UPDATE: This video was originally recorded in 2017. Since then, we have updated the corporate bond returns achieved by our individual corporate bond recommendations vs. large bond funds. We compare our investment performance to bond fund returns of BlackRock's iShares bond ETFs, a large competitor to Vanguard bond funds and Vanguard bond ETFs. This page discusses why, in particular, Vanguard bond fund returns are generally low; however, the limitations of the Vanguard bond funds can be found in most passive fixed income vehicles such as iShares LQD, iShares HYG, and iShares AGG.

In short, we have shown how individual investors owning a select portfolio of corporate bonds can outperform the world's largest bond funds, including Vanguard Total Bond Market Index Fund (Ticker: VBTLX), the world's largest bond fund. We discuss the drivers of low bond fund returns below.

Vanguard Total Bond Market Index Fund Overview

When most individual investors invest in fixed income, they invest in bond funds and bond ETFs, which often have poor investment returns. Investors have been told by the media and their financial advisors that there's no way to "beat the market." Unfortunately, these so-called experts have likely never owned an individual bond and have little to no knowledge of how the bond market works.

Vanguard Total Bond Market Index Fund has a variety of classes and ticker symbols, as shown in Figure 1, which lists the name of each class, its ticker symbol, and its size. As of June 30, 2021, Vanguard Total Bond Market was the world's largest bond fund with $312.4 billion under management, which is up 53% from $204 billion on December 31, 2018. It has grown to this size in spite of its weak performance.

Figure 1: Vanguard Total Bond Market Index Fund - Size by Investor Class as of June 30, 2021

| Class |

Ticker |

Size ($BB) |

| Vanguard Total Bond Market Index Fund Investor Shares |

VBMFX |

$1.5 |

| Vanguard Total Bond Market Index Fund Admiral Shares |

VBTLX |

$118.3 |

| Vanguard Total Bond Market ETF |

BND |

$78.8 |

| Vanguard Total Bond Market Index Fund Institutional Shares |

VBTIX |

$50.8 |

| Vanguard Total Bond Market Index Fund Institutional Plus Shares |

VBMPX |

$36.7 |

| Vanguard Total Bond Market Index Fund Institutional Select Shares |

VTBSX |

$26.3 |

| Total Net Assets of Vanguard Total Bond Market | | $312.4 |

By watching the video on this webpage, you can see the meager historical Vanguard bond fund returns. VBTLX performance was a 0.3% return in 2015, 2.5% in 2016, and 3.1% year to date (9/30/17). Four key factors drive weak VBLTX performance:

1) Overdiversification Mutes Returns

Since this Vanguard bond fund is so big, it owned 10,099 bonds on July 31, 2021. While there are many bonds worth owning, there are not 10,000. There's no reason investors need exposure to 10,000 bonds when owning a fixed income portfolio. Bonds typically have lower risk and price volatility vs. stocks, so the overdiversification bond funds provide is not necessary for bond investors. Within the Vanguard portfolio are some perfectly good bonds; however, the good ones get drowned out by thousands of other bonds that dilute VBTLX performance.

2) Low Volatility Takes Material Capital Appreciation off the Table

Think of VBTLX as a large ocean barge that does not turn easily. In the case of VBTLX, there can be significant changes and volatility in financial markets; however, in most cases, the VBTLX price doesn't budge. This may suit some risk-averse investors well, as, even in cases of significant market volatility, the price of VBTLX is largely stable. That said, when a bond fund's price is this stable, investors effectively take capital appreciation off the table given VBTLX's corresponding limited upside.

