenture indicates

that, prior to the first call date, up to 35% of the ATI '29 bonds were callable at a price of 104.875. In addition,

100% of the bonds were subject to a make-whole call prior to the October 1, 2024 call date.

The make-whole-call provision prior to the first call date is fairly standard for high

yield bonds.

Purchase of Notes Upon a Change of Control Repurchase Event

Another key term included in the ATI '29 supplemental bond indenture relates to the company's obligation to offer to

repurchase bonds from bondholders at 101% of par value in the event of a "Change of Control Repurchase Event." Such

event occurs when there is a sale or merger transaction whereby a) ATI is no longer in voting control of the

combined company and b) both Moody's and S&P downgrade the ATI bond

ratings at least one

notch.

Final Thoughts on Bond Indentures

Many investors avoid investing in bonds since they confront terms and conditions with which they may not be familiar.

While there is a bond investing learning curve, these concepts generally protect bondholders, and investors can

learn them over time.

Get Started

Watch Free Sample