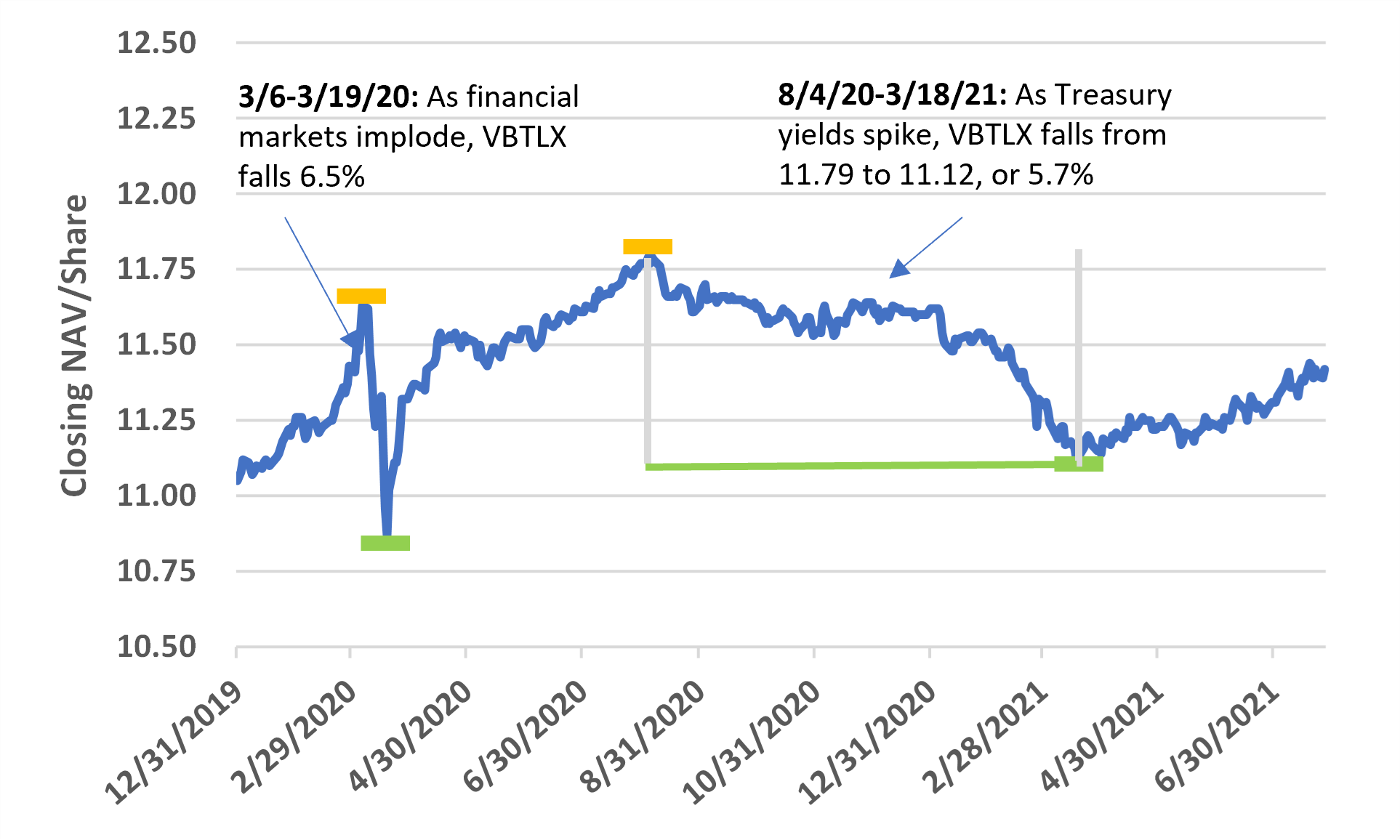

Figure 2 shows the closing net asset value per share of VBTLX from December 31, 2019 through July 27, 2021. In March 2020, financial markets imploded in the wake of Covid-19. While VBTLX's NAV per share fell from 11.63 on March 6, 2020 to 10.87 on March 19, 2020, a 6.5% decline, this decline was small when compared to the amount certain individual corporate bonds fell. Similarly, when Treasury yields increased approximately 1.5 percentage points from August 2020 into March 2021, VBTLX fell 5.7%. During this time, many corporate bonds of some of the world's best companies fell 15-20%, which created significant buying opportunities for BondSavvy subscribers. We provide an illustration of the volatility in certain corporate bond prices below in Figure 3.

Figure 2: VBTLX Performance - NAV/Share from 12/31/19 through 7/27/21

Source: Nasdaq market data.

Capital appreciation opportunities for individual corporate bonds

Compared to the price stability found in large bond funds, individual corporate bonds can have, at times, significant price volatility. Figure 3 shows historical prices for the Apple 3.45% 2/9/45 corporate bond (CUSIP: 037833BA7). Compared to the limited price declines shown in Figure 2 for VBTLX, the Apple bond fell 26.8% in the wake of Covid-19 and 16.8% as US Treasury yields spiked from August 2020 into March 2021. These are precisely the opportunities of which investors in individual corporate bonds can take advantage.

During 2020 and 2021, Apple had over $200 billion in cash, and its financial performance accelerated as the economy recovered from Covid-19. In our opinion, Apple has lower default risk than the US government, due to its excellent balance sheet and high profitability. Apple's strong financial profile limits how far the bond can fall, but, in times of financial market volatility, it's important for investors to take advantage of these price declines, which can lead to significant opportunities for capital appreciation and strong total returns. These opportunities are not available to investors in large bond funds such as VBTLX.

Figure 3: Price Performance of Apple 3.45% 2/9/45 Corporate Bond - 12/31/19-7/27/21

Source: FINRA market data.

3) Low-yielding asset classes that are often highly sensitive to interest rates: VBTLX is dominated by bonds that are the most sensitive to fluctuations in interest rates: US Treasurys and mortgage-backed securities. These bonds are known as 'rates' investments, with bond prices going up and down based on what happens to interest rates. In addition, due to their perceived lower credit risk than corporate bonds, bonds such as US Treasurys pay investors a lower coupon than a corporate bond with a similar maturity. Large bond funds such as VBTLX typically perform poorly during periods of rising interest rates. There are many corporate bonds that can perform well during such periods, as we discuss in our blog post How To Profit from Rising Interest Rates.

4) High hidden bond fund fees: Investors have been misled by the mutual fund industry, which claims 'low-cost' index funds such as VBLTX are truly low cost. They tout their low expense ratios; however, a bond fund's expense ratio can be a fraction of the total bond fund fees extracted from unknowing investors. Vanguard and other bond funds are anything but low cost, as these bond funds rapidly turn over their portfolios and incur significant bond fund trading costs. The extent of these bond fund costs are not disclosed by the fund and are not included in a bond fund's expense ratio, a number that is vastly understated and misrepresents the true costs of bond fund investing. In the end, Vanguard bond fund returns are negatively impacted by these bond transaction fees; however, investors in these funds never know how much.